Tesla Stock Gains After Musk Gets $30 Billion Award — What Now?Tesla board is hoping that the pile of shares would be enough to pin down the CEO and lock down his focus. But challenges are there. Here’s one — $30 billion might not be enough to keep Musk around.

💰 $30 Billion Retention Bonus

Tesla stock NASDAQ:TSLA is up about 4% since the start of the we

Key facts today

A class action lawsuit against Tesla (TSLA) alleges securities fraud from April 19, 2023, to June 22, 2025, claiming the company overstated its autonomous driving tech, impacting shareholder value.

Tesla's stock has jumped nearly $31, or 10%, due to rising stock prices, a new CEO pay package, and longer vehicle delivery wait times as buyers rush before tax credits end.

Tesla executives, including Elon Musk, are facing a lawsuit over claims that the Full Self-Driving and Robotaxi programs are safe, despite reports of operational issues and traffic violations.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.89 USD

7.13 B USD

97.69 B USD

2.71 B

About Tesla

Sector

Industry

CEO

Elon Reeve Musk

Website

Headquarters

Austin

Founded

2003

FIGI

BBG000N9MNX3

Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. The company operates through Automotive and Energy Generation and Storage. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of stationary energy storage products and solar energy systems, and sale of solar energy systems incentives. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Austin, TX.

Related stocks

Tesla Roadmap: From $300 Zone to $575Hello traders, here’s my latest analysis on Tesla (TSLA) based on the weekly and daily timeframes. On the weekly chart, I have drawn a downtrend line starting from December 2024, and the recent price action shows a breakout above this line on a weekly close. This breakout is a promising sign that an

TSLA to $450-$500 this year Technicals:

Big Picture: Huge wedge breakout, followed by retest and bounce, and now we are flagging.

2Month Chart: Every time TSLA has had a hammer candle on the 2M chart, we have rallied hard within 2-7 months.

100 SMA on the daily: Everytime TSLA’s daily 100 SMA has gone from an extended d

TESLA What Next? SELL!

My dear friends,

My technical analysis for TESLA is below:

The market is trading on 329.70 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 319.77

Recommended Stop Loss - 335.01

About Used Indicators:

A p

TESLA Sellers In Panic! BUY!

My dear friends,

TESLA looks like it will make a good move, and here are the details:

The market is trading on 302.63 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the mar

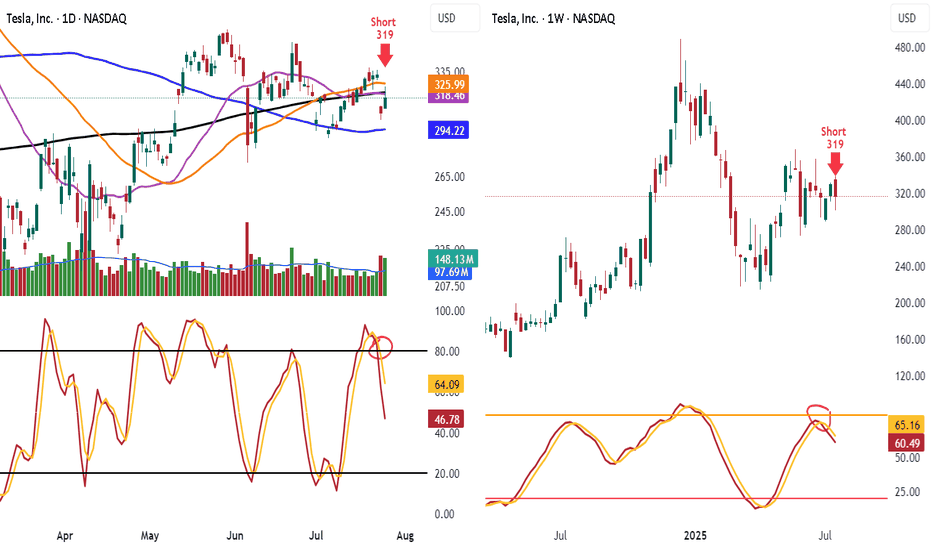

Shorted TSLA 319 Look at TSLA hit 50 day and 200 day MA and failed and know under them

Look at the lower highs and see the stoch heading down

Know lets look weekly stoch heading down and lower highs

Target is 100 day ma 294.22 take some off. When it breaks will add back on

Have trailing stop in place

TESLA ABC Trap ZoneTesla’s price action has been exhibiting a period of consolidation characterized by lateral movement, forming a pattern commonly identified as a triangular structure. Triangular formations, by their nature, have the potential to break out in either direction—upward or downward—depending on market dy

