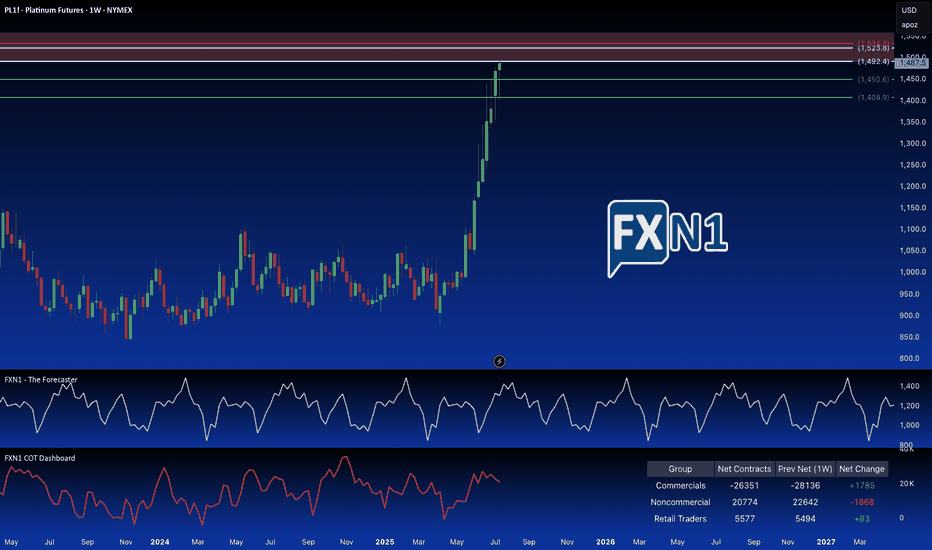

Platinum rally runs out of steam as nearterm outlook tilts shortThe Rally That Looked Unstoppable

Through the spring and into early summer, platinum looked like it had finally broken free of its long-standing range. From April to late June, prices surged over 36% to hit 11-year highs above $1,500/oz. The move was powered by a perfect storm of short-term drive

Related commodities

Platinum: Breaking the Supply Barrier?I'm adding a second Platinum position. Price has hit a strong weekly supply area, also a significant monthly supply zone. I'm anticipating a reversal here, as non-commercial holdings are decreasing, and seasonal patterns suggest a potential trend change. To further capitalize on potential upside,

From Sweep to Slaughter, Bear Setup EngagedOk a little late but I saw this and thought I'd share. Price has swept liquidity above the prior range high and failed to close strong. Structure is now rejecting under micro trend EMAs, breaking the local trend line and forming a short-term bearish momentum bias into the IFV zone. This is a short-

How much higher for Platinum futures In this video I look at the current price of platinum on a higher tf and forecast where I believe the cool down to this rally might begin.

Using tools like the fib extension, volume profile and speed fan we are able to highlight a major reaction zone ahead at $1600 region .

Set alerts at these

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Platinum Futures (Oct 2024) is Oct 29, 2024.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Platinum Futures (Oct 2024) before Oct 29, 2024.