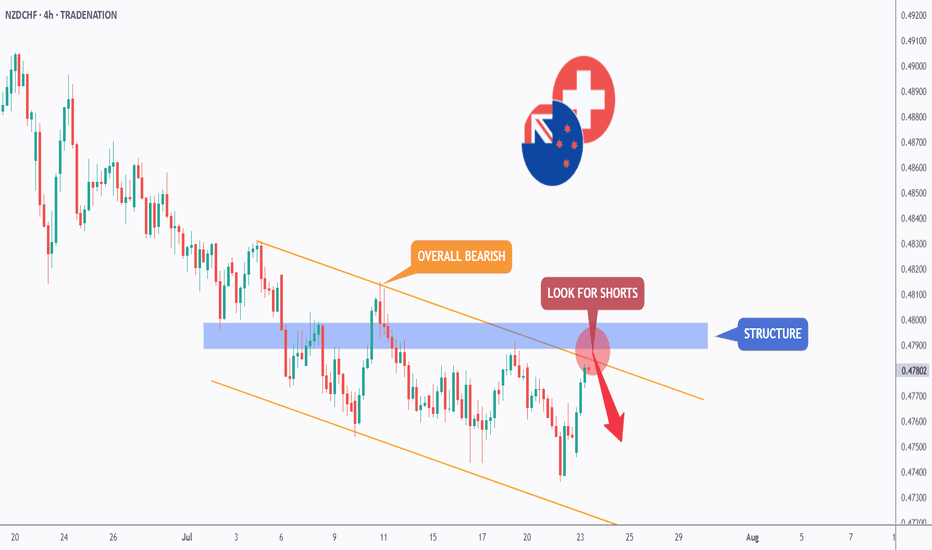

NZDCHF - Follow the Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDCHF has been overall bearish , trading within the falling orange channel and it is currently retesting the upper bound of the channel.

Moreover, it is rejecting a structure marked in blue.

📚 As per my tra

Related currencies

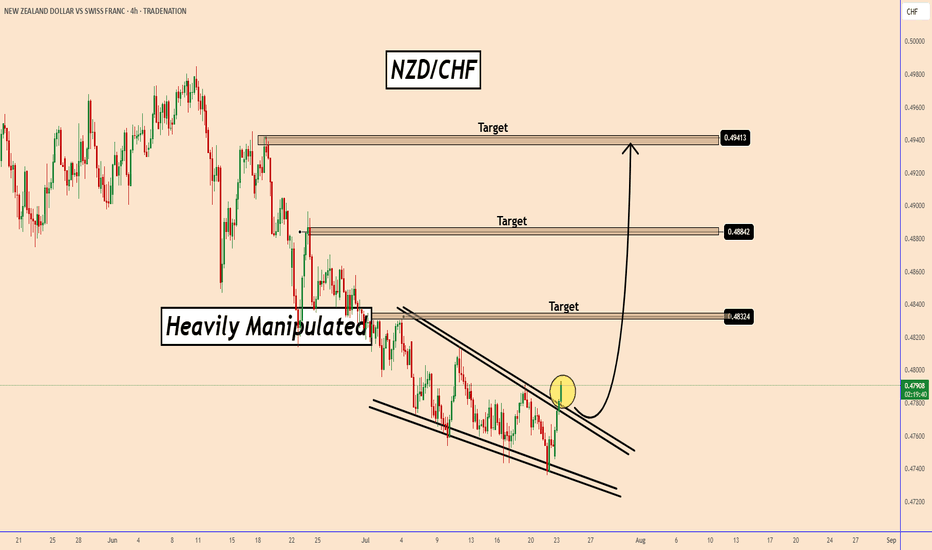

NZDCHF: A Clear Bullish Wedge PatternNZDCHF: A Clear Bullish Wedge Pattern

Today, NZDCHF broke out from a bullish Wedge pattern.

NZD looks strong today and breakout also looks strong.

If all goes well, NZDCHF should rise as shown in the chart.

