NZDGBP trade ideas

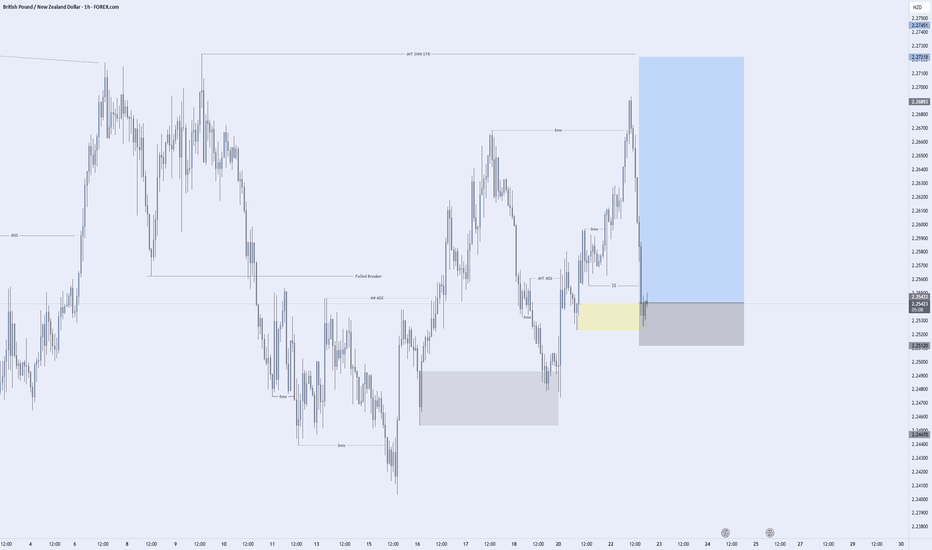

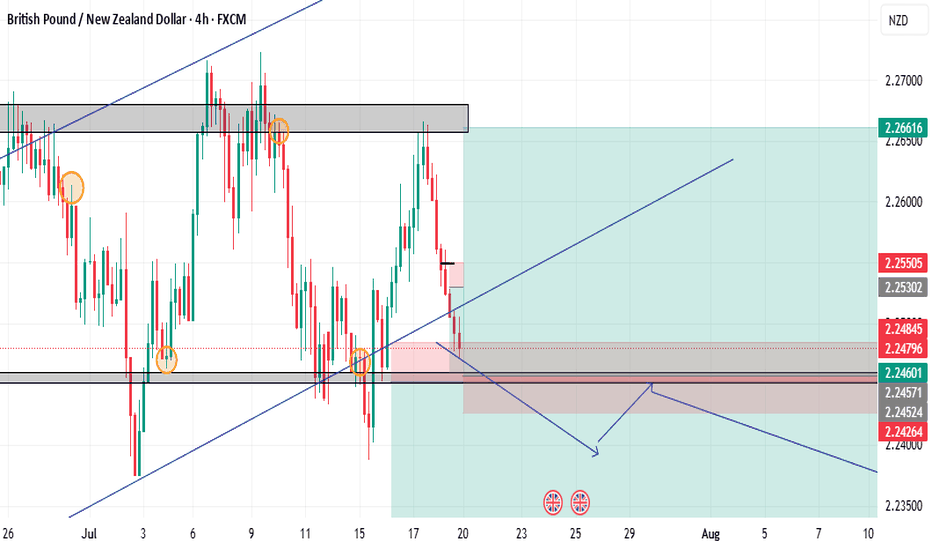

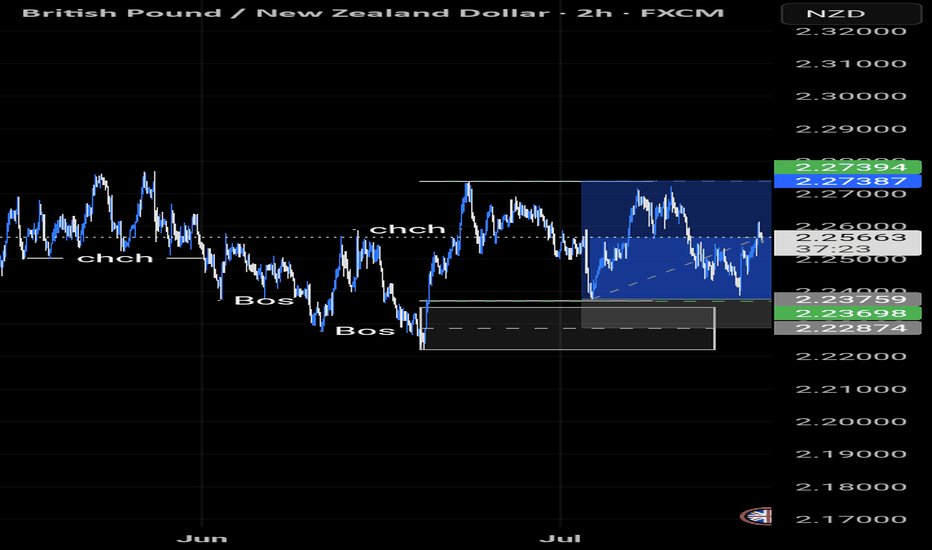

GBPNZD SHORT Market structure bearish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Around Psycholoogical Level 2.26000

