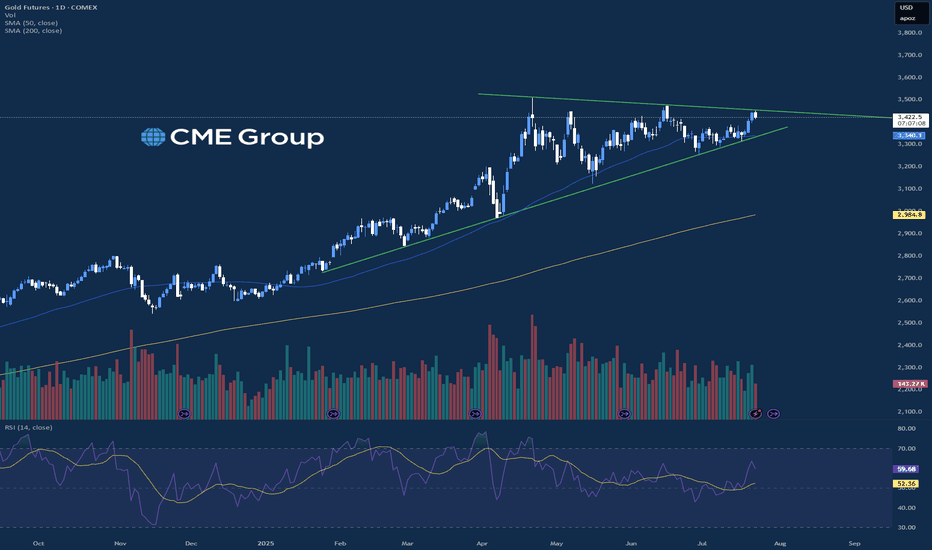

Gold Price Analysis (GC1! or XAU/USD): Challenges and OutlookSince reaching a historic high of $3,509 on April 22, 2025, gold has struggled to maintain its upward momentum. On the daily timeframe, the price experienced a sharp rejection spike after touching that peak, prompting a sideways range as the market seeks a clearer direction.

From a technical perspe

Related commodities

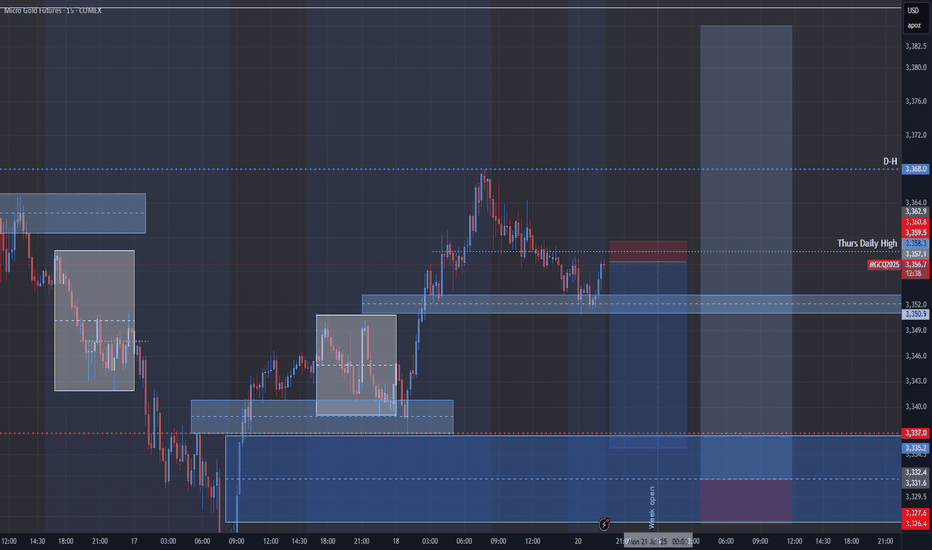

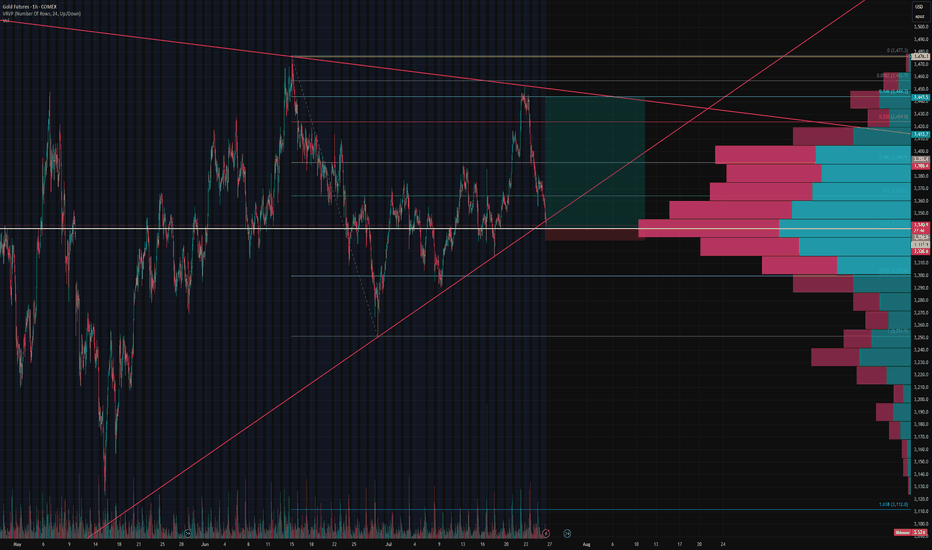

Gold will make a Low for the Week before Pushing BullishOn my previous Update I mention that we should have support off this H4 Gap. My problem with it s it immediately reacted to it when the market opened back up. well before the killzone. So I feel like this is a fake out to go short for now. they will make a low for the week then we will see it set up

