Why Pay $250K for a $115K Bitcoin? Welcome to Strategy (MSTR)This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason.

You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium?

No matter how sophisticated the explanations may sound, or how

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.036 CHF

−1.06 B CHF

420.91 M CHF

263.35 M

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

FIGI

BBG00LVDZ9R3

MicroStrategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

8/1/25 - $mstr - Selling spot and buying MSTR8/1/25 :: VROCKSTAR :: NASDAQ:MSTR

Selling spot and buying MSTR

- keeping it (purposefully) short today for everyone's benefit

- sold a bit of OTC:OBTC (which is nearly 15% off spot, e.g. $100k/BTC) to buy NASDAQ:MSTR MSD exposure here

- why?

- 1.6x mNAV is lowest it's been (nearly ever in cu

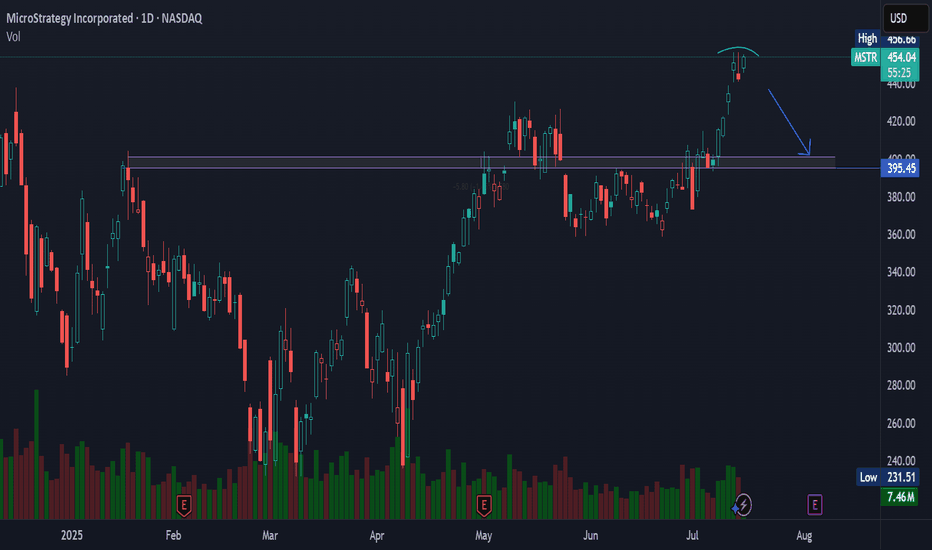

Long-Term Bitcoin Proxy Positioned for Next Upside RallyCurrent Price: $405.89

Direction: LONG

Targets:

- T1 = $418.50

- T2 = $425.99

Stop Levels:

- S1 = $399.50

- S2 = $386.20

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to id

$MSTR Weekly Ascending TriangleMicroStrategy has been consolidating within a textbook ascending triangle pattern, with a clear resistance around $520 and rising higher lows forming solid support. Price action remains inside a strong bullish channel, hugging the 50-week MA and riding above the 200/350 MAs.

A breakout above $520 c

MSTR Holding VWAP Support – Reversal Attempt but Earnings AheadMSTR bounced nearly 2% today after testing anchored VWAP support near $390. This recovery comes after a steady pullback from the recent $460 high. Price is holding above the yellow VWAP and just above the green zone, signaling possible short-term support.

However, volume remains light (3.72M vs. 11

Monthly $MSTR Bullflag MicroStrategy is forming a textbook bull flag on the monthly, right after a massive vertical leg from sub-$200 to over $500.

Strong pole ✅

Tight consolidation near the highs ✅

Monthly closes holding above prior resistance ✅

This thing is coiling under ~$455. Once it breaks, it could easily send

MSTR WEEKLY OPTIONS SETUP (2025-07-28)

### 🔻 MSTR WEEKLY OPTIONS SETUP (2025-07-28)

**Bearish Divergence with High Confidence — Time to Strike with a PUT?**

---

📊 **Momentum Recap:**

* **RSI:** Bearish 📉

* **Volume:** Weak (institutional exit risk)

* **Options Flow:** Mixed (calls > puts, but no alignment with price)

