GBPNZD Will Grow! Long!

Here is our detailed technical review for GBPNZD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 2.253.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 2.277 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZDGBP trade ideas

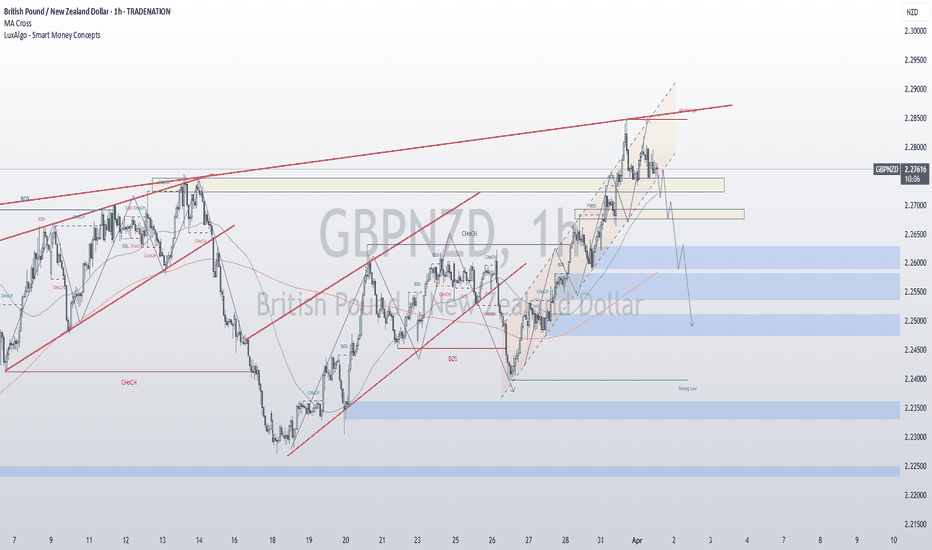

GBP/NZD 1-HRGBPNZD Approaching Key Resistance: A Closer Look at the Megaphone Pattern and Potential Reversal Zones

The current price action of GBPNZD on the 1-hour chart reveals the formation of a prominent megaphone pattern, a significant technical formation characterized by fluctuating price swings and widening ranges. This pattern, which often indicates increased market volatility and uncertainty, is an important signal to watch as it nears the upper resistance zone. Understanding the intricacies of this pattern and the key levels that are in play can provide valuable insights for traders seeking to capitalize on the upcoming potential price movements.

What is the Megaphone Pattern?

A megaphone pattern, also known as an expanding triangle or broadening formation, is typically seen when the price creates higher highs and lower lows. This type of formation suggests that market participants are uncertain, leading to erratic price swings. The pattern often serves as a warning of increased volatility and potential reversals, which is exactly what we may be witnessing with GBPNZD.

As the price moves toward the upper boundary of the megaphone formation, it’s essential to recognize that this resistance line represents a crucial point for potential market exhaustion. Typically, price reactions around this zone can lead to significant retracements or reversals. This creates an opportunity for traders to anticipate potential short positions or to watch for signs of reversal before making their move.

Key Resistance Levels and Potential Reversal

The current price is fast approaching the upper resistance line of the megaphone pattern, which has proven to be a critical zone where selling pressure could build up. If the market fails to break above this resistance, we could see a shift in momentum, where sellers step in, pushing the price lower. This could be triggered by a number of factors such as exhaustion of buying pressure, a failure to sustain higher prices, or the onset of bearish sentiment in the broader market.

Here are the key resistance and support zones to monitor carefully:

Resistance Zone (Key Upper Boundary of Megaphone Pattern):

This is the critical level where the price may encounter substantial selling pressure. A failure to break above this resistance could lead to a swift reversal. Watch for candlestick patterns like bearish engulfing, shooting stars, or evening stars, which could indicate that the market is ready to turn.

