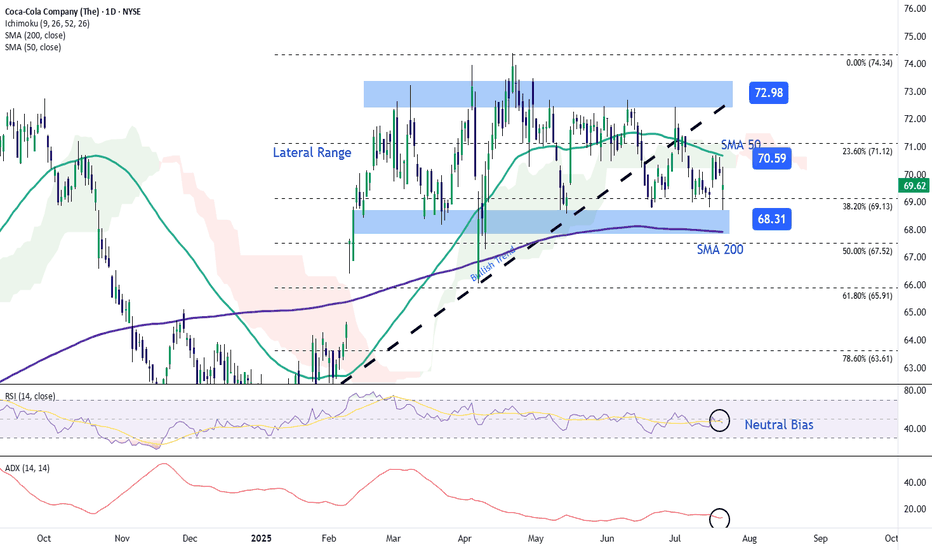

Coca-Cola Stock Falls Despite Strong EarningsDuring the latest trading session, Coca-Cola stock maintained a clear neutral bias after a nearly 1% decline, falling below the $70 per share level. This movement came despite the company reporting better-than-expected results, with earnings per share (EPS) of $0.87, above the $0.83 expected, and to

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

92.06 THB

365.58 B THB

1.61 T THB

4.27 B

About Coca-Cola Company (The)

Sector

Industry

CEO

James Quincey

Website

Headquarters

Atlanta

Founded

1886

ISIN

TH0150121802

FIGI

BBG01NBKDGC8

The Coca-Cola Co. engages in the manufacturing and marketing of non-alcoholic beverages. It operates through the following segments: Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Global Ventures, and Bottling Investments. The company was founded by Asa Griggs Candler on May 8, 1886 and is headquartered in Atlanta, GA.

