Key facts today

Oracle is involved in a significant investment deal between the U.S. and UAE to develop a 5-gigawatt AI campus in Abu Dhabi, boosting AI infrastructure in the Gulf.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.22 EUR

9.65 B EUR

48.83 B EUR

1.65 B

About Oracle Corporation

Sector

Industry

CEO

Safra Ada Catz

Website

Headquarters

Austin

Founded

1977

FIGI

BBG000C0RX21

Oracle Corp. engages in the provision of products and services that address aspects of corporate information technology environments, including applications and infrastructure technologies. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers enterprise applications and infrastructure technologies through cloud and on-premise deployment models including cloud services and license support offerings. The Hardware segment provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management, and other hardware-related software. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

ORCL looking at a new returned upsideRising momentum is seen for ORCL L after mid-term stochastic oscillator performs an oversold crossover and rising momentum. Furthermore, the 23-period RSI has rose steadily above the zero line.

Meanwhile, price action saw continued upside coming after forming a pair of higher high and low. Ichimok

ORCL - Weekly - The PlayClick Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!!

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

1.) The most recent two earnings

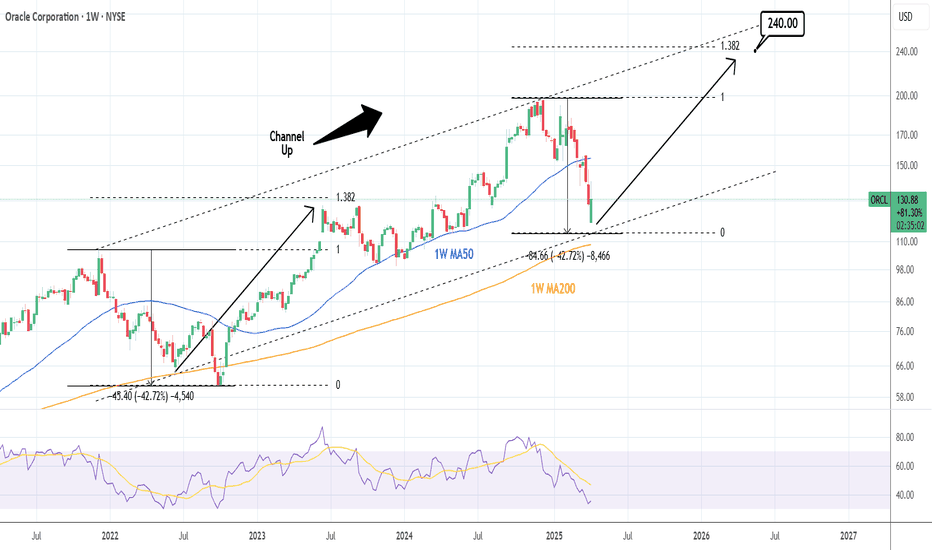

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term bu

ORCL for BuyOracle Corporation (ORCL) has recently reported its fiscal third-quarter earnings, with adjusted earnings of $1.47 per share on sales of $14.1 billion, slightly below Wall Street forecasts of $1.49 per share on $14.4 billion in sales. Despite this, the company provided a strong sales forecast for th

Check Out Oracle’s Chart Heading Into Next Week’s EarningsOracle NYSE:ORCL is set to report fiscal third-quarter results next Monday (March 10) after the closing bell rings in New York. What is technical and fundamental analysis saying about the software/cloud/AI giant’s stock heading into the results?

