CME FedWatch : the essential tool to consult before the FedThe CME FedWatch Tool is a free and widely used resource offered by CME Group. It has become a key reference in the financial industry for tracking, in real time, market expectations about upcoming interest rate decisions by the U.S. Federal Reserve (Fed). Frequently cited in financial media, this t

Related futures

Decoding Fed Rate Changes via Federal Funds Futures Index◉ What Are Federal Funds Futures?

● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other ove

Money Market says that rate cut will be an urgent one (again)Just take a look on a rate cut expectations.

In a short, the main technical graph is a difference (spread) between the nearest futures contract on FOMC interest rate (in this time Sept'24 ZQU2024) and the next one futures contract (in this time Oct'24 ZQV2024).

It's clear that spread turned to neg

The US Election and Possible Fed Rate DetourCBOT: Micro 2-Year Yield ( CBOT_MINI:2YY1! ), Micro 10-Year Yield ( CBOT_MINI:10Y1! )

Last Thursday night, I watched the first Biden-Trump presidential debate live on TV, along with tens of millions of likely voters of the 2024 US presidential election.

Who won the debate? According to the exit p

🎲 Interest Rates. To Cut, or not to Cut. That is the questionJamie Dimon Sees ‘Lot of Inflationary Forces in Front of Us’, as in recent interview to Bloomberg JPMorgan CEO has warned for months that rates could stay high.

Jamie Dimon said he’s still more worried about inflation than markets appear to be.

The JPMorgan Chase & Co. chief executive officer said

An Uncharted Landscape of Prolonged Yield Curve InversionCBOT: Micro 2-Year Yield ( CBOT_MINI:2YY1! ) and Micro 10-Year Yield ( CBOT_MINI:10Y1! )

The recent US inflation cycle started in June 2020. As the global pandemic interrupted the global supply chain, the prices of goods began to rise rapidly. In the following two years, the headline CPI shot up nea

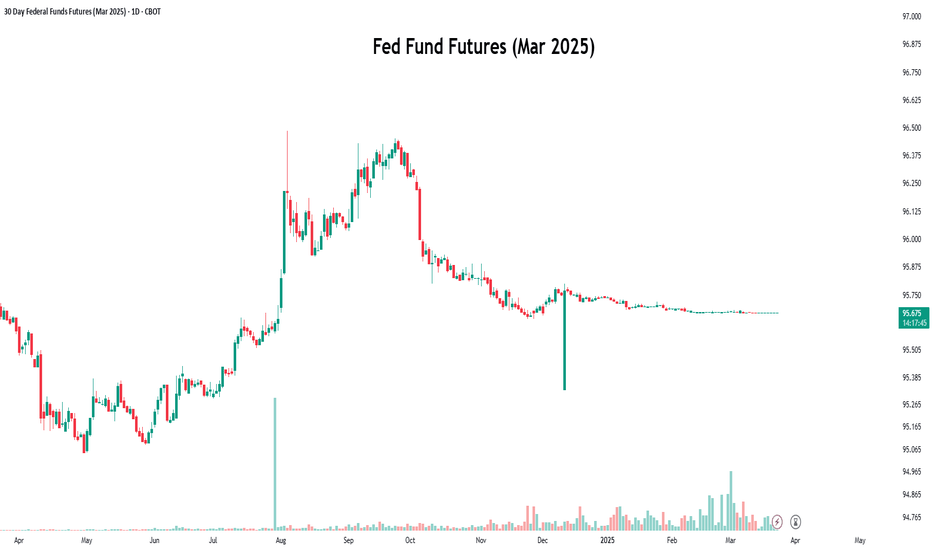

Repricing Interest Rate Cuts! We return to Fed Fund Futures, as the market has been repricing interest rate cut expectations. At the beginning of the year, there were 150bps of cuts expected by the market on the premise of a weaker economy, falling inflation, and a softer labor market. However, none of these expectations have ma

The Final Piece Of The Pre-FOMC Data JigsawAfter a disappointing labour market report last week, where a blowout nonfarm payrolls print was overshadowed by rather dismal details in the household survey, focus now turns to the February US CPI report, being the last significant piece of the data jigsaw before the March FOMC meeting.

Off the ba

Macro Trader: Swaps = DotsWell, what a turnaround it’s been. Just 57 days ago, markets were flat-out ignoring what the FOMC were saying on the policy outlook, and pricing as many as six 25bp rate cuts over the course of the year ahead. Now, less than two months later, the swaps are in line with the dots, as we see money mark

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for 30 Day Federal Funds Futures (Dec 2023) is Jan 2, 2024.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell 30 Day Federal Funds Futures (Dec 2023) before Jan 2, 2024.