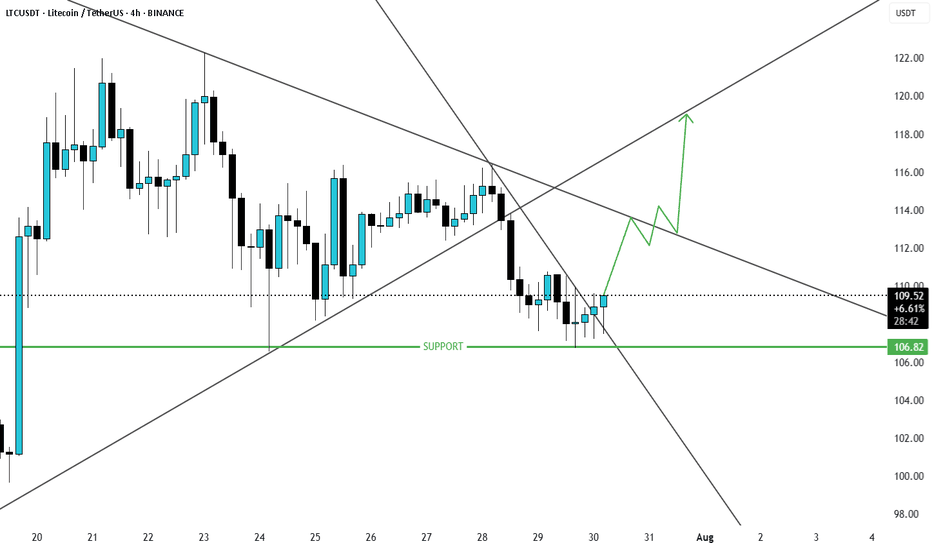

LTC is bullish now and many Traders don't see itSo if you pay attention to the LTC chart you can see that the price has formed a Ascending wedge which means it is expected to price move as equal as the measured price movement.( AB=CD )

NOTE: wait for break of the WEDGE .

Best regards CobraVanguard.💚

LTCUSDT trade ideas

Litecoin Approaches $100 Support, Eyeing 17% Rally to $128Hello✌

Let’s analyze Litecoin’s upcoming price potential 📈.

BINANCE:LTCUSDT is approaching a solid daily support around the key psychological level of $100, which coincides with the 0.5 Fibonacci retracement. Holding this level could open the door for a 17 % upside, targeting $128 near a major daily resistance. Keep an eye on this setup for a potential bounce! 📉🔄

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

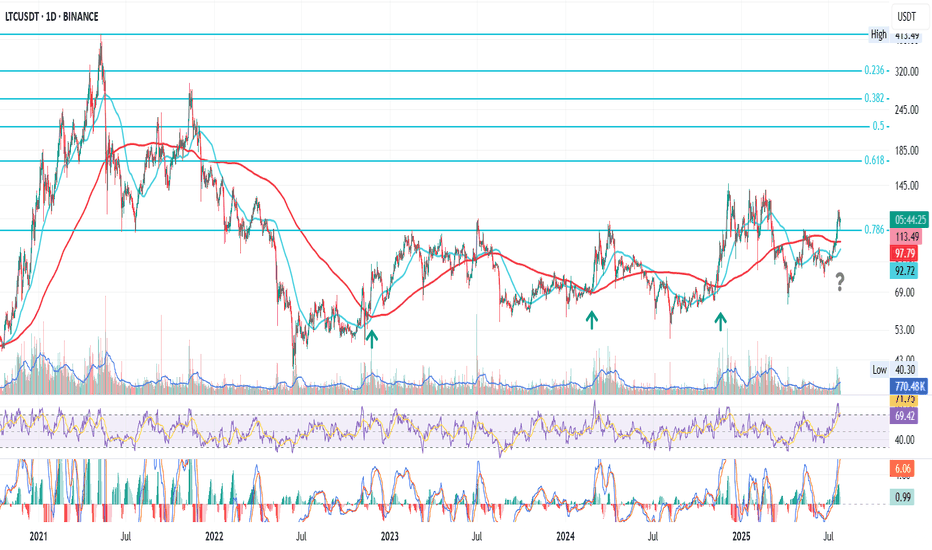

LTC Prepares to Break the CycleThis is LTC on the daily

After the bear market bottom in June 2022, LTC had three golden crosses, each followed by a rally into the 0.786 Fib level.

