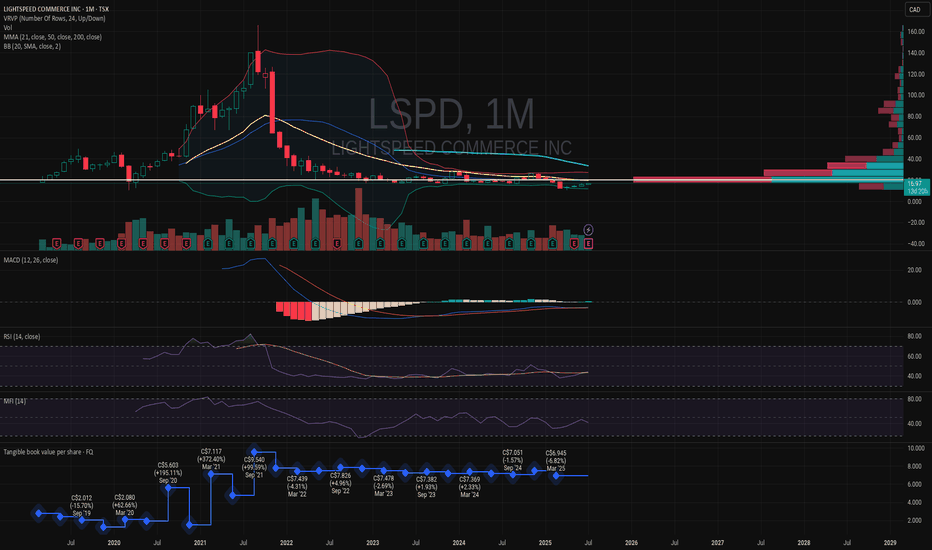

LSPD - Looks promising here. LONG. LSPD

If they can keep on keeping on, bring in cash, I think they have a good shot at carving out a market.

Of course I'm a newbie at all this and just giving my 0.00002 worth.

Same goes for all my charts. I don't profess to know a whole lot, but I'm trying.

If the last few years were tough for

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−6.42 CAD

−928.03 M CAD

1.50 B CAD

124.38 M

About LIGHTSPEED COMMERCE INC

Sector

Industry

CEO

Dax Dasilva

Website

Headquarters

Montréal

Founded

2005

FIGI

BBG00NG48T92

Lightspeed Commerce, Inc. engages in the provision of point-of-sale software for retailers and restaurants. It offers workflow analysis, training, configuration, networking, and business services. The company was founded by Dax Dasilva on March 21, 2005 and is headquartered in Montreal, Canada.

Related stocks

Accumulation complete, wealth distribution commenceVery typical pattern for profits here. Take a little portion of your portfolio to accumulate at this level before price goes parabolic. Price has consolidated at these levels for far too long and is now finally inching higher, after gathering immense demand. Expect price to visit all fresh supply zo

LSPD - Bullish ReversalLSPD (Lightspeed) appears to be oversold at the moment. The arrival of the new CEO is expected to significantly boost the stock. Additionally, there are signs of a potential reversal, particularly on the lower timeframe of 15 minutes, with an inverse head and shoulder formation indicating a possible

LSPD Lightspeed Canadian FinTech looking to breakoutLooking at LSPD chart, can see a breakout pattern emerging.

Can also see wyckoff accumulation pattern

Upside potential minimal 0.236 retracement if it's a wave 4, or if started brand new bullish leg as wave 1 (we'll only know once the wave 2 pullback successfully restests than current low, that can

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where LSPD is featured.

Frequently Asked Questions

The current price of LSPD is 16.98 CAD — it has decreased by −1.62% in the past 24 hours. Watch LIGHTSPEED POS INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NEO exchange LIGHTSPEED POS INC stocks are traded under the ticker LSPD.

LSPD stock has fallen by −5.51% compared to the previous week, the month change is a 7.06% rise, over the last year LIGHTSPEED POS INC has showed a −12.25% decrease.

We've gathered analysts' opinions on LIGHTSPEED POS INC future price: according to them, LSPD price has a max estimate of 29.94 CAD and a min estimate of 13.80 CAD. Watch LSPD chart and read a more detailed LIGHTSPEED POS INC stock forecast: see what analysts think of LIGHTSPEED POS INC and suggest that you do with its stocks.

LSPD reached its all-time high on Sep 22, 2021 with the price of 165.55 CAD, and its all-time low was 10.50 CAD and was reached on Apr 7, 2025. View more price dynamics on LSPD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LSPD stock is 5.50% volatile and has beta coefficient of 2.57. Track LIGHTSPEED POS INC stock price on the chart and check out the list of the most volatile stocks — is LIGHTSPEED POS INC there?

Today LIGHTSPEED POS INC has the market capitalization of 2.33 B, it has increased by 4.87% over the last week.

Yes, you can track LIGHTSPEED POS INC financials in yearly and quarterly reports right on TradingView.

LIGHTSPEED POS INC is going to release the next earnings report on Nov 6, 2025. Keep track of upcoming events with our Earnings Calendar.

LSPD earnings for the last quarter are 0.08 CAD per share, whereas the estimation was 0.17 CAD resulting in a −52.38% surprise. The estimated earnings for the next quarter are 0.17 CAD per share. See more details about LIGHTSPEED POS INC earnings.

LIGHTSPEED POS INC revenue for the last quarter amounts to 415.17 M CAD, despite the estimated figure of 391.09 M CAD. In the next quarter, revenue is expected to reach 424.65 M CAD.

LSPD net income for the last quarter is −68.60 M CAD, while the quarter before that showed −826.38 M CAD of net income which accounts for 91.70% change. Track more LIGHTSPEED POS INC financial stats to get the full picture.

No, LSPD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 4, 2025, the company has 3 K employees. See our rating of the largest employees — is LIGHTSPEED POS INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LIGHTSPEED POS INC EBITDA is −24.41 M CAD, and current EBITDA margin is −1.87%. See more stats in LIGHTSPEED POS INC financial statements.

Like other stocks, LSPD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LIGHTSPEED POS INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LIGHTSPEED POS INC technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LIGHTSPEED POS INC stock shows the sell signal. See more of LIGHTSPEED POS INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.