LTCUSD trade ideas

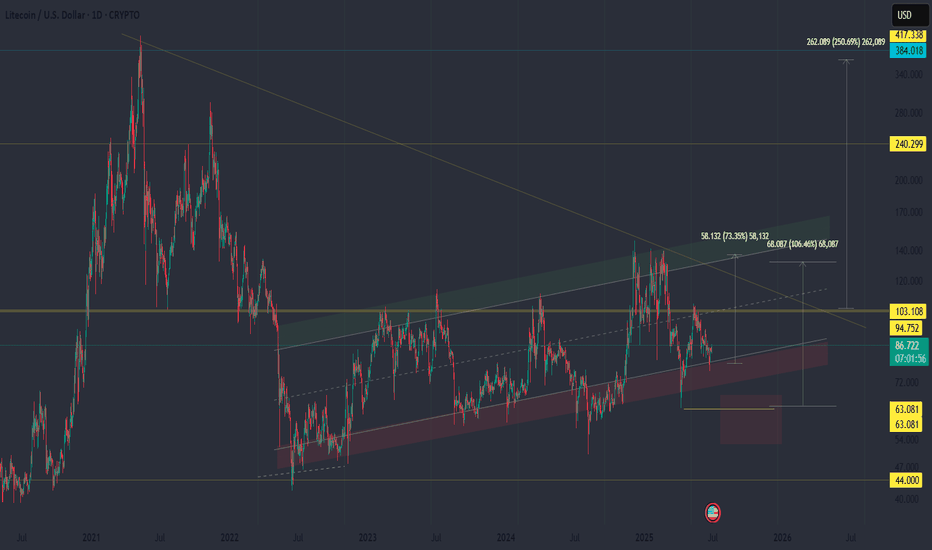

LTC is ready to jump one more timeEven though there isn’t a usual pattern like the ones I normally trade, we can see that the price is very close to LTC’s historical trend line.

Every time the price has reached this line before, it has gone up by at least 100% in a short time.

There is a risk that the line could break, but we would only risk about 20% or less. So, with a risk-to-reward ratio of at least 1 to 5, it’s worth taking the opportunity and watching for possible long entries in LTC.

LITECOIN (LTC) - On The Verge Of Exploding - ETF Catalyst?Litecoin: A Decentralized Network with a Differentiated Risk Profile

Litecoin (LTC), launched in 2011 by former Google engineer Charlie Lee, is one of the oldest and most active Layer-1 blockchain networks in the cryptocurrency space. Often referred to as the “digital silver” to Bitcoin’s “digital gold,” Litecoin was designed to offer faster transactions, lower fees, and broader accessibility while maintaining a similar monetary policy and codebase.

This post aims to provide an overview of Litecoin’s technical structure, usage, risk profile, and current developments—without speculative bias—so readers can form their own assessments.

1. Transparent Origins and Founder Dynamics

One key difference between Litecoin and Bitcoin lies in the identity of their respective creators. Bitcoin was developed by Satoshi Nakamoto, a pseudonymous and still-unknown individual or group, who is estimated to hold 750,000 to 1.1 million BTC—a significant portion of the total supply that has never moved. The dormant status of these holdings has occasionally raised concerns about future market impact if they were ever activated.

In contrast, Litecoin was founded by Charlie Lee, a known and public figure who was active in the community before, during, and after the launch. In 2017, Lee announced he had sold or donated nearly all his LTC holdings to avoid any potential conflict of interest. Today, no founder or insider is known to hold a disproportionate share of the Litecoin supply. This level of transparency and decentralization has been interpreted by some as a factor that lowers long-term governance and concentration risk.

2. Structural Simplicity and Leverage Exposure

Another distinction between Litecoin and Bitcoin lies in market structure and exposure to leverage.

Bitcoin is widely used as collateral in crypto lending markets and institutional derivatives, including perpetual futures and structured products. This has introduced significant systemic risk during periods of market stress, as high leverage has historically led to cascading liquidations across centralized and decentralized platforms.