To be fair, last time price broke above that resistance, but got pushed back — like everything else — by the macro storms earlier this year.

Now we’re approaching another golden cross, but the setup feels different:

1. Price is already holding above 0.786, at least for now.

2. Macro looks calmer, with crypto gaining favorable attention from the SEC, and rate cuts becoming a matter of when, not if.

Putting these together, I lean bullish on LTC price action going forward.

Whatever happens next — we’ll be here to watch it unfold.

Always take profits and manage risk.

Interaction is welcome.

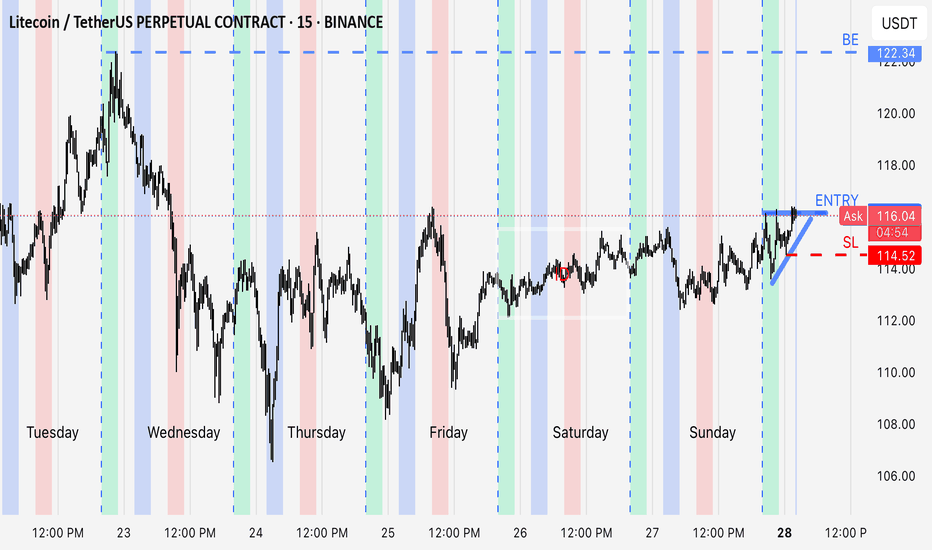

inside day breakoutLooking for a quick parabolic trade. Builded up from Asia and the gap time , supported by 20ma. On the daily it is bouncing of a 50% of a strong bullish move. This could be a really big R:R trade . Even 1:10 is possible. Looking to hold till close and breakeven if opportunity presents

LTC/USDT Robbery Underway | Bullish Setup, Get In Now!🔥💎 LTC/USDT HEIST PLAN: ROB AT ANY PRICE! 💎🔥

🚨 Bullish Move Incoming | Layered Entries | Thief Trader Exclusive 🚨

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

The time has come for another high-stakes Thief Trading heist, and this time we're lockin' in on LTC/USDT – aka "Litecoin vs Tether" 💣💸

🎯 Thief’s Mission Plan: BULLISH AT ANY PRICE LEVEL!

We're going full stealth mode with a layering strategy — stacking multiple limit orders like a true pro thief preparing for a clean escape! 🔪📉📈

🚪 ENTRY: "Anywhere, Anytime" 🚪

📈 Buy from any price level — but for optimal entry:

🟢 Use Buy Limit orders near recent lows (15-30 min TF)

🔔 Don’t forget to set alerts for breakout confirmation!

🛑 STOP LOSS: Strategic Defense 🛑

🗣️ "Listen up, team! Stop loss ain’t a maybe — it’s your armor. Place it smart, or prepare for pain." 🔥

📍Recommended SL: 100.00

🔐 Adjust based on your lot size & how deep you stack your orders.

🏁 TARGET: 130.00 🏁

💸 But always Escape Early if the plan gets too hot!

Use a Trailing SL to lock in gains and slip out clean 😎🧨

🧠 PRO TIPS from the THIEF:

🔎 Only Buy. No Shorting!

💣 Scalpers: Jump in with the trend, not against it.

🧲 Swing Traders: Stay patient, and execute the full heist.

🚀 Use Trailing Stops – Let profit ride, but stay protected!

📢 MARKET INSIGHT:

🔥 Bullish Bias backed by:

✅ On-Chain Metrics

✅ Sentiment Shifts

✅ Macro Flows

✅ COT Reports

✅ Intermarket Divergence

⚠️ TRADING ALERT: Stay Sharp!

