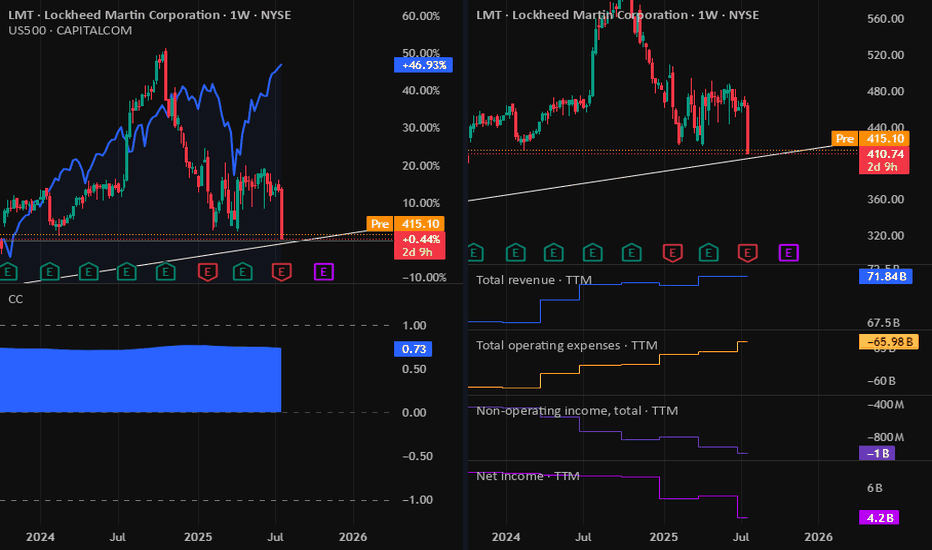

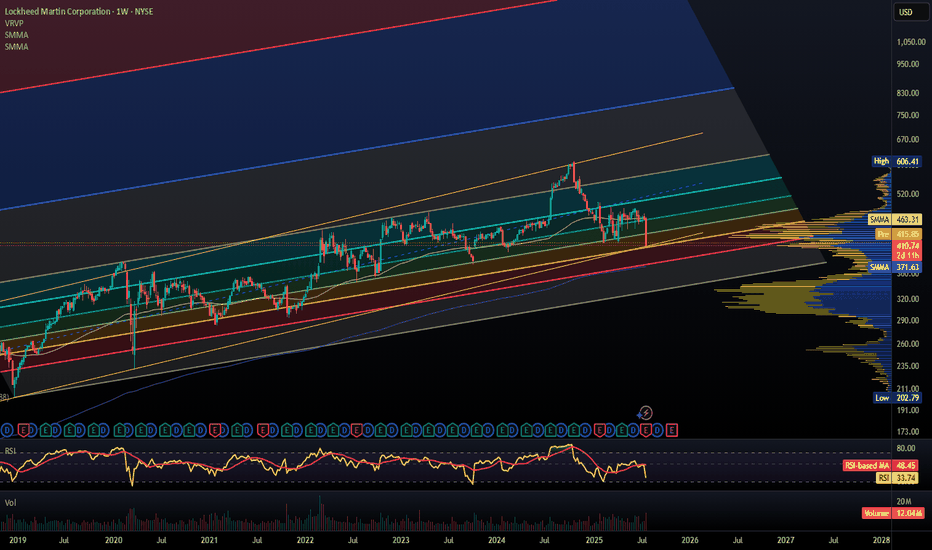

Lockheed Martin Stock in Bullish Trend - Key Levels to watchLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit f

Key facts today

Lockheed Martin's Q2 2025 earnings fell significantly, reporting $1.6 billion in losses mainly from issues in its Aeronautics Classified program and other projects.

A class action lawsuit has been filed against Lockheed Martin, alleging securities fraud that misled shareholders about its internal controls and financial health from January 2024 to July 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.150 CHF

4.85 B CHF

64.52 B CHF

233.29 M

About Lockheed Martin Corporation

Sector

Industry

CEO

James D. Taiclet

Website

Headquarters

Bethesda

Founded

1912

FIGI

BBG006TLRR45

Lockheed Martin Corp. is a global security and aerospace company, which engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. It operates through the following business segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. The Aeronautics segment researches, designs, develops, manufactures, integrates, sustains, supports, and upgrades advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. The MFC segment is involved in air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems, logistics, fire control systems, mission operations support, readiness, engineering support and integration services, manned and unmanned ground vehicles, and energy management solutions. The RMS segment designs, manufactures, services, and supports various military and commercial helicopters, surface ships, sea and land-based missile defense systems, radar systems, sea and air-based mission and combat systems, command and control mission solutions, cyber solutions, and simulation and training solutions. The Space segment includes the production of satellites, space transportation systems, and strategic, advanced strike, and defensive systems. The company was founded in 1995 and is headquartered in Bethesda, MD.

Related stocks

LMT: Lookheed Martin Dropped on Earnings 23-07-2025The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it.

Discl

Lockheed Martin (LMT) Stock in Strong Bullish TrendLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit f

LMT – Long Setup IdeaLMT – Long Setup

Current: \$463.01 | Premarket: \$464.01 (+0.22%)

---

📊 Why I’m Eyeing the Long:

✅ Strong base at \$450–460 – buyers defending this level hard for months. Solid floor.

✅ Premarket green after red day = possible bounce play incoming.

✅ Deutsche Bank PT \$472 – not huge, but con

Buy Idea: LMT @ around $480This war is really happening right now between Israel, Iran, and the United States.

