Exact Sciences: Downtrend May Be BrokenExact Sciences jumped on strong earnings two weeks ago, and some traders may think the oncology stock has further upside.

The first pattern on today’s chart is the bullish price gap on May 2 after results beat estimates. Prices apparently broke a falling trendline in the process.

EXAS then consoli

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−5.085 EUR

−993.85 M EUR

2.67 B EUR

185.75 M

About Exact Sciences Corporation

Sector

Industry

CEO

Kevin T. Conroy

Website

Headquarters

Madison

Founded

1995

FIGI

BBG01TNXQFV1

EXACT Sciences Corp. is a cancer screening and diagnostics company. The firm focuses on the early detection and prevention of some forms of cancer. It offers a non-invasive screening test called Cologuard for the early detection of colorectal cancer and pre-cancer and Oncotype DX. The company was founded on February 10, 1995, and is headquartered in Madison, WI.

Related stocks

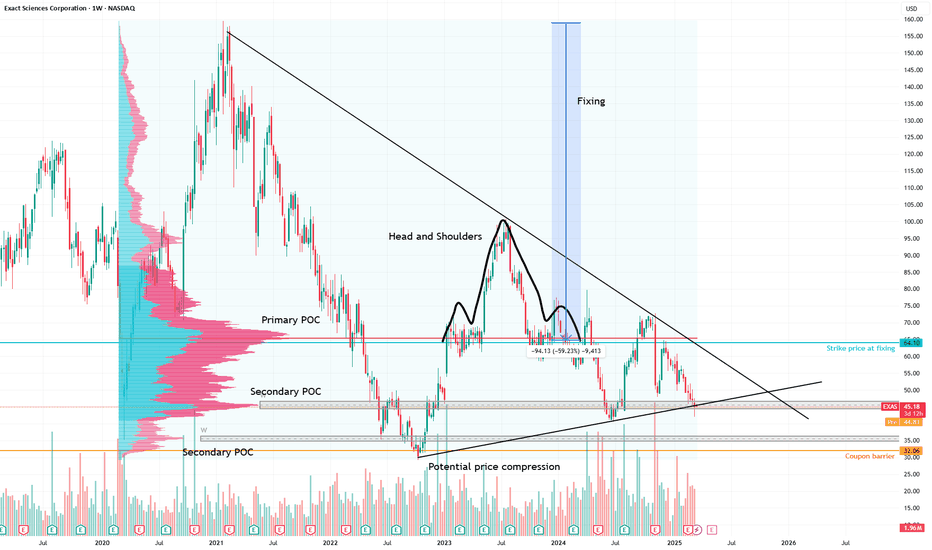

Rotation to healthcare ?Analysis of NLBNPIT1YHG3 certificate: EXACT SCIENCES, VRTX, AGILENT TECHNOLOGIES

Article debut: 18 March 2025

The certificate is at justcertificate.com

As a general rule, "buy the rumors and sell the news" works in most cases, so we won't deny it, but reports of rotations to industries like healt

EXAS a Bullish OutlookAs I predicted before, I had a 100% success rate. Let's consider a long position based on the current technical indicators.

Trend Line: We have a yellow trend line where the price bounced in 2016 and 2022. We are now approaching this trend line again.

Bat Pattern: The bat pattern indicates that poi

Exact Sciences: Anticipating a Market Correction Amidst OverbougExact Sciences is exhibiting bullish tendencies at present, but it's critical to anticipate a substantial correction upon touching, or descending below, the 0.618 Fibonacci retracement level. The stock is likely to retreat to around $70, a significant support level we've observed. The patterns in pl

Exact Sciences (EXAS) - Continuation of the DowntrendBased on my previous technical analysis where Exact Sciences exhibited bullish tendencies but warned of a possible substantial correction around the $70 level, we now find ourselves at a critical junction. Two possible scenarios could unfold from here: a bearish three drives pattern leading to a bou

ABC Correction looks to be over for EXASCorrection could now be over @ 62% retrace.

