Euro to Rise as Trade Tensions DefusedCME: Micro Euro/USD Futures ( CME_MINI:M6E1! ), #microfutures

On July 27th, U.S. President Donald Trump and European Commission President Ursula von der Leyen announced the U.S. has reached a trade deal with the European Union.

• President Trump said that the deal imposes a 15% tariff on most Europ

Related futures

Implied volatility, one more tool in our arsenalWHAT IS IMPLIED VOLATILITY?

Implied volatility (IV) refers to the market’s expectations of future volatility for a given asset, derived from option prices. Unlike historical volatility, which measures past price fluctuations, IV is forward-looking and reflects what traders believe will happen in t

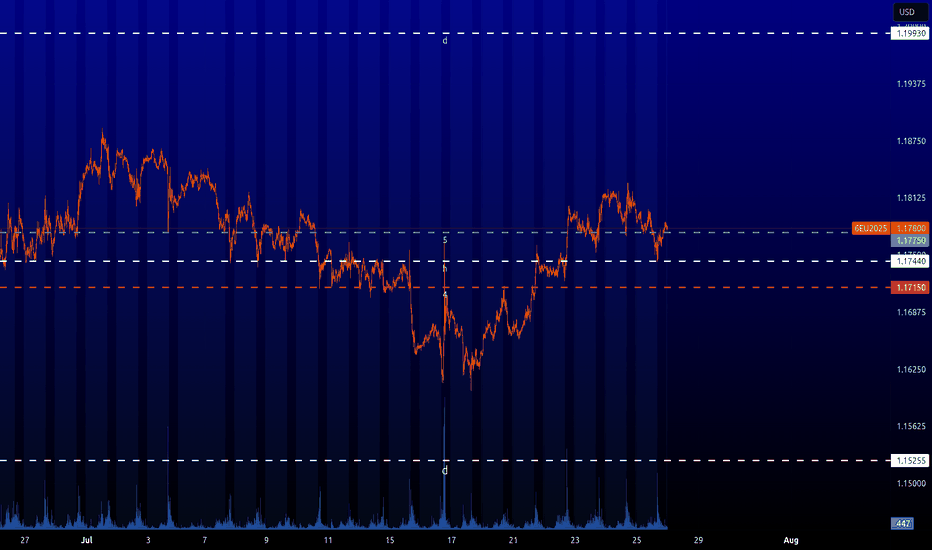

6E : Key levelsHere are the key levels for this instrument.

The nearest interesting level is at 1.17750. It is too early to buy it. The price needs to grow a little more and then it will be possible to buy this level with a limit order.