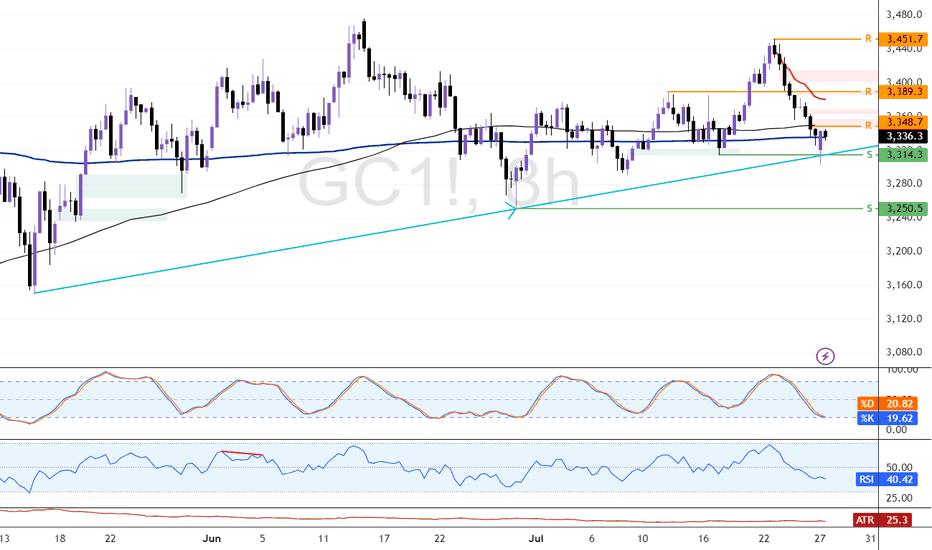

Gold: $3,348.0 Resistance in Focus for BullsFenzoFx—Gold's decline reached the ascending trendline near $3,314.0. The bullish trend remains intact while price holds above the trendline.

Immediate resistance is $3,348.0, and a close above this level could lift the market toward $3,389.0 and potentially $3,451.0, aligning with recent higher-l

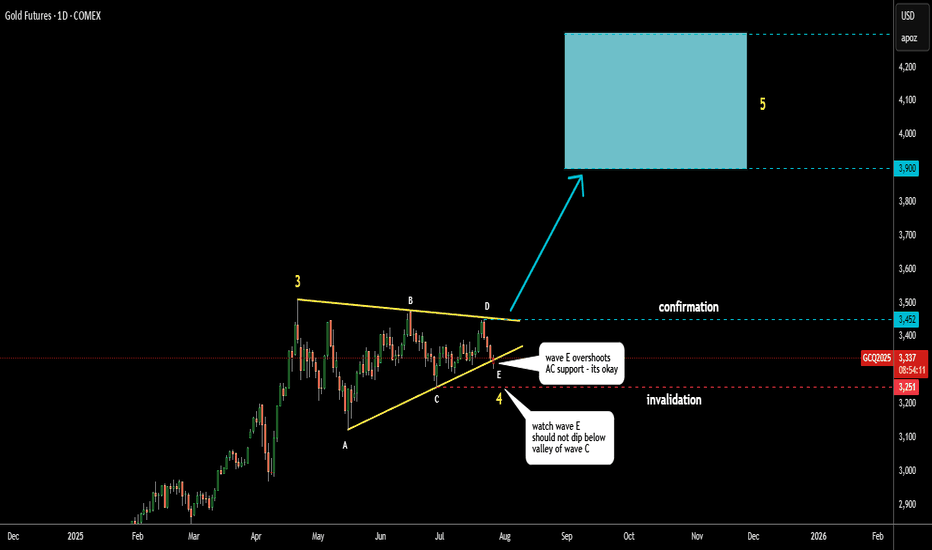

Gold Update 28 JULY 2025: On The EdgeGold is accurately following the path shown in my earlier post.

Wave D respects the triangle rules, staying below the top of wave B.

Wave E appears nearly complete, even piercing the A–C support line.

This is acceptable as long as wave E stays above the wave C low at $3,251.