Looking for a move up to the upper trend line into 2027 based on previous cycles.

+ Momentum divergence at the c wave low suggests energy is building for the next move higher.

Trendchanges and its author are not registered financial advisors. Every

EXAS - Amazing symmetry

If you want to know where price is going to be, look for the history. Will this break out of this range and head higher or flush below?

if it can close above 65 this week, I would keep an eye on it above 68. It moves quickly so a news could push this over/under.

Long via commons and optio

Exact sciences corp Exact Sciences is a biotech stock that is overpriced.

It's time to sell

We touched 3 times the resistance line of a rising wedge pattern, impulsive wave pattern, and RSI 71 weekly overbought zone, the Q2 doesn't seem good.

A leg down to 60$ retesting 69$ which is the resistance line of a rising

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

EXAS4957195

Exact Sciences Corporation 0.375% 01-MAR-2028Yield to maturity

4.26%

Maturity date

Mar 1, 2028

EXAS5793007

Exact Sciences Corporation 1.75% 15-APR-2031Yield to maturity

3.80%

Maturity date

Apr 15, 2031

EXAS4806408

Exact Sciences Corporation 0.375% 15-MAR-2027Yield to maturity

3.36%

Maturity date

Mar 15, 2027

EXAS5549793

Exact Sciences Corporation 2.0% 01-MAR-2030Yield to maturity

2.65%

Maturity date

Mar 1, 2030

See all 1EXAS bonds

Curated watchlists where 1EXAS is featured.

Frequently Asked Questions

The current price of 1EXAS is 45.615 EUR — it has decreased by −1.04% in the past 24 hours. Watch EXACT SCIENCES CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange EXACT SCIENCES CORP stocks are traded under the ticker 1EXAS.

1EXAS stock has fallen by −1.85% compared to the previous week, the month change is a −9.57% fall, over the last year EXACT SCIENCES CORP has showed a 15.86% increase.

We've gathered analysts' opinions on EXACT SCIENCES CORP future price: according to them, 1EXAS price has a max estimate of 78.76 EUR and a min estimate of 47.26 EUR. Watch 1EXAS chart and read a more detailed EXACT SCIENCES CORP stock forecast: see what analysts think of EXACT SCIENCES CORP and suggest that you do with its stocks.

1EXAS reached its all-time high on May 16, 2025 with the price of 51.230 EUR, and its all-time low was 39.355 EUR and was reached on Apr 29, 2025. View more price dynamics on 1EXAS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1EXAS stock is 1.05% volatile and has beta coefficient of 0.47. Track EXACT SCIENCES CORP stock price on the chart and check out the list of the most volatile stocks — is EXACT SCIENCES CORP there?

Today EXACT SCIENCES CORP has the market capitalization of 8.70 B, it has decreased by −1.78% over the last week.

Yes, you can track EXACT SCIENCES CORP financials in yearly and quarterly reports right on TradingView.

EXACT SCIENCES CORP is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

1EXAS earnings for the last quarter are −0.50 EUR per share, whereas the estimation was −0.35 EUR resulting in a −44.05% surprise. The estimated earnings for the next quarter are −0.11 EUR per share. See more details about EXACT SCIENCES CORP earnings.

EXACT SCIENCES CORP revenue for the last quarter amounts to 653.31 M EUR, despite the estimated figure of 636.54 M EUR. In the next quarter, revenue is expected to reach 672.94 M EUR.

1EXAS net income for the last quarter is −93.56 M EUR, while the quarter before that showed −835.17 M EUR of net income which accounts for 88.80% change. Track more EXACT SCIENCES CORP financial stats to get the full picture.

No, 1EXAS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 21, 2025, the company has 7 K employees. See our rating of the largest employees — is EXACT SCIENCES CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EXACT SCIENCES CORP EBITDA is 22.31 M EUR, and current EBITDA margin is 0.84%. See more stats in EXACT SCIENCES CORP financial statements.

Like other stocks, 1EXAS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EXACT SCIENCES CORP stock right from TradingView charts — choose your broker and connect to your account.