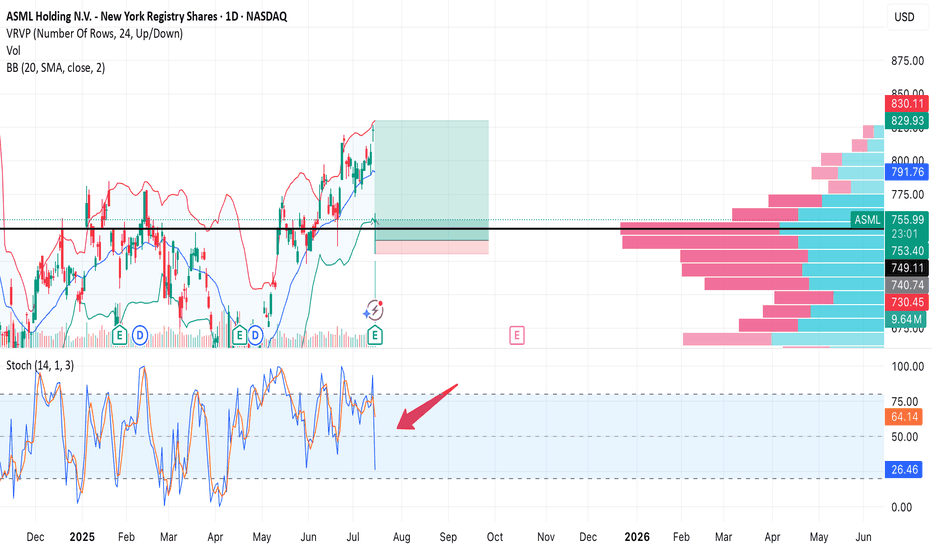

ASML, retrace for entry?ASML is currently having slight pull back, retesting the SMA 200 Weekly which were bought up with quite a volume.

Having broken out of 1 year resistance trendline consolidation (March 2024-March 2025) falling wedge/bull flag formation

If we are actually forming a trend reversal to the upside, this

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.0 EUR

7.57 B EUR

28.26 B EUR

392.65 M

About ASML HOLDING

Sector

Industry

CEO

Christophe D. Fouquet

Website

Headquarters

Veldhoven

Founded

1994

ISIN

NL0010273215

FIGI

BBG000C1HT47

ASML Holding NV engages in the development, production, marketing, sales, upgrading and servicing of advanced semiconductor equipment systems. It includes lithography, metrology and inspection systems. The company was founded on April 1, 1984 and is headquartered in Veldhoven, the Netherlands.

Related stocks

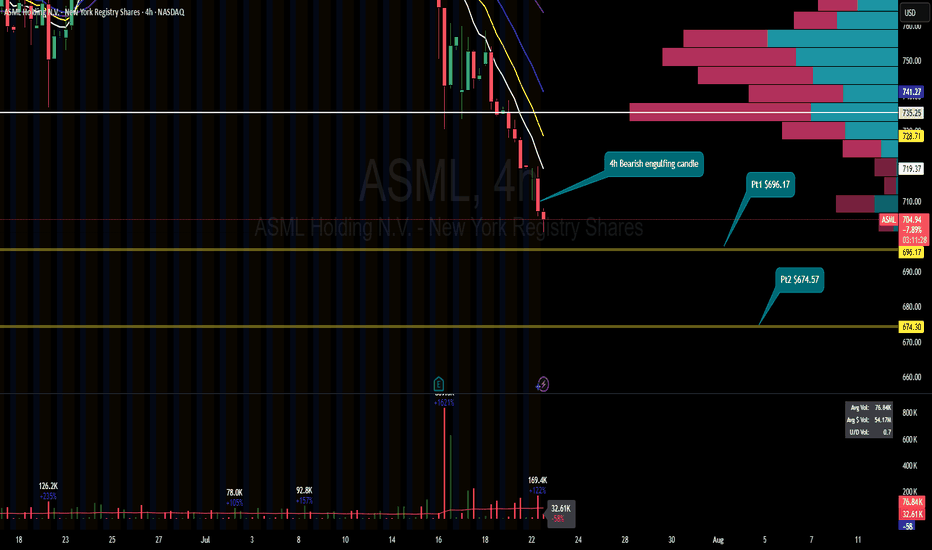

ASML — Strong earnings, sharp drop on profit-taking. Second chanAfter a strong quarterly report, NASDAQ:ASML stock initially surged, but then dropped -7.6% in a single session. Most likely due to profit-taking and a broader tech sector correction. Still, the key $754 support held, and the uptrend remains intact.

Trade Setup:

• Buy Zone: $754–760 (on retest)

ASMLASML Holding

ASML closed at $671.6 on July 7, 2025.

Market Capitalization:

ASML's market cap is approximately $302–$314 billion as of early July 2025, making it one of the world’s 30 most valuable companies.

Key Financials and Outlook

Next Earnings Release:

Scheduled for July 16, 2025. The consens

ASML ASML is trading around $659.4per share The stock has a market capitalization of approximately $312 billion

Company Overview

ASML is a global leader in advanced semiconductor equipment, specializing in lithography systems essential for chip manufacturing, including extreme ultraviolet (EUV) and dee

ASML Double Top Breakdown – Bearish SetupASML has formed a double top pattern, signaling potential downside. The neckline has been broken, confirming the bearish setup. If price holds below this level, further downside is expected.

Key Levels:

🟠 Entry: Below confirmation level

🔴 Stop Loss: 780.43

🟢 Target: 549.66

Bearish momentum is str

ASML REVERSAL SHIFT to the upside begins. SEED at 750 X2 Target!ASML Holding N.V. holds a near-monopoly in the semiconductor industry, particularly in the production of extreme ultraviolet (EUV) lithography machines, which are essential for manufacturing advanced chips. ASML is the sole provider of these machines, making them indispensable for chipmakers like TS

ASML Update! Bullish teal is proving itself! We identified in the last video (must watch if you didn't see it) that we need to prove teal over purple in this fight for a LTF breakout toward HTF algorithms.

We're seeing that happen in live-time! Continue to watch for teal to hold for a nice LTF breakout toward the $820 level and the HTF purpl

ASML Analysis - Short/mid-term outlook & trade ideasNot as clear of an opportunity as we had last time when we nailed those 100+ point trades. Check out those videos (linked below) to see the power of the algorithms!

But here, we can see a nice roadmap toward HTF intentional liquidity and what we need to see in order to get there.

Happy Trading :)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS247368710

ASML HOLDING 22/32Yield to maturity

2.84%

Maturity date

May 17, 2032

XS201003237

ASML HOLDING 20/30Yield to maturity

2.71%

Maturity date

Feb 25, 2030

XS216621972

ASML HOLDING 20/29Yield to maturity

2.67%

Maturity date

May 7, 2029

XS263141695

ASML HOLDING 23/25Yield to maturity

2.61%

Maturity date

Dec 6, 2025

XS152755619

ASML HOLDING N.V. 16/27Yield to maturity

2.37%

Maturity date

May 28, 2027

XS140578096

ASML HOLDING N.V. 16/26Yield to maturity

2.24%

Maturity date

Jul 7, 2026

See all ASML bonds

Curated watchlists where ASML is featured.

Frequently Asked Questions

The current price of ASML is 613.1 EUR — it has increased by 0.72% in the past 24 hours. Watch ASML HOLDING stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EURONEXT exchange ASML HOLDING stocks are traded under the ticker ASML.

ASML stock has risen by 3.89% compared to the previous week, the month change is a −8.39% fall, over the last year ASML HOLDING has showed a −31.50% decrease.

We've gathered analysts' opinions on ASML HOLDING future price: according to them, ASML price has a max estimate of 935.00 EUR and a min estimate of 500.00 EUR. Watch ASML chart and read a more detailed ASML HOLDING stock forecast: see what analysts think of ASML HOLDING and suggest that you do with its stocks.

ASML reached its all-time high on Jul 11, 2024 with the price of 1,021.8 EUR, and its all-time low was 6.7 EUR and was reached on Oct 9, 2002. View more price dynamics on ASML chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ASML stock is 4.55% volatile and has beta coefficient of 1.82. Track ASML HOLDING stock price on the chart and check out the list of the most volatile stocks — is ASML HOLDING there?

Today ASML HOLDING has the market capitalization of 246.79 B, it has decreased by −9.30% over the last week.

Yes, you can track ASML HOLDING financials in yearly and quarterly reports right on TradingView.

ASML HOLDING is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

ASML earnings for the last quarter are 5.90 EUR per share, whereas the estimation was 5.24 EUR resulting in a 12.66% surprise. The estimated earnings for the next quarter are 5.53 EUR per share. See more details about ASML HOLDING earnings.

ASML HOLDING revenue for the last quarter amounts to 7.69 B EUR, despite the estimated figure of 7.55 B EUR. In the next quarter, revenue is expected to reach 7.88 B EUR.

ASML net income for the last quarter is 2.29 B EUR, while the quarter before that showed 2.35 B EUR of net income which accounts for −2.75% change. Track more ASML HOLDING financial stats to get the full picture.

ASML HOLDING dividend yield was 0.94% in 2024, and payout ratio reached 33.24%. The year before the numbers were 0.89% and 30.64% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 31, 2025, the company has 44.03 K employees. See our rating of the largest employees — is ASML HOLDING on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ASML HOLDING EBITDA is 12.17 B EUR, and current EBITDA margin is 35.42%. See more stats in ASML HOLDING financial statements.

Like other stocks, ASML shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ASML HOLDING stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ASML HOLDING technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ASML HOLDING stock shows the sell signal. See more of ASML HOLDING technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.