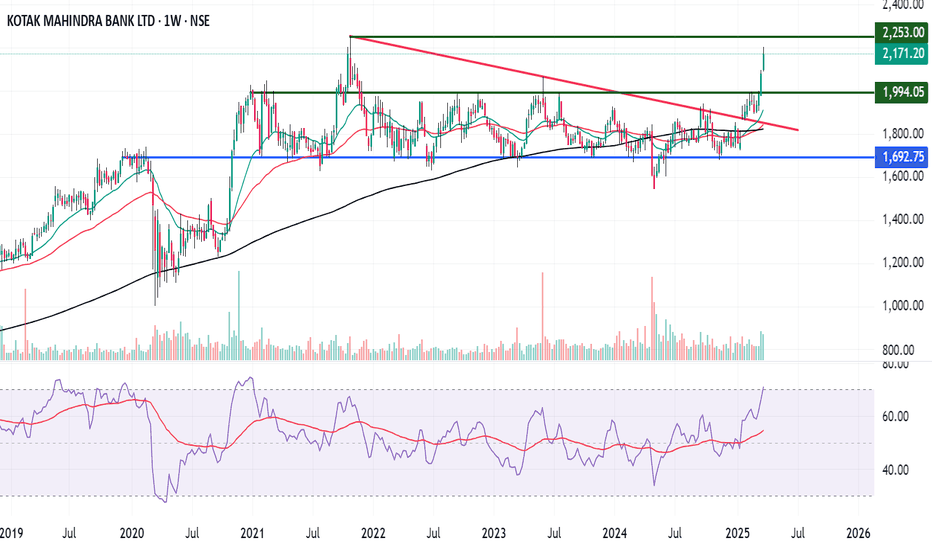

KOTAK MAHINDRA BANK BREAK OUT ON MONTHLY CHART/ UPSIDE POTENTIALThis stock is out of consolidation of almost 5 years. keep an eye of this stock start accumulating this stock on this price range. 1997 will be sl and target 2400.

Kotak Mahindra Bank has broken out of a **multi-year consolidation range** on the monthly chart. After several rejections near the 2,

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

111.30 INR

221.26 B INR

1.03 T INR

1.38 B

About KOTAK MAHINDRA BANK LTD

Sector

Industry

CEO

Ashok Valiram Vaswani

Website

Headquarters

Mumbai

Founded

1985

ISIN

INE237A01028

FIGI

BBG000CVD6Y2

Kotak Mahindra Bank Ltd. Engages in the provision of commercial banking services. It operates through the following segments: Treasury, Balance Sheet Management Unit (BMU) and Corporate Centre; Retail Banking; Corporate or Wholesale Banking; Vehicle Financing, Other Lending Activities; Broking; Advisory and Transactional Services; Asset Management; Insurance and Other Banking Business. The Treasury, BMU amd Corporate Centre segment involves in money market, forex market, derivatives, investments and primary dealership of government securities, and asset liability management. The Retail Banking segment refers to lending, branch banking, and credit cards. The Corporate/Wholesale Banking segment includes wholesale borrowings, lendings and other related services to the corporate sector which are not included under retail banking. The Vehicle Financing segment pertains to retail vehicle finance and wholesale trade finance to auto dealers. The Other Lending Activities segment manages financing against securities, securitization, and other loans and services. The Broking segment offers stock broking services. The Advisory and Transactional Services segment accomodates financial advisory and transactional services such as mergers and acquisition advice, and equity and debt issue management services. The Asset Management segment administers investments on behalf of clients and funds. The Insurance segment provides life insurance and general insurance. The Other Banking Business segment engages in other business not classified above. The company was founded by Uday Suresh Kotak on November 21, 1985 and is headquartered in Mumbai, India.

KOTAK BANKNSE:KOTAKBANK

Note :

1. One should go long with a Stop Loss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Management and Risk Appetite.

Disclaimer :

>You are responsible for your profits and loss.

>The idea share

Kokat Bank - Long Setup (Weekly view)Good setup in Kotak Bank after long consolidation. Have been in upmove for last few days. Looking good on weekly basis. Banks in general have been showing strength. Should see further move beyond 2250, if a new base is formed in that region.

Please note, this is a not a buy/sell reco. For study pur

KOTAKBANK KEY LEVELS FOR 17/02/2025//description

// All credit goes to Tony for the concept of this indicator. His Trading View link: www.tradingview.com

// Note: The calculation method in this indicator differs from Tony's, but the concept is derived from his work.

I want to make it clear that I am not a seller, and this method was

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where KOTAKBANK is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Related stocks

Frequently Asked Questions

The current price of KOTAKBANK is 2,074.30 INR — it has decreased by −0.33% in the past 24 hours. Watch KOTAK MAHINDRA BANK LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange KOTAK MAHINDRA BANK LTD stocks are traded under the ticker KOTAKBANK.

KOTAKBANK stock has fallen by −1.17% compared to the previous week, the month change is a −5.76% fall, over the last year KOTAK MAHINDRA BANK LTD has showed a 21.14% increase.

We've gathered analysts' opinions on KOTAK MAHINDRA BANK LTD future price: according to them, KOTAKBANK price has a max estimate of 2,673.00 INR and a min estimate of 1,900.00 INR. Watch KOTAKBANK chart and read a more detailed KOTAK MAHINDRA BANK LTD stock forecast: see what analysts think of KOTAK MAHINDRA BANK LTD and suggest that you do with its stocks.

KOTAKBANK reached its all-time high on Apr 22, 2025 with the price of 2,301.90 INR, and its all-time low was 7.05 INR and was reached on Apr 28, 2003. View more price dynamics on KOTAKBANK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

KOTAKBANK stock is 0.82% volatile and has beta coefficient of 0.81. Track KOTAK MAHINDRA BANK LTD stock price on the chart and check out the list of the most volatile stocks — is KOTAK MAHINDRA BANK LTD there?

Today KOTAK MAHINDRA BANK LTD has the market capitalization of 4.13 T, it has increased by 0.03% over the last week.

Yes, you can track KOTAK MAHINDRA BANK LTD financials in yearly and quarterly reports right on TradingView.

KOTAK MAHINDRA BANK LTD is going to release the next earnings report on Jul 21, 2025. Keep track of upcoming events with our Earnings Calendar.

KOTAKBANK earnings for the last quarter are 17.90 INR per share, whereas the estimation was 17.71 INR resulting in a 1.05% surprise. The estimated earnings for the next quarter are 16.83 INR per share. See more details about KOTAK MAHINDRA BANK LTD earnings.

KOTAK MAHINDRA BANK LTD revenue for the last quarter amounts to 104.66 B INR, despite the estimated figure of 104.61 B INR. In the next quarter, revenue is expected to reach 102.12 B INR.

KOTAKBANK net income for the last quarter is 49.33 B INR, while the quarter before that showed 47.01 B INR of net income which accounts for 4.93% change. Track more KOTAK MAHINDRA BANK LTD financial stats to get the full picture.

Yes, KOTAKBANK dividends are paid annually. The last dividend per share was 2.00 INR. As of today, Dividend Yield (TTM)% is 0.10%. Tracking KOTAK MAHINDRA BANK LTD dividends might help you take more informed decisions.

Like other stocks, KOTAKBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade KOTAK MAHINDRA BANK LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So KOTAK MAHINDRA BANK LTD technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating KOTAK MAHINDRA BANK LTD stock shows the buy signal. See more of KOTAK MAHINDRA BANK LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.