#LRC Ready for a Massive Recovery From Here | Must Watch Yello, Paradisers! Is #LRCUSDT finally ready for a breakout, or is it just another trap for early bulls? Let's break down the current structure of #LRC.

💎#Loopring ( CAPITALCOM:LRC ) has been moving within a descending wedge pattern for weeks, with price consistently making lower highs and lower lows—clearly respecting both descending resistance and support levels. However, we are now starting to see signs of change as it retests the upper trendline.

💎A breakout above the descending resistance is about to occur, and it’s doing so right around the 50EMA, which adds further confluence for a possible bullish move. This move is increasing the probability of a short-term trend reversal.

💎The support zone around $0.078–$0.082 is the key region to watch now. If bulls can hold above this zone and reclaim it as a base, we could see a breakout continuation toward the moderate resistance at $0.096. Should momentum build up from there, the next big target is the strong resistance at $0.1118—a level marked by historical seller interest and significant volume profile resistance.

💎However, if #LRCUSD falls below the strong demand zone at $0.0706, this entire bullish setup becomes invalid. That breakdown would suggest the market isn't ready yet, and could trigger another wave down toward fresh lows.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

LRCUSDT trade ideas

LRC – Breakout Watch in Motion📆 On the 2H timeframe, CAPITALCOM:LRC is attempting a breakout from the falling wedge structure — a bullish pattern gaining momentum ⚠️

A clean breakout and hold above resistance could open doors to a swift upside move 📈

👀 Keep this setup on your radar — structure is heating up!

Not financial advice.

LRC/USDT 1W – Final Test Before a Major Reversal?> Loopring (LRC) is currently sitting at a critical long-term support zone, and the next few weeks could determine whether a strong reversal or deeper decline will follow.

---

🧠 Macro Overview:

After falling more than 97% from its all-time high (ATH) of $3.0596, LRC is now revisiting a historical demand zone between $0.0657–$0.0821. This area has acted as a powerful launchpad during previous cycles and remains a major accumulation zone.

---

🔎 Technical Structure & Price Action:

✅ Historical Demand Zone (Strong Support)

Marked by the yellow box, this range has historically triggered major price rallies.

Buyers have consistently stepped in at this level since early 2021.

✅ Possible Double Bottom Formation

A potential double bottom pattern is forming in this zone. A breakout above $0.1189 would confirm the bullish reversal structure.

✅ Low Volume = Volatility Brewing

Current low-volume environment could indicate quiet accumulation before a potential breakout.

✅ Weakening Downtrend

The multi-year downtrend is still intact, but the selling momentum is fading as price consolidates in this key support area.

---

🟢 Bullish Scenario (Reversal or Relief Rally):

1. Price holds and bounces from the $0.0657–$0.0821 demand zone.

2. Breakout above $0.1189 (initial resistance) opens the door for:

🎯 $0.1632 – First key resistance.

🎯 $0.3205 & $0.4398 – Mid-term resistance levels.

🎯 $1.1848 – Long-term recovery target if altcoin momentum returns.

> A weekly candle close above $0.1632 with strong volume would confirm the bullish trend shift.

---

🔴 Bearish Scenario (Support Breakdown):

1. A breakdown below $0.0657 would invalidate the support zone.

2. Potential downside targets:

⚠️ $0.0550 – Psychological support.

⚠️ Uncharted territory below $0.0550 could trigger panic selling and deeper declines.

> In this case, strict risk management is essential, as breaking this zone may lead to a fresh leg down in price discovery.

---

📈 Strategy & Outlook:

Short-term/Swing Traders:

Consider speculative entries within the support zone with tight stop-losses below $0.0657.

Wait for a confirmed breakout above $0.1189–$0.1632 for trend validation.

Long-term Investors:

This zone presents a compelling Dollar-Cost Averaging (DCA) opportunity with high reward potential.

However, maintain capital discipline in case of deeper downside risk.

---

💡 Conclusion:

> LRC is at a make-or-break level.

If this historical support holds and volume kicks in, we could be witnessing the early signs of a major weekly reversal.

But if the support fails, it may enter a new bearish phase with further downside.