Litecoin, in contrast, has relatively limited exposure to leveraged products and collateralized lending. It is not commonly used as collateral in CeFi or DeFi protocols, and institutional futures markets for LTC are smaller and less active. As a result:

Litecoin is less likely to trigger or be affected by mass liquidations

It has reduced systemic risk due to lower market entanglement

Its price tends to reflect more organic supply/demand dynamics

It is less involved in cross-collateralized or rehypothecated loan systems

This simpler structure may appeal to risk-aware investors looking for cleaner exposure without the reflexivity effects common in heavily leveraged markets.

3. Scarcity and Monetary Policy

Litecoin shares a similar deflationary model with Bitcoin, with a hard cap of 84 million LTC and scheduled halving events every four years. The most recent halving occurred in August 2023, reducing the block reward from 12.5 to 6.25 LTC per block.

With over 75 million LTC already mined, fewer than 9 million remain in future issuance. The protocol’s monetary policy is deterministic and cannot be altered unilaterally, which may appeal to those who prioritize predictable supply and inflation resistance.

While Litecoin’s cap is four times higher than Bitcoin’s, the relative issuance schedule and halving dynamics mirror Bitcoin’s design. Some investors view this as a hedge against fiat currency debasement, although the asset's volatility and adoption context should be taken into account.

4. Network Fundamentals and Real-World Use

Litecoin has maintained near 100% uptime since inception, and its transaction throughput and fee structure are generally favorable compared to many competing networks.

In 2024, Litecoin became the most used crypto for payments via BitPay, surpassing Bitcoin in transaction volume, driven by its fast 2.5-minute block times and low transaction fees. It is supported by major platforms including PayPal, and accepted by thousands of online and retail merchants.

From a security perspective, Litecoin’s hashrate reached all-time highs in 2025, partly due to merge-mining with Dogecoin, which has helped strengthen its proof-of-work infrastructure. Network upgrades like MWEB (MimbleWimble Extension Blocks) have added optional privacy layers to Litecoin’s UTXO model, while Lightning Network integration supports instant payments.

These developments suggest that Litecoin continues to evolve, with emphasis on efficiency, user privacy, and practical usability.

5. Institutional Presence and ETF Outlook

Litecoin has seen modest but growing institutional involvement. Products such as the Grayscale Litecoin Trust (LTCN) have existed for several years, and Coinbase introduced Litecoin futures trading in 2024. Fidelity also offers LTC trading and custody to institutional clients.

More notably, a Spot Litecoin ETF application is currently under review by the U.S. Securities and Exchange Commission (SEC), with analysts from Bloomberg estimating a 95% probability of approval before the end of 2025. If approved, this would make Litecoin one of the first proof-of-work assets outside of Bitcoin to gain direct exposure through a regulated ETF vehicle.

Should that happen, it may increase access, liquidity, and legitimacy among traditional investors. However, as always, regulatory decisions remain uncertain and subject to broader political and market conditions.

6. Technical Structure and Long-Term Price Action

From a macro-technical perspective, Litecoin has historically followed a pattern of higher lows and higher highs across each market cycle. This structure remains intact as of 2025, with a strong support at 81 USD on a 6 months timeframe.

Summary

Litecoin presents a combination of characteristics that differentiate it from other crypto assets, including:

✅ A public, transparent founder and no major insider dominance

✅ Limited exposure to leveraged lending, reducing systemic risk

✅ Deterministic monetary policy with a fixed supply and halving schedule

✅ Real-world usage in payments and retail adoption

✅ Strong network security and development activity

✅ Potential ETF approval that may broaden accessibility

These features do not necessarily imply outperformance, but they form the basis for an asset with a relatively clean structure, historical resilience, and a distinct position in the crypto ecosystem.

🔎 Disclaimer:

The information presented here is for educational and informational purposes only and should not be interpreted as financial advice.

Always conduct your own research, assess your individual risk profile, and make investment decisions based on your own analysis and objectives.

Litecoin is approaching a critical breakout point.

LTC has been consolidating within this symmetrical triangle for an extended period, showing decreasing volatility and tighter price action. The structure suggests that a significant move is imminent.

🎯 Target 1: $400

🎯 Target 2: $1,000

If the breakout occurs in the coming weeks, we could see Litecoin reaching the $400 level within the next 2 to 3 months, with potential to hit $1,000 over the next 12 months — especially if bullish momentum picks up across the crypto market.