Oracle’s Fundamental Analysis

As I write this, t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ORCL4972631

Oracle Corporation 3.6% 01-APR-2050Yield to maturity

7.11%

Maturity date

Apr 1, 2050

ORCL4972632

Oracle Corporation 3.85% 01-APR-2060Yield to maturity

7.09%

Maturity date

Apr 1, 2060

ORCL5153814

Oracle Corporation 4.1% 25-MAR-2061Yield to maturity

6.93%

Maturity date

Mar 25, 2061

ORCL5153813

Oracle Corporation 3.95% 25-MAR-2051Yield to maturity

6.90%

Maturity date

Mar 25, 2051

US68389XBJ3

ORACLE 16/46Yield to maturity

6.88%

Maturity date

Jul 15, 2046

ORCK

ORACLE 17/47Yield to maturity

6.86%

Maturity date

Nov 15, 2047

ORCH

ORACLE 15/55Yield to maturity

6.79%

Maturity date

May 15, 2055

US68389XBF1

ORACLE 15/45Yield to maturity

6.77%

Maturity date

May 15, 2045

ORCL5153812

Oracle Corporation 3.65% 25-MAR-2041Yield to maturity

6.58%

Maturity date

Mar 25, 2041

US68389XAW5

ORACLE 14/44Yield to maturity

6.57%

Maturity date

Jul 8, 2044

ORCL5902732

Oracle Corporation 5.5% 27-SEP-2064Yield to maturity

6.48%

Maturity date

Sep 27, 2064

See all ORC bonds

Curated watchlists where ORC is featured.

Related stocks

Frequently Asked Questions

The current price of ORC is 150.00 EUR — it has increased by 1.97% in the past 24 hours. Watch ORACLE CORP. DL-,01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange ORACLE CORP. DL-,01 stocks are traded under the ticker ORC.

ORC stock has risen by 1.23% compared to the previous week, the month change is a 14.64% rise, over the last year ORACLE CORP. DL-,01 has showed a 33.29% increase.

We've gathered analysts' opinions on ORACLE CORP. DL-,01 future price: according to them, ORC price has a max estimate of 216.42 EUR and a min estimate of 114.37 EUR. Watch ORC chart and read a more detailed ORACLE CORP. DL-,01 stock forecast: see what analysts think of ORACLE CORP. DL-,01 and suggest that you do with its stocks.

ORC stock is 0.21% volatile and has beta coefficient of 1.57. Track ORACLE CORP. DL-,01 stock price on the chart and check out the list of the most volatile stocks — is ORACLE CORP. DL-,01 there?

Today ORACLE CORP. DL-,01 has the market capitalization of 419.40 B, it has increased by 4.39% over the last week.

Yes, you can track ORACLE CORP. DL-,01 financials in yearly and quarterly reports right on TradingView.

ORACLE CORP. DL-,01 is going to release the next earnings report on Jun 11, 2025. Keep track of upcoming events with our Earnings Calendar.

ORC earnings for the last quarter are 1.42 EUR per share, whereas the estimation was 1.44 EUR resulting in a −1.49% surprise. The estimated earnings for the next quarter are 1.45 EUR per share. See more details about ORACLE CORP. DL-,01 earnings.

ORACLE CORP. DL-,01 revenue for the last quarter amounts to 13.62 B EUR, despite the estimated figure of 13.86 B EUR. In the next quarter, revenue is expected to reach 13.73 B EUR.

ORC net income for the last quarter is 2.83 B EUR, while the quarter before that showed 2.98 B EUR of net income which accounts for −5.01% change. Track more ORACLE CORP. DL-,01 financial stats to get the full picture.

Yes, ORC dividends are paid quarterly. The last dividend per share was 0.45 EUR. As of today, Dividend Yield (TTM)% is 0.99%. Tracking ORACLE CORP. DL-,01 dividends might help you take more informed decisions.

ORACLE CORP. DL-,01 dividend yield was 1.37% in 2023, and payout ratio reached 43.15%. The year before the numbers were 1.28% and 44.24% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 6, 2025, the company has 159 K employees. See our rating of the largest employees — is ORACLE CORP. DL-,01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ORACLE CORP. DL-,01 EBITDA is 22.92 B EUR, and current EBITDA margin is 41.94%. See more stats in ORACLE CORP. DL-,01 financial statements.

Like other stocks, ORC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ORACLE CORP. DL-,01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ORACLE CORP. DL-,01 technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ORACLE CORP. DL-,01 stock shows the buy signal. See more of ORACLE CORP. DL-,01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.