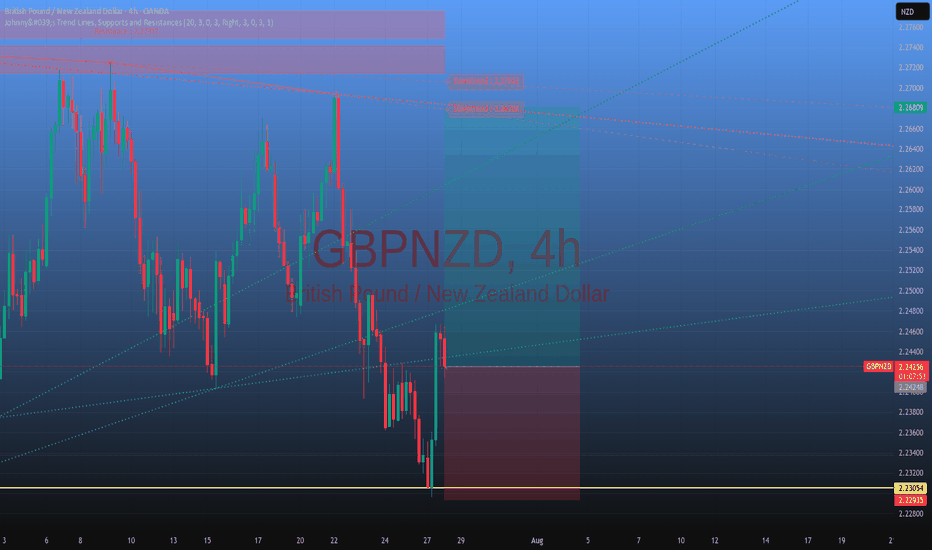

GBP_NZD BEARISH BIAS|SHORT|

✅GBP_NZD has retested

A resistance level of 2.2500

And we are seeing a bearish reaction

With the price going down so we are

Bearish biased now and we will be

Expecting the pair to go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDGBP trade ideas

GBPNZD - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

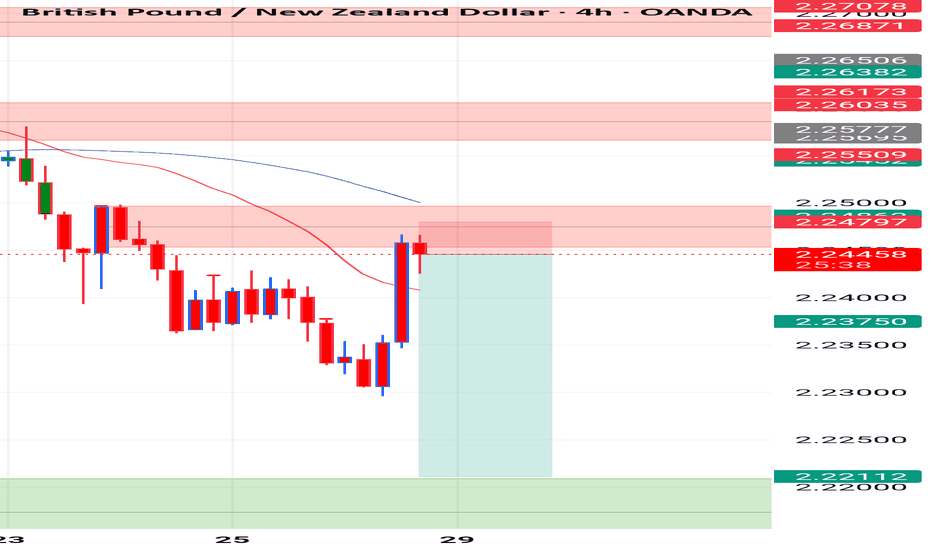

GBPNZD – Range High Meets Weekly Trend PressureGBPNZD – Range High Meets Weekly Trend Pressure 📉

When an uptrend runs into a wall, it doesn’t always crash — sometimes it just stalls. GBPNZD is now pressing against daily range resistance while the broader weekly uptrend still looms in the background. This is where short-term traders can find opportunity in fading a push that’s lost fuel.

📉 I’m bearish on GBPNZD — looking to short at the top of its daily range.

Why this setup stands out:

Price at a well-defined daily resistance zone 📍

Weekly uptrend slowing, momentum flattening 🔄

GBP under pressure after a 25 bps Bank of England rate cut 📉

NZD not strong, but less exposed to immediate policy easing ✅

Clear technical invalidation if resistance breaks 🎯

The British Pound’s rally has been losing steam, and the latest BoE move — cutting its benchmark rate by 25 basis points — confirms the dovish turn. This rate cut, aimed at supporting a slowing economy, signals reduced yield appeal for GBP in the near term.

The New Zealand Dollar still faces mixed fundamentals, with cautious central bank policy and consumer sentiment lagging. Yet in this matchup, NZD’s relative stability against GBP’s policy-driven weakness tilts the scales toward sellers, especially at stretched technical levels.

This is a tactical play — shorting into daily resistance within a broader range, with tight risk control. If price rejects here, a rotation back toward mid-range levels is on the table.

Would you fade this range high now that the BoE has already pulled the trigger?

3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy 🚀 3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy Ignites!

Pair: GBP/NZD

Timeframe:

Bias: Bullish Reversal Setup

Strategy: Rocket Booster Strategy

Signal Strength: ✅✅✅

🔍 Breakdown of the 3 Signals:

1️⃣ Volume Oscillator – Reversal Underway

Buy-side volume is increasing after a dry spell, suggesting a potential trend reversal and accumulation phase.

