NZD/CAD - Triangle Breakout (05.08.2025)The NZD/CAD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline O

Related currencies

Bullish bounce?NZD/CAD is falling towards the pivot, which acts as a pullback support that lines up with the 50% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.81602

1st Support: 0.81199

1st Resistance: 0.82135

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your ca

Bullish rise?NZD/CAD has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.81602

1st Support: 0.81199

1st Resistance:0.82167

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs

NZDCAD Will Go Lower! Short!

Take a look at our analysis for NZDCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.817.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish mo

NZD-CAD Bullish Flag Breakout! Buy!

Hello,Traders!

NZD-CAD made a bullish

Breakout from the bullish

Flag pattern and the breakout

Is confirmed so we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part o

NZDCAD SHORT Market structure bearish on HTFs DW

Entry at both weekly and daily

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.82000

H4 Candlestick rejection

Levels 3.23

Entry 100%

REMEMBER : Tradin

Bearish Gameplan Activated – NZD/CAD Heist Operation💣 NZD/CAD “Kiwi vs Loonie” Forex Vault Robbery Heist Plan 🔫💰

Bearish Plan | Multiple Limit Orders | Scalping/Swing Style

🧠💼 Welcome to another high-stakes Thief Trader Heist – this time we're targeting the NZD/CAD vault. The Loonie's got weakness in its wings, and the Kiwi’s already flapping into t

(art📊 Smart Money Concept Trade Setup (NZD/CAD – 30-Min Chart)

🧠 Market Structure Overview:

Price initially formed a Lower Low (left side of the chart).

Then, price made a clear Break of Structure (BOS) to the upside, creating a Higher High.

An IDM indicates price manipulation and confirms liquidity r

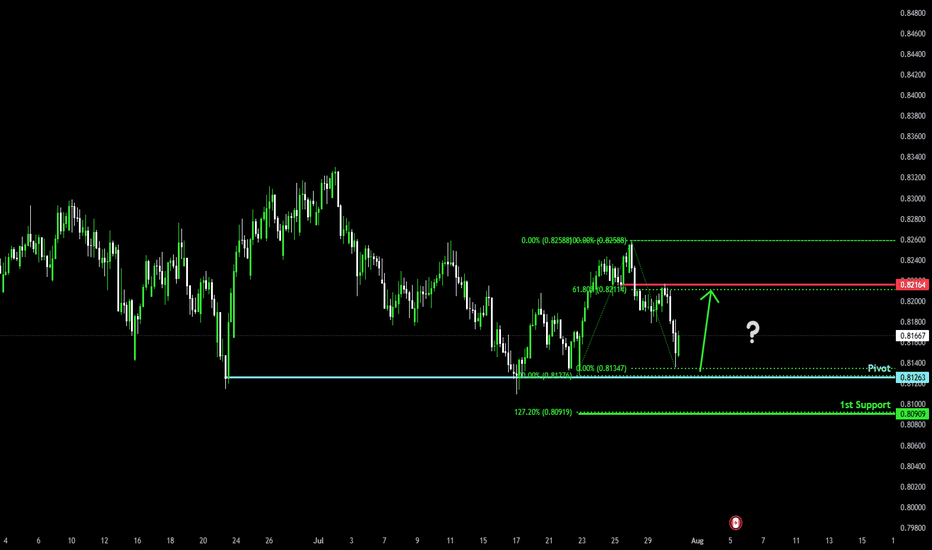

Bullish reversal?NZD/CAD is falling towards the pivot an could bounce to the 1st resistance.

Pivot: 0.81263

1st Support: 0.80909

1st Resistance: 0.82164

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CADNZD is 1.2137 NZD — it has decreased by −0.21% in the past 24 hours. See more of CADNZD rate dynamics on the detailed chart.

The value of the CADNZD pair is quoted as 1 CAD per x NZD. For example, if the pair is trading at 1.50, it means it takes 1.5 NZD to buy 1 CAD.

The term volatility describes the risk related to the changes in an asset's value. CADNZD has the volatility rating of 0.49%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CADNZD showed a −0.71% fall over the past week, the month change is a 0.54% rise, and over the last year it has increased by 0.48%. Track live rate changes on the CADNZD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CADNZD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADNZD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CADNZD technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CADNZD shows the sell signal, and 1 month rating is buy. See more of CADNZD technicals for a more comprehensive analysis.