Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

11.644 CHF

1.96 B CHF

5.29 B CHF

183.62 M

About Synopsys, Inc.

Sector

Industry

CEO

Sassine Ghazi

Website

Headquarters

Sunnyvale

Founded

1986

FIGI

BBG00LVGGKQ3

Synopsys, Inc. engages in the provision of electronic design automation (EDA) software that engineers use to design and test integrated circuits (ICs). It also offers semiconductor intellectual property (IP) products. It operates through the following segments: Design Automation, Design IP, and Software Integrity. The Design Automation segment includes silicon design, verification products and services, system integration products and services, digital, custom, and FPGA IC design software, verification software and hardware products, and manufacturing software products. The Software Integrity segment includes a solution for building security and compliance testing into the customers' software development lifecycle and supply chain. The company was founded by Aart J. de Geus, Bill Krieger, Dave Gregory, and Rick Rudell in December 1986 and is headquartered in Sunnyvale, CA.

Related stocks

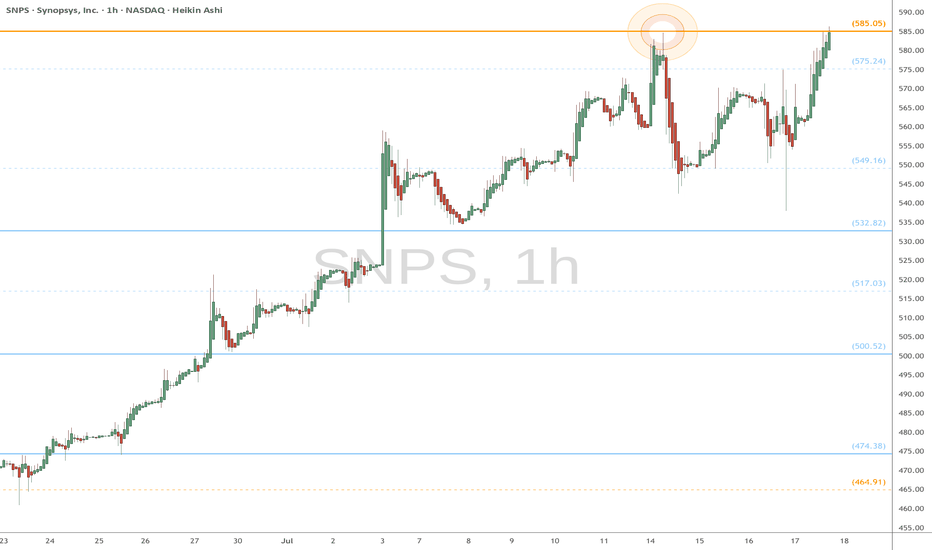

Inverse Head and Shoulders Already Completed Toward a New ATHThe price has completed the formation of an inverse head and shoulders pattern, with the final breakout occurring last week.

Volume confirms the validity of the pattern.

The distance from the head to the neckline projects a target toward a new all-time high (ATH).

As often happens after a breakout

SNPS – Dangerous Correction Wave Nearing Completion?The wave structure marked in red often indicates a corrective move. While it appears impulsive at first glance, such formations typically end with a strong candle in the direction of the trend, followed by a full retracement.

This rally is likely not a new bullish impulse but a complex correction w

SNPS Trading Plan: Anticipating a Break Above SMA 150 at 535.73NASDAQ:SNPS

Currently, the price of SNPS is 520.70, which is slightly below the 150 SMA (527.81). The suggested entry point is 535.73, positioned above the SMA 150 to confirm a potential upward trend.

Entry Strategy:

Wait for the price to break above 535.73 to signal confirmation of strength and

Stock Of The Day / 05.12.2024 / SNPS12.05.2024 / NASDAQ:SNPS

Fundamentals. Negative catalyst after earnings report and weak 2025 forecast.

Technical analysis.

Daily chart: nearest potential support level is 515.00 formed by the nearest break in the trend.

Premarket: Gap Down on moderate volume.

Trading session: The pric

SNPS Breakout Potential to the UpsideNASDAQ:SNPS has been range-bound since 2023 and is finally showing technical patterns that reveal Dark Pool hidden accumulation, pro trader nudges, and the potential for HFTs to gap and run the stock upward.

