Is Samsung's Chip Bet Paying Off?Samsung Electronics is navigating a complex global landscape, marked by intense technological competition and shifting geopolitical alliances. A recent $16.5 billion deal to supply advanced chips to Tesla, confirmed by Elon Musk, signals a potential turning point. This contract, set to run until lat

Key facts today

Samsung Electronics secured a $16.5 billion contract with Tesla to produce AI6 chips in Texas, boosting its 2024 revenue by 7.6% and enhancing its semiconductor market position.

Samsung Electronics may benefit from Intel's possible exit from chip manufacturing, as Bernstein highlights Intel's struggles to attract external customers for its foundry services.

In the second quarter of 2025, Samsung Electronics reported a 38% increase in smartphone shipments, while the overall U.S. smartphone market saw only a 1% growth, and iPhone shipments declined by 11%.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5,200 KRW

33.62 T KRW

300.87 T KRW

807.35 M

About SAMSUNG ELECTRONICS

Sector

Industry

CEO

Young-Hyun Jun

Website

Headquarters

Suwon-si

Founded

1969

ISIN

KR7005931001

FIGI

BBG000BG4QJ9

Samsung Electronics Co., Ltd. engages in the manufacturing and selling of electronics and computer peripherals. The company operates through following business divisions: Device Experience (DX), Device Solutions (DS), Samsung Display (SDC), and Harman. The DX division offers televisions, monitors, refrigerators, washing machines, air conditioners, smartphones, network systems, and computers. The DS division deals with semiconductor components including DRAM, NAND Flash, and mobile APs. The SDC division provides OLED panels for smartphones. The Harman division consists of digital cockpits, car audio, and portable speakers. The company was founded on January 13, 1969 and is headquartered in Suwon-si, South Korea.

Related stocks

The key is whether it can rise above 61800

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(Samsung Electronics 1D chart)

HA-Low indicator and HA-High indicator have begun to converge.

Accordingly, a trend is expected to occur soon.

Since the pri

Good time to buy Samsung stocksIt went down a lot, and checked the floor.

It gave a fake rebound and fell back.

So, now it's ready for a go.

What do I mean?

Many individual investors entered thinking the price will go up, and they are losing hopes seeing a little minus %.

They will give up, and only after that process the price

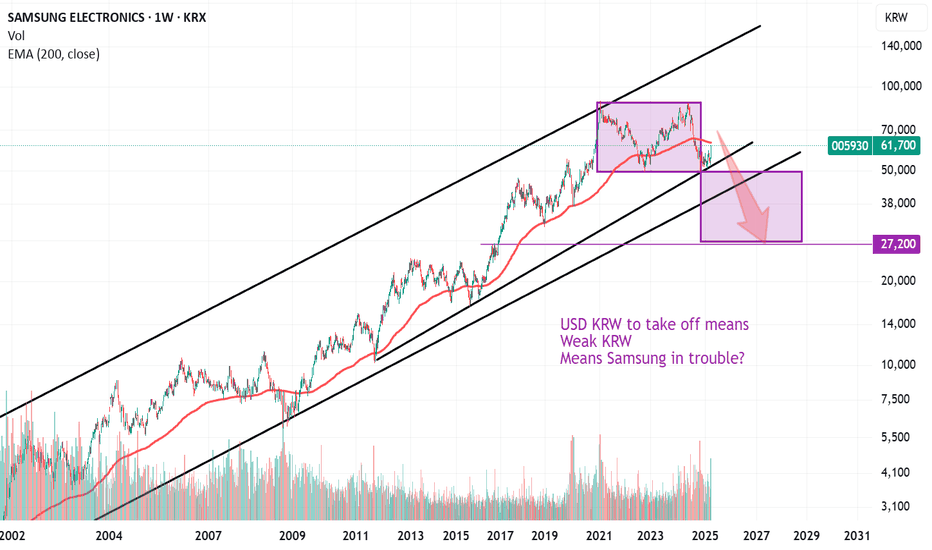

SAMSUNG ELECTRONICS - KRXSAMSUNG ELECTRONICS - KRX

Est-ce le meilleur moment pour un achat ?