#LRCUSDT #Loopring #AltcoinReversal #CryptoSupportZone #CryptoAnalysis #TechnicalAnalysis #SwingTradeSetup #BearishOrBullish #LRCChart #CryptoOpportunities

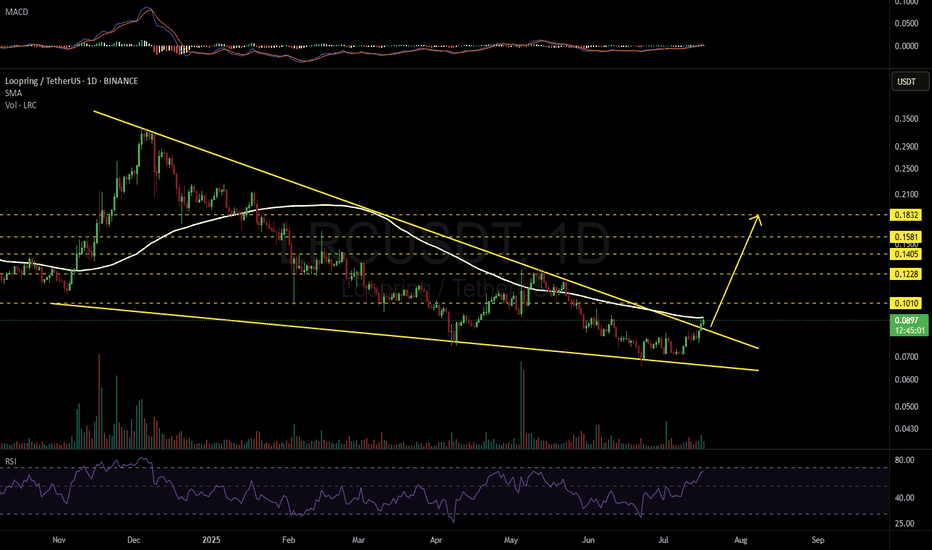

LRCUSDT 1D#LRC has broken above the falling wedge resistance and is now facing the daily SMA100.

For the bullish move to continue, it needs to break above the SMA100 as well.

The best entry point would be on a successful retest of the pattern.

Targets:

🎯 $0.1010

🎯 $0.1228

🎯 $0.1405

🎯 $0.1581

🎯 $0.1832

⚠️ Always use a tight stop-loss and apply proper risk management.

LRC - Sine Line Says: Bullish!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

📈For the bulls to take over and ignite the next bullish wave in line with the Sine Line cycles, a break above the $0.12 structure marked in blue is needed.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

LRCUSDT | Weak Support, Strong Resistance — Proceed with CautionLRCUSDT is trading between clearly defined zones, where the red box acts as a significant resistance and the green box serves as a mild support level. However, the critical detail here is that the support does not appear very reliable — and that should make you extra cautious if you're planning to long from there.

🔴 Resistance: Respect the Sellers

The red box is a zone where sellers have previously stepped in and where supply could easily overwhelm demand again. If price approaches this region and starts to struggle, short opportunities can be considered — but only with confirmation on lower time frames. Think exhaustion candles, failed breakouts, and lack of volume follow-through.

🟢 Support: Don’t Get Too Comfortable

Yes, the green box might offer a small reaction zone, but this isn’t the kind of support you marry — it’s the kind you date briefly. If the price drops and finds temporary footing there, scalps or short-term longs might work, but you should not be expecting major reversals unless significant volume and structure change show up.

🧠 Mental Model:

If price hits the green box and breaks below, don’t hold on hoping for a miracle. Let go fast.

If price reaches the red box and confirms rejection, lean into the short with a tight stop.

If the red box breaks and holds above, especially with volume and bullish orderflow, that’s your cue to flip the bias and ride the move higher with a new mindset.

Remember, trading is a game of adaptation, not ego. Stick to structure, wait for your confirmations, and stay emotion-free in your decisions.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

LRC: BULLISH divergence on daily chartBullish Divergence Confirmed:

Both the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are showing bullish divergence on the daily chart. While the price has made a lower low, the RSI and MACD have formed higher lows, indicating weakening downward momentum and a potential trend reversal.

Low Market Cap Potential:

Given the coin’s low market capitalization, it has the potential for significant price appreciation if buying momentum accelerates, as low-cap assets are often more volatile and responsive to positive sentiment.

As always, monitor the trade closely and adjust your strategy as needed based on market conditions.

LRC/USDT – Horizontal channel. Continuing to work.Loopring - is an open protocol designed for building decentralized crypto exchanges.

CoinMarketCap : #262

Since the publication of my trading idea, the price has reached the resistance zone of the inner channel at $0.3338 (+158%). From there, it retraced back to the support of the outer channel, following the overall market movement.

I've marked potential liquidity grabs (wicks) as well as future target zones in case of a trend reversal on the chart.