The other levels are still far away, but they will be interesting for the mar

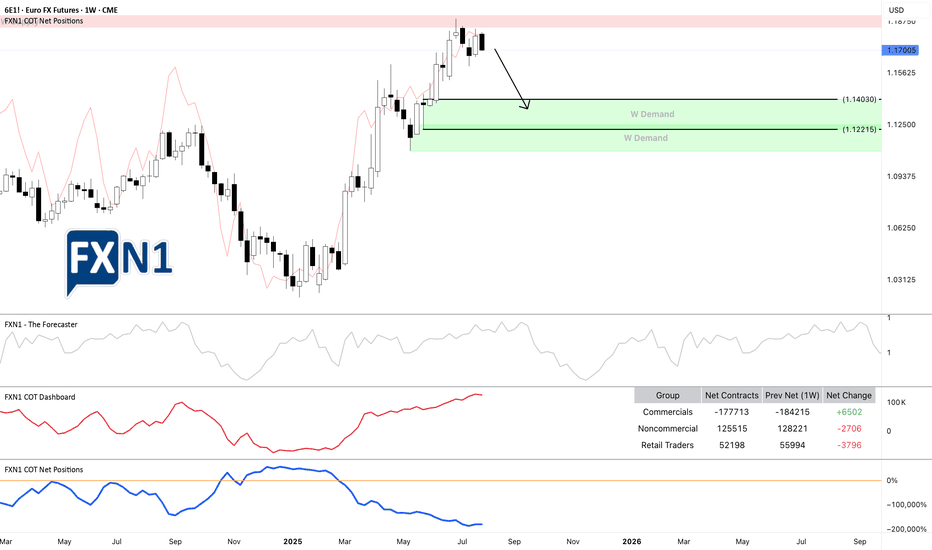

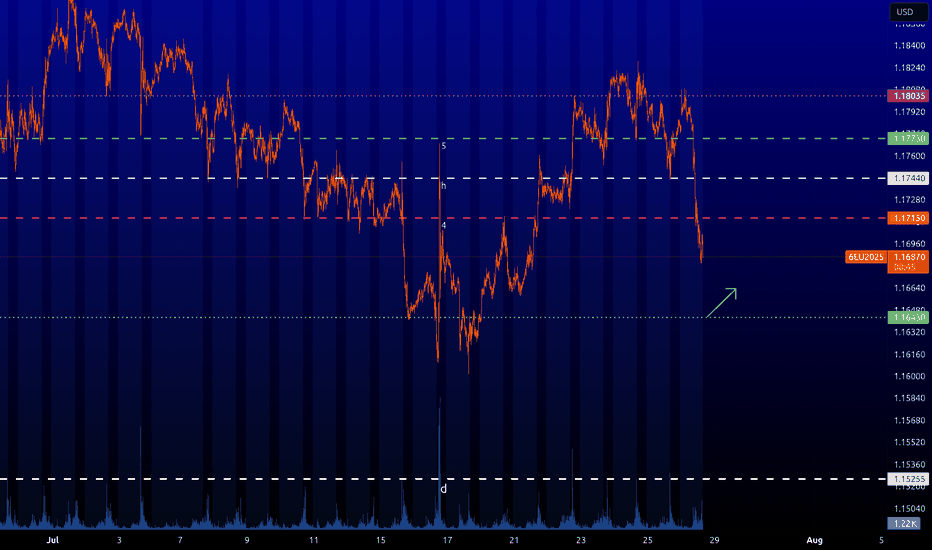

6E1!: Rebound at Weekly Supply Sparks Potential ReversalThe EURUSD (6E1! futures) experienced a rebound from a weekly supply zone * and now appears to be approaching a potential reversal toward a demand area. The overall picture is clear: we already capitalized on the rebound off the previous weekly supply zone, and at this point, we're simply observing