Mon analyse :

*Sur un graphique hebdo (W1)

- SAMSUNG ELECTRO est dans une tendance haussière depuis 2016

- Une zone résistante qui limite le mouvement haussier et une zone de soutient qui limite le mouvement baissier

*Sur u

Samsung Galaxy S25 Series to Adopt Snapdragon ExclusivelySamsung is poised to make a strategic shift with its upcoming Galaxy S25 series by exclusively integrating Qualcomm's Snapdragon 8 Gen 4 SoC. This move marks a departure from earlier plans to use Samsung's Exynos chips across all models.

Key Points:

1. Snapdragon 8 Gen 4 Dominance:

- The G

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 005935 is featured.

Frequently Asked Questions

The current price of 005935 is 57,400 KRW — it has increased by 0.88% in the past 24 hours. Watch SAMSUNG ELECTRONICS (1P) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on KRX exchange SAMSUNG ELECTRONICS (1P) stocks are traded under the ticker 005935.

005935 stock has risen by 1.95% compared to the previous week, the month change is a 14.34% rise, over the last year SAMSUNG ELECTRONICS (1P) has showed a −10.03% decrease.

We've gathered analysts' opinions on SAMSUNG ELECTRONICS (1P) future price: according to them, 005935 price has a max estimate of 70,000.00 KRW and a min estimate of 66,300.00 KRW. Watch 005935 chart and read a more detailed SAMSUNG ELECTRONICS (1P) stock forecast: see what analysts think of SAMSUNG ELECTRONICS (1P) and suggest that you do with its stocks.

005935 reached its all-time high on Jan 11, 2021 with the price of 86,800 KRW, and its all-time low was 4,200 KRW and was reached on Oct 10, 2003. View more price dynamics on 005935 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

005935 stock is 2.32% volatile and has beta coefficient of 1.13. Track SAMSUNG ELECTRONICS (1P) stock price on the chart and check out the list of the most volatile stocks — is SAMSUNG ELECTRONICS (1P) there?

Today SAMSUNG ELECTRONICS (1P) has the market capitalization of 380.07 T, it has increased by 6.75% over the last week.

Yes, you can track SAMSUNG ELECTRONICS (1P) financials in yearly and quarterly reports right on TradingView.

SAMSUNG ELECTRONICS (1P) is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

005935 earnings for the last quarter are 1.19 K KRW per share, whereas the estimation was 866.77 KRW resulting in a 37.52% surprise. The estimated earnings for the next quarter are 883.25 KRW per share. See more details about SAMSUNG ELECTRONICS (1P) earnings.

SAMSUNG ELECTRONICS (1P) revenue for the last quarter amounts to 79.10 T KRW, despite the estimated figure of 77.60 T KRW. In the next quarter, revenue is expected to reach 74.47 T KRW.

005935 net income for the last quarter is 8.03 T KRW, while the quarter before that showed 7.58 T KRW of net income which accounts for 5.97% change. Track more SAMSUNG ELECTRONICS (1P) financial stats to get the full picture.

Yes, 005935 dividends are paid quarterly. The last dividend per share was 361.00 KRW. As of today, Dividend Yield (TTM)% is 2.55%. Tracking SAMSUNG ELECTRONICS (1P) dividends might help you take more informed decisions.

SAMSUNG ELECTRONICS (1P) dividend yield was 3.27% in 2024, and payout ratio reached 29.07%. The year before the numbers were 2.32% and 67.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 129.48 K employees. See our rating of the largest employees — is SAMSUNG ELECTRONICS (1P) on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SAMSUNG ELECTRONICS (1P) EBITDA is 76.99 T KRW, and current EBITDA margin is 25.05%. See more stats in SAMSUNG ELECTRONICS (1P) financial statements.

Like other stocks, 005935 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SAMSUNG ELECTRONICS (1P) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SAMSUNG ELECTRONICS (1P) technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SAMSUNG ELECTRONICS (1P) stock shows the strong buy signal. See more of SAMSUNG ELECTRONICS (1P) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.