GBPJPY: Get Ready to Buy 🇬🇧🇯🇵

GBPJPY is consolidating within a narrow horizontal range

on a daily time frame.

I am waiting for its bullish breakout and a daily candle close above

199.85 to confirm the next bullish wave.

A rise will be expected to 201 level then.

❤️Please, support my work with like, thank you!❤️

I am par

About British Pound / Japanese Yen

The British Pound (GBP) vs. the Japanese Yen (JPY) is a highly volatile pair. JPY is often used as a funding currency of a trade because it’s historically a low yielding currency. Since UK is one of the larger economies in Europe, the GBPJPY pair can be considered as a proxy for worldwide economic health. On the other hand, this pair performs like a representer for market 'risk-off' moves as the carry trade gets reversed. As a result, GBPJPY is able to develop strong trends that exceed thousands of pips.

Related currencies

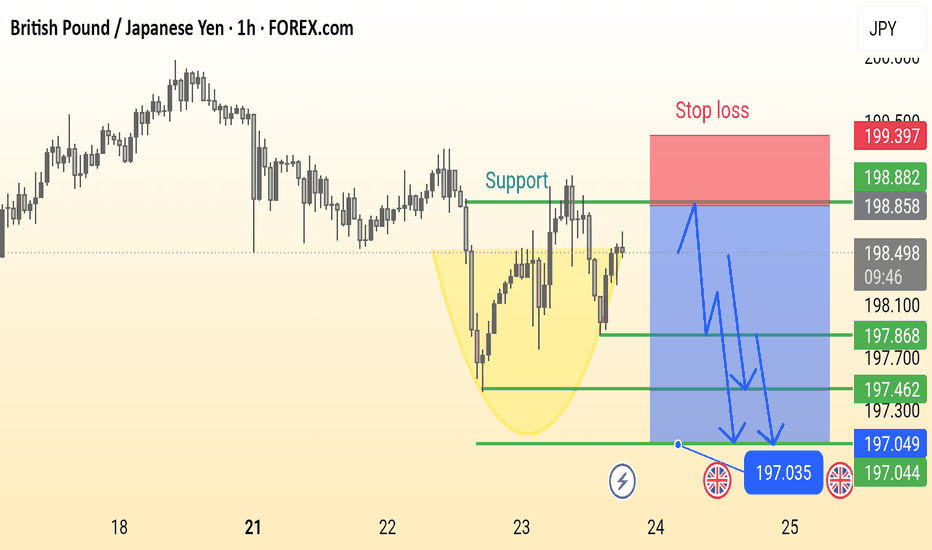

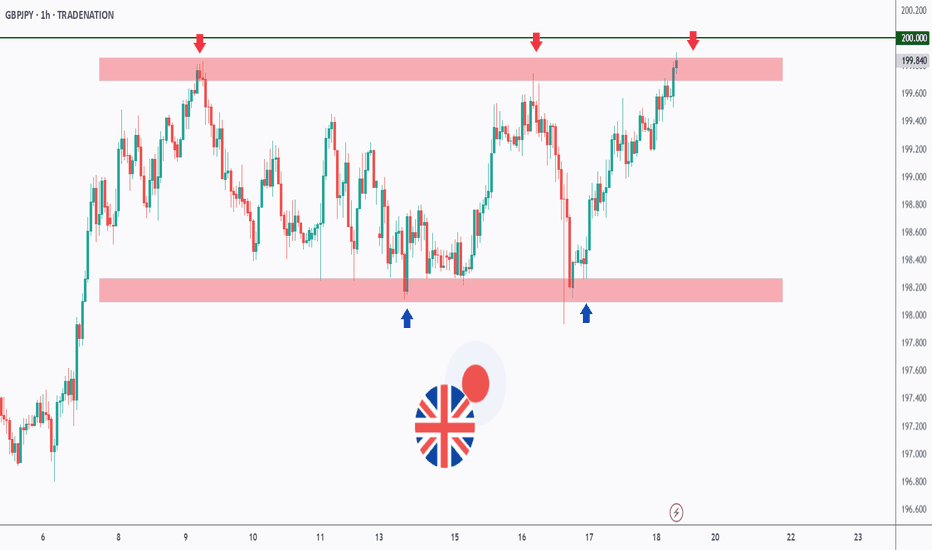

GBP/JPY Analysis is Ready This is a 1-hour chart of the GBP/JPY currency pair showing a potential bearish setup. Key elements include:

Support Zone: Around 198.000, previously tested multiple times.

