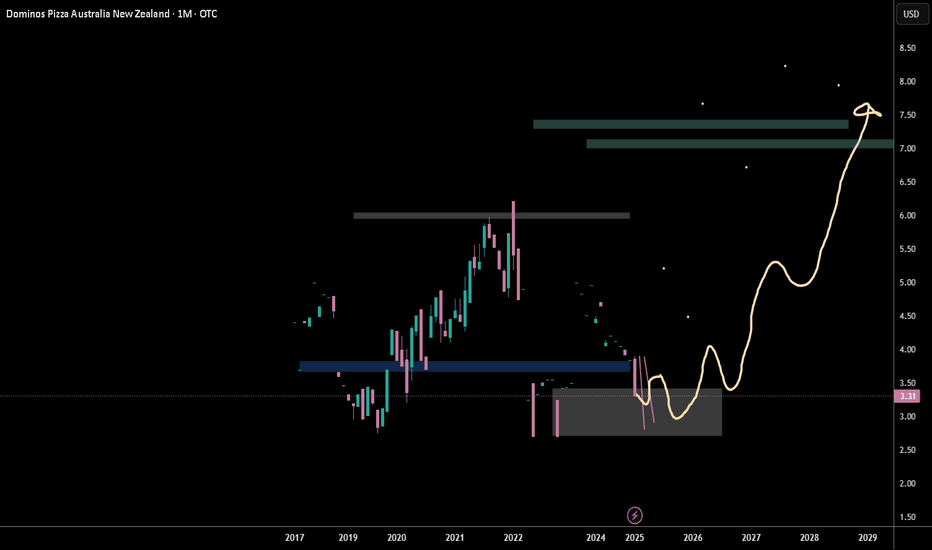

DMP's long setupsRisk On approach with discounts ahead. win win ;)

- Technical Analysis is KEY with timing ..

-Both their charts AUD and NZD seem to be

cleanest dirty shirts in the wash.

- Fundamentals helped my confluence levels

-Retesting demand zone but price structure needs better PA within zone bef

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.29 USD

112.85 M USD

831.36 M USD

381.35 M

About DOMINO'S PIZZA GROUP PLC ORD GBP0.00520833

Sector

Industry

CEO

Andrew Charles Rennie

Website

Headquarters

West Ashland

Founded

1999

ISIN

GB00BYN59130

FIGI

BBG00DJ1X449

Domino's Pizza Group Plc owns, operates and franchises pizza stores in the United Kingdom, Republic of Ireland, Germany, Switzerland, Liechtenstein and Luxembourg. The company was founded by Thomas Stephen Monaghan in 1960 and is headquartered in West Ashland, the United Kingdom.

Related stocks

Q&As: order bookThere are people who trade based in order book exclusively & promote these so called orderflow trading platforms, even these days. Surely, it's a great deed to learn this interesting, exotic & unusual skill, but the thing is it's completely unnecessary.

The real use cases for DOM aka LOB aka order

Domino's pizza to $480Huge upside here, oversold on every level keeps bouncing off the 200ma and looking for a price target of $480 fast to be honest, wall street had better expectations, but this had to do with the crappy delivery drivers and lack of employment. Things are changing in the company as far as paying the ri

Cup & Handle on domino's pizza!!Anyone thinking the price of pizza going down is fooling themselves, even though it didn't meet "wall streets" expectations it met mine and i bought the dip today below the trend line, tons of possibilities here and once this stock moves it moves and can easy clear $430 this week if the market allow

Dominoes riding the Rona waveA new pivot point has been created, Dominoes was having some issues with their bigger franchises hampering their ability to expand in the UK. They seem to have kicked that to the side and are now happily expanding. The share price reflects this, however we have seen this area of the chart as a key

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DMPZF is 3.64 USD — it hasn't changed in the past 24 hours. Watch Domino's Pizza Australia New Zealand stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Domino's Pizza Australia New Zealand stocks are traded under the ticker DMPZF.

We've gathered analysts' opinions on Domino's Pizza Australia New Zealand future price: according to them, DMPZF price has a max estimate of 6.73 USD and a min estimate of 3.37 USD. Watch DMPZF chart and read a more detailed Domino's Pizza Australia New Zealand stock forecast: see what analysts think of Domino's Pizza Australia New Zealand and suggest that you do with its stocks.

DMPZF reached its all-time high on Jan 4, 2022 with the price of 6.22 USD, and its all-time low was 2.70 USD and was reached on Oct 28, 2022. View more price dynamics on DMPZF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DMPZF stock is 0.00% volatile and has beta coefficient of 0.84. Track Domino's Pizza Australia New Zealand stock price on the chart and check out the list of the most volatile stocks — is Domino's Pizza Australia New Zealand there?

Today Domino's Pizza Australia New Zealand has the market capitalization of 1.35 B, it has decreased by −0.01% over the last week.

Yes, you can track Domino's Pizza Australia New Zealand financials in yearly and quarterly reports right on TradingView.

Domino's Pizza Australia New Zealand is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

DMPZF net income for the last half-year is 59.93 M USD, while the previous report showed 53.48 M USD of net income which accounts for 12.06% change. Track more Domino's Pizza Australia New Zealand financial stats to get the full picture.

Domino's Pizza Australia New Zealand dividend yield was 3.49% in 2024, and payout ratio reached 48.01%. The year before the numbers were 2.79% and 37.47% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 22, 2025, the company has 2.06 K employees. See our rating of the largest employees — is Domino's Pizza Australia New Zealand on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Domino's Pizza Australia New Zealand EBITDA is 170.27 M USD, and current EBITDA margin is 20.48%. See more stats in Domino's Pizza Australia New Zealand financial statements.

Like other stocks, DMPZF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Domino's Pizza Australia New Zealand stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Domino's Pizza Australia New Zealand technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Domino's Pizza Australia New Zealand stock shows the sell signal. See more of Domino's Pizza Australia New Zealand technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.