It remains heavily manipulated because the SNB has been intervening over the past two w

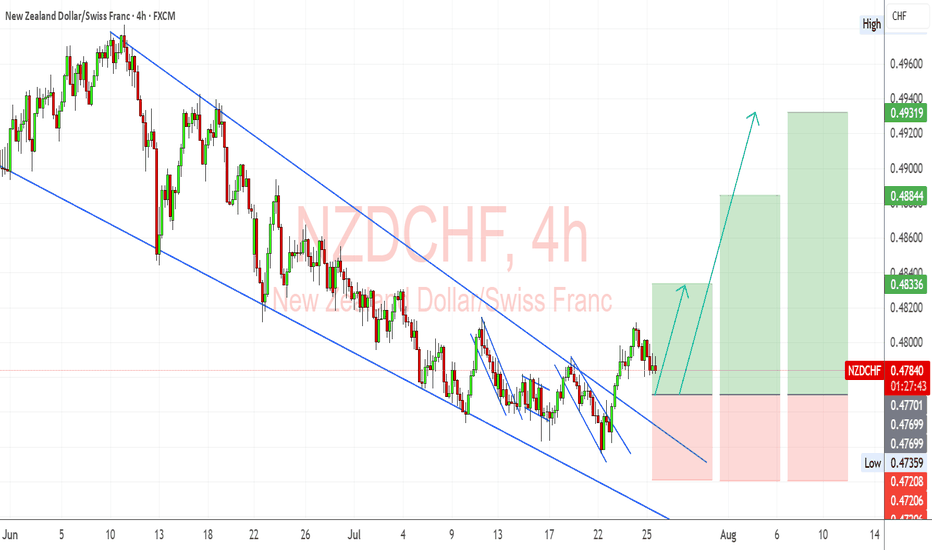

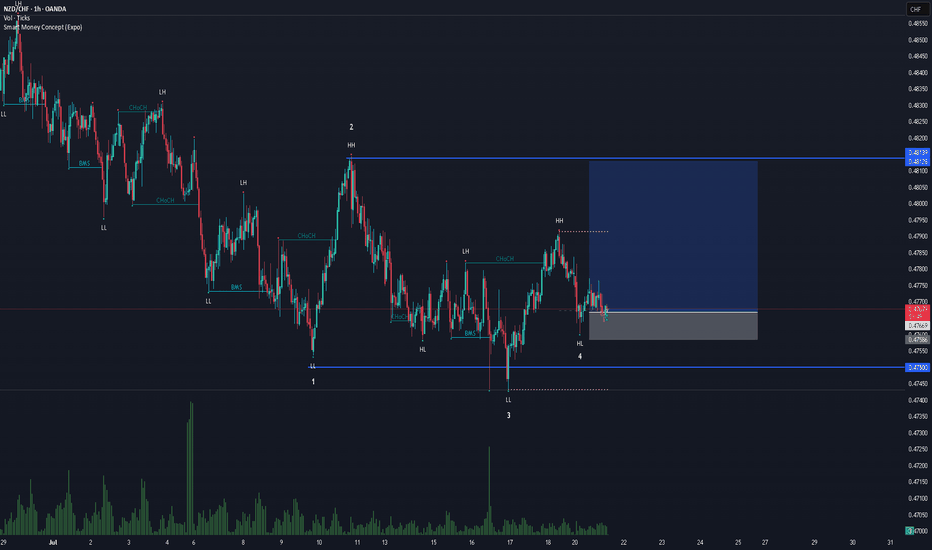

NZDCHF – Bullish Breakout Sets Stage for ReversalNZDCHF has broken decisively out of a long-term descending channel, signaling a potential trend reversal. Price action confirmed multiple bullish flags within the falling structure, followed by a clean breakout and higher low retest, supporting a bullish continuation bias.

Currently, the pair is st

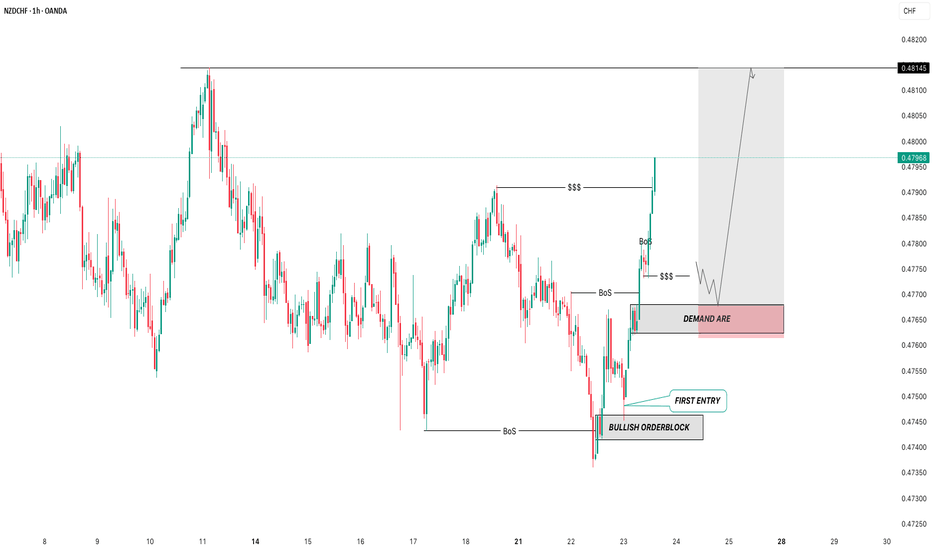

BUY LIMIT FOR NZDCHF Title: NZDCHF - Potential Long Opportunity - 30-Minute

Description: "NZDCHF on the 30-minute timeframe is currently exhibiting choppy price action. The recent selling pressure is likely influenced by the CHF's safe-haven status. However, I am anticipating a potential bullish move.

Entry: I will cons

NZDCHF → Pre-breakdown consolidation on a downtrendFX:NZDCHF is forming a pre-breakout consolidation amid a downtrend. Focus on support at 0.4759. Global and local trends are down...

On July 10-11, the currency pair attempted to break out of the trend. In the chart, it looks like a resistance breakout, but technically it was a short squeeze ai

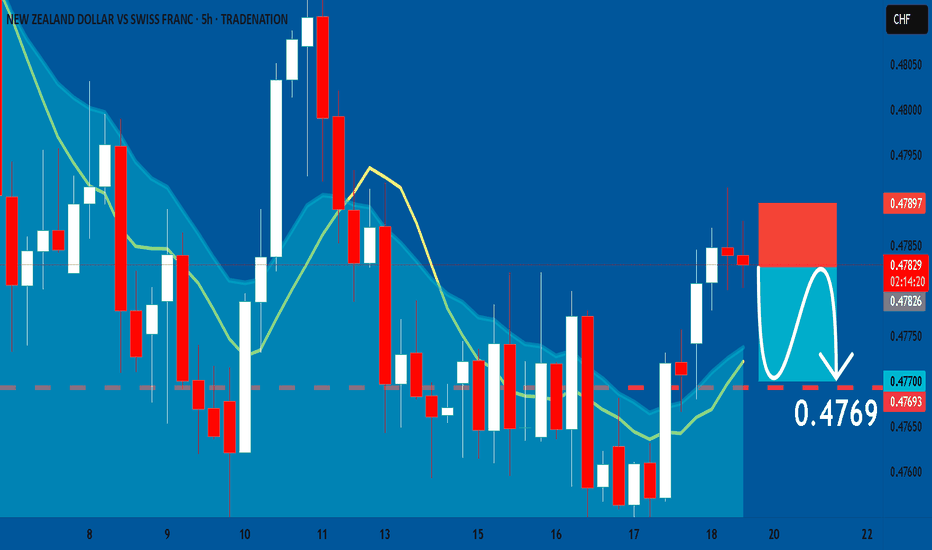

SELL NZDCHF now for a 4h time frame bearish trend continuationSELL NZDCHF now for a 4h time frame bearish trend continuation

SELL NZDCHF now for a four hour time frame bearish trend continuation..........

STOP LOSS: 0.4788

This sell trade setup is based on hidden bearish divergence trend continuation trading pattern...

Always remember, the trend is your fr

NZDCHF BUYSPrice was in a long downtrend, but sellers eventually lost strength. After a sharp selloff, the market began moving sideways — showing signs that larger players were quietly building positions while keeping price in a range.

Price then dipped below the range and quickly reversed, followed by strong

NZDCHF: Will Keep Falling! Here is Why:

The recent price action on the NZDCHF pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingVie

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of NZDCHF is 0.47846 CHF — it has decreased by −0.20% in the past 24 hours. See more of NZDCHF rate dynamics on the detailed chart.

The value of the NZDCHF pair is quoted as 1 NZD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 NZD.

The term volatility describes the risk related to the changes in an asset's value. NZDCHF has the volatility rating of 0.47%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The NZDCHF showed a 0.22% rise over the past week, the month change is a −1.51% fall, and over the last year it has decreased by −7.87%. Track live rate changes on the NZDCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

NZDCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade NZDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with NZDCHF technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the NZDCHF shows the sell signal, and 1 month rating is strong sell. See more of NZDCHF technicals for a more comprehensive analysis.