Watch closely — the move could be explosive.

Best of luck to everyone! 🚀

LTC/USDExpecting something like this on most alts.

I've been waiting patiently for a real correction in everything, but my timing was drastically off. Looks like FOMO is still in charge. My guess, stock market to ATH after ATH for a while and a final wave of FOMO for crypto will enter the air.

I believe the majority are expecting a COVID-like rebound, followed by rally continuation, but the majority tends to be wrong.

What I can tell you is the true crypto bull run will not begin on optimism, as it has been...

It will begin on pessimism.

LTC/USDT — Accumulation Before Breakout?📊 Technical Overview:

Litecoin is forming a potential reversal structure near a key long-term support zone. Historically, this area acted as an accumulation range before significant upward moves.

The price is still holding within a broad ascending channel, and current consolidation may represent the final stage before a breakout.

🔻 Below lies a potential liquidity trap zone — a fakeout could occur, triggering weak hands before continuation. For us, that’s a spot to add, not to exit.

📈 Trade Plan:

-Partial entry is already possible at the current zone

-Additional entries planned if price drops lower

-No stop-loss — risk is managed strictly via position sizing

-Take-profits aligned with major resistance zones where selling pressure occurred in the past

Litecoin is setting itself for some heavy upside to 1,114Are we priming for another Crypto Summer.

Across the board is showing strong upside to come for all - ETH, BTC and even Litecoin.

⚡ Faster, Cheaper BTC Alternative

Litecoin still delivers cheap, fast transactions — it’s the “digital silver” to Bitcoin’s gold.

🪙 Institutional Interest Sneaking In

More funds and platforms are quietly adding LTC to their offerings — don’t sleep on it.

🔄 High Correlation with Bitcoin

If BTC breaks out, LTC often follows fast — and sometimes harder.

💎 Still Undervalued vs. Major Alts

LTC hasn’t popped yet like ETH or SOL — which makes it a solid catch-up play.

The price has broken the Wedge formation.

We need it to close above the neckline of the W Formation

and for the price to go above 20MA & 200MA.

Once it goes above 949, we can see the next target to 1,114.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Litecoin Rebounds from FVG with $902.3 in SightFenzoFx—Litecoin is trading just below the $88.6 resistance after bouncing from the bullish fair value gap near $85.5.

If the $88.60 resistance is breached, LTC could aim for the previous week's high at $902.3. Please note that the bullish view remains valid above $82.4.

Long trade

Trade Details

Pair: LTCUSD (Litecoin / US Dollar)

Trade Type: Long (Buyside)

Session: NY AM, Monday, June 23rd, 2025

Time: 11:00 AM

Entry & Exit

Entry: $81.74

Take Profit (TP): $92.84 (+13.58%)

Stop Loss (SL): $79.48 (-2.76%)

Risk-Reward Ratio (RR): 4.91R

Trade Setup & Rationale

Structure: Price was consolidating above its moving averages; bullish momentum was building after the pullback. Confirmation: Entry followed the break above both the EMA (86.90) and WMA (86.02), with strong upward volume.

Target Zones: Take profit set at the top of prior consolidation and gap-fill zone.

Stop: Below the key structural low.

Bullish Momentum Possible While LTC Holds Above $86.93Litecoin pulled back from $92.32, dipping to a key support at $88.52, backed by Anchored VWAP. Stochastic shows oversold conditions, signaling a potential rebound.

If $88.52 holds, a bullish wave toward $92.32 could follow. The outlook stays positive above $86.93;

LTC Approaches Support Zone with Breakout PotentialFenzoFx—Litecoin dropped 1.92% after approaching the $89.0 resistance. It now trades near $86.4, a zone aligned with a high-volume node and previous daily low.

Support ranges from $85.9 to $83.2. If LTC stays above $83.2, a bullish breakout above $89.0 may follow. A close below $83.2 invalidates this outlook.

Litecoin: A good coin to add to your holdingsHello,

There is an opportunity to buy Litecoin at the current price with a short-term potential of an over 100% gain. The coin is currently trading close to the bottom of a corrective pattern. We see the current price as a great opportunity for buyers to take advantage of.

