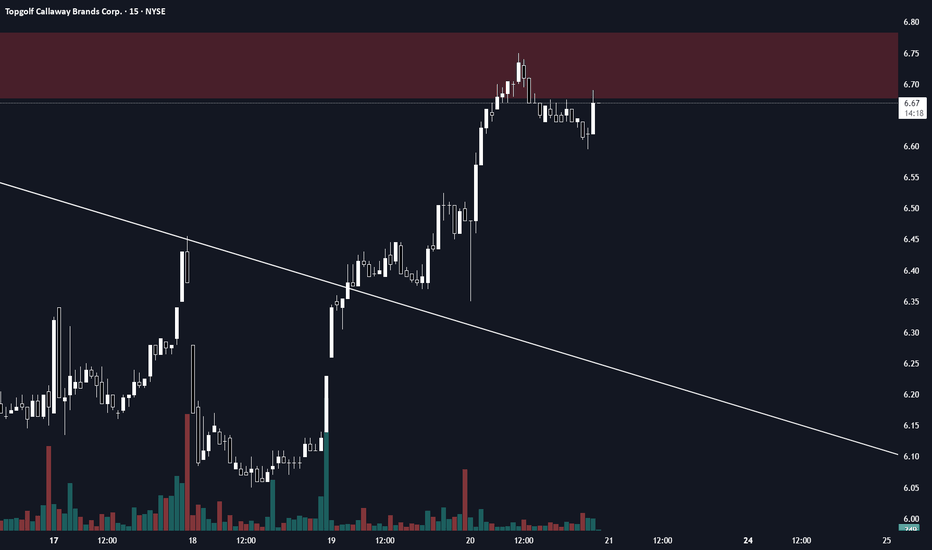

MODG - Algorithms are setting up for a HTF bounce!With our recent earnings move towards teal, this is setting up beautifully to make its way toward our HTF target that we identified a while back and still expect to be a target. Once there, we will have a tight stop considering its a HTF level that we are trading off of, and a long term hold plan.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−7.90 USD

−1.45 B USD

4.24 B USD

129.41 M

About Topgolf Callaway Brands Corp.

Sector

Industry

CEO

Oliver G. Brewer

Website

Headquarters

Carlsbad

Founded

1982

FIGI

BBG000CPCVY1

Topgolf Callaway Brands Corp. engages in the manufacture and distribution of golf equipment and accessories. It operates through following segments: Topgolf, Golf Equipment and Active Lifestyle. The Topgolf segment includes the operations of its Topgolf business. The Golf Equipment segment includes the operations of its golf clubs and golf balls business. The Active Lifestyle segment includes the operations of its soft goods business marketed under the Callaway, TravisMathew, Jack Wolfskin and OGIO brand names. The company was founded by Ely Reeves Callaway, Jr. in 1982 and is headquartered in Carlsbad, CA.

Related stocks

TopGolf | MODG | Long at $7.85 TopGolf NYSE:MODG finally closed the last price gap on the daily chart from the 2020 pandemic crash. All price gaps (as of this analysis) are now above the current price. While I am not stating this is bottom (high $6's or even low $5's are not fully off the table given the downward momentum), the

MODG - How to identify and enter a LTF tradeHere's a quick idea and how I could simply analyze a potential trade like this short on MODG:

1. Higher Time Frame intentional target

2. LTF Supply zone (level where known sellers exist)

3. Certain technical confluences within the algorithms, volume, and price action

1-2-3 punch and we've set ours

GOOGL Strong Move Post-Earnings. My AnalysisHey, guys. Not going to go into too much detail on the description here. Just wanted to get my thoughts out there on NASDAQ:GOOGL . Certainly seems to have a strong long term trend here. As always, in long term trends, there could be various counter trend moves so always be prepared in that regard

TopGolfThe new golf that is taking place is Topgolf and it is showing out in the earnings. This company has room to expand and become a big player over time. Take a look at the support and resistance zones to see where we could be headed. They generally increase in prices after a good earnings call like th

