PioneersA company specialized in the manufacturing of zero-gravity objects.

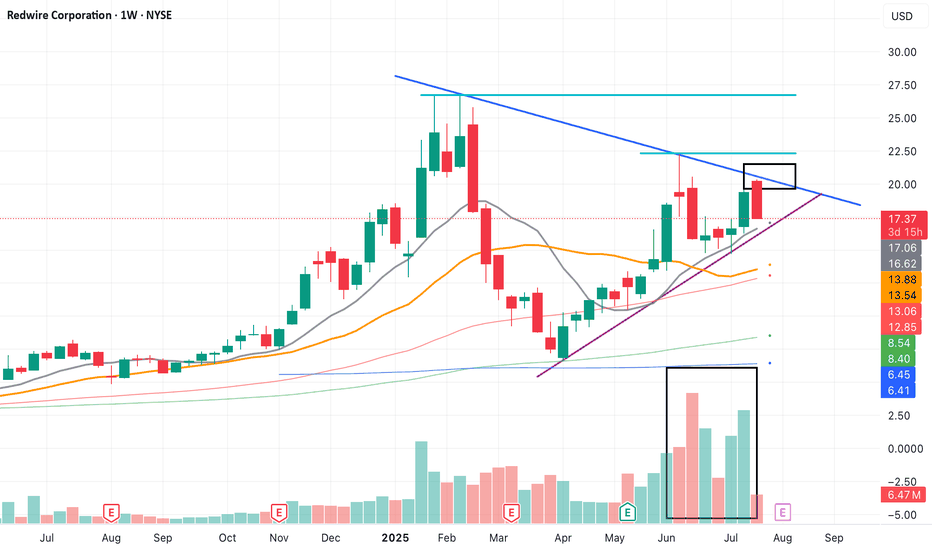

The price is approaching the purple support zone, where a partial entry could be considered while awaiting a bullish breakout of the blue resistance level.

If successful, the position can be increased.

For greater safety, one cou

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.26 USD

−114.31 M USD

304.10 M USD

51.07 M

About Redwire Corporation

Sector

Industry

CEO

Peter Cannito

Website

Headquarters

Jacksonville

Founded

2020

FIGI

BBG00YGLXD60

Redwire Corp. manufactures and supplies space equipment. It offers critical space solutions and reliability components for the next generation space economy with IP for solar power generation and in-space 3D printing and manufacturing. It assists its customers in solving challenges of future space missions. The company was founded in 2020 and is headquartered in Jacksonville, FL.

Related stocks

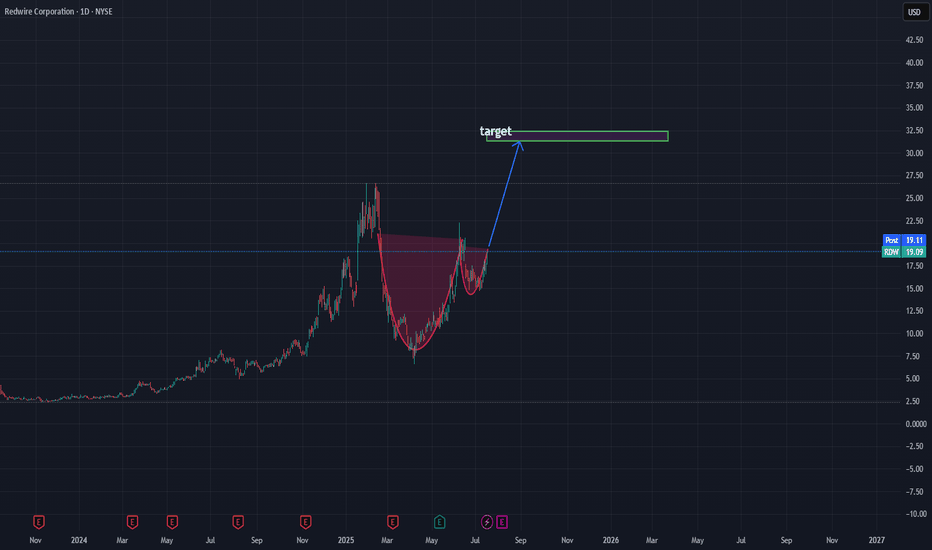

$RDW new contract, technicals ready to launch Stock has been finding support on a meaningful volume shelf and got positive news about winning a critical new contract this morning. We're bouncing forcefully off the 200 and 20 SMA confluence area on the news and showing signs of improving price action The AVWAP pinch between the February 13th hig

RDW – 30-Min Long Trade Setup !📈🟢

🔹 Asset: Redwire Corporation (RDW – NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Rising Wedge Breakout + Retest

📊 Trade Plan – Long Position

✅ Entry Zone: $10.16 (Breakout of wedge + key level reclaim)

✅ Stop-Loss (SL): $9.47 (Below structure & trendline support)

🎯 Take Profit Targets:

📌 TP1:

RDW – Redwire Corporation – 30-Min Long Trade Setup !:

📈 🚀

🔹 Asset: RDW (NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Wedge Breakout + Base Formation

📊 Trade Plan (Long Position)

✅ Entry Zone: Around $8.90 (wedge breakout + price base confirmation)

✅ Stop-Loss (SL): Below $8.40 (structure support & risk protection zone)

🎯 Take Profit Targe

Monday RDW Trade Setup!🚀 🚀

🔻 **Stop Loss (SL):** Below **16.51**

📈 **Entry:** Above **17.11**

🎯 **Target 1 (T1):** **17.74**

🎯 **Target 2 (T2):** **18.42**

💡 **Why Trade:**

Symmetrical triangle breakout with bullish continuation and volume supporting the move.

✅ **Conclusion:**

Prepare for Monday's brea

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where RDW is featured.

Frequently Asked Questions

The current price of RDW is 14.71 USD — it has decreased by −0.41% in the past 24 hours. Watch Redwire Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Redwire Corporation stocks are traded under the ticker RDW.

RDW stock has fallen by −4.73% compared to the previous week, the month change is a −5.71% fall, over the last year Redwire Corporation has showed a 168.43% increase.

We've gathered analysts' opinions on Redwire Corporation future price: according to them, RDW price has a max estimate of 28.00 USD and a min estimate of 16.00 USD. Watch RDW chart and read a more detailed Redwire Corporation stock forecast: see what analysts think of Redwire Corporation and suggest that you do with its stocks.

RDW stock is 10.15% volatile and has beta coefficient of 2.97. Track Redwire Corporation stock price on the chart and check out the list of the most volatile stocks — is Redwire Corporation there?

Today Redwire Corporation has the market capitalization of 2.11 B, it has increased by 11.82% over the last week.

Yes, you can track Redwire Corporation financials in yearly and quarterly reports right on TradingView.

Redwire Corporation is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

RDW earnings for the last quarter are −0.09 USD per share, whereas the estimation was −0.29 USD resulting in a 68.75% surprise. The estimated earnings for the next quarter are −0.12 USD per share. See more details about Redwire Corporation earnings.

Redwire Corporation revenue for the last quarter amounts to 61.40 M USD, despite the estimated figure of 73.85 M USD. In the next quarter, revenue is expected to reach 82.79 M USD.

RDW net income for the last quarter is −2.95 M USD, while the quarter before that showed −67.17 M USD of net income which accounts for 95.61% change. Track more Redwire Corporation financial stats to get the full picture.

No, RDW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 6, 2025, the company has 750 employees. See our rating of the largest employees — is Redwire Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Redwire Corporation EBITDA is −26.38 M USD, and current EBITDA margin is −6.54%. See more stats in Redwire Corporation financial statements.

Like other stocks, RDW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Redwire Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Redwire Corporation technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Redwire Corporation stock shows the buy signal. See more of Redwire Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.