Bearish Cup Pattern: Highlighted in yellow, suggesting a reversal.

Stop Loss: Marked above 199.397.

Sell Entry Zone: Near t

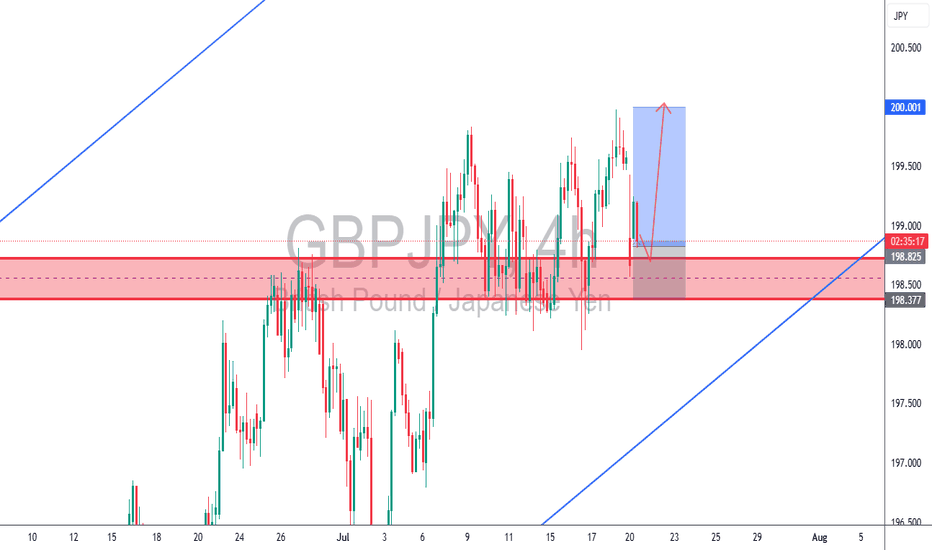

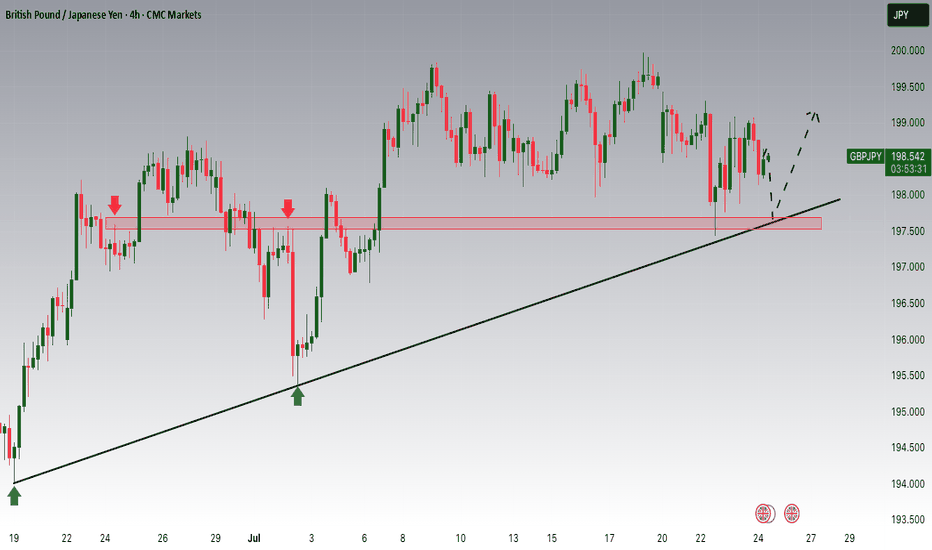

GBPJPY 4H – Demand Zone Rejection | Bullish Continuation🏹 GBPJPY 4H – Demand Zone Rejection | Bullish Continuation

GBPJPY tapped into a key 4H demand zone with a strong rejection wick, respecting both horizontal support and trendline structure. With bullish momentum building, price is likely to push toward the psychological 200.000 level.