Related stocks

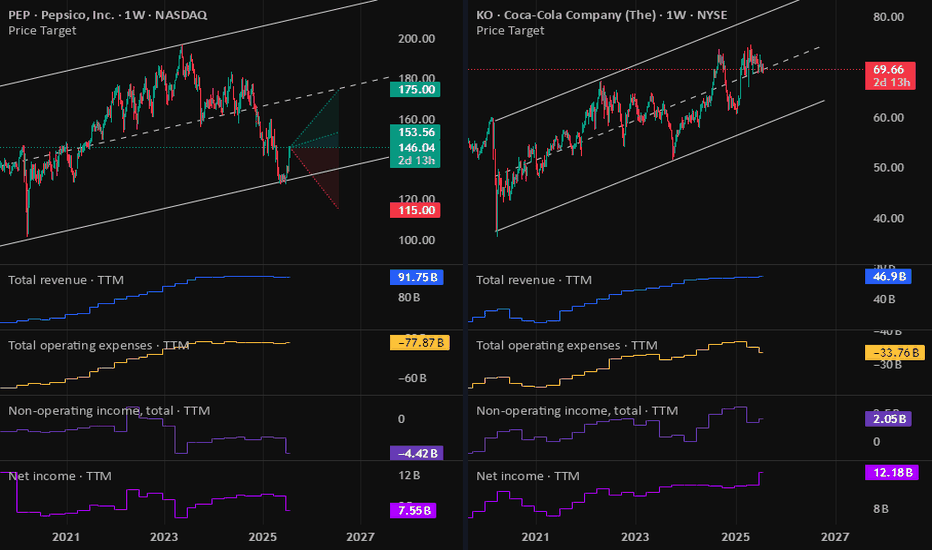

KO: Coca-Cola (CFD) Earnings 23-07-2025Yesterday we have the Coca-Cola earnings report came out and beat on both earning and revenue. But due to the technical position I do not see it a good entry on the stock CFD, still see PepsiCo stock CFD is a better option.

Disclaimer: This content is NOT a financial advise, it is for educational pu

Coca Cola to protect my portfolio and help it growOne of the most important things we must try to determine as investors is what company is the best at what they do in their field. In my opinion Coca Cola is and has always been the number one soft drink manufacturer, always finding new yet subtle ways to stay ahead of their competition.

The reason

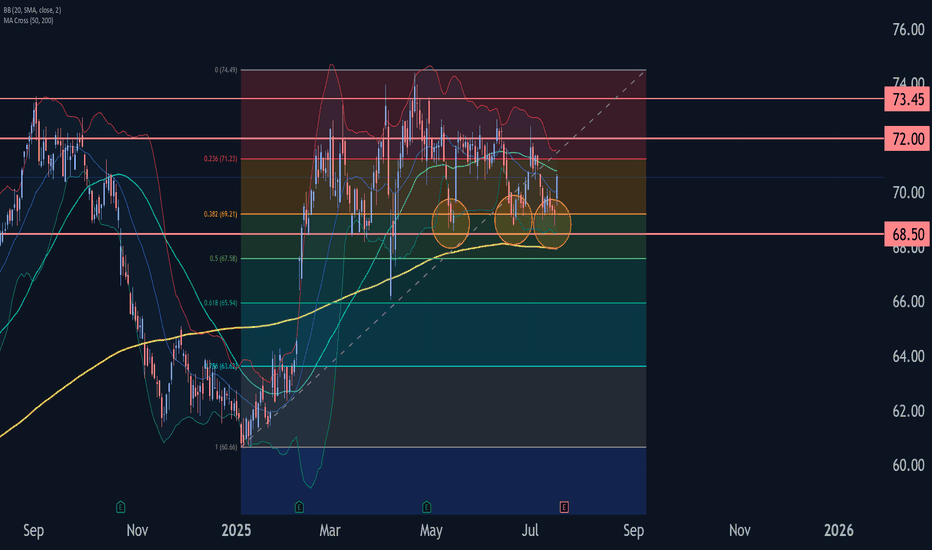

Coca-Cola Wave Analysis – 17 July 2025- Coca-Cola reversed from the support area

- Likely to rise to resistance level 72.00

Coca-Cola recently reversed from the support area between the key support level 68.55 (which has been reversing the price from May), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impu