📰 News Events = Volatility.

💡 Avoid fresh entries during high-impact events.

📉 Use Trailing SL to secure your running trades.

💖 SUPPORT THE CREW 💖

🚀 Smash that Boost Button if you believe in the Thief Style Strategy

👑 Let's rob the market together, one level at a time.

🧠 Stay sharp, stay sneaky – and I’ll see you at the next target 🎯

— Thief Trader 🐱👤💰🚁🌍

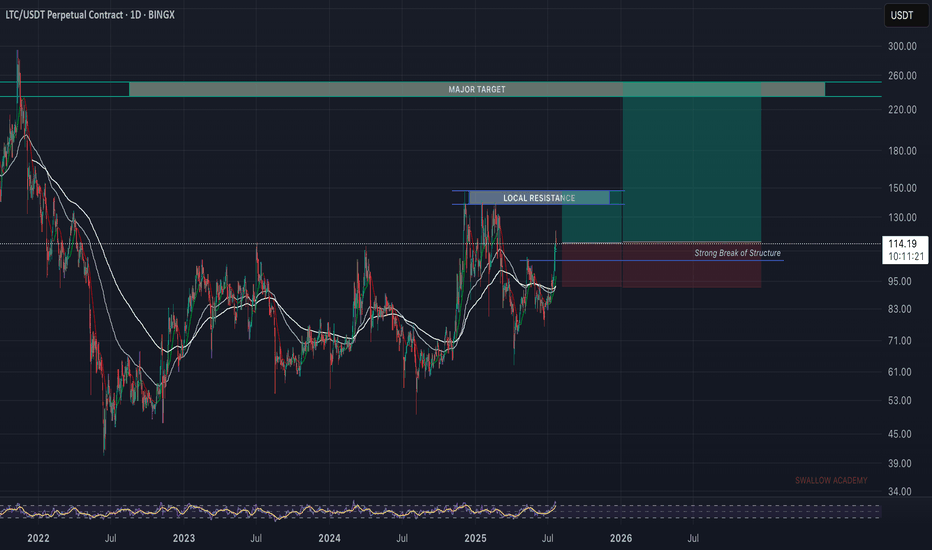

Litecoin (LTC): Looking Bad Now, But Has Good Potential Litecoin is in bad shape, where sellers are showing pressure, which could lead to bigger downward movement.

Despite that, we are still above the local neckline area, so we are still bullish, for now!

More in-depth info is in the video—enjoy!

Swallow Academy

Litecoin (LTC): Still Bullish And Still Good For Long!Well, this video came out a little laggy, as markets were very volatile and had in the background the order book open, but overall we managed to make one TA for you.

We are bullish; it is still good for long as we are about to explode towards the local resistance line most likely—the $150 area.

More in-depth info is in the video—enjoy!

Swallow Academy

LITCOIN BUY OR SELL !!!Hello friends🙌

🔊According to the price drop, you can see that the price has been below the specified resistance for a while and when it was able to break the resistance, it shows us the power of the buyers. Now, when we return to the previous resistance, which has now become a support, you can see that the buyers are providing good support and the price is expected to move to the specified targets.

Note that the most important rule in trading is capital and risk management So make sure to follow it.

🔥Follow us for more signals🔥

*Trade safely with us*

$LTC READY FOR EXPLOSION! THE COMEBACK OF THE OG?Litecoin has quietly formed one of the most massive macro structures in the market — a multi-year falling wedge on the 2-week timeframe, now breaking out with early confirmation.

This could be the start of a generational move, similar to the 2020 breakout. Let's break it down:

🧠 Technical Breakdown:

✅ Falling wedge forming since 2021 — 4 years of compression

✅ Volume and structure support breakout

✅ LTC already gave a 914% rally last time it broke a similar level

📏 Target zone extends above $900–$1000

🛒 Entry Zone:

Current Price: $118

🟢 Buy on breakout or dips near $105–$110 for safer entries

🎯 Target Zones:

TP1: $280

TP2: $400

TP3: $650

TP4: $950+

🛑 Stop-loss:

Breakdown below $72 (last higher low & wedge base)

⚖️ Risk-to-Reward:

High timeframe structure = High conviction play.

Potential R:R > 8x — Rare macro opportunities like this don’t come often.

🧩 Final Thoughts:

LTC may not be the flashiest alt anymore, but this setup is technically undeniable. If BTC enters full bull cycle, LTC could ride the wave explosively.

🔥 This could be a "buy and forget" macro play for 6–12 months.

💬 Let me know your thoughts in the comments & hit that ❤️ if you like macro setups like these!

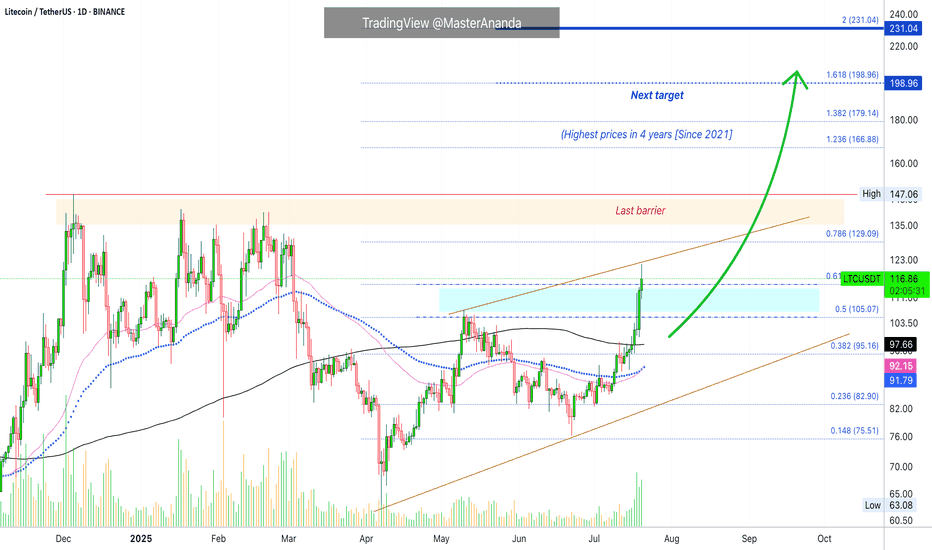

Litecoin's Path Beyond $200 Revealed · Daily TimeframeWe looked at Litecoin on the weekly timeframe which is the long-term picture, but we also need to consider the daily to see what is happening up-close.

As soon as we open this chart we have three signals that stand out:

1) Litecoin is now trading above MA200 safely and rising. This is a very strong bullish development and supports additional growth.

2) Trading volume has been rising significantly being now the highest since February 2025. The difference is that in February we were in distribution, resistance being confirmed with prices set to move lower. In this case, the action is rising from support and volume is rising rather than dropping.

3) May's peak has been broken. Many pairs are still trading below their high in May. Those that broke this level are the ones moving first and this signal exudes strength. Litecoin is now one of the top performers specially in the group with a big market capitalization.

The next barrier is the December 2024 high at $147. Short-term the next target is $129. As soon as the former breaks, we are going to be looking at the highest price since 2021.

Litecoin is fighting resistance today, 0.618 Fib. extension at $115. It is trading above this level but the confirmation only happens at the daily close. If it closes above, bullish confirmed. It if closes below, it means that there will need to be some struggling before higher prices. This struggling can last a few days just as it can extend. Seeing Ethereum and how it is moving straight up, Litecoin is likely to do the same.

Overall, conditions are good for Litecoin on the daily timeframe.

Thank you for reading.

Namaste.