The MACD indicator is showing signs of a bullish crossover further reinforcing our bullish view. We see $1476 as a feasible target in the near term.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Is This the Perfect Moment to Rob the LTC/USD Vault?🏴☠️ LTC/USD Heist Mode: The Moving Average Break-In Plan 💰📈

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Calling all Market Bandits, Crypto Hustlers & Chart Raiders! 🤑💰🚀

🚨Mission Briefing

We’re eyeing a bullish breakout hit job on the LTC/USD chart — all based on the elite 🔥Thief Trading Style🔥 with a touch of candle science, moving average vault-cracking, and some solid day/swing setups. This ain’t your grandma’s trade plan — this is high-level lootin’ with precision.

🕵️♂️ 🎯 ENTRY PLAN — Unlock the Vault at $86.00

Wait for the MA breakout + candle close above that sneaky Moving Average line.

➡️ Execute Buy Stop orders above MA

➡️ OR place Buy Limit during a pullback to swing low/high zones in 15m–30m timeframe.

📌 Pro tip: Set an alert – catch the breakout live, don’t chase it later.

🛑 STOP LOSS — Your Getaway Route

Place your Thief SL near the recent swing low (82.00 using 3H chart).

🎤“If you’re entering like a pro, stop loss goes where it should – not where fear lives. But hey, it's your ride or die. Choose wisely.” 🔥

💡Adjust SL based on lot size, risk %, & how deep your robbery goes.

🏴☠️ TARGET ZONE — Exit the Scene at $92.00

Get your bags packed, profits stacked, and be ready to escape before the market catches on.

💸 Grab the loot and bounce before the reversal gangs arrive!

📈 Why the Heist?

The LTC/USD crypto market is showing bullish momentum, backed by key analysis angles:

🔍 Fundamentals

📊 COT Report

💥 On-Chain Metrics

🧠 Sentimental Heat

🌍 Intermarket Structure

👉 Check your intel. React. Don’t sleep. 🔗🔗

⚠️ News Alert & Risk Tip

🗞️ Stay clear of trades during volatile news releases

🔐 Use trailing stops to lock in gains

🚫 Protect your positions – don't let profits slip through cracks.

📌Disclaimer:

This ain’t financial advice — it’s just a shared plan for market raiders. Trade at your own risk, and don’t forget to bring your own map. Market shifts faster than a getaway car — so adapt & react smartly. 🧠💡

💖 BOOST the Plan 💥

Hit that Boost Button if you're vibin’ with the robbery crew. It powers up the strategy and supports the movement. Together, we trade to take — The Thief Trading Way. 💸💪🎉

🚀 Catch you on the next breakout. Stay sneaky, stay sharp. 🐱👤🤑

Overbought LTC Faces Pressure at $85.0 BarrierLitecoin is building liquidity near $85.0, a strong resistance backed by volume, with Stochastic at 92.0 indicating short-term overbought conditions.

If LTC dips below $83.86, a bearish wave may follow toward $82.33 and $79.51. Conversely, a close above $87.99 could resume the uptrend toward $88.98.

Litecoin Stock Chart Fibonacci Analysis 062325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 81/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Litecoin Encounters Resistance After Sharp RallyLitecoin climbed from $82.4 and is testing the bearish fair value gap at $90.4. With Stochastic showing short-term overbought conditions at 87.0, consolidation is expected.

LTC may retest $89.0 and then dip toward support at $86.9, which aligns with a volume point of interest. The bullish view holds above $82.4; below it, the outlook weakens.

LTC coming into MAJOR Support

As you can see in the second photo, LTC has been holding this trendline as support for almost a decade, as far back as 2017. LTC still has a few weeks left to fall but once in comes down in between these 2 major weekly trendlines I have drawn, I think that's as far down as it will go, and we should see a major bounce.

Litecoin Is Forming A Bullish PatternLitecoin with ticker LTCUSD made nice and clean five-wave recovery back to 100 area in the 4-hour chart, which confirms support in place and bullish reversal, so it can be a higher degree wave (1), thus more upside is expected for a higher degree wave (3) after current complex W-X-Y correction in wave (2) that can be in final stages. First support is here around 90-85 area, while second deeper one would be at 80 area.