NZDGBP trade ideas

GBPNZD long positionGBPNZD is very bullish for a long time, it reacted near the 0.71 daily fibonacci level with a nice sweep and strong volume.

price have formed a nice continuation setup, im entering on the 0.79 level of the fibonacci because than my stoploss can cover the double bottoms liquidity trendline and the orderblock below.

this is for educational purpose only and not any financial advice, if you're willing to risk you're money on this trade than this is 100% your own responsibility

GBP/NZD - Reaching a weak resistance area , time for corectionHi guys , we are looking into GBP/NZD - it has had a very good uptrend the past few weeks, and it reached a very weak resistance area, which is giving us the indication that a correction is due.

Currently on 1H and 4H we reached high over-bought area with close to 0 support to remain at this price.

Entry: 2.19630

Target 1: 2.19100

Target 2: 2.18400

SL : 2.20200

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my community so you can follow up with me in private!

GBPNZD FORECASTThe higher timeframe looks good guys, I'm interested in the buying scenario because of how yesterday's candle closed. However, today's daily candle when it closed can give us a clear picture of where does the market is likely to go. But I won't ignore some potential the market will provide me. When you look at the 1H timeframe we find the market gives a clear structure and shows us the sense of continuation to the upside. Let's wait guys and see how the market will pray out.

GBPNZD Trade Plan: Swing BUY Trade (Trend Continuation Setup)📌 Entry: Buy at 2.2000 – 2.2050 (Liquidity Grab Zone)

📌 Stop Loss (SL): Below 2.1950 (Safe Level)

📌 Take Profit 1 (TP1): 2.2150 (Break of Structure Level)

📌 Take Profit 2 (TP2): 2.2200 (HTF Resistance)

📌 Take Profit 3 (Final TP3): 2.2250 (High Supply Zone)

🎯 Risk-to-Reward (R:R): 1:4+ (High Probability Trade)

Final Decision – What Would I Do?

🔹 Wait for an H1/H4 Close Above 2.2050 Before Entering

🔹 Refine Entry Near 2.2000 – 2.2050 If Price Pulls Back

🔹 Hold for Swing Targets at 2.2150 – 2.2250

🔥 High-Conviction Institutional Setup

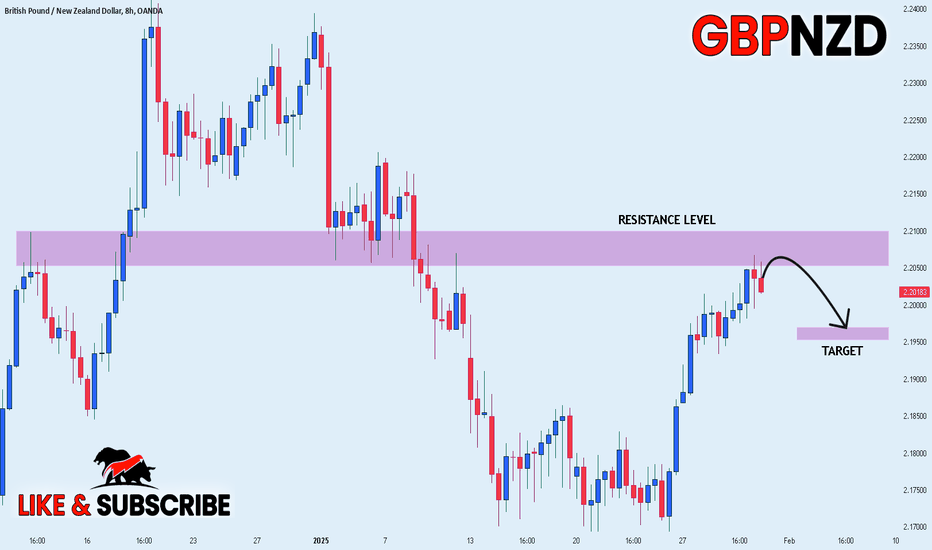

GBPNZD Approaching Key Resistance – Potential Sell SetupOANDA:GBPNZD is approaching a critical resistance zone that has previously attracted strong selling interest, making it a key level to watch.

If rejection signals appear, such as bearish engulfing candles or increased selling volume, I anticipate a move toward 2.19900. However, if the resistance fails to hold, it may open the door for further upside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

GBPNZD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

GBP/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

GBP/NZD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 12H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.158 area.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD - Bullish Triangle Break + SetupHello traders

GBPNZD has been forming a triangle pattern since 13 January and has now broke bullishly out of it. While it was a descending triangle, the rsi had been forming a bullish divergence showing a sign of strength.

Add to this the fact that this setup is forming on a daily trendline making this a high probability setup to me.

This is the link to the daily chart

For me the entry would be to place a limit order slightly above the 0.5 fib level and a target of the largest range inside the triangle as marked on the chart.

GBPNZD: Bearish Continuation & Short Trade

GBPNZD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GBPNZD

Entry - 2.1991

Stop - 2.2074

Take - 2.1842

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️