Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

40 IDR

1.17 T IDR

3.92 T IDR

6.66 B

About INDUSTRI JAMU & FARMASI SIDO MUNCUL

Sector

Industry

CEO

David Hidayat

Website

Headquarters

Semarang

Founded

1951

ISIN

ID1000130305

FIGI

BBG005LYHJZ2

PT Industri Jamu dan Farmasi Sido Muncul Tbk engages in the production of herbal and traditional medicines and pharmaceutical products. The firm operates through the following segments: Herbal Medicine, Food and Beverages, and Pharmacy. The Herbal Medicine segment Sido Muncul provides a variety of products including Tolak Angin Cair, Tolak Angin Cair Anak, Tolak Angin, Sugar-Free and Tolak Angin Flu, as well as Tolak Linu Cair, Tolak Linu Mint, Jamu Komplit, Sari Kulit Manggis, and Sari Kunyit.It also offers soft capsules such as Tolak Angin Mint, Tolak Linu, Virgin Coconut Oil (VCO), Sari Kunyit, Sari Kunyit Plus Blackpepper, Vitamin D3 1000 IU, Vitamin D3 400 IU, Vitamin E 300 IU and Vitamin E 100 IU and JSH Capsules. The Food and Beverages segment includes KukuBima EnerG! with various flavors such as Grape, Mango, Orange, Original, Coffee, Soda Milk, Guava, and Pineapple, Ginger Milk, Ginger Coffee and various other health drinks. The Pharmacy segment products include Anacetine Syrup, Inflasone, Berlosid, Licokalk, and Licodexon. The company was founded by Rakhmat Sulistio in 1951 and is headquartered in Semarang, Indonesia.

Related stocks

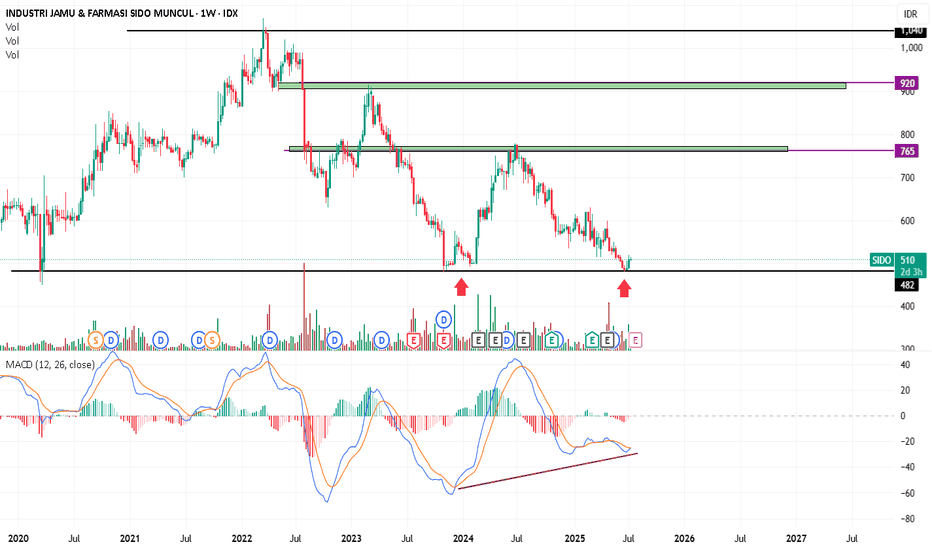

Buy when there's blood in the streets, SIDO Market Outlook!Here we can see the potential movement for SIDO, I created a downside target as well as an upside target that you can look out for.

for the downside I made a target from the formation of a bull flag pattern, and for the upside target I used fibonaci and also elliot waves.

SIDO potential Butterfly Pattern and Cup&Handle (previous post)SIDO potential forming Butterfly pattern after successfully completed Point C and reverse to the upside.

Hopefully SIDO able to complete the pattern which is the next resistence and continue to reach the Cup&Handle pattern target (see previous post on Cup&Handle pattern)

SIDO: Breakout of Bearish Channel, Bullish Outlook Ahead?Hello Fellow Stock Traders, Here's a Technical Analysis of SIDO!

Industri Jamu & Farmasi Sido Muncul (SIDO) has demonstrated significant price development by breaking out of its bearish channel. This price action indicates the beginning of a bullish trend in the stock, accompanied by a bullish ca

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SIDO is 500 IDR — it has decreased by −1.96% in the past 24 hours. Watch INDUSTRI JAMU & FARMASI SIDO MUNCUL stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on IDX exchange INDUSTRI JAMU & FARMASI SIDO MUNCUL stocks are traded under the ticker SIDO.

SIDO stock has fallen by −2.91% compared to the previous week, the month change is a 2.46% rise, over the last year INDUSTRI JAMU & FARMASI SIDO MUNCUL has showed a −31.03% decrease.

We've gathered analysts' opinions on INDUSTRI JAMU & FARMASI SIDO MUNCUL future price: according to them, SIDO price has a max estimate of 625.00 IDR and a min estimate of 450.00 IDR. Watch SIDO chart and read a more detailed INDUSTRI JAMU & FARMASI SIDO MUNCUL stock forecast: see what analysts think of INDUSTRI JAMU & FARMASI SIDO MUNCUL and suggest that you do with its stocks.

SIDO reached its all-time high on Mar 17, 2022 with the price of 1,070 IDR, and its all-time low was 210 IDR and was reached on Aug 24, 2015. View more price dynamics on SIDO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SIDO stock is 6.85% volatile and has beta coefficient of 0.45. Track INDUSTRI JAMU & FARMASI SIDO MUNCUL stock price on the chart and check out the list of the most volatile stocks — is INDUSTRI JAMU & FARMASI SIDO MUNCUL there?

Today INDUSTRI JAMU & FARMASI SIDO MUNCUL has the market capitalization of 14.89 T, it has decreased by −1.94% over the last week.

Yes, you can track INDUSTRI JAMU & FARMASI SIDO MUNCUL financials in yearly and quarterly reports right on TradingView.

INDUSTRI JAMU & FARMASI SIDO MUNCUL is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

SIDO net income for the last quarter is 367.53 B IDR, while the quarter before that showed 232.94 B IDR of net income which accounts for 57.78% change. Track more INDUSTRI JAMU & FARMASI SIDO MUNCUL financial stats to get the full picture.

INDUSTRI JAMU & FARMASI SIDO MUNCUL dividend yield was 6.61% in 2024, and payout ratio reached 99.91%. The year before the numbers were 5.83% and 96.57% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 3.56 K employees. See our rating of the largest employees — is INDUSTRI JAMU & FARMASI SIDO MUNCUL on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INDUSTRI JAMU & FARMASI SIDO MUNCUL EBITDA is 1.65 T IDR, and current EBITDA margin is 42.67%. See more stats in INDUSTRI JAMU & FARMASI SIDO MUNCUL financial statements.

Like other stocks, SIDO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INDUSTRI JAMU & FARMASI SIDO MUNCUL stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So INDUSTRI JAMU & FARMASI SIDO MUNCUL technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating INDUSTRI JAMU & FARMASI SIDO MUNCUL stock shows the sell signal. See more of INDUSTRI JAMU & FARMASI SIDO MUNCUL technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.