Mercer (MERC) Boosts Production Capacity With Structurlam Buy

The Structurlam assets include a state-of-the-art mass timber facility in Conway, AR which has an annual capacity of approximately 75,000 cubic meters. It can produce both glulam and cross-laminated timber (CLT). The deal also includes three facilities located in British Columbia, Canada with a c

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.26 EUR

−82.24 M EUR

1.97 B EUR

38.07 M

About Mercer International Inc.

Sector

Industry

CEO

Juan Carlos Bueno

Website

Headquarters

Vancouver

Founded

1968

FIGI

BBG000FHKF90

Mercer International, Inc. engages in the provision of renewable bio-based products. It operates through the following segments: Pulp, Solid Wood, and Corporate and Other. The Pulp segment consists of the manufacture, sale, and distribution of pulp, electricity, and chemicals at pulp mills. The Solid Wood segment is involved in the manufacture, sale, and distribution of lumber, manufactured products, wood pallets, electricity, biofuels, and wood residuals at sawmills and other facilities in Germany and mass timber facilities in North America. The Corporate and Other segment refers to sandalwood business. The company was founded on July 1, 1968 and is headquartered in Vancouver, Canada.

Related stocks

See all ideas

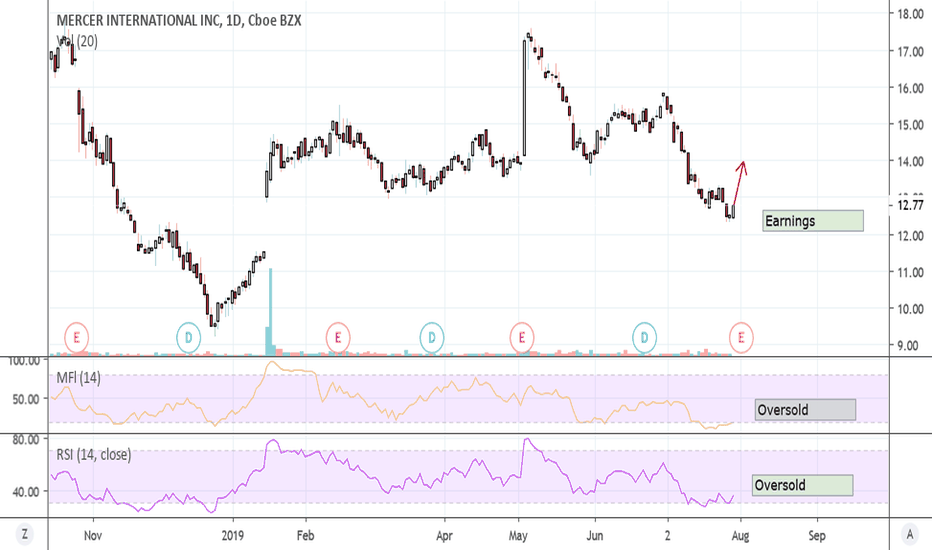

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MERC5219084

Mercer International Inc. 5.125% 01-FEB-2029Yield to maturity

13.52%

Maturity date

Feb 1, 2029

MERC5655174

Mercer International Inc. 12.875% 01-OCT-2028Yield to maturity

12.71%

Maturity date

Oct 1, 2028

MERC5112519

Mercer International Inc. 5.125% 01-FEB-2029Yield to maturity

4.46%

Maturity date

Feb 1, 2029

See all AEZ bonds

Frequently Asked Questions

The current price of AEZ is 3.00 EUR — it has increased by 0.67% in the past 24 hours. Watch MERCER INTL INC. DL 1 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange MERCER INTL INC. DL 1 stocks are traded under the ticker AEZ.

AEZ stock has fallen by −3.23% compared to the previous week, the month change is a −7.41% fall, over the last year MERCER INTL INC. DL 1 has showed a −62.73% decrease.

We've gathered analysts' opinions on MERCER INTL INC. DL 1 future price: according to them, AEZ price has a max estimate of 4.43 EUR and a min estimate of 3.54 EUR. Watch AEZ chart and read a more detailed MERCER INTL INC. DL 1 stock forecast: see what analysts think of MERCER INTL INC. DL 1 and suggest that you do with its stocks.

AEZ stock is 0.00% volatile and has beta coefficient of 1.17. Track MERCER INTL INC. DL 1 stock price on the chart and check out the list of the most volatile stocks — is MERCER INTL INC. DL 1 there?

Today MERCER INTL INC. DL 1 has the market capitalization of 199.32 M, it has decreased by −4.83% over the last week.

Yes, you can track MERCER INTL INC. DL 1 financials in yearly and quarterly reports right on TradingView.

MERCER INTL INC. DL 1 is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

AEZ earnings for the last quarter are −0.31 EUR per share, whereas the estimation was −0.17 EUR resulting in a −83.23% surprise. The estimated earnings for the next quarter are −0.16 EUR per share. See more details about MERCER INTL INC. DL 1 earnings.

MERCER INTL INC. DL 1 revenue for the last quarter amounts to 468.62 M EUR, despite the estimated figure of 467.23 M EUR. In the next quarter, revenue is expected to reach 444.47 M EUR.

AEZ net income for the last quarter is −20.65 M EUR, while the quarter before that showed 16.14 M EUR of net income which accounts for −227.95% change. Track more MERCER INTL INC. DL 1 financial stats to get the full picture.

Yes, AEZ dividends are paid quarterly. The last dividend per share was 0.07 EUR. As of today, Dividend Yield (TTM)% is 8.70%. Tracking MERCER INTL INC. DL 1 dividends might help you take more informed decisions.

As of Jun 24, 2025, the company has 3.58 K employees. See our rating of the largest employees — is MERCER INTL INC. DL 1 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MERCER INTL INC. DL 1 EBITDA is 210.02 M EUR, and current EBITDA margin is 11.93%. See more stats in MERCER INTL INC. DL 1 financial statements.

Like other stocks, AEZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MERCER INTL INC. DL 1 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MERCER INTL INC. DL 1 technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MERCER INTL INC. DL 1 stock shows the sell signal. See more of MERCER INTL INC. DL 1 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.