Key facts today

Morgan Stanley has raised its price target for Meta Platforms (META) to $750 from $650, while continuing to hold an overweight rating on the stock.

Meta Platforms settled with shareholders, ending an $8 billion trial and avoiding Mark Zuckerberg's testimony on alleged Facebook data violations, just before the trial's second day.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26.34 USD

62.36 B USD

164.50 B USD

2.17 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG000MM2P62

Meta Platforms, Inc., engages in the development of social media applications. It builds technology that helps people connect, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

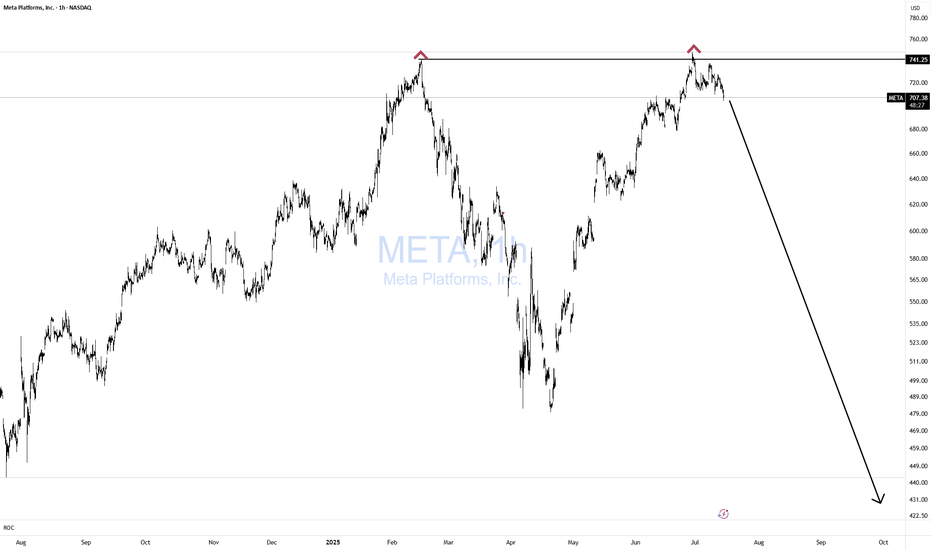

Meta .. (Where we stand)Long term, I think this stock is headed back to 300-400...

Short term I think it's a high chance we see 740-800...

Let me explain

Back in Feb we tagged our long term resistance, corrected and then we retested it with a lower high on the RSI (Bearish divergence) that you can see on the monthly

MetaSince the last post I made price has yet to make a new high. It has managed to chop in this area with a slight downward bias. If we're on the verge of the top of the indices, there is no reason to think Meta will continue higher much longer. This pattern, which is clearly corrective in nature, is wa

7/3/25 - $meta - Still a buy sub $1k/shr7/3/25 :: VROCKSTAR :: NASDAQ:META

Still a buy sub $1k/shr

- reality is, why would you bet against zuck

- his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $50

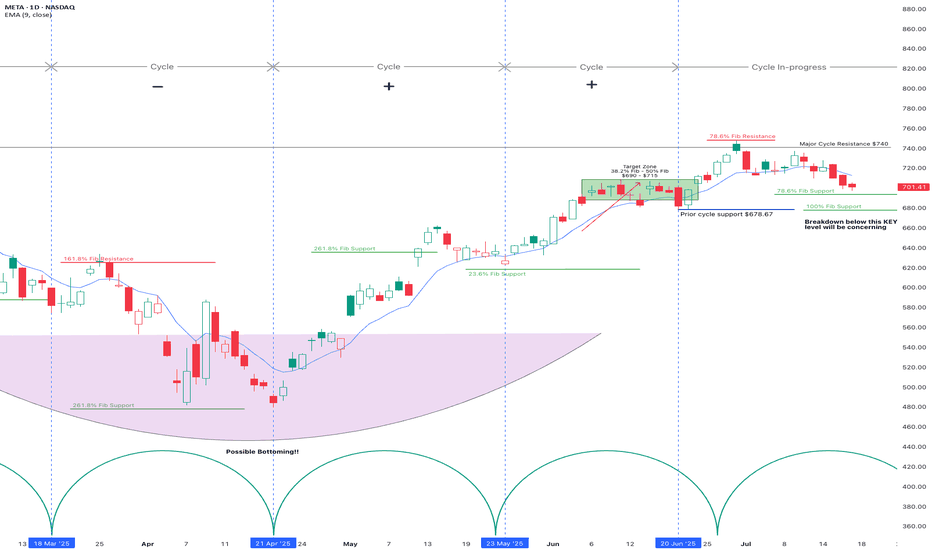

META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown B

🔻 NASDAQ:META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown Below $690 🐻

📅 Posted: July 18, 2025

💡 All models say “bearish,” but volume is the wildcard. Tight play, big potential.