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.68

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

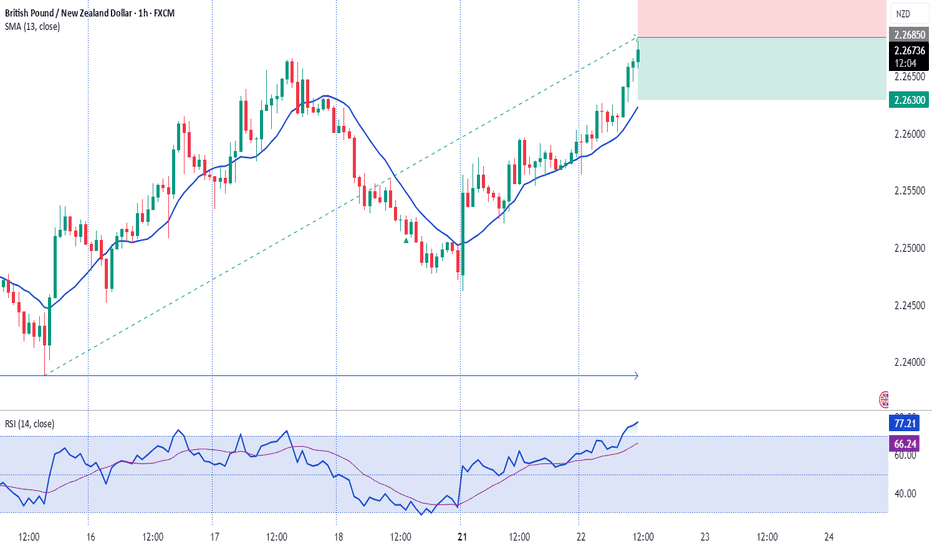

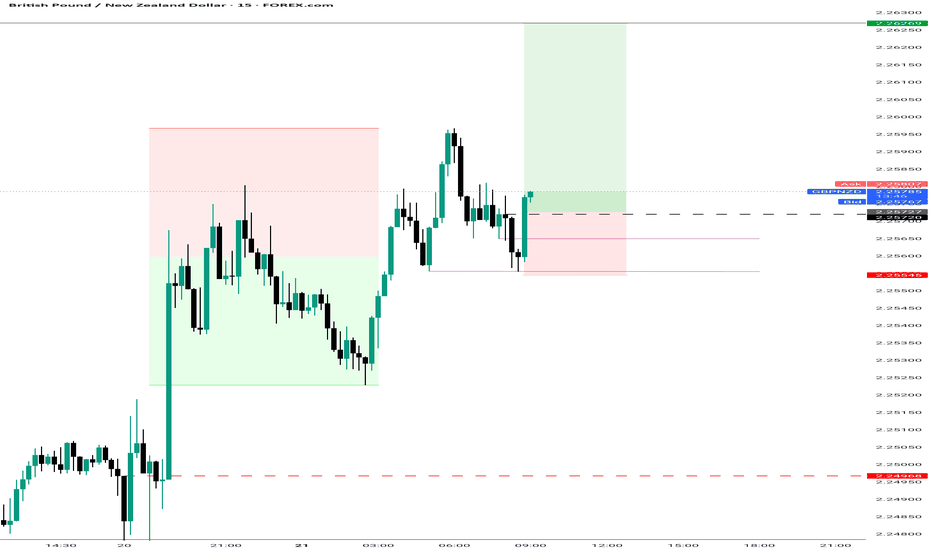

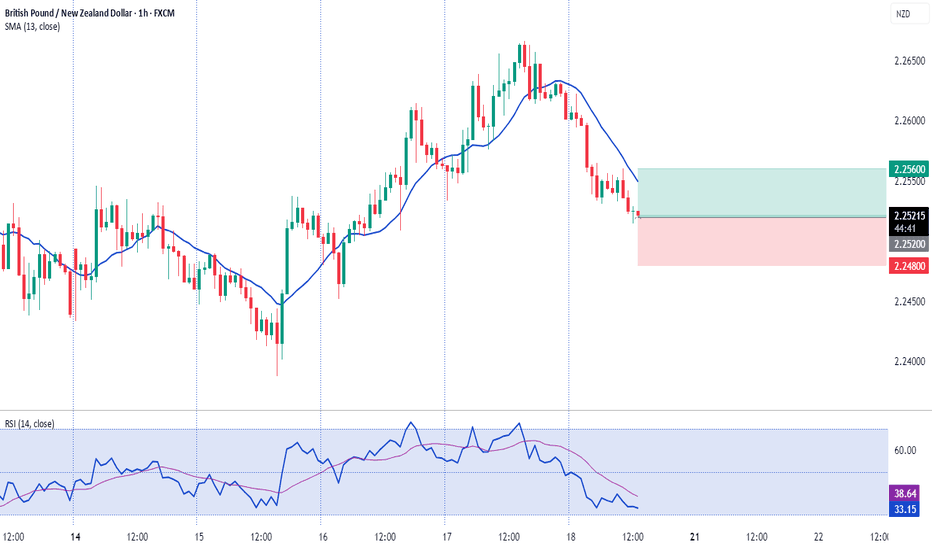

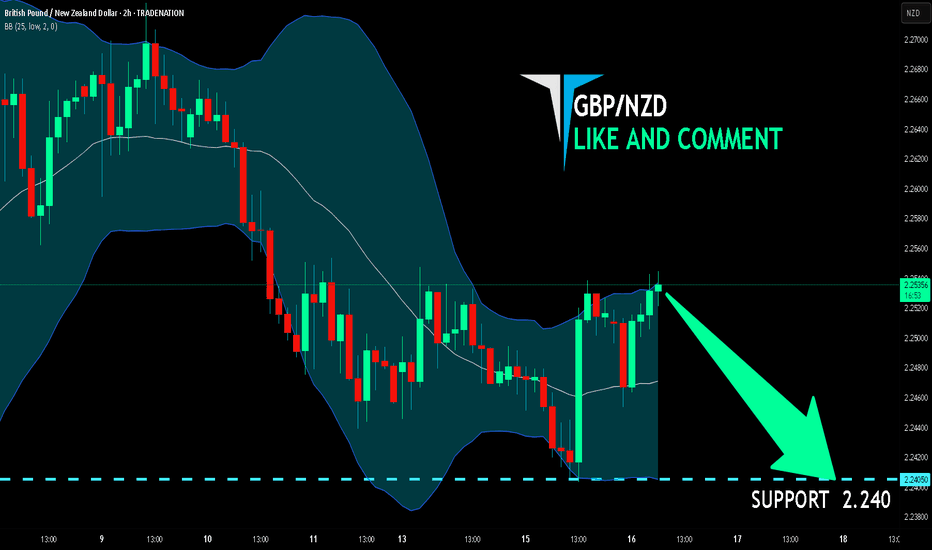

