Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.52 MYR

2.02 B MYR

11.71 B MYR

2.33 B

About TELEKOM MALAYSIA BHD

Sector

Industry

CEO

Amar Huzami Bin Md Deris

Website

Headquarters

Kuala Lumpur

Founded

1946

ISIN

MYL4863OO006

FIGI

BBG000BFRZD2

Toyota Motor Corporation (Toyota) conducts business in the automotive industry. The Company also conducts business in finance and other industries. The Company's segments include Automotive, Financial Services and All Other. Toyota sells its vehicles in approximately 190 countries and regions. Toyota's markets for its automobiles are Japan, North America, Europe and Asia. The Company's Automotive segment includes the design, manufacture, assembly and sale of passenger vehicles, minivans and commercial vehicles, such as trucks and related parts and accessories. The Company's Financial Services segment consists of providing financing to dealers and their customers for the purchase or lease of Toyota vehicles. The All Other segment includes the design, manufacturing and sale of housing, telecommunications and other businesses. Its information technology related businesses include a Web portal for automobile information called GAZOO.com.

Related stocks

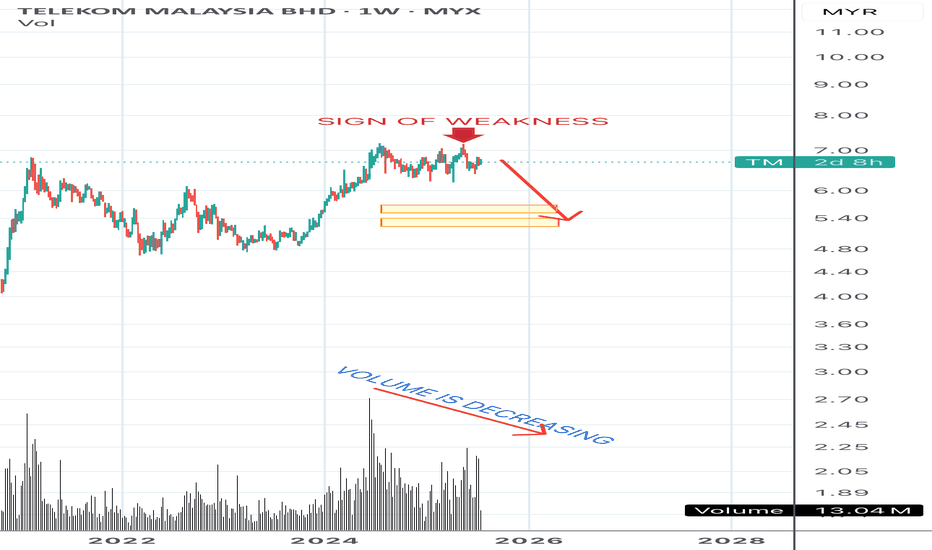

Daily - Telekom - Breakout Yearly High

Technical Analysis:

1) All MA200 below prices

2) Price breakout RM6.39 and heading to RM7.57

3) If price stand firmed above RM7.57, might MIGHT head to RM9.10

Do I have patient to wait for it? Without chasing the price?

We shall see

I like to use 3 windows to view it on monthly, weekly and dail

TELEKOMTelekom Malaysia teams up with Singtel to develop data centre in Johor

partnering Singapore Telecommunications Ltd (Singtel) to establish greenfield data centre facilities in Iskandar Puteri, Johor.

TM’s long-term data centre strategy, strengthens TM’s position as one of the market leaders in Mal

TM entering stage 2I covered TM for VIP members back in 13 Aug when i see the stocks entering from stage 4 to stage 2. (Screenshot)

There is a cheat buy area on 15 Aug as the volume start flowing in. Price solid breakout on 16 Aug. Price experience correction before QR release.

After good QR released, market got goo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TM is 6.75 MYR — it hasn't changed in the past 24 hours. Watch TELEKOM MALAYSIA BHD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MYX exchange TELEKOM MALAYSIA BHD stocks are traded under the ticker TM.

TM stock has risen by 0.15% compared to the previous week, the month change is a 2.12% rise, over the last year TELEKOM MALAYSIA BHD has showed a −2.46% decrease.

We've gathered analysts' opinions on TELEKOM MALAYSIA BHD future price: according to them, TM price has a max estimate of 9.10 MYR and a min estimate of 4.20 MYR. Watch TM chart and read a more detailed TELEKOM MALAYSIA BHD stock forecast: see what analysts think of TELEKOM MALAYSIA BHD and suggest that you do with its stocks.

TM stock is 0.59% volatile and has beta coefficient of 0.61. Track TELEKOM MALAYSIA BHD stock price on the chart and check out the list of the most volatile stocks — is TELEKOM MALAYSIA BHD there?

Today TELEKOM MALAYSIA BHD has the market capitalization of 25.90 B, it has increased by 0.45% over the last week.

Yes, you can track TELEKOM MALAYSIA BHD financials in yearly and quarterly reports right on TradingView.

TELEKOM MALAYSIA BHD is going to release the next earnings report on Aug 22, 2025. Keep track of upcoming events with our Earnings Calendar.

TM earnings for the last quarter are 0.10 MYR per share, whereas the estimation was 0.10 MYR resulting in a 1.41% surprise. The estimated earnings for the next quarter are 0.10 MYR per share. See more details about TELEKOM MALAYSIA BHD earnings.

TELEKOM MALAYSIA BHD revenue for the last quarter amounts to 2.85 B MYR, despite the estimated figure of 2.98 B MYR. In the next quarter, revenue is expected to reach 2.90 B MYR.

TM net income for the last quarter is 401.20 M MYR, while the quarter before that showed 730.60 M MYR of net income which accounts for −45.09% change. Track more TELEKOM MALAYSIA BHD financial stats to get the full picture.

TELEKOM MALAYSIA BHD dividend yield was 3.76% in 2024, and payout ratio reached 47.56%. The year before the numbers were 4.50% and 51.14% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TELEKOM MALAYSIA BHD EBITDA is 4.46 B MYR, and current EBITDA margin is 37.63%. See more stats in TELEKOM MALAYSIA BHD financial statements.

Like other stocks, TM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TELEKOM MALAYSIA BHD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TELEKOM MALAYSIA BHD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TELEKOM MALAYSIA BHD stock shows the buy signal. See more of TELEKOM MALAYSIA BHD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.