⸻

🧠 AI Consensus Summary: Bearish But Not Triggered

Model Bias Key Notes

Grok 🐻 Bearish RSI 40.5, wea

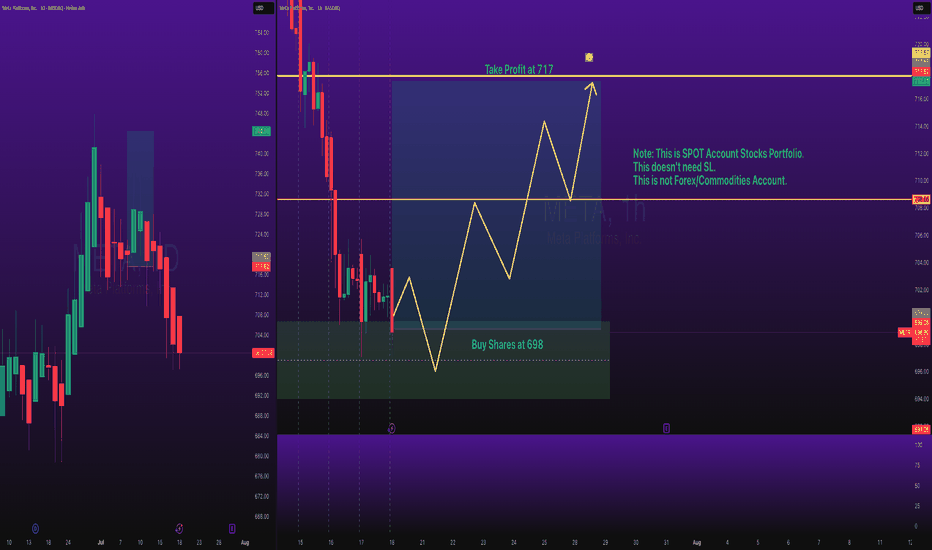

Stocks SPOT ACCOUNT: META Shares Buy Trade with Take ProfitStocks SPOT ACCOUNT:

NASDAQ:META shares: my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

META | Accumulation Zone Identified — Road to $990?🧠 META | Accumulation Zone Identified — Road to $990?

📊 Ticker: META (Meta Platforms Inc.)

🕒 Timeframe: 1H

📍 Current Price: $717.36

📈 Bias: Bullish accumulation → Expansion

🔍 WaverVanir DSS Thesis

Our system has flagged a liquidity harvesting and accumulation phase between $676–$740. Institutional

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

META (Meta Platforms Inc.) – Macro Compression Before Expansion META sits at a decisive macro juncture:

A clean SMC structure combined with Fibonacci premium zones signals an imminent directional expansion.

🧠 Macro Thesis:

Price is coiled just under 0.786–0.886 Premium Zone ($729–$760)

↳ This is a known trap area for retail liquidity – institutions often engine

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

15.50%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.22%

Maturity date

Aug 15, 2062

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.18%

Maturity date

Aug 15, 2052

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.94%

Maturity date

Aug 15, 2064

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.88%

Maturity date

May 15, 2063

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.86%

Maturity date

Aug 15, 2054

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.80%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all META bonds

Curated watchlists where META is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of META is 704.28 USD — it has increased by 0.41% in the past 24 hours. Watch Meta Platforms stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Meta Platforms stocks are traded under the ticker META.

META stock has fallen by −2.52% compared to the previous week, the month change is a 0.87% rise, over the last year Meta Platforms has showed a 48.27% increase.

We've gathered analysts' opinions on Meta Platforms future price: according to them, META price has a max estimate of 918.00 USD and a min estimate of 525.00 USD. Watch META chart and read a more detailed Meta Platforms stock forecast: see what analysts think of Meta Platforms and suggest that you do with its stocks.

META reached its all-time high on Jun 30, 2025 with the price of 747.90 USD, and its all-time low was 17.55 USD and was reached on Sep 4, 2012. View more price dynamics on META chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

META stock is 1.89% volatile and has beta coefficient of 1.38. Track Meta Platforms stock price on the chart and check out the list of the most volatile stocks — is Meta Platforms there?

Today Meta Platforms has the market capitalization of 1.77 T, it has decreased by −2.24% over the last week.

Yes, you can track Meta Platforms financials in yearly and quarterly reports right on TradingView.

Meta Platforms is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

META earnings for the last quarter are 6.43 USD per share, whereas the estimation was 5.23 USD resulting in a 22.83% surprise. The estimated earnings for the next quarter are 5.85 USD per share. See more details about Meta Platforms earnings.

Meta Platforms revenue for the last quarter amounts to 42.31 B USD, despite the estimated figure of 41.34 B USD. In the next quarter, revenue is expected to reach 44.73 B USD.

META net income for the last quarter is 16.64 B USD, while the quarter before that showed 20.84 B USD of net income which accounts for −20.13% change. Track more Meta Platforms financial stats to get the full picture.

Yes, META dividends are paid quarterly. The last dividend per share was 0.52 USD. As of today, Dividend Yield (TTM)% is 0.29%. Tracking Meta Platforms dividends might help you take more informed decisions.

Meta Platforms dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 21, 2025, the company has 74.07 K employees. See our rating of the largest employees — is Meta Platforms on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Meta Platforms EBITDA is 89.28 B USD, and current EBITDA margin is 51.83%. See more stats in Meta Platforms financial statements.

Like other stocks, META shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Meta Platforms stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Meta Platforms technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Meta Platforms stock shows the buy signal. See more of Meta Platforms technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.