GBP_NZD LOCAL SHORT|

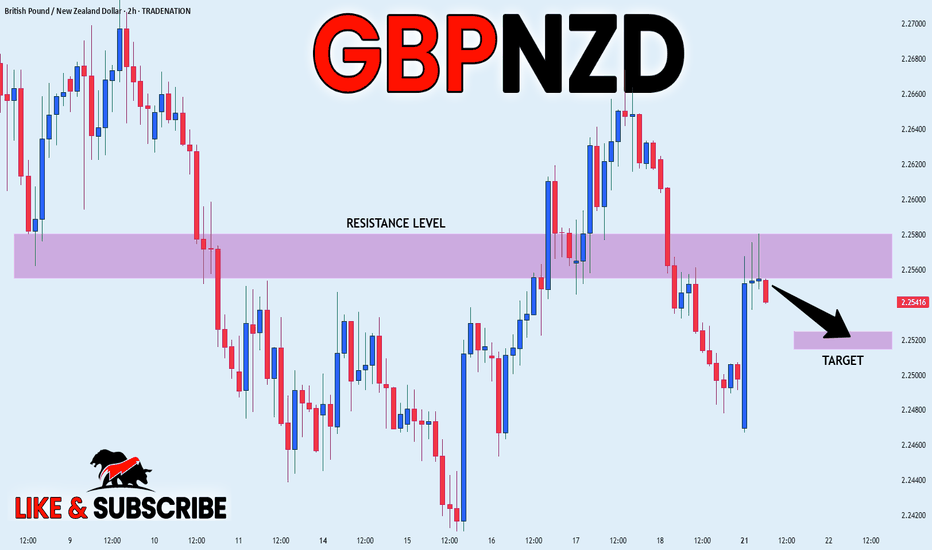

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

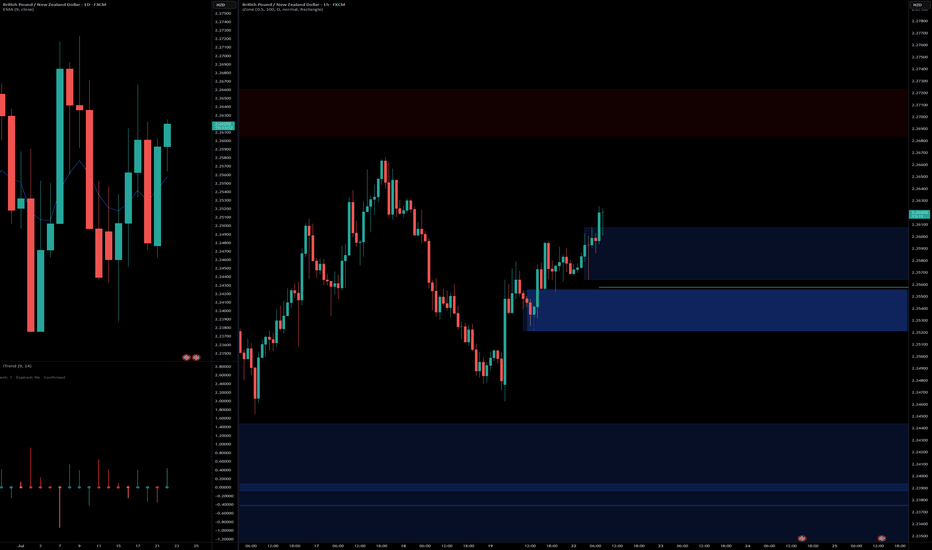

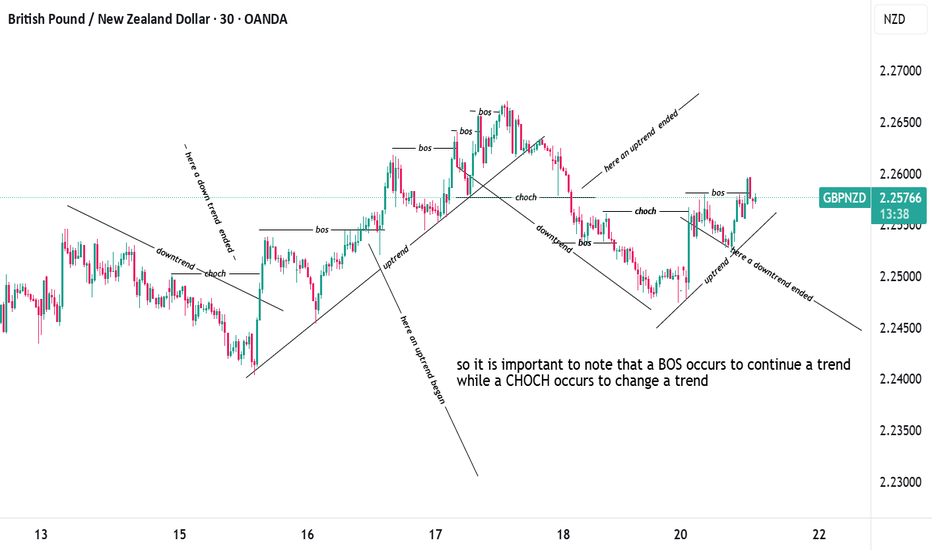

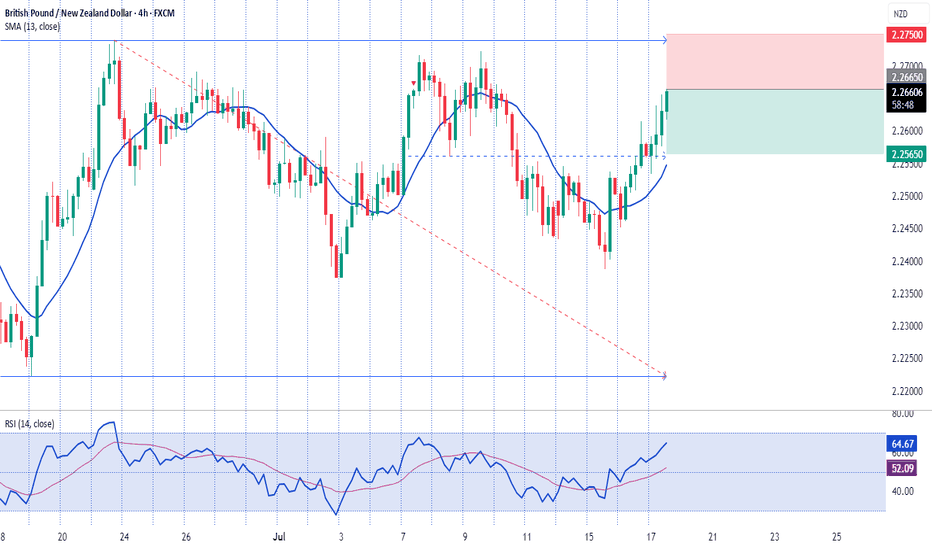