This stock is setting up to challenge the all-time high. Often in the current Moderately

Synopsys Inc. Growth Expectations Ahead of the Quarterly ResultKey arguments in support of the idea.

▪ Expectation of a robust quarterly report.

▪ Attractive entry price and favorable valuation levels based on key multiples.

Investment Thesis

Synopsys, Inc. (SNPS) is the largest computer-aided design (CAD) company in the electronics design industry. Its fla

Synopsys Inc. (SNPS) - Waiting for an Entry PointSynopsys Inc. (SNPS) - Waiting for an Entry Point NASDAQ:SNPS

The stock is approaching a potential entry point around $559.31, above the trendline it tends to respect. The entry will be executed with stop loss management in place. It's important to monitor the developments and stay updated accord

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SNPS6020496

Synopsys, Inc. 5.7% 01-APR-2055Yield to maturity

5.73%

Maturity date

Apr 1, 2055

SNPS6020495

Synopsys, Inc. 5.15% 01-APR-2035Yield to maturity

4.97%

Maturity date

Apr 1, 2035

SNPS6020494

Synopsys, Inc. 5.0% 01-APR-2032Yield to maturity

4.76%

Maturity date

Apr 1, 2032

SNPS6020493

Synopsys, Inc. 4.85% 01-APR-2030Yield to maturity

4.37%

Maturity date

Apr 1, 2030

SNPS6020491

Synopsys, Inc. 4.55% 01-APR-2027Yield to maturity

4.23%

Maturity date

Apr 1, 2027

SNPS6020492

Synopsys, Inc. 4.65% 01-APR-2028Yield to maturity

4.17%

Maturity date

Apr 1, 2028

See all SYP bonds

Curated watchlists where SYP is featured.

Frequently Asked Questions

The current price of SYP is 528.105 CHF — it has increased by 2.55% in the past 24 hours. Watch SYNOPSYS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange SYNOPSYS INC stocks are traded under the ticker SYP.

SYP stock has risen by 16.81% compared to the previous week, the month change is a 59.23% rise, over the last year SYNOPSYS INC has showed a −3.72% decrease.

We've gathered analysts' opinions on SYNOPSYS INC future price: according to them, SYP price has a max estimate of 556.66 CHF and a min estimate of 413.52 CHF. Watch SYP chart and read a more detailed SYNOPSYS INC stock forecast: see what analysts think of SYNOPSYS INC and suggest that you do with its stocks.

SYP stock is 2.48% volatile and has beta coefficient of 1.47. Track SYNOPSYS INC stock price on the chart and check out the list of the most volatile stocks — is SYNOPSYS INC there?

Today SYNOPSYS INC has the market capitalization of 93.32 B, it has increased by 1.23% over the last week.

Yes, you can track SYNOPSYS INC financials in yearly and quarterly reports right on TradingView.

SYNOPSYS INC is going to release the next earnings report on Sep 9, 2025. Keep track of upcoming events with our Earnings Calendar.

SYP earnings for the last quarter are 3.04 CHF per share, whereas the estimation was 2.81 CHF resulting in a 8.11% surprise. The estimated earnings for the next quarter are 3.09 CHF per share. See more details about SYNOPSYS INC earnings.

SYNOPSYS INC revenue for the last quarter amounts to 1.33 B CHF, despite the estimated figure of 1.32 B CHF. In the next quarter, revenue is expected to reach 1.44 B CHF.

SYP net income for the last quarter is 289.08 M CHF, while the quarter before that showed 269.55 M CHF of net income which accounts for 7.24% change. Track more SYNOPSYS INC financial stats to get the full picture.

No, SYP doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 20 K employees. See our rating of the largest employees — is SYNOPSYS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SYNOPSYS INC EBITDA is 1.43 B CHF, and current EBITDA margin is 31.31%. See more stats in SYNOPSYS INC financial statements.

Like other stocks, SYP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SYNOPSYS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SYNOPSYS INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SYNOPSYS INC stock shows the strong buy signal. See more of SYNOPSYS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.