SELL CHFJPY for bullish trend reversal SELL CHFJPY for bullish trend reversal

STOP LOSS : 185.38

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its o

About Swiss Franc / Japanese Yen

The Swiss Franc vs. the Japanese Yen. After reaching its low in 2008 this pair has steadily traded higher mainly due to aggressive Japanese monetary easing. Also, due to low interest rates and different financial properties these currencies are considered to be safe haven and funding currencies.

Related currencies

CHFJPY: Bearish Continuation is Expected! Here is Why

The price of CHFJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/

CHF_JPY RISKY LONG|

✅CHF_JPY has retested a key support level of 182.800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 183.700 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and r

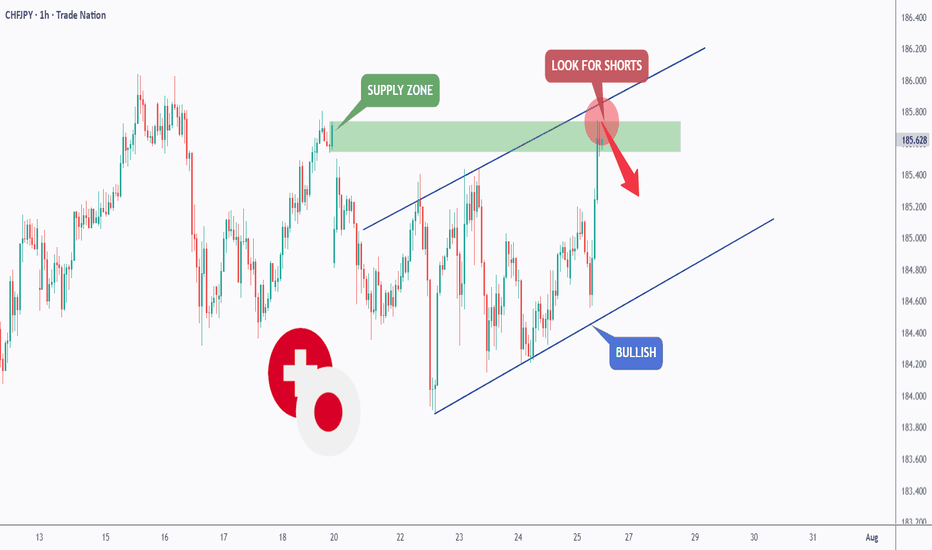

CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red c

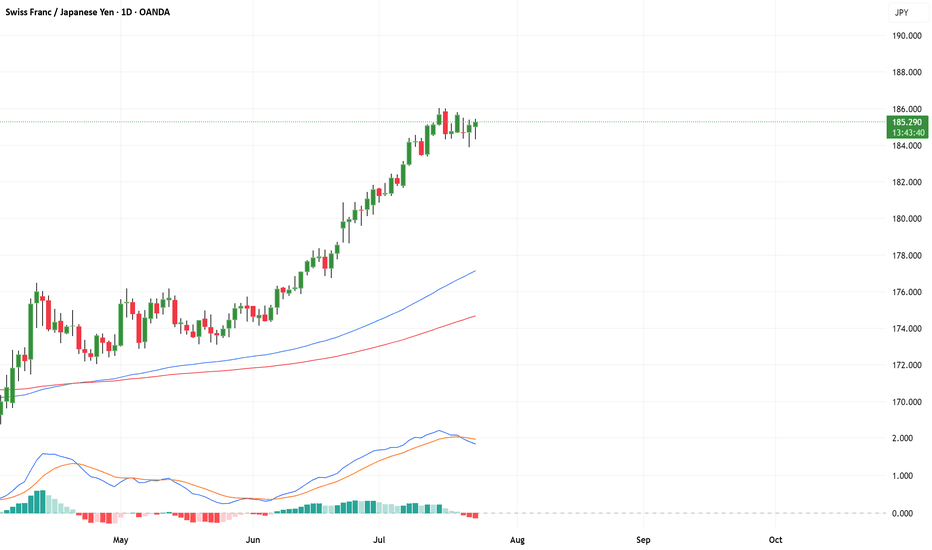

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves

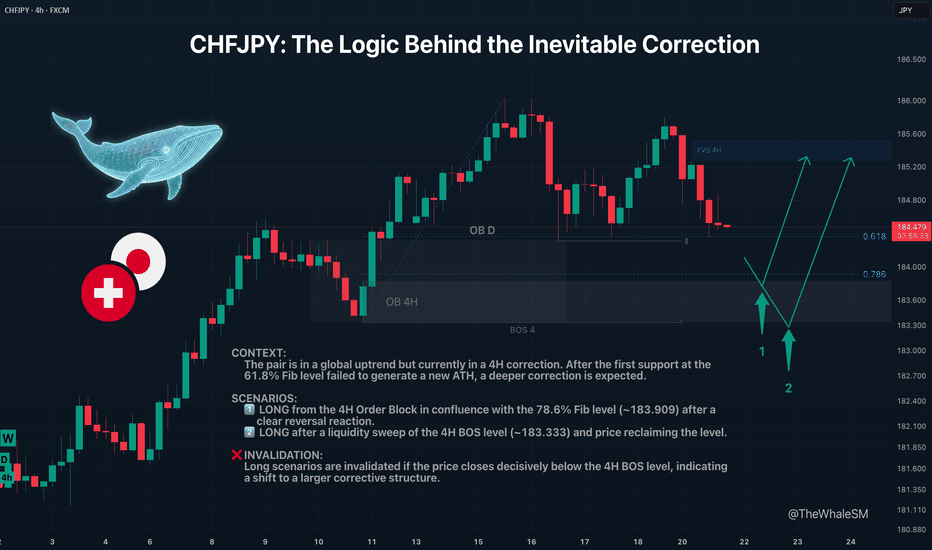

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institu

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the CHFJPY pair is quoted as 1 CHF per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 CHF.

CHFJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CHFJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.