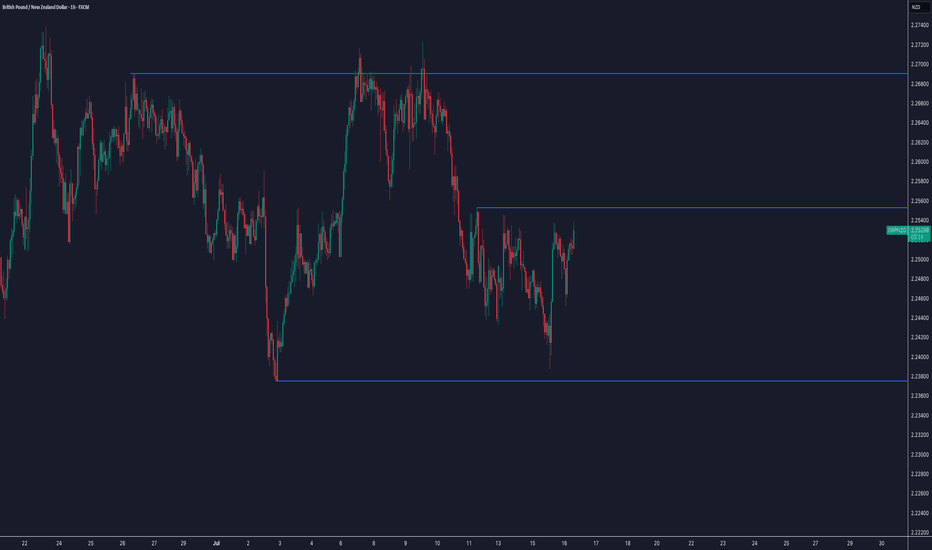

GBPNZD SELL IDEAPrice is currently forming an Ascending channel on the Daily chart.

Current trend - Downtrend with price approaching a major support after recently forming a lower high. A break and close of the candle below the support level on the daily chart and retest on lower Tfs would be confirmation of a downtrend, formation of a lower low, and entry for a sell.

Meanwhile, if the support is respected, I'll be on the lookout for a double bottom and formation of a higher low for entries to the next resistance.

