Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

53.80 INR

3.22 B INR

25.29 B INR

19.03 M

About AGI GREENPAC LTD

Sector

Industry

CEO

Rajesh Khosla

Website

Headquarters

Gurgaon

Founded

1960

ISIN

INE415A01038

FIGI

BBG000CSP122

AGI Greenpac Ltd. engages in the manufacturing and selling of sanitary ware, faucets, pipes, container glass bottles, PET bottles and security caps & closures. It operates through the following segments: Building Products, Packaging Products, and Others. The company was founded on February 8, 1960 and is headquartered in Gurgaon, India.

Related stocks

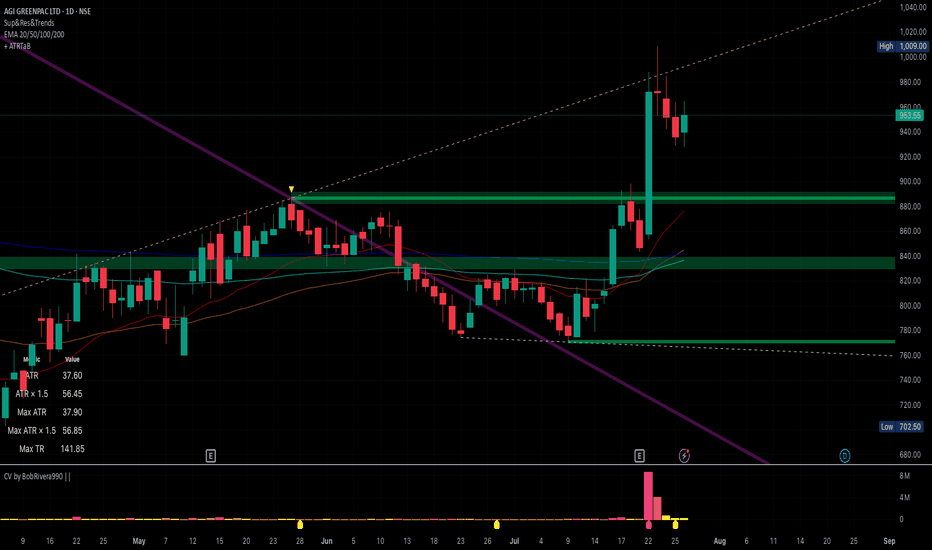

AGI GREENPAC LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

AGI CMP 1030.AGItrading at 52 week high zone.And trading above all Short Long bullish Moving Averages.On daily basis a strong White Morubozzu candle with massive volume showing possiblities to break its Lst all time . Last year in same quarter it have tried two time to break these levels.All (Monthly,Weekly,Dail

AGI GREENPAC LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

AGI Greenpac Ltd view for Intraday 20th September #AGI AGI Greenpac Ltd view for Intraday 20th September #AGI

Buying may witness above 890

Support area 875-880. Below ignoring buying momentum for intraday

Selling may witness below 875

Resistance area 890

Above ignoring selling momentum for intraday

Charts for Educational purposes only.

Please follow

AGI Greenpac Ltd.*AGI Greenpac Ltd*

P&F Formation on Yearly Basis

Strong Price BreakOut & Sustained.

Continued Strong Vol Consolidation.

RSI: 1H>D>W<M. All in Bullish Zone.

EMAs: Widening Gaps amongst 20/ 50/ 100 levels on Monthly TF.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

Stable Financial wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AGI is 919.00 INR — it has increased by 0.44% in the past 24 hours. Watch AGI GREENPAC LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange AGI GREENPAC LTD stocks are traded under the ticker AGI.

AGI stock has fallen by −3.33% compared to the previous week, the month change is a 18.76% rise, over the last year AGI GREENPAC LTD has showed a 21.08% increase.

We've gathered analysts' opinions on AGI GREENPAC LTD future price: according to them, AGI price has a max estimate of 1,431.00 INR and a min estimate of 1,431.00 INR. Watch AGI chart and read a more detailed AGI GREENPAC LTD stock forecast: see what analysts think of AGI GREENPAC LTD and suggest that you do with its stocks.

AGI stock is 2.39% volatile and has beta coefficient of 1.17. Track AGI GREENPAC LTD stock price on the chart and check out the list of the most volatile stocks — is AGI GREENPAC LTD there?

Today AGI GREENPAC LTD has the market capitalization of 59.90 B, it has increased by 6.35% over the last week.

Yes, you can track AGI GREENPAC LTD financials in yearly and quarterly reports right on TradingView.

AGI GREENPAC LTD is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AGI net income for the last quarter is 888.50 M INR, while the quarter before that showed 966.10 M INR of net income which accounts for −8.03% change. Track more AGI GREENPAC LTD financial stats to get the full picture.

Yes, AGI dividends are paid annually. The last dividend per share was 6.00 INR. As of today, Dividend Yield (TTM)% is 0.65%. Tracking AGI GREENPAC LTD dividends might help you take more informed decisions.

AGI GREENPAC LTD dividend yield was 0.94% in 2024, and payout ratio reached 14.05%. The year before the numbers were 0.83% and 15.45% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AGI GREENPAC LTD EBITDA is 6.19 B INR, and current EBITDA margin is 24.28%. See more stats in AGI GREENPAC LTD financial statements.

Like other stocks, AGI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AGI GREENPAC LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AGI GREENPAC LTD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AGI GREENPAC LTD stock shows the buy signal. See more of AGI GREENPAC LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.