✅ Demand zone

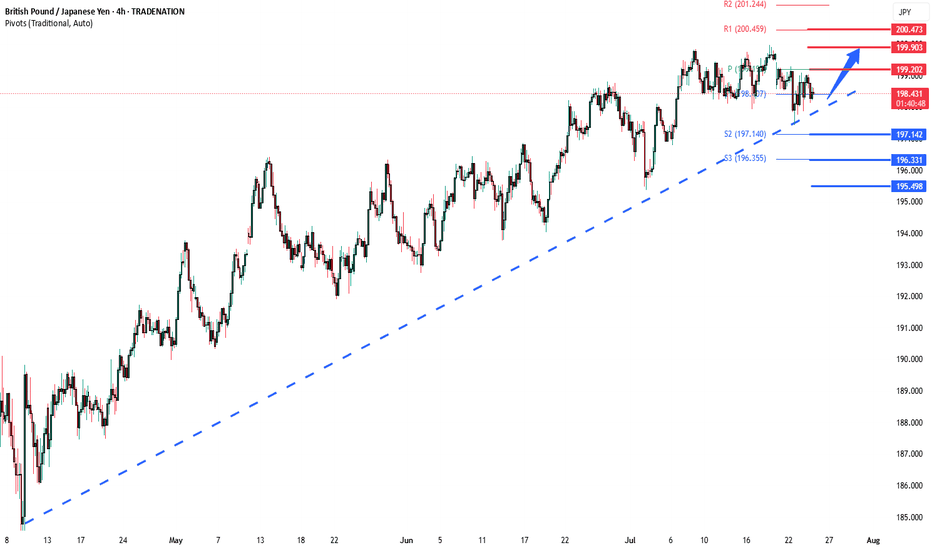

GBPJPY uptrend co0ntinuation support at 196.75Key Support: 196.75

This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at:

199.20 – Initial resistance and short-term target

199.70 – Minor resistance zone

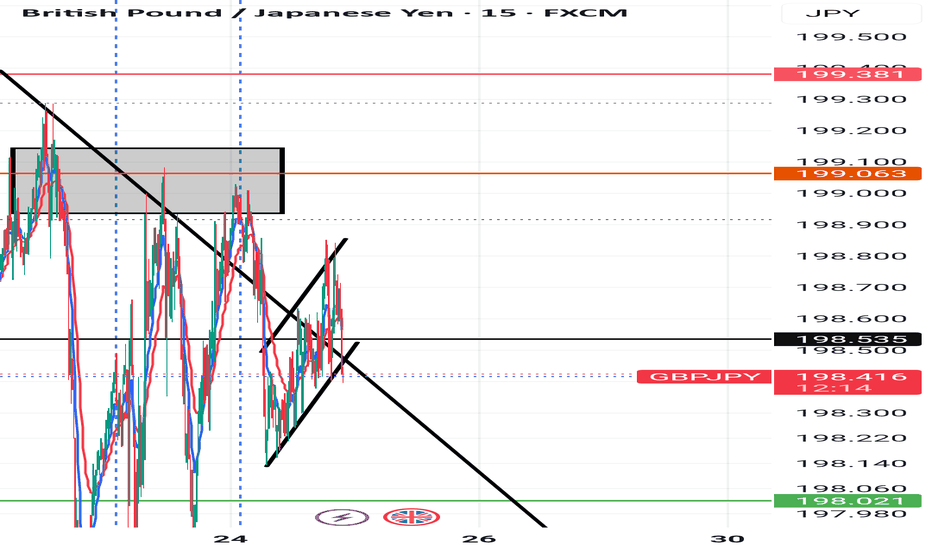

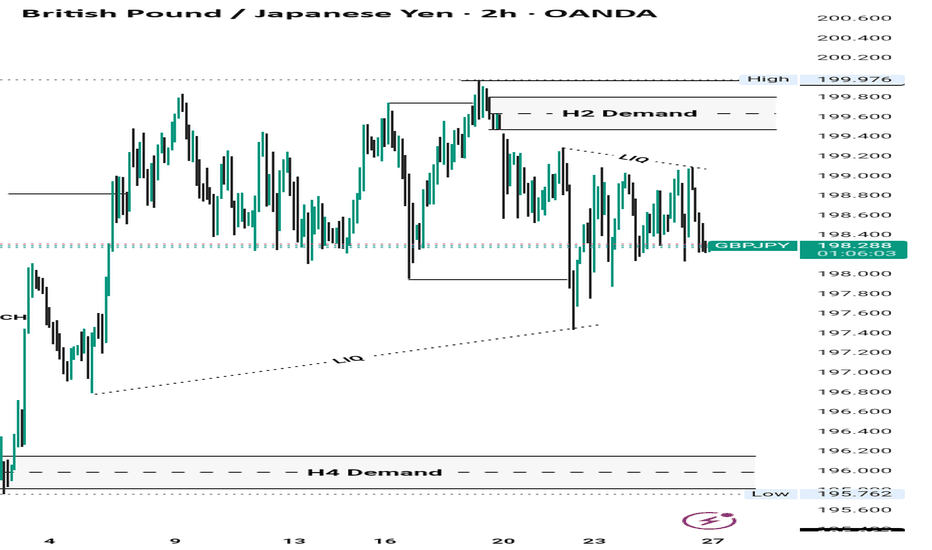

GBPJPY short From what I'm seeing

GBPJPY is not done yet

As buyers have tried to push price higher but pressure from the sellers still keeping price from going any further.

The battle continues

Causing the market to range

Next week tell who wins

For I'm seeing sellers with the upper hand

My thoughts 💭 o

GBPJPYGBPJPY price is near the main resistance zone 200.168. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is s

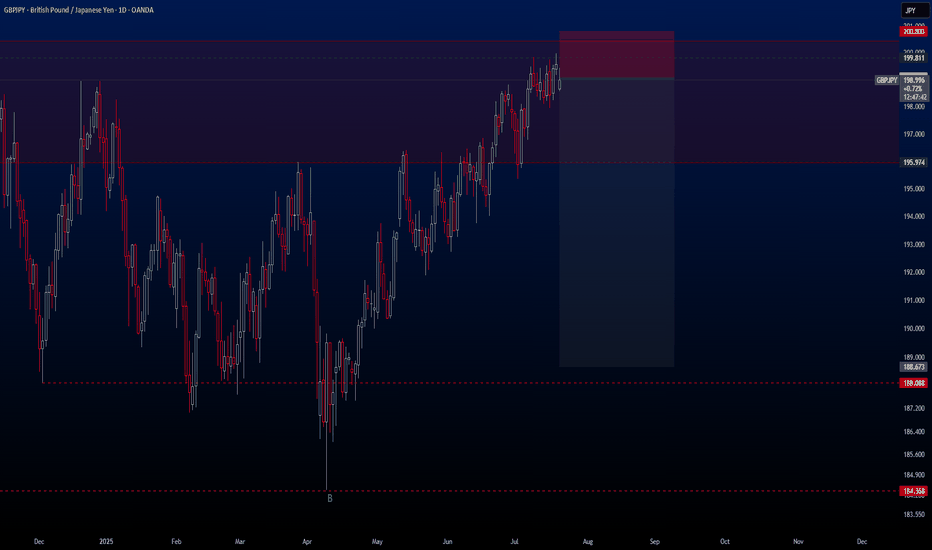

GBPJPYHello traders,

The holidays are over and we’re back to trading again! 🙂

Our first trade is on the **GBPJPY** pair. This setup is quite ideal for those thinking long-term. I’ve already activated this trade on my side.

🔍 **Trade Details**

✔️ **Timeframe**: D/W

✔️ **Risk-to-Reward Ratio**: 1:6

✔️ **Tr

GBPJPY - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been hovering within a big range.

This week, GBPJPY is retesting the upper bound of the range and $200 round number.

As long as the resistance holds, we will be looking for shorts on lower time

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPJPY is 198.448 JPY — it has decreased by −0.09% in the past 24 hours. See more of GBPJPY rate dynamics on the detailed chart.

The value of the GBPJPY pair is quoted as 1 GBP per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPJPY has the volatility rating of 0.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPJPY showed a −0.44% fall over the past week, the month change is a 0.04% rise, and over the last year it has increased by 0.29%. Track live rate changes on the GBPJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPJPY shows the buy signal, and 1 month rating is strong buy. See more of GBPJPY technicals for a more comprehensive analysis.