Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26.55 INR

7.00 B INR

46.43 B INR

91.30 M

About SARDA ENERGY & MIN LTD

Sector

Industry

Website

Headquarters

Raipur

Founded

1973

ISIN

INE385C01021

FIGI

BBG000CYBF41

Sarda Energy & Minerals Ltd. is a holding company, which engages in the manufacture of sponge iron, ferro alloys, billet, wire-rod, and iron ore pellet. It operates through the following segments: Steel, Ferro, and Power. The company was founded on June 23, 1973 and is headquartered in Raipur, India.

Related stocks

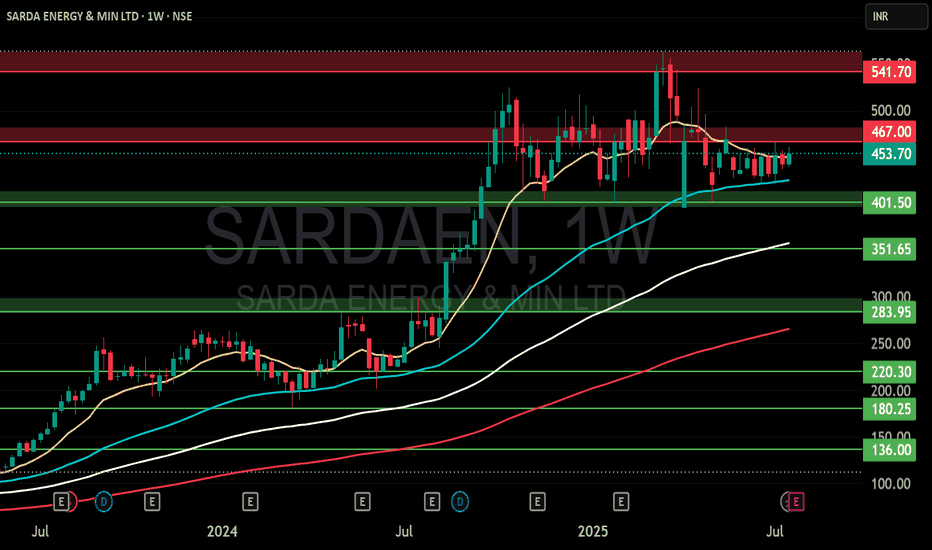

SARDA ENERGY & MIN LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

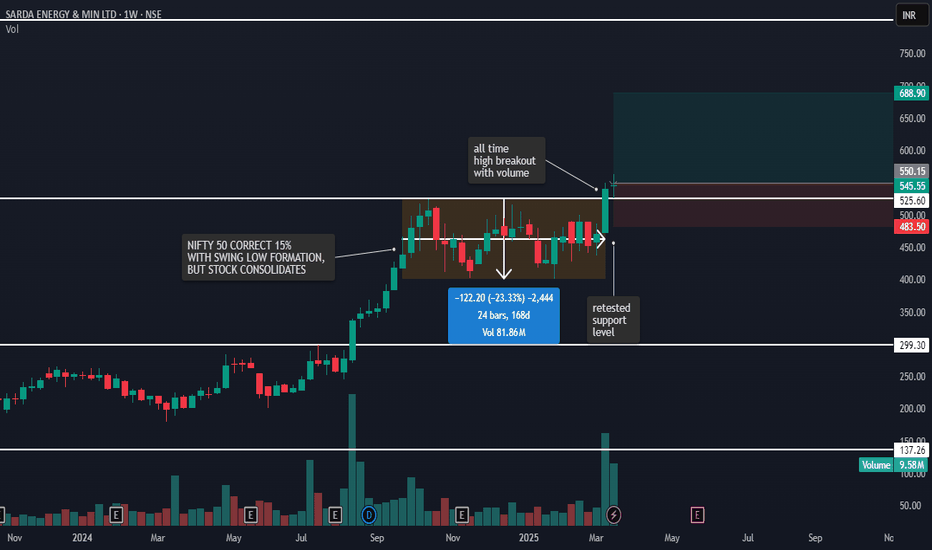

Sarda Energy & MineralsSarda Energy & Minerals looks like consolidating after the breakout. It has formed a tight flag. If it closes above 565 then it would be considered as a breakout. Weak below 525. This post is purely for educational purposes to learn the financial markets.

Disclaimer: I'm not a SEBI registered advis

sarda energywitnessed a rise in its attributable consolidated net profit to 1.97 billion Indian rupees in the fiscal third quarter from 1.17 billion rupees a year ago, according to a filing to the stock exchanges on Saturday by the steel and iron manufacturer.

Earnings per share during the quarter ended Dec 31

SARDA ENERGY & MIN LTD ⚡ SARDA ENERGY & MIN LTD (NSE) - Breakout Watch! ⚡

📈 Symmetrical Triangle Pattern tightening—breakout loading?

🔍 Stock testing resistance near 52WH

✅ RS Rating: 97.7 | Alpha Signal: BUY

📊 Strong accumulation, momentum building!

Is this ready for a breakout move? Let’s discuss! 👇🔥

#Breakout #Sto

50 SMA Rising- Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Its 50 SMA Rising Strategy. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep tra

Ascending triangle breakoutGood volume buildup in daily and weekly timeframe.

Highest volume buildup in past one year.

Ascending triangle breakout with good volume.

Depending on the market momentum the price cand give small retracement or move up.

Fundamental's are OK.

DII stakes are up.

NOTE: I do my analysis, do yours

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SARDAEN is 546.10 INR — it has increased by 0.79% in the past 24 hours. Watch SARDA ENERGY & MIN LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange SARDA ENERGY & MIN LTD stocks are traded under the ticker SARDAEN.

SARDAEN stock has risen by 22.10% compared to the previous week, the month change is a 25.73% rise, over the last year SARDA ENERGY & MIN LTD has showed a 115.81% increase.

SARDAEN reached its all-time high on Mar 19, 2025 with the price of 563.45 INR, and its all-time low was 7.10 INR and was reached on Aug 6, 2013. View more price dynamics on SARDAEN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SARDAEN stock is 4.07% volatile and has beta coefficient of 0.80. Track SARDA ENERGY & MIN LTD stock price on the chart and check out the list of the most volatile stocks — is SARDA ENERGY & MIN LTD there?

Today SARDA ENERGY & MIN LTD has the market capitalization of 184.14 B, it has decreased by −3.98% over the last week.

Yes, you can track SARDA ENERGY & MIN LTD financials in yearly and quarterly reports right on TradingView.

SARDA ENERGY & MIN LTD is going to release the next earnings report on Nov 10, 2025. Keep track of upcoming events with our Earnings Calendar.

SARDAEN net income for the last quarter is 4.34 B INR, while the quarter before that showed 1.08 B INR of net income which accounts for 301.11% change. Track more SARDA ENERGY & MIN LTD financial stats to get the full picture.

Yes, SARDAEN dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.19%. Tracking SARDA ENERGY & MIN LTD dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SARDA ENERGY & MIN LTD EBITDA is 15.87 B INR, and current EBITDA margin is 26.41%. See more stats in SARDA ENERGY & MIN LTD financial statements.

Like other stocks, SARDAEN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SARDA ENERGY & MIN LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SARDA ENERGY & MIN LTD technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SARDA ENERGY & MIN LTD stock shows the strong buy signal. See more of SARDA ENERGY & MIN LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.