2️⃣ MACD – Bullish Cross Below Zero Line

Early momentum shift detected — this is where smart entries begin before full confirmation.

3️⃣ ADX + DI+ – Buyers Taking Control

ADX rising above 20 → Strengthening trend

DI+ crossing up → Buyers are clearly stepping in

🔧 Rocket Booster Strategy Criteria Met:

✅ Price is above EMA 50 and EMA 200

✅ Momentum, volume, and trend all aligned

✅ Ideal launch conditions for a bullish continuation

💡 Trade Idea (Example Only):

Entry: Market or pullback

Stop-Loss: Below swing low / EMA 50

TP1: Previous high

TP2: 2R+ extension

Optional: Use a trailing stop for scaling out

⚠️ Disclaimer:

This is not financial advice. Use a simulation account to test this strategy first.

Always apply risk management and have a clear profit-taking plan.

Never risk more than you can afford to lose.

🔚 Final Thought:

When volume, momentum, and trend align — it’s time to pay attention.

This is a textbook Rocket Booster setup: clean, powerful, and primed for upside.

Rocket Boost This Content To Learn More

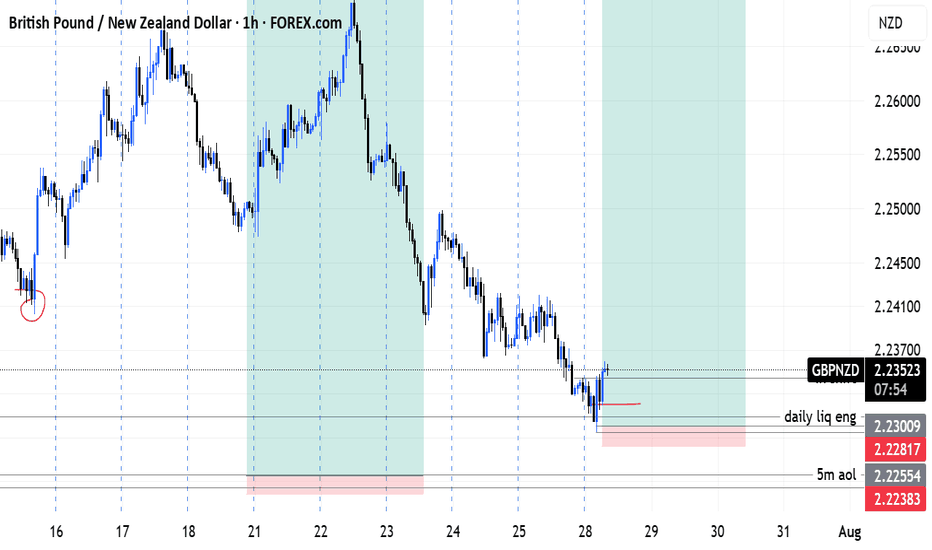

GBPNZD 15m buyHello friends. The price of the GBPNZD symbol in the 15-minute time frame after hitting the FVG high time frame is now bullish. You can see that it also happened in the choch direction. If it returns to the FVG 15m area, it can be entered for buy. Friends, please note that this is just a theory.

GBP/ NZD Ready Read The Captions This 1-hour chart analysis of GBP/NZD highlights key trading zones:

Support level: 2.23949

Demand zone: 2.25236

Target zone: 2.26073

The price is currently rising from support and approaching the demand zone. Two possible scenarios are shown: a breakout toward the target zone or a pullback to the support before a new upward attempt.

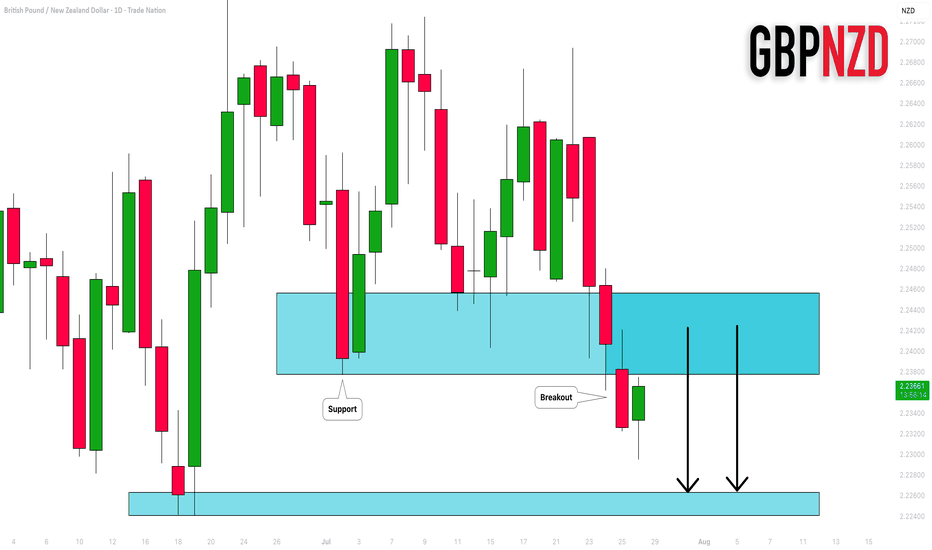

GBPNZD: Important Breakout 🇬🇧🇳🇿

GBPNZD broke and closed below a significant support cluster on a daily.

The broken structure turned into a strong resistance.

I will expect a bearish move from that.

Next support - 2.2264

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.