Keep a close eye on this

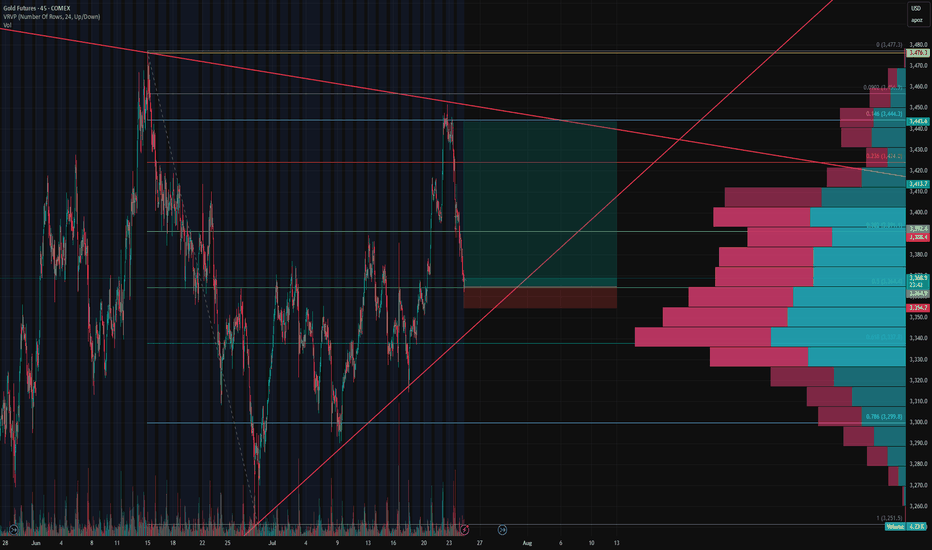

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on t

New Week...New Bullishness on Gold???Sorry my post have not been showing up. I have mistakenly been posting them as private! lol. But new week on gold looking to see some good bullish action this week but it also is the end of the month and price could stall till we get some news to move it. I need more confirmation before taking any m

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the re

Close out the Week STRONGLooks like price has found its bottom and is ready to push from here. We are looking for a strong forceful break out from this zone so we can go for the higher levels. Everything looks right from here and value keeps shifting up. I know we should get a solid entry but waiting for it to line up with

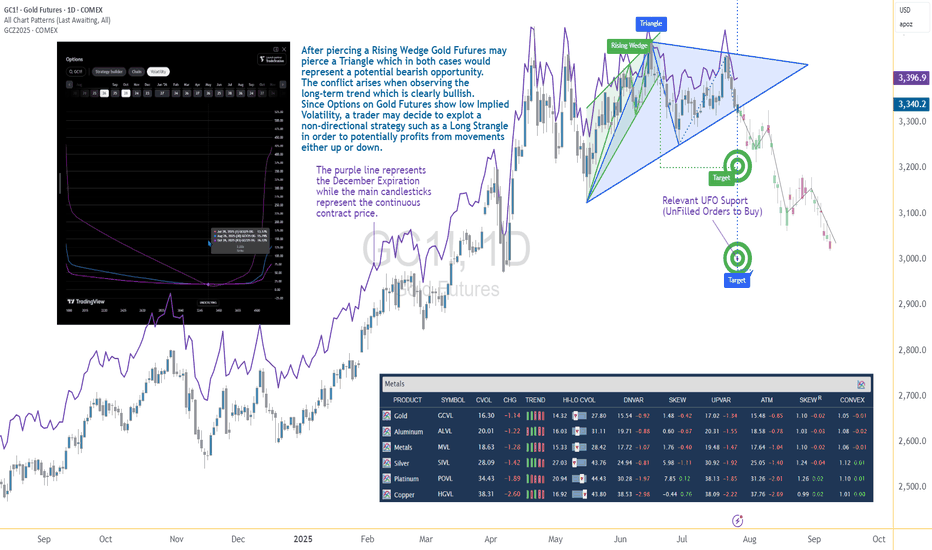

Options Blueprint Series [Intermediate]: Gold Triangle Trap PlayGold’s Volatility Decline Meets a Classic Chart Setup

Gold Futures have been steadily declining after piercing a Rising Wedge on June 20. Now, the market structure reveals the formation of a Triangle pattern nearing its apex — a point often associated with imminent breakouts. While this setup typi

Precious Metals Pushing HigherMarkets were mixed across the board today with the precious metals leading the charge higher on the session. Gold, Silver, and Copper all traded higher again today with Copper being up near 1.5% and Gold and seeing slight gains. Copper and Silver are similar in the fact that they are more industrial

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 1-Ounce Gold Futures (Feb 2026) is 3,366.25 USD — it has risen 0.12% in the past 24 hours. Watch 1-Ounce Gold Futures (Feb 2026) price in more detail on the chart.

The volume of 1-Ounce Gold Futures (Feb 2026) is 3.00. Track more important stats on the 1-Ounce Gold Futures (Feb 2026) chart.

The nearest expiration date for 1-Ounce Gold Futures (Feb 2026) is Jan 28, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell 1-Ounce Gold Futures (Feb 2026) before Jan 28, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For 1-Ounce Gold Futures (Feb 2026) this number is 2.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for 1-Ounce Gold Futures (Feb 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for 1-Ounce Gold Futures (Feb 2026). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of 1-Ounce Gold Futures (Feb 2026) technicals for a more comprehensive analysis.