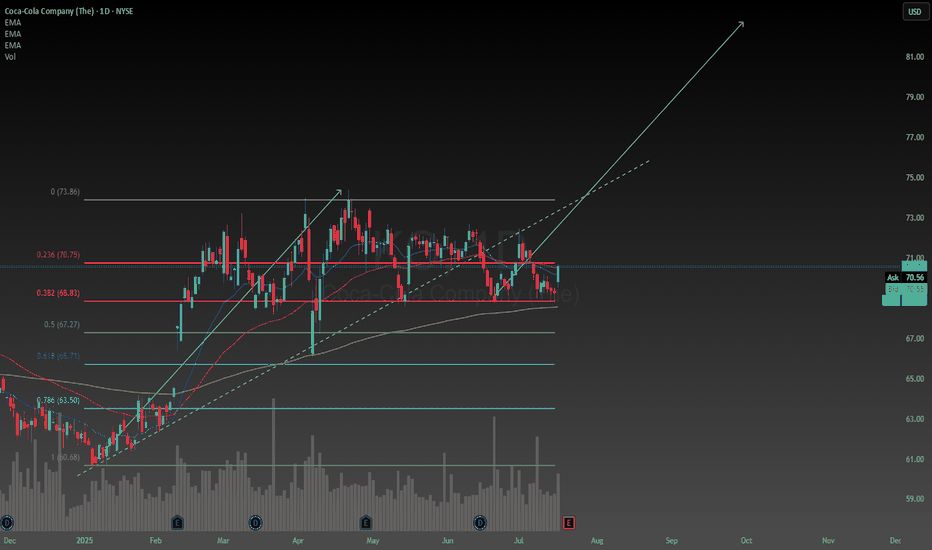

Coca-Cola: Nearing Final Wave III HighDespite recent sell-offs, we still expect Coca-Cola to reach a final high of magenta wave within our beige Target Zone between $76.58 and $81.51, which should also mark the completion of the broader beige wave III. However, an alternative scenario—with a 38% probability—remains in play: in this ca

Trading The 3 Step Rocket Booster StrategyTrading within a certain time frame has shown me that its better to set a time stop limit.

This time stop limit tells you when to stop trading your entry.

-

Now does this work? am not sure but i will try anything

that will produce results.

-

Right now am focusing on short term trading strategies.The

Coca-Cola Wave Analysis – 19 June 2025

- Coca-Cola broke the support zone

- Likely to fall to support level at 68.55

Coca-Cola recently broke the support zone located between the support level 70.35 (which reversed the price twice from May) and the 61.8% Fibonacci correction of the upward impulse 1 from May.

The breakout of this supp

How To Buy A Short Squeeze Using This 3 Step SystemToday i felt lifted and happy.

But Yesterday i was very sad

because of a silly fight

with a drunk friend of mine.

Need i mention i was sober.

I had to self defense myself but i feel much

better after writing down my feelings.

Basically i had to run away from the

fight.There is nothing

wrong wi

Simple Coca Cola daily chart analysisCoca Cola, my favorite defensive stock seems to be at a price decision in time. I have found a single trend line that looks reasonable. There seems to be a lot of congestion in price over the last few days this leads me to believe a breakout is coming soon. 25% of my portfolio is Coca Cola, it pays

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CCCC

COCA-COLA CO 20/51Yield to maturity

6.97%

Maturity date

Mar 15, 2051

KO4982890

Coca-Cola Company 2.6% 01-JUN-2050Yield to maturity

6.79%

Maturity date

Jun 1, 2050

KO4982891

Coca-Cola Company 2.75% 01-JUN-2060Yield to maturity

6.74%

Maturity date

Jun 1, 2060

US191216DL1

COCA-COLA 21/51Yield to maturity

6.61%

Maturity date

Mar 5, 2051

KO4982889

Coca-Cola Company 2.5% 01-JUN-2040Yield to maturity

6.09%

Maturity date

Jun 1, 2040

CCCB

COCA-COLA 21/41Yield to maturity

6.03%

Maturity date

May 5, 2041

US191216CQ1

COCA-COLA CO 20/50Yield to maturity

5.93%

Maturity date

Mar 25, 2050

KO5807227

Coca-Cola Company 5.4% 13-MAY-2064Yield to maturity

5.72%

Maturity date

May 13, 2064

KO5868479

Coca-Cola Company 5.2% 14-JAN-2055Yield to maturity

5.65%

Maturity date

Jan 14, 2055

KO5807226

Coca-Cola Company 5.3% 13-MAY-2054Yield to maturity

5.60%

Maturity date

May 13, 2054

US191216CP3

COCA-COLA CO 20/40Yield to maturity

5.49%

Maturity date

Mar 25, 2040

See all KO80 bonds

Curated watchlists where KO80 is featured.