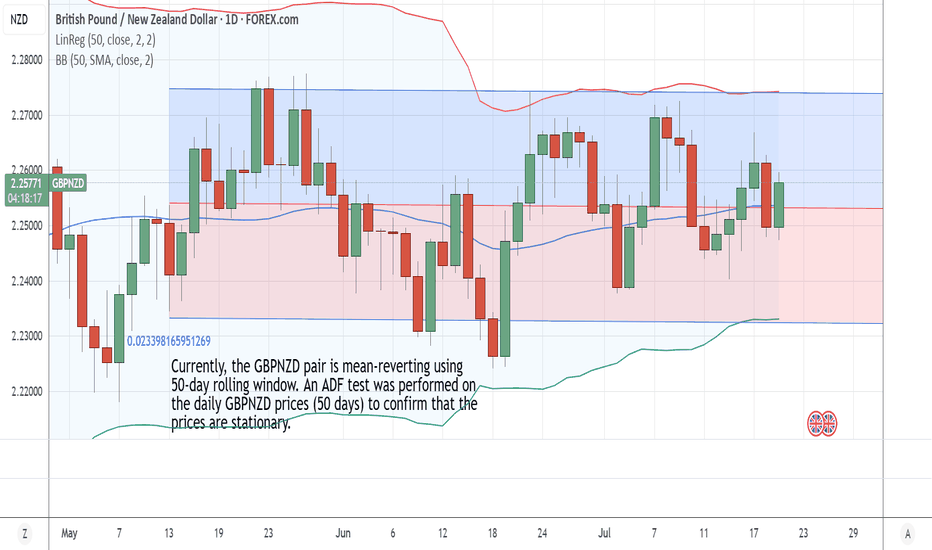

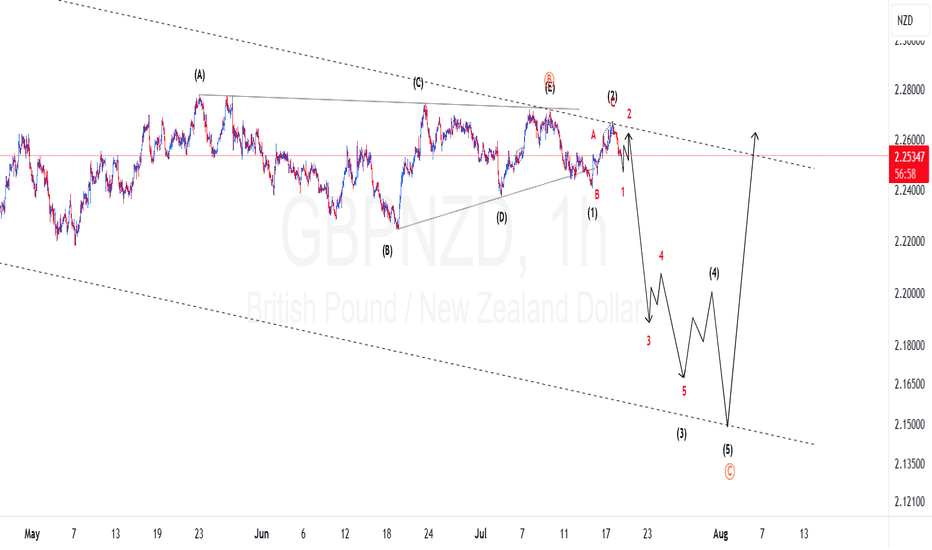

GBPNZD Elliotwaves update: Are Bears still on control?We have been on this in the past two weeks and now we can see clear signs of bears controlling the price. We had a triangle correction completed and made an impulsive wave to the downside which confirmed our bias. Now are are on the first wave of wave 3 and we should anticipate momentum to the downside to increase. To take advantage of the drop one should find areas where price might find resistance and other confluences like Fibonacci to take a trade.