* **Sentiment

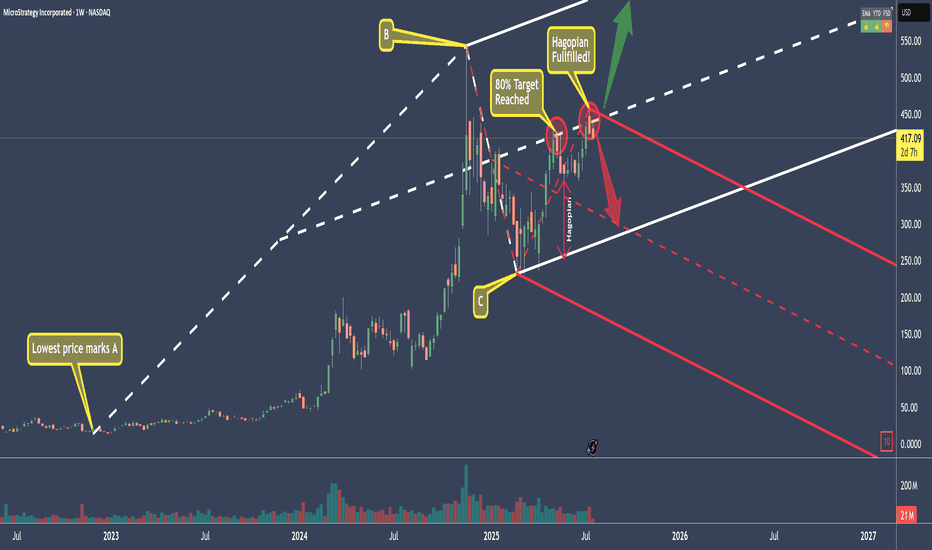

MSTR - Microstrategy Short...for now.The White Fork is created by choosing point A, which must be the lowest price before the swing.

B and C are the natural high and low of the swing we want to measure.

What this gives us is a Pitchfork that projects the most probable path of price.

Additionally, with the three lines that make the F

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

MICROSTRAT. 24/29 CV ZOYield to maturity

0.97%

Maturity date

Dec 1, 2029

US594972AT8

MICROSTRAT. 25/30 CV ZOYield to maturity

−3.17%

Maturity date

Mar 1, 2030

US594972AN1

MICROSTRAT. 25/32 CVYield to maturity

−6.67%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−7.34%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−12.86%

Maturity date

Mar 15, 2030

US594972AP6

MICROSTRAT. 24/28 CV 144AYield to maturity

−17.73%

Maturity date

Sep 15, 2028

See all MIGA bonds

Curated watchlists where MIGA is featured.

Frequently Asked Questions

The current price of MIGA is 329.512 CHF — it has increased by 2.23% in the past 24 hours. Watch MICROSTRATEGY stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange MICROSTRATEGY stocks are traded under the ticker MIGA.

MIGA stock has risen by 0.66% compared to the previous week, the month change is a 2.81% rise, over the last year MICROSTRATEGY has showed a −77.37% decrease.

We've gathered analysts' opinions on MICROSTRATEGY future price: according to them, MIGA price has a max estimate of 574.70 CHF and a min estimate of 163.04 CHF. Watch MIGA chart and read a more detailed MICROSTRATEGY stock forecast: see what analysts think of MICROSTRATEGY and suggest that you do with its stocks.

MIGA reached its all-time high on Mar 28, 2024 with the price of 1,791.034 CHF, and its all-time low was 99.192 CHF and was reached on Sep 6, 2024. View more price dynamics on MIGA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MIGA stock is 2.21% volatile and has beta coefficient of 0.37. Track MICROSTRATEGY stock price on the chart and check out the list of the most volatile stocks — is MICROSTRATEGY there?

Today MICROSTRATEGY has the market capitalization of 84.74 B, it has increased by 5.55% over the last week.

Yes, you can track MICROSTRATEGY financials in yearly and quarterly reports right on TradingView.

MICROSTRATEGY is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

MIGA earnings for the last quarter are 25.86 CHF per share, whereas the estimation was −0.08 CHF resulting in a 33.25 K% surprise. The estimated earnings for the next quarter are −0.07 CHF per share. See more details about MICROSTRATEGY earnings.

MICROSTRATEGY revenue for the last quarter amounts to 90.83 M CHF, despite the estimated figure of 90.08 M CHF. In the next quarter, revenue is expected to reach 95.95 M CHF.

MIGA net income for the last quarter is 7.95 B CHF, while the quarter before that showed −3.73 B CHF of net income which accounts for 312.96% change. Track more MICROSTRATEGY financial stats to get the full picture.

No, MIGA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 3, 2025, the company has 1.53 K employees. See our rating of the largest employees — is MICROSTRATEGY on this list?

Like other stocks, MIGA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MICROSTRATEGY stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MICROSTRATEGY technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MICROSTRATEGY stock shows the sell signal. See more of MICROSTRATEGY technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.