Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

81.30 INR

2.44 B INR

99.11 B INR

19.94 M

About AMBER ENTERPRISES (I) LTD

Sector

Industry

CEO

Jasbir Singh

Website

Headquarters

Gurugra

Founded

1990

ISIN

INE371P01015

FIGI

BBG00JQ7FM63

Amber Enterprises India Ltd. engages in the manufacture of home appliances equipment. The firm operates through the following Divisions: Consumer Durables Division; Electronic Manufacturing Services Division and; Railway Subsystems & Defence Division. The Consumer Durables Division comprises RAC finished goods, room AC components including motors, and nonroom AC components, symbolising commitment to product diversity and innovation. The Electronic Manufacturing Services Division comprises ILJIN Electronics, EVER Electronics and Ascent Circuits, delivers cutting-edge solutions to various segments of industries viz. telecom, automotive, smart energy meters, consumer electronics and appliances, hearables, and wearables & bare board PCBs, demonstrating technological prowess and adaptability. The Railway Subsystems & Defence Division provides integrated solutions to rolling stock customers, including Indian Railways, Metro, RRTS, buses and Defence, where it offer customised solutions in HVAC, doors, gangways, and pantry systems. The company was founded by Kartar Singh on April 2, 1990 and is headquartered in Gurugra, India.

Related stocks

Amber Enterprises Amber Enterprises – Q1 FY26 Concall Highlights

## Robust Growth | Strategic Capex | Margin Focus

## Financials

- Revenue: ₹3,449 Cr (↑ 44% YoY)

- Operating EBITDA: ₹263 Cr (↑ 31% YoY)

*Margin impacted by product mix*

- PAT: ₹106 Cr (↑ 42% YoY)

- FY26 EBITDA Margin Guidance: 8–9%

Resistance 80

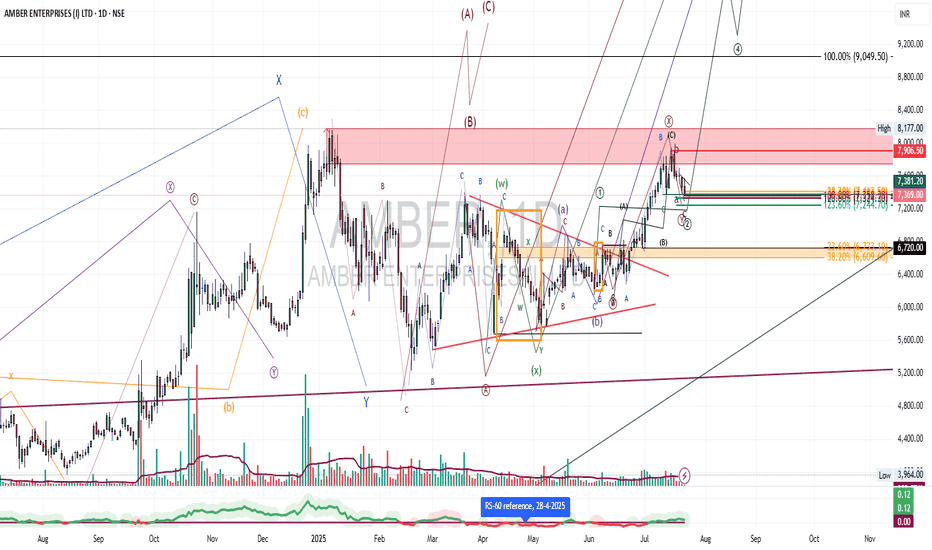

AMBER ENTERPRISES LTD S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AMBER is 7,871.00 INR — it has decreased by −1.16% in the past 24 hours. Watch AMBER ENTERPRISES (I) LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange AMBER ENTERPRISES (I) LTD stocks are traded under the ticker AMBER.

AMBER stock has risen by 6.80% compared to the previous week, the month change is a 11.25% rise, over the last year AMBER ENTERPRISES (I) LTD has showed a 81.57% increase.

We've gathered analysts' opinions on AMBER ENTERPRISES (I) LTD future price: according to them, AMBER price has a max estimate of 10,129.00 INR and a min estimate of 5,208.00 INR. Watch AMBER chart and read a more detailed AMBER ENTERPRISES (I) LTD stock forecast: see what analysts think of AMBER ENTERPRISES (I) LTD and suggest that you do with its stocks.

AMBER reached its all-time high on Jan 7, 2025 with the price of 8,177.00 INR, and its all-time low was 622.00 INR and was reached on Feb 18, 2019. View more price dynamics on AMBER chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AMBER stock is 4.12% volatile and has beta coefficient of 0.60. Track AMBER ENTERPRISES (I) LTD stock price on the chart and check out the list of the most volatile stocks — is AMBER ENTERPRISES (I) LTD there?

Today AMBER ENTERPRISES (I) LTD has the market capitalization of 266.61 B, it has decreased by −1.90% over the last week.

Yes, you can track AMBER ENTERPRISES (I) LTD financials in yearly and quarterly reports right on TradingView.

AMBER ENTERPRISES (I) LTD is going to release the next earnings report on Nov 7, 2025. Keep track of upcoming events with our Earnings Calendar.

AMBER earnings for the last quarter are 30.80 INR per share, whereas the estimation was 22.75 INR resulting in a 35.40% surprise. The estimated earnings for the next quarter are 0.71 INR per share. See more details about AMBER ENTERPRISES (I) LTD earnings.

AMBER ENTERPRISES (I) LTD revenue for the last quarter amounts to 34.49 B INR, despite the estimated figure of 26.71 B INR. In the next quarter, revenue is expected to reach 21.32 B INR.

AMBER net income for the last quarter is 1.04 B INR, while the quarter before that showed 1.16 B INR of net income which accounts for −10.51% change. Track more AMBER ENTERPRISES (I) LTD financial stats to get the full picture.

AMBER ENTERPRISES (I) LTD dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 18.46 K employees. See our rating of the largest employees — is AMBER ENTERPRISES (I) LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMBER ENTERPRISES (I) LTD EBITDA is 8.24 B INR, and current EBITDA margin is 7.38%. See more stats in AMBER ENTERPRISES (I) LTD financial statements.

Like other stocks, AMBER shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMBER ENTERPRISES (I) LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMBER ENTERPRISES (I) LTD technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMBER ENTERPRISES (I) LTD stock shows the buy signal. See more of AMBER ENTERPRISES (I) LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.