USD/SEK 9.25428 VS 9.54526 Trade SetupsHello Traders, USD/SEK 9.25428 VS 9.54526.

Looking to complete a possible Running Pattern ( Blue )

to continue the downside movement Breaking 9.26228 / 9.25428 VS 9.15617 / 9.04740.

Or ( Yellow ) Continuation / Consolidation / Corrective Pattern

to Continue uside movent Breaking the current downtrend vs 9.54526 / 9.53482.

SEKUSD trade ideas

US dollar recovers against Swedish kronaOver the last 24 hours we have seen a remarkable recovery in the USD/SEK pair, as we bounced from a major confluence of technical indicators. On the daily chart, we had been hovering just above the 200 day EMA for several sessions, but on Monday exploded to the upside. The candle stick was rather large, which of course is extraordinarily bullish, and making for an even more interesting set up is the fact that we had seen the 50% Fibonacci retracement level acted as support as well.

Looking at the daily chart we can also see that the Tuesday session is now starting to form a supportive looking candle as well, so if we can break above the highs during the trading session on Monday, then the market is likely to go looking towards the next major round figure, 9.5 SEK. To the downside, the obvious support is at the 9.25 SEK level, which featured the technical indications.

The question now is whether or not this is about US dollar strength or more of a risk off type of situation? The US dollar strength could be due to the stock markets in the United States, as they have shown a bit of resiliency in comparison to their European and Asian cousins. Ultimately, this looks like a nice long term set up that traders will be taken advantage of, with an obvious stop loss area. Beyond that, we could even see the market go above the 9.50 SEK level, but in the short term that would be your most obvious target. If we did break higher than that, the next target would be the 9.6 SEK level. If we were to break down below the 9.25 SEK handle, then it would open the door to the 9.15 SEK level below which also features the 61.8% Fibonacci retracement level.

SHORT TRADE ON USD/SEK by ThinkingAntsOk4H CHART EXPLANATION:

Price is on a bearish trend since May, broke the daily Ascending channel and now it is making a bearish corrective structure facing a support zone. The idea of this trade is to short once the support zone is broken, and the potential movement may reach the next support zone.

MULTI TIMEFRAME VISION:

-Daily:

-Weekly:

USD/SEK approaching major confluence of liquidityThe US dollar has initially tried to rally during the trading session on Tuesday but then turned around to fall towards the 9.25 SEK level. This is an area that has been important more than once as you can see in the past, but there are also a major confluence of indicators in this general vicinity as well.

The market looks very supported in this area, but we are crashing into it, which makes quite a bit of sense when you think about the Federal Reserve stepping away from its hawkish monetary stance. Beyond that, we could have more of a “risk on” move as well, which would also break this market down. After all, the Swedish krona is considered to be a currency that is highly influenced by technology.

The market is testing the 50% Fibonacci retracement level, which of course attract a lot of attention as well. Quite frankly, the 200 day EMA sitting just below also adds a lot of support. That being said, there is a simple way to approach this market, the one that I will be using to go forward.

I will use the close on Tuesday as a barometer as to which direction we should be trading. If we can break above the highs of the trading session, that would show a significant break higher based upon the fact that we have already repudiated buying. A break above there opens the door to the 9.35 SEK level, possibly even the 9.45 SEK level. On the other hand, if we break down below the bottom of the candle stick, it opens up the door to the 61.8% Fibonacci retracement level down at the 9.15 SEK.

While the market looks very negative, we do have quite a bit of support. That being said though, things certainly look bad for the greenback in general so any bounced will probably be somewhat short-lived.

$USDSEK still seems to be in bulish channel. Considering the state of Sweden economy, the negligence of Riksbank and still strong dollar besides the market over reaction on FED notes, I believe this pair will hit 10 very soon. Technical says this channel could continue much higher: Touch channel bottom and volume seems to be on a rise.

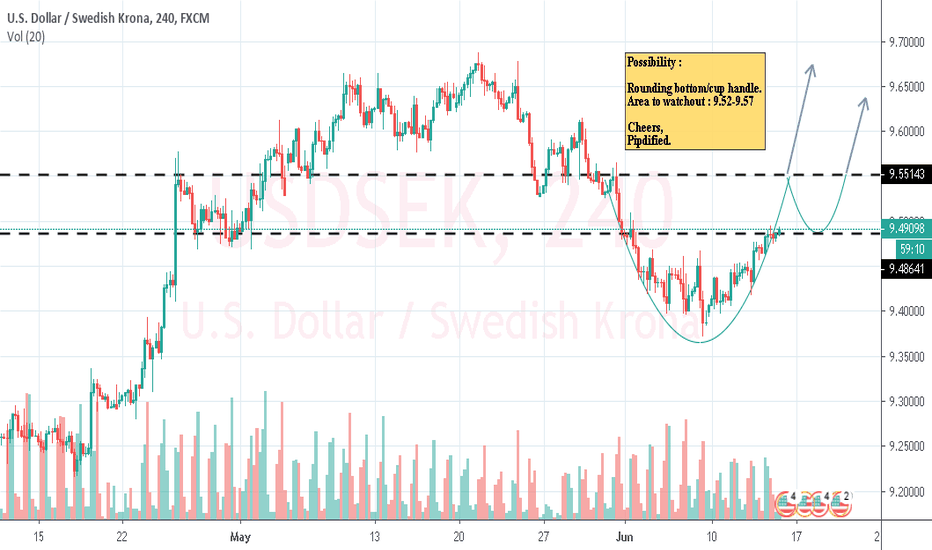

USDSEK - 240 - Wait for a 4-hour candle closeTrade idea

USDSEK is trying to recover some more of its losses made during the end of May. Of course, the pair has some obstacle to overcome first, before it could make its way higher. We need to see clear close of a 4-hour candle above the 9.472 barrier and ideally a close above the 200 EMA. Only then we will consider further upside.

Please see the chart for levels, targets and the alternative scenario.

Don't forget your stop-loss.

Failed socialist country going to ZERONot going to enter into details about Sweden.

Sweden central bank "Uh we have no idea why our currency is falling and why our economy is falling behind" duuuuh!

Am already shorting it via EURSEK & added a bit with USDSEK, have a limit order at that green level.

If I am in the green on EURSEK & add on USDSEK as it goes does can I call this adding to my winner?

Stop loss is tight. If this EURSEK is THE double bottom before the rally (and USDSEK bottoms at the same time) this can fly up to the moon.

here is my analysis of USD/SEK.If i did or made something wrong plz lemme know, i am not a pro trader nor a newbie. I am going long on this trade because of the uptrend on the higher time-frame,level of resistance became support and was tested multiples times by the market making it a major zone. Of course i will not buy imitatively when the market open but wait for a chart pattern like engulfing or a break above close above candle to do so. Im well open for opinion even critiques.