Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.76 EUR

−9.32 M EUR

4.40 M EUR

5.35 M

About DRAGANFLY INC.

Sector

Industry

CEO

Cameron Chell

Website

Headquarters

Saskatoon

Founded

1998

FIGI

BBG00QTPW1N2

Draganfly, Inc. engages in the manufacture and sale of commercial unmanned aerial vehicle systems and software serving the public safety, agriculture, industrial inspections, security, mapping, and surveying markets. Its products include quad-copters, fixed wing aircrafts, ground based robots, hand held controllers, and software used for tracking, live streaming, and data collection. The firm also offers custom engineering, training, simulation consulting, as well as data and flight training services. The company was founded by Zenon Dragan and Christine Dragan in 1998 and is headquartered in Saskatoon, Canada.

Related stocks

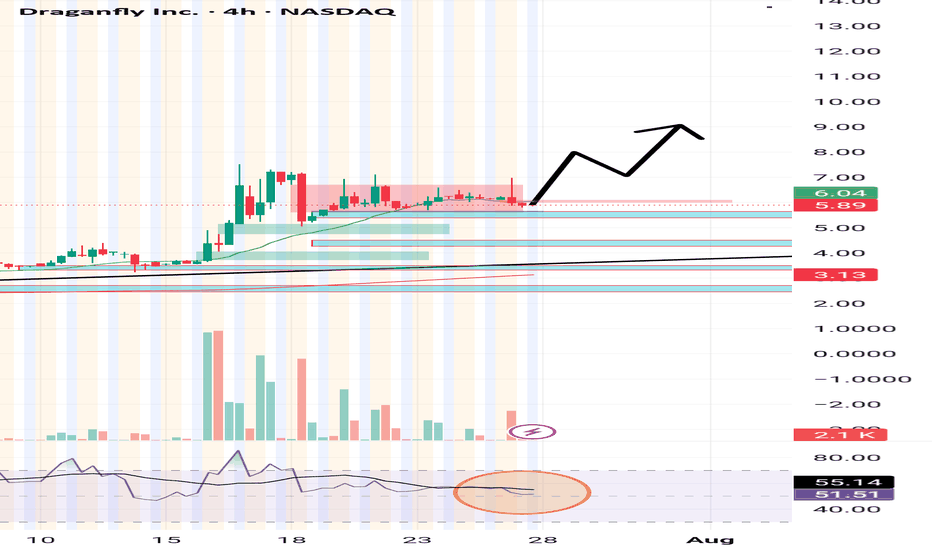

DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

7/9/25 - $dpro - PSA... rotate7/9/25 :: VROCKSTAR :: NASDAQ:DPRO

PSA... rotate

- saw some d00d shilling this

- couldn't help myself

- this isn't a company with a future outside M&A or restructuring

- the meme move is simply what we've gotten in chitco's since the liquidity bottom in april

- you do you

- but friends don't let

Draganfly Inc. (DPRO) Stock Performance and Financial HighlightsDraganfly Inc. (DPRO) has experienced significant stock price fluctuations from October 2024 to December 2024. Here’s a summary of its recent performance:

October 2024: The stock opened at $0.88 on October 2, 2024, and traded mostly below $1 throughout the month. The price began to climb towards th

Bullish on DronesThe USA has banned the use of all Russian and Chinese drowns. This is the wait that we have all endured now. With stocks like Dragonfly and drone Delivery Canada... its a perfect opportunity to generate revenue and have a stronger position in the markets in North America. I expect this stock will re

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange DRAGANFLY INC. stocks are traded under the ticker 3U8.

We've gathered analysts' opinions on DRAGANFLY INC. future price: according to them, 3U8 price has a max estimate of 6.09 EUR and a min estimate of 5.15 EUR. Watch 3U8 chart and read a more detailed DRAGANFLY INC. stock forecast: see what analysts think of DRAGANFLY INC. and suggest that you do with its stocks.

Yes, you can track DRAGANFLY INC. financials in yearly and quarterly reports right on TradingView.

DRAGANFLY INC. is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

3U8 earnings for the last quarter are −0.40 EUR per share, whereas the estimation was −0.41 EUR resulting in a 2.33% surprise. The estimated earnings for the next quarter are −0.33 EUR per share. See more details about DRAGANFLY INC. earnings.

DRAGANFLY INC. revenue for the last quarter amounts to 994.05 K EUR, despite the estimated figure of 1.32 M EUR. In the next quarter, revenue is expected to reach 1.40 M EUR.

3U8 net income for the last quarter is −2.20 M EUR, while the quarter before that showed −3.17 M EUR of net income which accounts for 30.60% change. Track more DRAGANFLY INC. financial stats to get the full picture.

No, 3U8 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 8, 2025, the company has 54 employees. See our rating of the largest employees — is DRAGANFLY INC. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DRAGANFLY INC. EBITDA is −9.33 M EUR, and current EBITDA margin is −215.25%. See more stats in DRAGANFLY INC. financial statements.

Like other stocks, 3U8 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DRAGANFLY INC. stock right from TradingView charts — choose your broker and connect to your account.