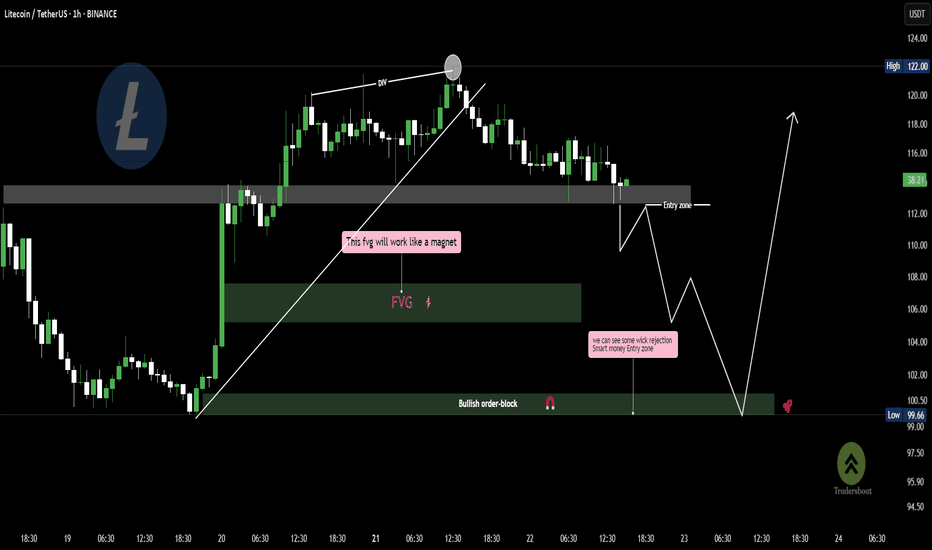

LTC Liquidity play loading.....Smart Money Awaits!🧠 Technical Breakdown:

Divergence signals exhaustion at the highs.

Price is likely to dip into the Fair Value Gap (FVG) — marked as a magnet zone for price attraction.

Expect wick rejections near the bullish order block — this is your smart money entry zone.

The projected move shows a possible liquidity sweep followed by strong upside continuation.

⚠️ This is not a call to enter — it's a reminder: Smart entries are built from trap zones and imbalance plays.

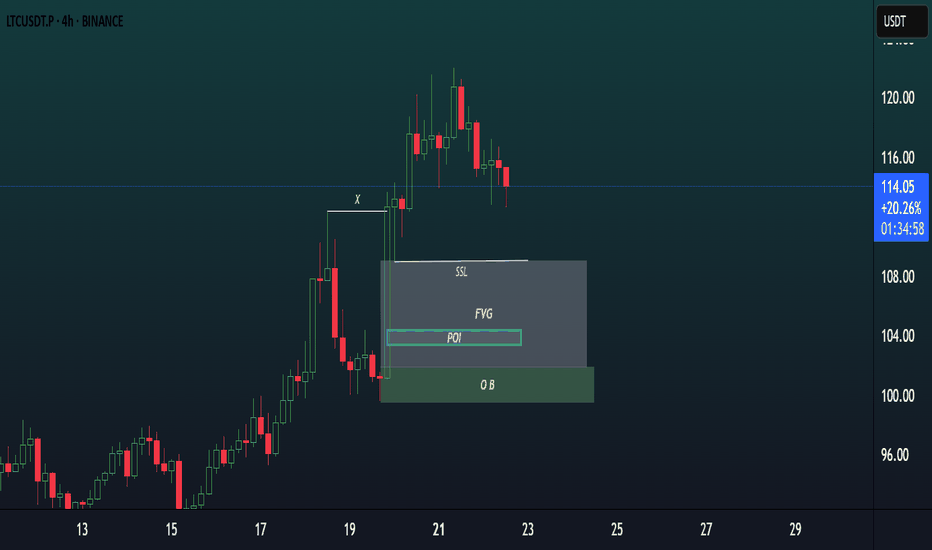

LTCUSDT 4H CHART ANALYSIS.Structure: Market is in a bullish trend, forming higher highs and retracing after a strong impulse move.

Liquidity Sweep (SSL): Recent candles show a sweep of sell-side liquidity, targeting the lows near $108, clearing out weak longs.

FVG (Fair Value Gap): Price is approaching a 4H imbalance zone ($104–$108), indicating an inefficiency that may attract buy orders.

POI & OB Zone: A Point of Interest (POI) and a Bullish Order Block (OB) rest just below FVG (around $102–$104), acting as a strong confluence for reversal.

Expectations: If price fills the FVG and reacts from POI/OB with a bullish engulfing or confirmation, we can expect a bounce targeting the previous high around $125+.

Ideal Setup: Look for entry around $102–$106, with SL below OB and TP 1.5–2x above previous high.

This setup aligns with Smart Money Concepts (SMC) – liquidity sweep, FVG fill, and OB reaction. ✅

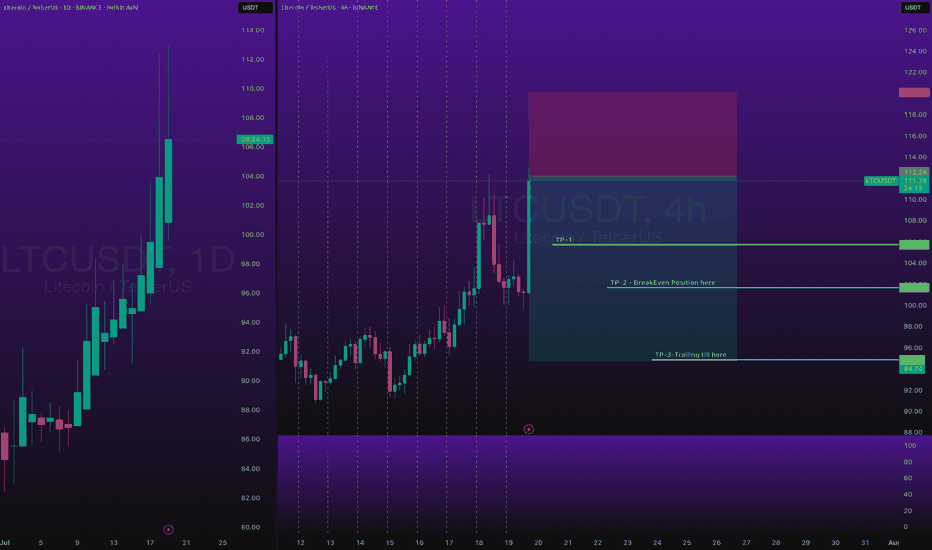

LTCUSDT Short Risking 1% to make 2.22% BINANCE:LTCUSDT Short Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Risking 1% to make 2.22% on COINBASE:LTCUSD is good trade, lets see.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

LTC- LitCoin - This is how a Fake Break on Fib looks like This is how a Fake Break on Fib looks like using Weis Wave with Speed Index

Reading the Daily Cha rt

1. Fib Location - Sellers could enter here

2. Largest Up volume wave after a while - also sellers could be hidden in there.

3. Increasing PVR (progressing volume rate) = as we approve the top more volume comes in (sellers)

4. This up wave has the highest Speed Index 10.0S of all the up waves in the trend, that's a HTMU (hard to move up = sellers)

5. The highest PVR bar =sellers

6. Another Abnormal Speed Index 25.5 S - that's another HTMU = more sellers on the up move, price cannot progress upward anymore.

7. and finally down we go with a PRS signal.

All the ingredients for the Short were there. Reading Weis Wave with Speed Index is like reading a book, page after page, until you reach to the last page that the writer has kept the surprise, the only difference is that this is never ending chart book with many stories. This was the story of LTC for now. I think this story has not ended yet and continue to drop to another Fib, the details on the 1HR!.

I hope you enjoy this chart reading lesson using Weis Wave with Speed Index.

LTCUSDT | Daily Chart Analysis | Bullish Structure UnfoldingLTCUSDT | Daily Chart Analysis | Bullish Structure Unfolding

🔍 Let’s break down LTC/USDT’s technical setup, focusing on volume, Elliot Wave structure, and key target levels for this bullish scenario. If you're following this channel, be sure to react and let us know your thoughts on the roadmap!

⏳ Daily Overview

LTCUSDT is moving within a defined ascending channel, supported by increasing bullish momentum and clear Elliot Wave progression. The recent wave count points to a textbook impulse, setting up the next key move.

🔺 Long Setup:

The market has completed Waves (1) through (4), and we’re now looking at the development of Wave (5) to the upside.

- Wave (5) Target Zones:

- $130.00

- $144.44

These are the next resistance levels based on previous highs and channel dynamics.

- Key support to watch:

- $105.30 — this zone may act as a springboard for the next rally if tested.

📊 Key Highlights:

- Volume has shown a clear bullish divergence as price advances, signaling growing interest and strength heading into Wave (5).

- The bullish channel remains intact, and each dip has been met with higher lows, confirming the ongoing uptrend.

- Elliot Wave structure suggests further upside, with the $130.00 and $144.44 levels as potential targets.

🚨 Conclusion:

LTC bulls should keep an eye on price action as it approaches support at $105.30 — a bounce here could ignite the next leg higher toward our target zones. Reaction from the channel community will be crucial as Wave (5) unfolds. Show your support with a reaction below if you’re riding this wave!

Litecoin (LTC): Looking for Breakout + Targets to be ReachedLitecoin has done very well recently, where the current price is testing the branch of EMAs, where we are expecting to see a breakout, after which we will be looking for upward movement toward our first and second targets.

Swallowa Acaademy