Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.65 INR

1.62 B INR

89.32 B INR

462.42 M

About DELHIVERY LTD

Sector

Industry

CEO

Sahil Barua

Website

Headquarters

Gurugram

Founded

2011

ISIN

INE148O01028

FIGI

BBG017704BH8

Delhivery Ltd. engages in the provision of logistics solutions to eCommerce partners. It operates through the India and Rest of the World geographical segments. It involves building the operating system for commerce, through a combination of infrastructure, logistics operations, and cutting-edge engineering and technology capabilities. It offers express parcel, partial-truckload, freight, truckload freight, cross-border, and supply chain services. The company was founded by Sahil Barua, Kapil Bharati, Bhavesh Manglani, Mohit Tandon, and Amit Prakash Ambasta in May 2011 and is headquartered in Gurugram, India.

Related stocks

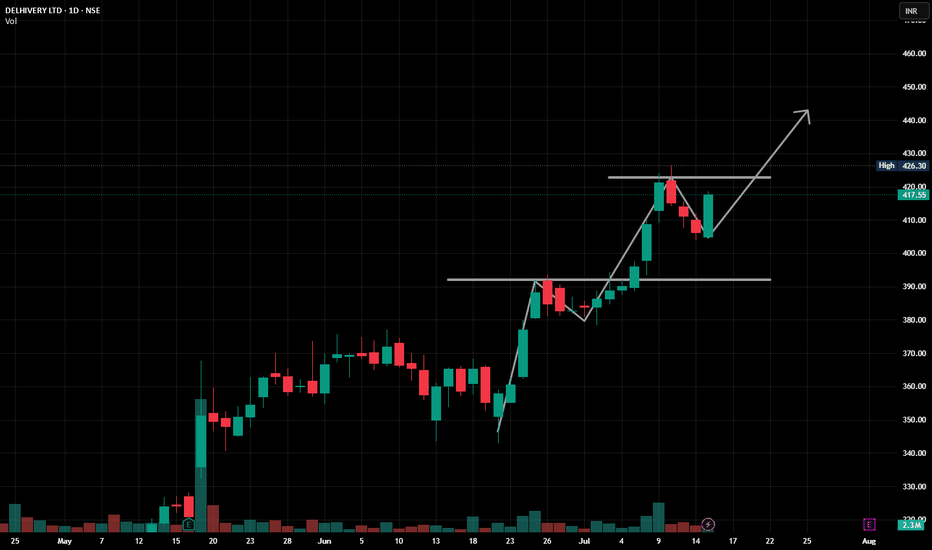

Bullish structure in play!NSE:DELHIVERY

Bullish structure in play!

Forming higher highs & higher lows

Strong bounce from ₹405 support

Eyes on breakout above ₹426.30

Volume confirms buying interest again

More importantly, during this time, NSE:DELHIVERY usually goes to ₹450 as shown here:

https: //www.

Next

DELHIVERY LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

Cup & Handle pattern and Trendline Breakout - DELHIVERYTechnical Analysis:

Current Price: ₹351.25 (Note: Live prices can fluctuate. As of the market close today, Delhivery closed around ₹350.60 on the NSE).

Target: Your target of ₹410 suggests a potential upside.

Trendline Breakout: Breaking above a significant downtrend line can indicate a shift

Delhivery Ltd view for Intraday 19th May #DELHIVERY Delhivery Ltd view for Intraday 19th May #DELHIVERY

Resistance 325 Watching above 325 for upside momentum.

Support area 310 Below 320 ignoring upside momentum for intraday

Watching below 309 for downside movement...

Above 314 ignoring downside move for intraday

Charts for Educational purposes on

Intraday SellThe volume profile is a tool that allows traders to see the volume on a horizontal level at each price. You can visualize at some price levels there is a lot of volume and at some very little to none.The importance of this tool lies in the fact that volume attracts price. Meaning large areas of v

Delhivery Ltd.*Delhivery Ltd.*

*W* in the making on Monthly Basis.

Retracement starting from Bottoming out.

Volume traction building up.

Respective targets mentioned.

Logistics business turning around.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

This is an Opinion. Do your own research.

*_Happ

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DELHIVERY is 429.85 INR — it has increased by 1.08% in the past 24 hours. Watch DELHIVERY LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange DELHIVERY LTD stocks are traded under the ticker DELHIVERY.

DELHIVERY stock has fallen by −1.30% compared to the previous week, the month change is a 11.95% rise, over the last year DELHIVERY LTD has showed a 5.10% increase.

We've gathered analysts' opinions on DELHIVERY LTD future price: according to them, DELHIVERY price has a max estimate of 515.00 INR and a min estimate of 277.00 INR. Watch DELHIVERY chart and read a more detailed DELHIVERY LTD stock forecast: see what analysts think of DELHIVERY LTD and suggest that you do with its stocks.

DELHIVERY reached its all-time high on Jul 21, 2022 with the price of 708.00 INR, and its all-time low was 236.55 INR and was reached on Mar 13, 2025. View more price dynamics on DELHIVERY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DELHIVERY stock is 3.12% volatile and has beta coefficient of 1.85. Track DELHIVERY LTD stock price on the chart and check out the list of the most volatile stocks — is DELHIVERY LTD there?

Today DELHIVERY LTD has the market capitalization of 320.92 B, it has increased by 1.41% over the last week.

Yes, you can track DELHIVERY LTD financials in yearly and quarterly reports right on TradingView.

DELHIVERY LTD is going to release the next earnings report on Nov 7, 2025. Keep track of upcoming events with our Earnings Calendar.

DELHIVERY earnings for the last quarter are 1.24 INR per share, whereas the estimation was 0.95 INR resulting in a 30.53% surprise. The estimated earnings for the next quarter are 1.58 INR per share. See more details about DELHIVERY LTD earnings.

DELHIVERY LTD revenue for the last quarter amounts to 22.94 B INR, despite the estimated figure of 24.09 B INR. In the next quarter, revenue is expected to reach 26.05 B INR.

DELHIVERY net income for the last quarter is 910.46 M INR, while the quarter before that showed 725.57 M INR of net income which accounts for 25.48% change. Track more DELHIVERY LTD financial stats to get the full picture.

No, DELHIVERY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DELHIVERY LTD EBITDA is 4.28 B INR, and current EBITDA margin is 4.21%. See more stats in DELHIVERY LTD financial statements.

Like other stocks, DELHIVERY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DELHIVERY LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DELHIVERY LTD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DELHIVERY LTD stock shows the buy signal. See more of DELHIVERY LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.