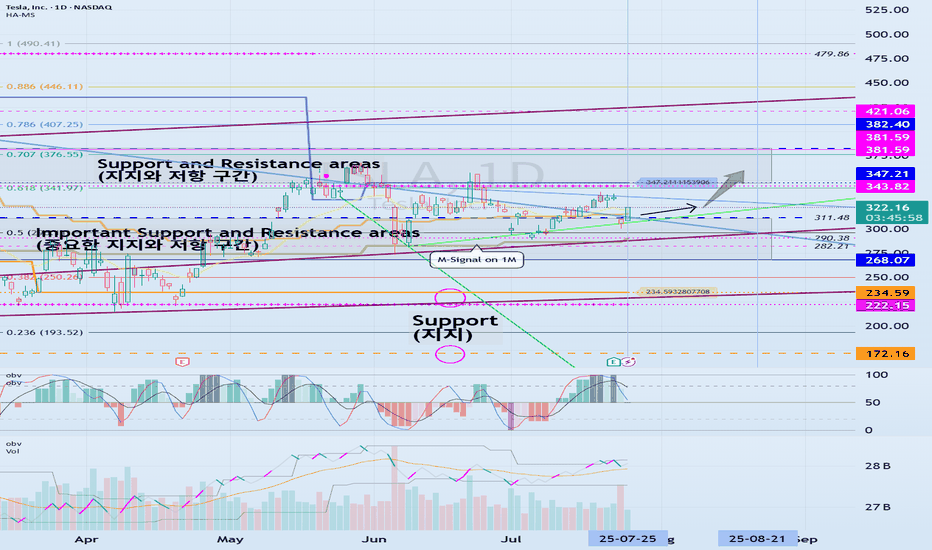

Next Volatility Period: Around August 21

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

#TSLA

We need to see if it is rising along the rising channel.

The key is whether it can rise with support near 311.48 to break out of the downtrend line.

The

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSLA4317805

Tesla Energy Operations, Inc. 5.45% 17-DEC-2030Yield to maturity

11.26%

Maturity date

Dec 17, 2030

TSLA4296328

Tesla Energy Operations, Inc. 5.45% 16-OCT-2030Yield to maturity

10.51%

Maturity date

Oct 16, 2030

TSLA4290558

Tesla Energy Operations, Inc. 5.45% 01-OCT-2030Yield to maturity

9.82%

Maturity date

Oct 1, 2030

TSLA4247202

Tesla Energy Operations, Inc. 5.45% 21-MAY-2030Yield to maturity

9.30%

Maturity date

May 21, 2030

TSLA4286421

Tesla Energy Operations, Inc. 5.45% 17-SEP-2030Yield to maturity

8.52%

Maturity date

Sep 17, 2030

TSLA4324758

Tesla Energy Operations, Inc. 4.7% 14-JAN-2026Yield to maturity

8.01%

Maturity date

Jan 14, 2026

TSLA4231716

Tesla Energy Operations, Inc. 5.45% 23-APR-2030Yield to maturity

7.89%

Maturity date

Apr 23, 2030

TSLA4250220

Tesla Energy Operations, Inc. 5.45% 29-MAY-2030Yield to maturity

7.67%

Maturity date

May 29, 2030

TSLA4313161

Tesla Energy Operations, Inc. 5.45% 03-DEC-2030Yield to maturity

7.43%

Maturity date

Dec 3, 2030

TSLA4222068

Tesla Energy Operations, Inc. 5.45% 19-MAR-2030Yield to maturity

7.39%

Maturity date

Mar 19, 2030

TSLA4265473

Tesla Energy Operations, Inc. 5.45% 16-JUL-2030Yield to maturity

7.00%

Maturity date

Jul 16, 2030

See all TSLA bonds

Curated watchlists where TSLA is featured.

Frequently Asked Questions

The current price of TSLA is 348.10 USD — it has increased by 0.53% in the past 24 hours. Watch Tesla stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Tesla stocks are traded under the ticker TSLA.

TSLA stock has risen by 10.32% compared to the previous week, the month change is a 10.70% rise, over the last year Tesla has showed a 75.39% increase.

We've gathered analysts' opinions on Tesla future price: according to them, TSLA price has a max estimate of 500.00 USD and a min estimate of 115.00 USD. Watch TSLA chart and read a more detailed Tesla stock forecast: see what analysts think of Tesla and suggest that you do with its stocks.

TSLA reached its all-time high on Dec 18, 2024 with the price of 488.54 USD, and its all-time low was 1.00 USD and was reached on Jul 7, 2010. View more price dynamics on TSLA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TSLA stock is 2.57% volatile and has beta coefficient of 1.71. Track Tesla stock price on the chart and check out the list of the most volatile stocks — is Tesla there?

Today Tesla has the market capitalization of 1.10 T, it has increased by 6.49% over the last week.

Yes, you can track Tesla financials in yearly and quarterly reports right on TradingView.

Tesla is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

TSLA earnings for the last quarter are 0.40 USD per share, whereas the estimation was 0.40 USD resulting in a 0.70% surprise. The estimated earnings for the next quarter are 0.49 USD per share. See more details about Tesla earnings.

Tesla revenue for the last quarter amounts to 22.50 B USD, despite the estimated figure of 22.28 B USD. In the next quarter, revenue is expected to reach 24.56 B USD.

TSLA net income for the last quarter is 1.17 B USD, while the quarter before that showed 409.00 M USD of net income which accounts for 186.55% change. Track more Tesla financial stats to get the full picture.

No, TSLA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 13, 2025, the company has 125.67 K employees. See our rating of the largest employees — is Tesla on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tesla EBITDA is 11.50 B USD, and current EBITDA margin is 13.44%. See more stats in Tesla financial statements.

Like other stocks, TSLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tesla stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tesla technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tesla stock shows the strong buy signal. See more of Tesla technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.