Support Zones:

Should the price fail to breach the resistance level, it's crucial to keep a close eye on the support areas where the market could react and potentially reverse upward. These levels include:

2.2670: A strong support area where the price has historically shown signs of consolidation and upward movement. If the price retraces to this level, we may see a bounce, especially if it coincides with other technical indicators such as RSI or MACD signaling oversold conditions.

2.2560: This level represents another potential support zone where previous price action has indicated short-term reversals. If the market consolidates around this level, it could provide the foundation for a potential bullish reaction.

2.2445: As we move further down, this level represents a deeper support zone. A price drop to this point could trigger more significant buying interest, especially if the broader market sentiment remains favorable for the pair.

2.2200: This is one of the most critical support levels to watch. A price move toward this zone would suggest a strong bearish trend, and if it holds, it could lead to a more substantial price correction or the continuation of a downtrend.

What to Look For: Signs of a Reversal

When approaching key resistance levels such as the upper boundary of the megaphone pattern, it’s important to watch for signs of a reversal. These may include:

Candlestick Patterns: Reversal candlestick formations such as doji, shooting star, or bearish engulfing patterns around the resistance level could signal that the market is losing momentum and that sellers may step in.

Volume Indicators: A decrease in volume at the upper boundary or increased volume on bearish candles could provide additional confirmation of a potential reversal. A sudden surge in volume after a failed breakout could signify that the price is ready to move lower.

Momentum Indicators: Tools such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator could also help identify overbought conditions or divergences, suggesting that a reversal may be imminent.

The Bigger Picture

Traders need to consider both the short-term and long-term outlook when analyzing GBPNZD. On a broader scale, the megaphone pattern may indicate a market that is in a state of indecision, but as the price moves toward key levels, the likelihood of a major price shift increases. A breakout above the upper resistance would suggest continued strength for the bullish trend, while a failure to break above and a subsequent price rejection could set the stage for a bearish move down to the key support levels outlined.

Conclusion

In summary, GBPNZD is at a pivotal moment. The formation of the megaphone pattern is signaling increased volatility, with the price nearing key resistance levels. Traders should remain vigilant, monitoring the price action closely around these levels, looking for signs of reversal or confirmation of a breakout. The key support levels at 2.2670, 2.2560, 2.2445, and 2.2200 should be watched carefully, as they will likely play a significant role in the upcoming price movements. By staying informed of these levels and patterns, traders can position themselves effectively for potential price shifts in the near future.

gbpnzd sell signal

. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP_NZD GROWTH AHEAD|LONG|

✅GBP_NZD made a retest

Of the key horizontal level of 2.2600

Which is now a support after a powerful

Breakout so we are bullish biased

And we will be expecting a further

Bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD is in Selling DirectionHello Traders

In This Chart GBPNZD 4 HOURLY Forex Forecast By FOREX PLANET

today GBPNZD analysis 👆

🟢This Chart includes GBPNZD market update)

🟢What is The Next Opportunity on GBPNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP-NZD Free Signal! Buy!

Hello,Traders!

GBP-NZD is trading in an

Uptrend and the pair made

A bullish breakout of the

Key horizontal level of 2.2600

Which is now a support then

Made a retest and we are now

Seeing a bullish rebound

Already which reinforces our

Bullish bias on the pair and

Suggests that we enter

A long trade with the

Take Profit of 2.2715

And the Stop Loss of 2.2568

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the GBPNZD next move:

The instrument tests an important psychological level 2.2627

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.2500

My Stop Loss - 2.2695

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPNZD Will Move Lower! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2.263.

The above observations make me that the market will inevitably achieve 2.229 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD is ready to push againNo comment needed. All information is in the chart analysis.

Steps to follow:

Analyze yourself.

Take the position with SL and Take Profits.

Wait, it may take a couple of days, so take a break and step away from the screen from time to time, just like I do :)

Get the result.

I will update the trade every day.

Like, comment with your good mood or viewpoint, share with your circle. It’s together that we get stronger!

Good trades, Traders!

The golden bear