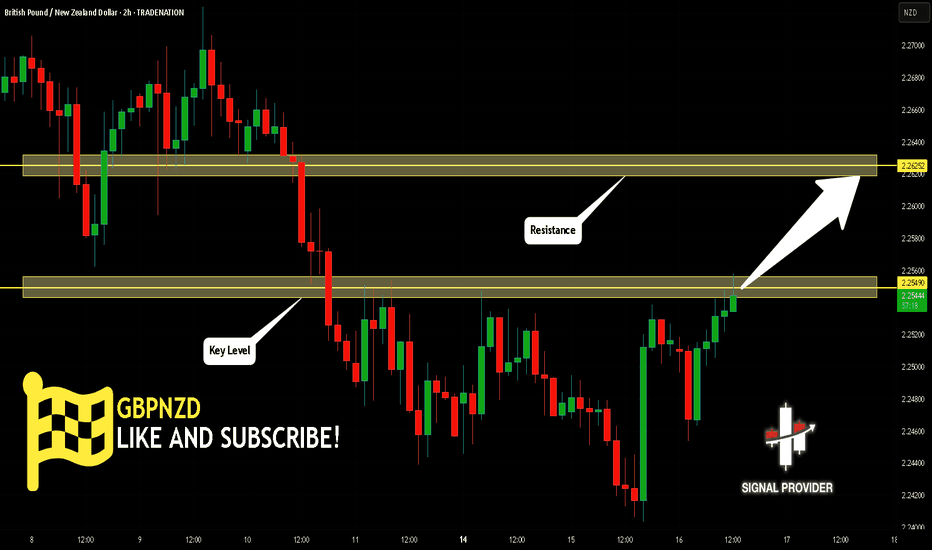

GBPNZD Is Bullish! Buy!

Here is our detailed technical review for GBPNZD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 2.254.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 2.262 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

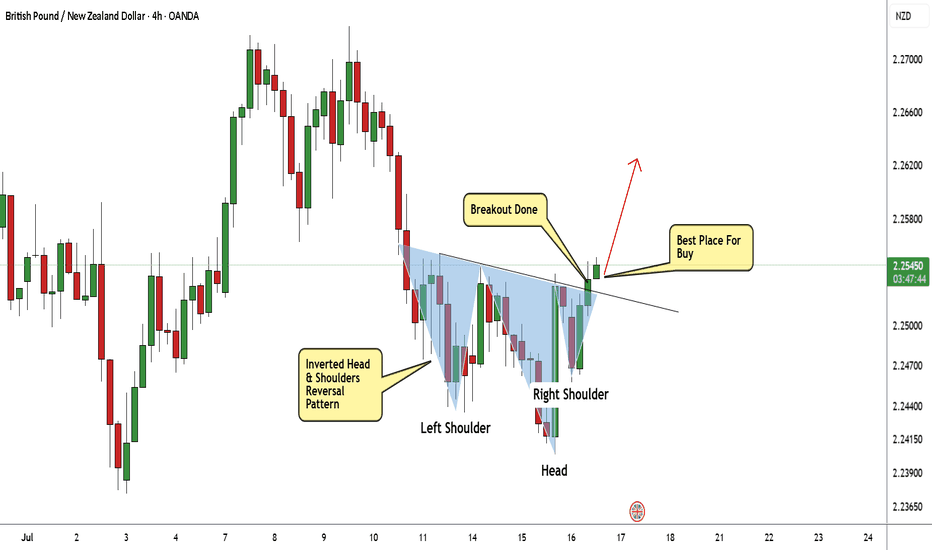

GBP/NZD Made Inverted H&S Pattern ,Time To Buy And Get 150 PipsHere is my 4H Chart On GBP/NZD , The price created a very clear reversal pattern ( inverted head and shoulders pattern ) and the price closed above neckline so the pattern confirmed and we can buy it and targeting from 100: 200 pips , if we have a daily closure above 2.25600 it will be a great confirmation telling us the price will continue to upside .

GBP/NZD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

It makes sense for us to go short on GBP/NZD right now from the resistance line above with the target of 2.240 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD and Elliott Wave PrinciplesWave 2(Blue) was a Zigzag and we should expect a Flat for Wave 4(Blue). After Wave 3(Blue) completes, a lunge to the downside occurs and this is our Wave A of the Flat. We are on the Wave B(Black) of a Flat as Wave A(Black) has already completed. Our Wave B(Black) should go beyond the end of Wave 3(Blue) since it is a Flat.

GBPNZD: Long Trade Explained

GBPNZD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPNZD

Entry - 2.2484

Sl - 2.2425

Tp - 2.2599

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPNZD What Next? BUY!

My dear friends,

My technical analysis for GBPNZDis below:

The market is trading on 2.2457 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2547

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK