PepsiCo (PEP) Stock Rallies 7.4% Following Earnings ReportPepsiCo (PEP) Stock Rallies 7.4% Following Earnings Report – What Comes Next?

Yesterday, PepsiCo Inc. (PEP) released its quarterly earnings report, which significantly exceeded market expectations:

→ Earnings per share (EPS) came in at $2.12, surpassing the forecast of $2.02.

→ Gross revenue reach

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.68 EUR

9.25 B EUR

88.73 B EUR

1.36 B

About PepsiCo, Inc.

Sector

Industry

CEO

Ramon Luis Laguarta

Website

Headquarters

Purchase

Founded

1965

FIGI

BBG00KH5L957

PepsiCo, Inc. engages in the manufacture, marketing, distribution, and sale of beverages, food, and snacks. It operates through the following business segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), PepsiCo Beverages North America (PBNA), Latin America (LatAm), Europe, Africa, Middle East, and South Asia (AMESA), and Asia Pacific, Australia and New Zealand, and China Region (APAC). The FLNA segment consists of branded convenient food businesses in the United States and Canada. The QFNA segment includes cereals, rice, and pasta under the Quaker, Pearl Milling Company, Quaker Chewy, Cap'n Crunch, Life, and Rice-A-Roni brands. The PBNA segment is composed of beverage concentrates, fountain syrups, and finished goods under various beverage brands such as Pepsi, Gatorade, Mountain Dew, Diet Pepsi, Aquafina, Diet Mountain Dew, Sierra Mist, and Mug. The LatAm segment covers beverage, food, and snack businesses in the Latin American region. The Europe segment offers beverage, food, and snack goods in Europe and Sub-Saharan Africa regions. The AMESA segment deals with all beverage and convenient food businesses in Africa, the Middle East, and South Asia. The APAC segment refers to all business operations in the Asia Pacific, Australia and New Zealand, and China region. The company was founded by Donald M. Kendall, Sr. and Herman W. Lay in 1965 and is headquartered in Purchase, NY.

Related stocks

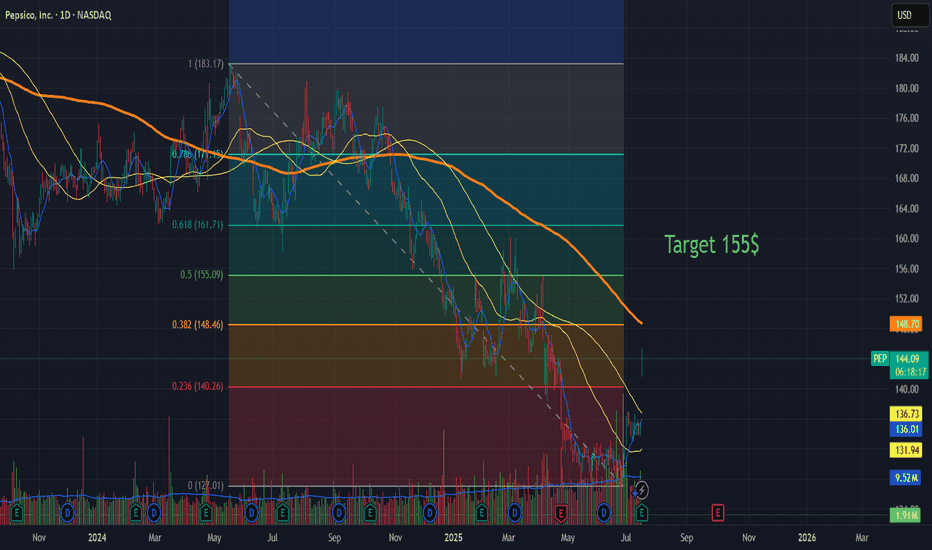

PEPsico is looking to pop up further NASDAQ:PEP had a strong gap up, and with the latest completion of the cup and handle, it is clear that the upside is likely coming back. Bullish engulfing candle was seen as a strong contender for continued upside. My guess is with the positive momentum, the stock is likely to break above the downt

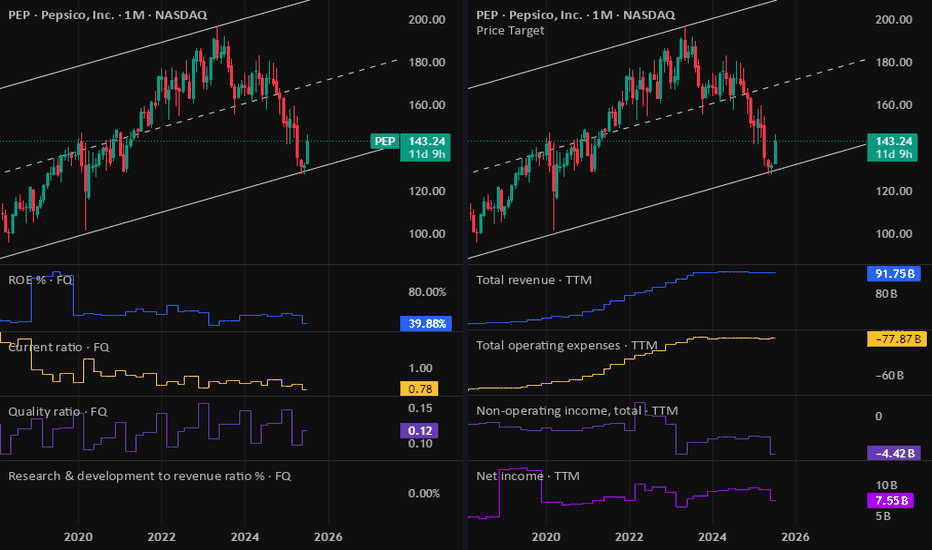

PEP: PepsiCo Earnings resultsIts looks like PEP is a buy now. Just want to double check on future sales growth as it is stable for a while. Lower stock price made the dividend very attractive since PEP is a defensive stock.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

PEP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The recent consolidation shelf around $130.00 is the first line of defense. The absolute low and our line in the sand is the Selling Climax low at $127.60.

Resistance: The 20-week moving average at $138.30 is the immediate ceiling it needs to break through.

Next

PEP Long-Term Buy Opportunityhi Traders,

The chart presents a compelling long-term buying opportunity for PepsiCo (PEP). The price is currently sitting in the identified "buy zone", a historically reliable area for accumulation. If we experience further dips, it’s still considered a buying opportunity all the way down to the 2

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US713448FG8

PEPSICO 21/51Yield to maturity

6.92%

Maturity date

Oct 21, 2051

PEP4895343

PepsiCo, Inc. 2.875% 15-OCT-2049Yield to maturity

6.69%

Maturity date

Oct 15, 2049

PEP4864210

PepsiCo, Inc. 3.375% 29-JUL-2049Yield to maturity

6.49%

Maturity date

Jul 29, 2049

US713448FF0

PEPSICO 21/41Yield to maturity

6.45%

Maturity date

Oct 21, 2041

US713448DP0

PEPSICO INC. 16/46Yield to maturity

6.40%

Maturity date

Oct 6, 2046

PEP4968015

PepsiCo, Inc. 3.875% 19-MAR-2060Yield to maturity

6.27%

Maturity date

Mar 19, 2060

PEP4968014

PepsiCo, Inc. 3.625% 19-MAR-2050Yield to maturity

6.25%

Maturity date

Mar 19, 2050

PEPS

PEPSICO INC. 17/47Yield to maturity

6.19%

Maturity date

May 2, 2047

PEP5447005

PepsiCo, Inc. 4.2% 18-JUL-2052Yield to maturity

6.07%

Maturity date

Jul 18, 2052

PEP3887895

PepsiCo, Inc. 3.6% 13-AUG-2042Yield to maturity

6.07%

Maturity date

Aug 13, 2042

PEPB

PEPSICO INC. 12/42Yield to maturity

6.01%

Maturity date

Mar 5, 2042

See all 4PEP bonds

Curated watchlists where 4PEP is featured.

Frequently Asked Questions

The current price of 4PEP is 121.64 EUR — it has decreased by −1.49% in the past 24 hours. Watch PEPSICO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange PEPSICO stocks are traded under the ticker 4PEP.

4PEP stock has fallen by −1.86% compared to the previous week, the month change is a 9.66% rise, over the last year PEPSICO has showed a −22.55% decrease.

We've gathered analysts' opinions on PEPSICO future price: according to them, 4PEP price has a max estimate of 149.68 EUR and a min estimate of 98.36 EUR. Watch 4PEP chart and read a more detailed PEPSICO stock forecast: see what analysts think of PEPSICO and suggest that you do with its stocks.

4PEP reached its all-time high on Oct 31, 2022 with the price of 184.58 EUR, and its all-time low was 81.00 EUR and was reached on May 14, 2018. View more price dynamics on 4PEP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4PEP stock is 1.51% volatile and has beta coefficient of 0.08. Track PEPSICO stock price on the chart and check out the list of the most volatile stocks — is PEPSICO there?

Today PEPSICO has the market capitalization of 167.19 B, it has increased by 0.05% over the last week.

Yes, you can track PEPSICO financials in yearly and quarterly reports right on TradingView.

PEPSICO is going to release the next earnings report on Oct 2, 2025. Keep track of upcoming events with our Earnings Calendar.

4PEP earnings for the last quarter are 1.80 EUR per share, whereas the estimation was 1.72 EUR resulting in a 4.50% surprise. The estimated earnings for the next quarter are 1.92 EUR per share. See more details about PEPSICO earnings.

PEPSICO revenue for the last quarter amounts to 19.29 B EUR, despite the estimated figure of 18.91 B EUR. In the next quarter, revenue is expected to reach 20.34 B EUR.

4PEP net income for the last quarter is 1.07 B EUR, while the quarter before that showed 1.70 B EUR of net income which accounts for −36.75% change. Track more PEPSICO financial stats to get the full picture.

Yes, 4PEP dividends are paid quarterly. The last dividend per share was 1.25 EUR. As of today, Dividend Yield (TTM)% is 3.83%. Tracking PEPSICO dividends might help you take more informed decisions.

PEPSICO dividend yield was 3.51% in 2024, and payout ratio reached 76.68%. The year before the numbers were 2.91% and 75.37% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 319 K employees. See our rating of the largest employees — is PEPSICO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PEPSICO EBITDA is 15.14 B EUR, and current EBITDA margin is 19.72%. See more stats in PEPSICO financial statements.

Like other stocks, 4PEP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PEPSICO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PEPSICO technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PEPSICO stock shows the sell signal. See more of PEPSICO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.