Because of this, countries are spending more money on weapons, defense systems and military gear.

The U.S. and its friends are about to increase their defense budgets and Lockheed Martin is one of the biggest co

U.S. – Iran Tensions: How Geopolitics Could Rattle the MarketsRising tensions between the United States and Iran are once again casting a shadow over global markets. From oil prices to defense contractors and transport stocks, this situation has the potential to ignite volatility across several key sectors.

🔍 What Traders Should Watch:

Oil & Energy Stocks – I

What happens when war whispers... and Wall Street listens? 🦅🔥

"🌍 📉📈

Lockheed Martin ( NYSE:LMT ) just pierced through a tightening triangle 🔺— like a fighter jet breaking the sound barrier ✈️💥

Coincidence? 🤔 Or is this price action a signal of something brewing behind the scenes? 🕵️♂️

⚔️ Global tension is rising.

💰 Defense budgets are booming.

And NY

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LMT4988881

Lockheed Martin Corporation 2.8% 15-JUN-2050Yield to maturity

6.83%

Maturity date

Jun 15, 2050

LMT4549067

Lockheed Martin Corporation 4.09% 15-SEP-2052Yield to maturity

6.27%

Maturity date

Sep 15, 2052

LMT5402220

Lockheed Martin Corporation 4.3% 15-JUN-2062Yield to maturity

6.25%

Maturity date

Jun 15, 2062

LOMA

LOCKHEED MARTIN 2045Yield to maturity

6.19%

Maturity date

Mar 1, 2045

LMT5402219

Lockheed Martin Corporation 4.15% 15-JUN-2053Yield to maturity

6.19%

Maturity date

Jun 15, 2053

LMT5741406

Lockheed Martin Corporation 5.2% 15-FEB-2064Yield to maturity

5.95%

Maturity date

Feb 15, 2064

LMT4002344

Lockheed Martin Corporation 4.07% 15-DEC-2042Yield to maturity

5.95%

Maturity date

Dec 15, 2042

US539830BL2

LOCKHEED MARTIN 15/46Yield to maturity

5.90%

Maturity date

May 15, 2046

LMT5592253

Lockheed Martin Corporation 5.2% 15-FEB-2055Yield to maturity

5.76%

Maturity date

Feb 15, 2055

LMT5492512

Lockheed Martin Corporation 5.9% 15-NOV-2063Yield to maturity

5.68%

Maturity date

Nov 15, 2063

LMT5492511

Lockheed Martin Corporation 5.7% 15-NOV-2054Yield to maturity

5.66%

Maturity date

Nov 15, 2054

See all LOM bonds

Curated watchlists where LOM is featured.

Frequently Asked Questions

The current price of LOM is 339.600 CHF — it has decreased by −0.10% in the past 24 hours. Watch LOCKHEED MARTIN CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange LOCKHEED MARTIN CO stocks are traded under the ticker LOM.

LOM stock has risen by 1.21% compared to the previous week, the month change is a −7.22% fall, over the last year LOCKHEED MARTIN CO has showed a −28.65% decrease.

We've gathered analysts' opinions on LOCKHEED MARTIN CO future price: according to them, LOM price has a max estimate of 546.17 CHF and a min estimate of 324.44 CHF. Watch LOM chart and read a more detailed LOCKHEED MARTIN CO stock forecast: see what analysts think of LOCKHEED MARTIN CO and suggest that you do with its stocks.

LOM stock is 1.05% volatile and has beta coefficient of 0.33. Track LOCKHEED MARTIN CO stock price on the chart and check out the list of the most volatile stocks — is LOCKHEED MARTIN CO there?

Today LOCKHEED MARTIN CO has the market capitalization of 80.12 B, it has increased by 1.89% over the last week.

Yes, you can track LOCKHEED MARTIN CO financials in yearly and quarterly reports right on TradingView.

LOCKHEED MARTIN CO is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

LOM earnings for the last quarter are 1.16 CHF per share, whereas the estimation was 5.17 CHF resulting in a −77.60% surprise. The estimated earnings for the next quarter are 5.21 CHF per share. See more details about LOCKHEED MARTIN CO earnings.

LOCKHEED MARTIN CO revenue for the last quarter amounts to 14.40 B CHF, despite the estimated figure of 14.73 B CHF. In the next quarter, revenue is expected to reach 15.07 B CHF.

LOM net income for the last quarter is 271.34 M CHF, while the quarter before that showed 1.52 B CHF of net income which accounts for −82.10% change. Track more LOCKHEED MARTIN CO financial stats to get the full picture.

Yes, LOM dividends are paid quarterly. The last dividend per share was 2.70 CHF. As of today, Dividend Yield (TTM)% is 3.10%. Tracking LOCKHEED MARTIN CO dividends might help you take more informed decisions.

LOCKHEED MARTIN CO dividend yield was 2.62% in 2024, and payout ratio reached 57.16%. The year before the numbers were 2.68% and 44.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 121 K employees. See our rating of the largest employees — is LOCKHEED MARTIN CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LOCKHEED MARTIN CO EBITDA is 5.96 B CHF, and current EBITDA margin is 11.83%. See more stats in LOCKHEED MARTIN CO financial statements.

Like other stocks, LOM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LOCKHEED MARTIN CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LOCKHEED MARTIN CO technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LOCKHEED MARTIN CO stock shows the strong sell signal. See more of LOCKHEED MARTIN CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.