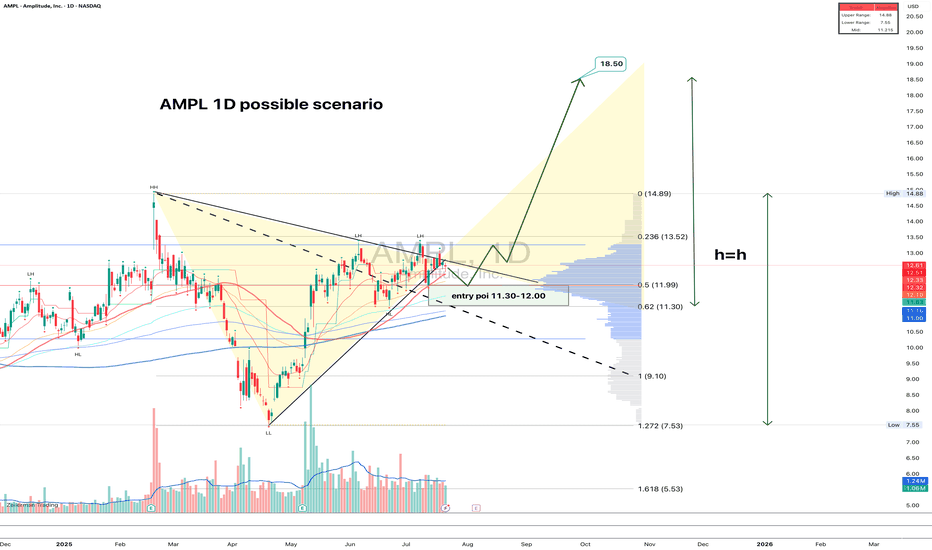

AMPL: structure clean, volume right, fundamentals warming upAMPL just broke out of a symmetrical triangle on the daily chart. The breakout was confirmed with decent volume, and now price is calmly pulling back into the 11.30–12.00 zone — exactly the kind of textbook retest that gets serious traders interested. The 0.618 Fib level sits at 11.30, and 0.5 at 11

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.75 USD

−94.32 M USD

299.27 M USD

70.83 M

About Amplitude, Inc.

Sector

Industry

CEO

Spenser Skates

Website

Headquarters

San Francisco

Founded

2011

FIGI

BBG012CDTZY6

Amplitude, Inc. provides a digital analytics platform that helps companies analyze their customer behavior within digital products. It delivers its application over the Internet as a subscription service using a software as a service (SaaS) model. The company was founded by Spenser Skates, Jeffrey Wang, and Curtis Liu in November 2011 and is headquartered in San Francisco, CA.

Related stocks

Amplitude: 2021 IPO Comeback Kid $AMPL $COIN $SNOWDoesn't look like there are many buyers for $AMPL, a peer of $COIN $SNOW 2020-2021 IPO cohorts, though business results look promising in the long-term.

I'd say anything above $10 is a good entry for this as a long-term tech stock that can outperform in future cycles.

Amplitude Inc (NASDAQ:AMPL)

Amplitude might be getting ready to breakout. Hello Friends!

Amplitude has declined by 70% from it’s highs. Back in February analyst had a price target of $40 and $60 for 2022. Currently is consolidating and a breakout can have its eye on two price targets.

Target#1: $27.50

Target #2: $33.00

After $33 a gap fill opportunity to $40 might be an

Bullish Dragon Breakout on AmpltudeWe have broken back above a Bearish Trendline and are Springing back above the 1.13 fib extension while testing the Neckline of a Potential Double Bottom and the RSI is back above the 50 line. Best case scenario here is that this price action is followed by a major Retrace to the upside between the

$AMPL is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $52,27;

stop-loss — $4

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AMPL is 12.48 USD — it has decreased by −0.08% in the past 24 hours. Watch Amplitude, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Amplitude, Inc. stocks are traded under the ticker AMPL.

AMPL stock hasn't changed in a week, the month change is a 6.50% rise, over the last year Amplitude, Inc. has showed a 53.63% increase.

We've gathered analysts' opinions on Amplitude, Inc. future price: according to them, AMPL price has a max estimate of 16.00 USD and a min estimate of 11.00 USD. Watch AMPL chart and read a more detailed Amplitude, Inc. stock forecast: see what analysts think of Amplitude, Inc. and suggest that you do with its stocks.

AMPL reached its all-time high on Nov 4, 2021 with the price of 87.98 USD, and its all-time low was 7.37 USD and was reached on Aug 5, 2024. View more price dynamics on AMPL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMPL stock is 2.68% volatile and has beta coefficient of 1.47. Track Amplitude, Inc. stock price on the chart and check out the list of the most volatile stocks — is Amplitude, Inc. there?

Today Amplitude, Inc. has the market capitalization of 1.65 B, it has increased by 6.47% over the last week.

Yes, you can track Amplitude, Inc. financials in yearly and quarterly reports right on TradingView.

Amplitude, Inc. is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

Amplitude, Inc. revenue for the last quarter amounts to 79.95 M USD, despite the estimated figure of 79.76 M USD. In the next quarter, revenue is expected to reach 81.32 M USD.

AMPL net income for the last quarter is −22.23 M USD, while the quarter before that showed −32.59 M USD of net income which accounts for 31.79% change. Track more Amplitude, Inc. financial stats to get the full picture.

No, AMPL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 23, 2025, the company has 724 employees. See our rating of the largest employees — is Amplitude, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Amplitude, Inc. EBITDA is −99.93 M USD, and current EBITDA margin is −33.84%. See more stats in Amplitude, Inc. financial statements.

Like other stocks, AMPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Amplitude, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Amplitude, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Amplitude, Inc. stock shows the buy signal. See more of Amplitude, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.