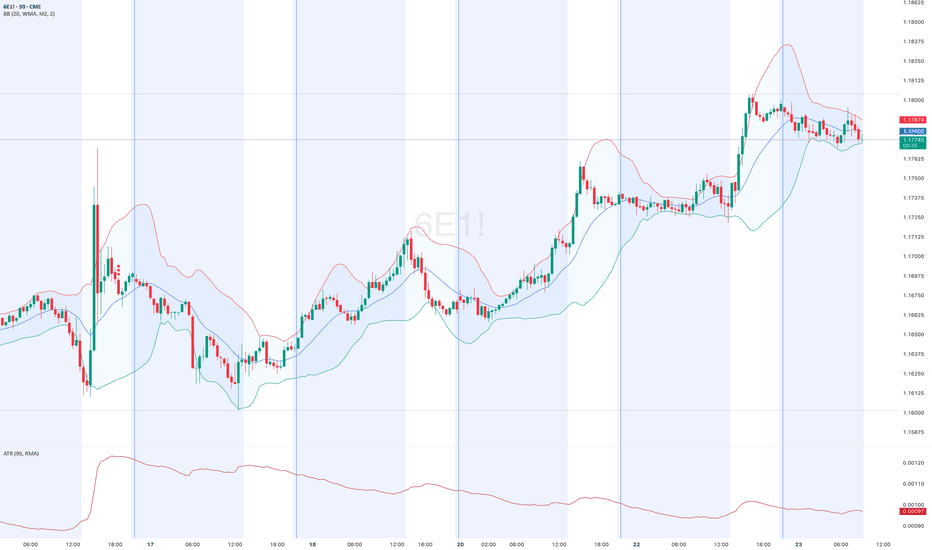

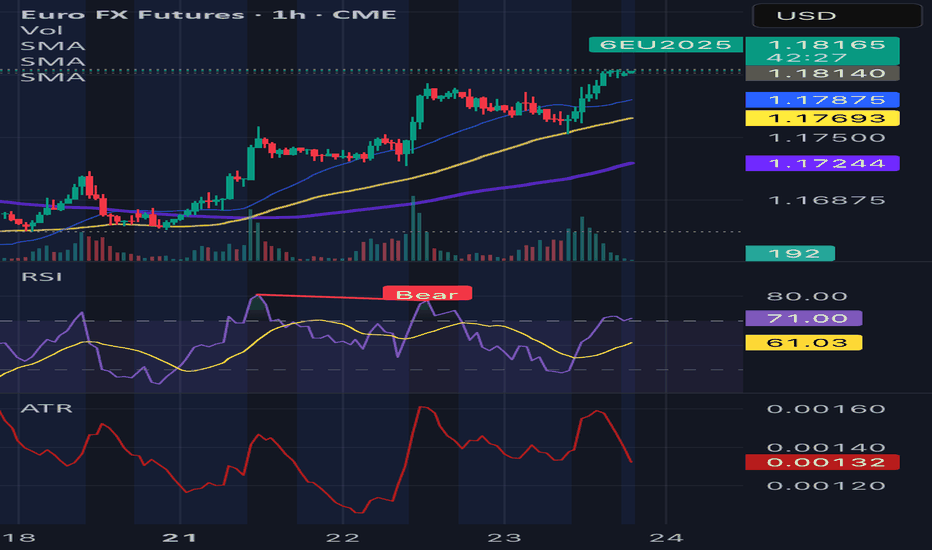

Euro Futures (6E) – Bearish Drift Below ResistanceEuro Futures (6E) appears to be grinding lower showing clear signs of fading bullish momentum.

After a bounce off 1.16160 support on July 17, Euro Futures (6E) made a failed push into 1.17995 resistance on Tuesday, July 22, a level that’s acted as a firm ceiling since June 26.

Since then, price ac

EUR/USD Futures – Key Decision ZonePrice is consolidating between 1.1430 and 1.1485, forming a range near previous value areas.

A breakout is likely imminent. Watching for:

📈 Bullish scenario: Break and retest of 1.1490 → targeting 1.1570 supply zone.

📉 Bearish scenario: Sweep of 1.1430 lows with strong volume → targeting 1.1370 dem

EURUSDEURUSD - Still has potential either now or in the future to go up to 1.3726.

Off futures has potential to go below 0.95 based on analysis only.

Confluence:

Futures Analysis - Can go both ways based on todays price action.

Forex Analysis: Still in a downtrend based on the longer term perspective,

Retrace and get long Current fundamental analysis suggest long euro short dollar options market suggest that people are starting to prefer puts in later expirations but put call ratio still about one cause call premium is up compared to put For September expiration also ecb not expected to cut rates while the fed is ant

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Euro FX Futures (Sep 2028) is 1.20110 USD — it has fallen −1.01% in the past 24 hours. Watch Euro FX Futures (Sep 2028) price in more detail on the chart.

Track more important stats on the Euro FX Futures (Sep 2028) chart.

The nearest expiration date for Euro FX Futures (Sep 2028) is Sep 18, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Euro FX Futures (Sep 2028) before Sep 18, 2028.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Euro FX Futures (Sep 2028). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Euro FX Futures (Sep 2028) technicals for a more comprehensive analysis.