Remember, if you're feeling scared right now, so is everyone else. Many have lost faith in a market recovery. Typically, these are strong triggers for position accumulation.

There's no need to guess where the price will go—just build your strategy and follow it.

My previous idea generated solid profit, and I'm now reinvesting from profits using compound interest.

Loopring (LRC/USDT) Daily Chart Analysis📊 Trend: Bearish (Descending Channel)

🔹 Key Levels:

✅ Support: $0.12 - $0.13 (Demand Zone)

🚀 Resistance: $0.18 - $0.35

Market Outlook & Strategy

🔸 Bullish Scenario: If LRC breaks above the descending channel, it could aim for $0.18 and potentially $0.34.

🔸 Bearish Scenario: If price fails to break out, it might retest the $0.12 support zone.

📌 Trading Plan:

1️⃣ Breakout Entry: Buy if price closes above the channel with strong volume.

2️⃣ Rejection Short: Sell near resistance if rejection occurs.

3️⃣ Support Buy: If price dips to $0.12, look for bullish signals before entering.

🔔 Stay updated & manage risk properly!

LRC potential date for PumpBINANCE:LRCUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation this idea

➡️We are in downtrend and this fib still relevant! Trade around investments zone -0.18

➡️ Main support buyers zone is between 0.27-0.20 cents. This zone we can come back to test in October.

➡️ Last time we need around 157 days for accumulation. If history repeat we can see final stage accumulation around October 2022

➡️ First local sellers zone is 0.70 cents

➡️ Main sellers price we can find out on Daily tf by Volume range - 1.13

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

LRC - Loopring Weekly support holdingCritical area here for loopring as we test the support low from summer 2021. Real clear correlation between here at .88, and that would be the expectation if we continue to hold this low.

We broke out of the initial supply line coming down, but the secondary one is also being respected as resistance for now, so that would be a sign of strength, should we break above it.

Daily momentum is turning up from oversold and continues rising above .184 and could exhaust as high as .59 cents.

Targets would start around 50 cents at the top of the range, and into extension levels, 88, 160, and potentially as high as the measured move / 2.0

LRC Long -> 1.36$Long Position on LRC/USDT

We have entered a long position at the current price of 0.1348 USDT. Based on our chart analysis, we expect the price to soon reach the marked levels.

At each target, we suggest taking partial profits to secure gains and reduce risk.

Targets:

0.50 USDT – First target, take partial profits here.

0.80 USDT – Second target, take more profits.

1.40 USDT – Final target, exit the remaining position.

A stop-loss should be placed below the recent low to manage risk effectively.

LRC is Setting Up BIG!Loopring (LRC) is presenting an excellent opportunity with a confluence of technical factors aligning at the old high demand zone. This area holds significant importance as it combines the strength of a multi-tap demand zone with a Fibonacci retracement level, enhancing its reliability for a potential bounce.

Why the Old High Demand Zone is Key

3-Tap Test:

The price has tapped into this demand zone multiple times, signaling its strength as a support level. Each tap reinforces the zone, indicating buyer interest and the likelihood of a reversal from this level.

Historical Significance:

This zone corresponds to a previous high where LRC established strong momentum. Retesting old highs as support is a common bullish continuation pattern, suggesting this area is crucial for price stability.

Fibonacci Confluence:

The demand zone aligns perfectly with a key Fibonacci retracement level (e.g., 0.618 or 0.786). Fibonacci levels are widely respected in the market, making this zone even more attractive for an entry.

Why This Setup Stands Out

High-Probability Reversal: The confluence of factors increases the likelihood of a strong bounce, making it an ideal point to join the trend.

Low Risk, High Reward: Entering near this zone offers a tighter stop-loss and greater upside potential if the price rebounds.

Market Structure Support: The demand zone holds significance in maintaining the bullish structure of LRC.

How to Approach This Trade

Spot Buy at the Demand Zone: Place buy orders within the old high demand zone, ensuring you're positioned at this critical level.

Watch for Confirmation: Look for bullish price action, such as candlestick patterns (e.g., hammer or engulfing candles) or increasing volume near the zone.

Set a Stop-Loss: Place a stop-loss slightly below the demand zone to protect against invalidation.

Hold for a Fibonacci Extension: If the price bounces, aim for higher Fibonacci extension levels as potential targets.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

Tip of The Iceberg

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

#LRC/USDT Ready to go up#LRC

The price is moving in a descending channel on a 1-day frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.2112

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2150

First target 0.2258

Second target 0.2331

Third target 0.2427