Topgolf Callaway's Stock Surges Amidst Acquisition RumorsIn a whirlwind of market activity, Topgolf Callaway ( NYSE:MODG ) finds itself at the center of speculation and volatility as rumors swirl regarding a potential acquisition. Despite initially soaring on reports of acquisition interest, the stock saw gains trimmed after the company denied any ongoing

MODG pushing to resistanceMODG is one to watch as it heads back to resistance at ~$14. Should it clear that level, there is room to run to ~$16. Looks to be forming inverse Head and Shoulders. Nice divergence on the MACD over the last couple of months. Today pushed through the 50 day without much issue.

A tough one to chartOne of the uglier charts I have seen but I love the story. Hard to find the right entry with this one but I started with a couple Jan calls here. Could see the small cap momentum continuing and Callaway has been making all the right moves. They just opened another top golf location in Florida recent

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ELY5180784

Topgolf Callaway Brands Corp. 2.75% 01-MAY-2026Yield to maturity

6.65%

Maturity date

May 1, 2026

See all MODG bonds

Frequently Asked Questions

The current price of MODG is 8.79 USD — it has increased by 4.78% in the past 24 hours. Watch Topgolf Callaway Brands Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Topgolf Callaway Brands Corp. stocks are traded under the ticker MODG.

MODG stock has fallen by −8.64% compared to the previous week, the month change is a −2.49% fall, over the last year Topgolf Callaway Brands Corp. has showed a −36.21% decrease.

We've gathered analysts' opinions on Topgolf Callaway Brands Corp. future price: according to them, MODG price has a max estimate of 10.50 USD and a min estimate of 7.00 USD. Watch MODG chart and read a more detailed Topgolf Callaway Brands Corp. stock forecast: see what analysts think of Topgolf Callaway Brands Corp. and suggest that you do with its stocks.

MODG reached its all-time high on Jun 20, 1997 with the price of 38.50 USD, and its all-time low was 2.22 USD and was reached on Jun 18, 1992. View more price dynamics on MODG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MODG stock is 7.79% volatile and has beta coefficient of 0.68. Track Topgolf Callaway Brands Corp. stock price on the chart and check out the list of the most volatile stocks — is Topgolf Callaway Brands Corp. there?

Today Topgolf Callaway Brands Corp. has the market capitalization of 1.65 B, it has decreased by −2.75% over the last week.

Yes, you can track Topgolf Callaway Brands Corp. financials in yearly and quarterly reports right on TradingView.

Topgolf Callaway Brands Corp. is going to release the next earnings report on Nov 18, 2025. Keep track of upcoming events with our Earnings Calendar.

MODG earnings for the last quarter are 0.24 USD per share, whereas the estimation was 0.02 USD resulting in a 911.25% surprise. The estimated earnings for the next quarter are −0.27 USD per share. See more details about Topgolf Callaway Brands Corp. earnings.

Topgolf Callaway Brands Corp. revenue for the last quarter amounts to 1.11 B USD, despite the estimated figure of 1.09 B USD. In the next quarter, revenue is expected to reach 946.78 M USD.

MODG net income for the last quarter is 2.10 M USD, while the quarter before that showed −1.51 B USD of net income which accounts for 100.14% change. Track more Topgolf Callaway Brands Corp. financial stats to get the full picture.

As of Aug 7, 2025, the company has 30 K employees. See our rating of the largest employees — is Topgolf Callaway Brands Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Topgolf Callaway Brands Corp. EBITDA is 484.20 M USD, and current EBITDA margin is 11.41%. See more stats in Topgolf Callaway Brands Corp. financial statements.

Like other stocks, MODG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Topgolf Callaway Brands Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Topgolf Callaway Brands Corp. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Topgolf Callaway Brands Corp. stock shows the sell signal. See more of Topgolf Callaway Brands Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.