Key facts today

On August 8, the Nifty India Defence index fell nearly 2%, marking three straight sessions of losses for Bharat Electronics Ltd (BEL) amid a consolidation phase after earlier gains.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.50 INR

53.21 B INR

234.64 B INR

3.56 B

About BHARAT ELECTRONICS LTD

Sector

Industry

CEO

Manoj Jain

Website

Headquarters

Bangalore

Founded

1954

ISIN

INE263A01024

FIGI

BBG000CP4VM3

Bharat Electronics Ltd. provides advanced products and systems for military, government and civilian customers. The firm's products and services include Communication & C4I systems, Weapon Systems, Electronic Warfare and Avionics. It also provides weapon systems, radar and fire control systems, electro optics and communication, vacuum interrupters, electronic voting, telecom and SATCOM systems, semiconductor devices, microwave and transmitting tubes, solar products and systems. The company was founded on April 21, 1954 and is headquartered in Bangalore, India.

Related stocks

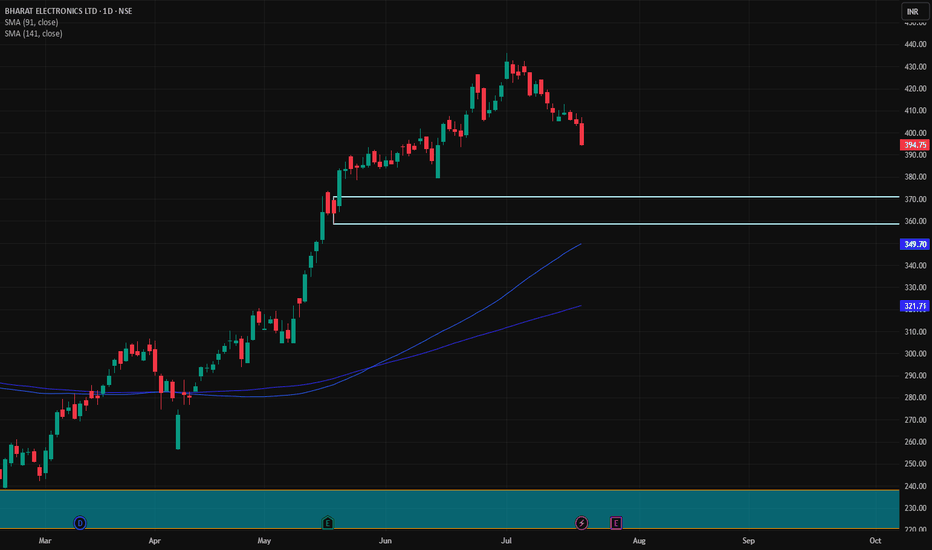

BEL🛒 Trade Plan Summary – Long Entry

Parameter Value

Entry 371

Stop Loss (SL) 358

Risk 13 pts

Target 535

Reward 164 pts

Risk-Reward (RR) 12.6 (High Conviction Trade)

🧠 Market Context

Last High: 436 – A possible resistance before final target.

Last Low: 337 – Still above HTF proximal zone, reinforcing

BHARAT ELECTRONICS LTD – Is in Uptrend …. What NextBEL: CMP: 363.90 RSI: 80.47

BEL is consistently making new highs and is currently in a strong uptrend. The RSI indicates that the stock is in the overbought zone, following a sharp price expansion over the past week. Wave analysis suggests there is still an upside potential of 20–22% from curr

BEL : Flying High, creating new Highs.BEL : Flying High, creating new Highs.

After a Buy Signal as displayed on Chart , it never looked back .

3 Months Time Frame Chart .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Range breakout | Impulse of bull starthi Traders,

1. The swing formation is solid

2. BEL has taken the ascending trend line support.

3. The the range bound is weekly has broke upward, leading to impulse wave of bull trend.

4. Projected Target 1 and Target 2 with 20% and 40% returns from the CMP with 1:81 and 1:4.01 risk reward ratio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BEL is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of BEL is 384.60 INR — it has decreased by −0.81% in the past 24 hours. Watch BHARAT ELECTRONICS LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange BHARAT ELECTRONICS LTD stocks are traded under the ticker BEL.

BEL stock has risen by 0.39% compared to the previous week, the month change is a −9.28% fall, over the last year BHARAT ELECTRONICS LTD has showed a 27.77% increase.

We've gathered analysts' opinions on BHARAT ELECTRONICS LTD future price: according to them, BEL price has a max estimate of 550.00 INR and a min estimate of 246.00 INR. Watch BEL chart and read a more detailed BHARAT ELECTRONICS LTD stock forecast: see what analysts think of BHARAT ELECTRONICS LTD and suggest that you do with its stocks.

BEL stock is 1.08% volatile and has beta coefficient of 1.70. Track BHARAT ELECTRONICS LTD stock price on the chart and check out the list of the most volatile stocks — is BHARAT ELECTRONICS LTD there?

Today BHARAT ELECTRONICS LTD has the market capitalization of 2.84 T, it has decreased by −1.75% over the last week.

Yes, you can track BHARAT ELECTRONICS LTD financials in yearly and quarterly reports right on TradingView.

BHARAT ELECTRONICS LTD is going to release the next earnings report on Oct 24, 2025. Keep track of upcoming events with our Earnings Calendar.

BEL earnings for the last quarter are 1.33 INR per share, whereas the estimation was 1.26 INR resulting in a 5.56% surprise. The estimated earnings for the next quarter are 1.25 INR per share. See more details about BHARAT ELECTRONICS LTD earnings.

BHARAT ELECTRONICS LTD revenue for the last quarter amounts to 44.17 B INR, despite the estimated figure of 48.02 B INR. In the next quarter, revenue is expected to reach 54.98 B INR.

BEL net income for the last quarter is 9.70 B INR, while the quarter before that showed 21.27 B INR of net income which accounts for −54.40% change. Track more BHARAT ELECTRONICS LTD financial stats to get the full picture.

BHARAT ELECTRONICS LTD dividend yield was 0.80% in 2024, and payout ratio reached 32.97%. The year before the numbers were 1.09% and 40.36% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 9, 2025, the company has 26.24 K employees. See our rating of the largest employees — is BHARAT ELECTRONICS LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BHARAT ELECTRONICS LTD EBITDA is 71.24 B INR, and current EBITDA margin is 29.31%. See more stats in BHARAT ELECTRONICS LTD financial statements.

Like other stocks, BEL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BHARAT ELECTRONICS LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BHARAT ELECTRONICS LTD technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BHARAT ELECTRONICS LTD stock shows the buy signal. See more of BHARAT ELECTRONICS LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.