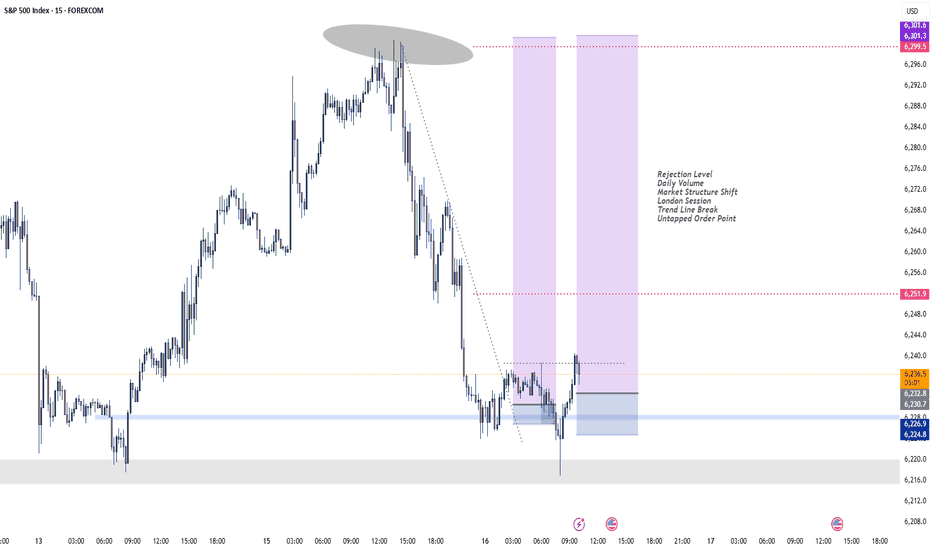

S&P 500 Daily Chart Analysis For Week of July 11, 2025Technical Analysis and Outlook:

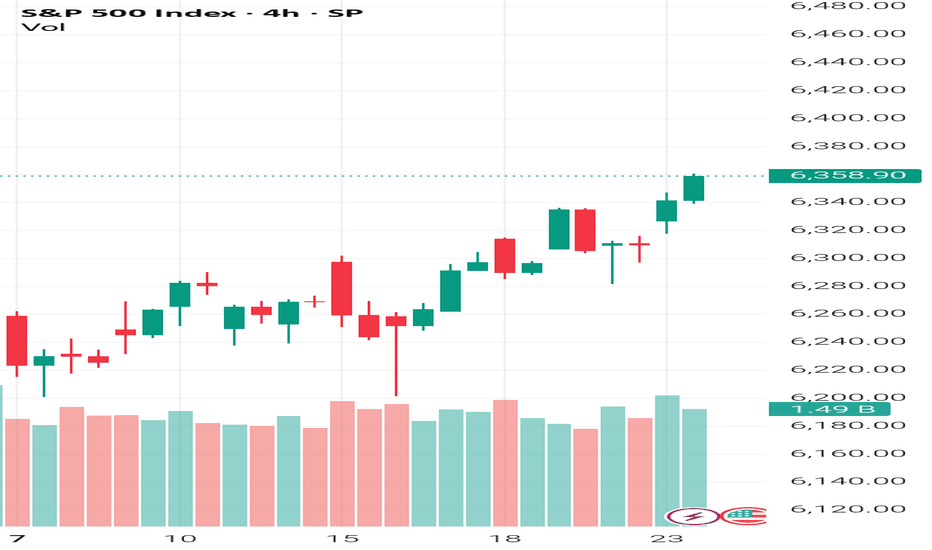

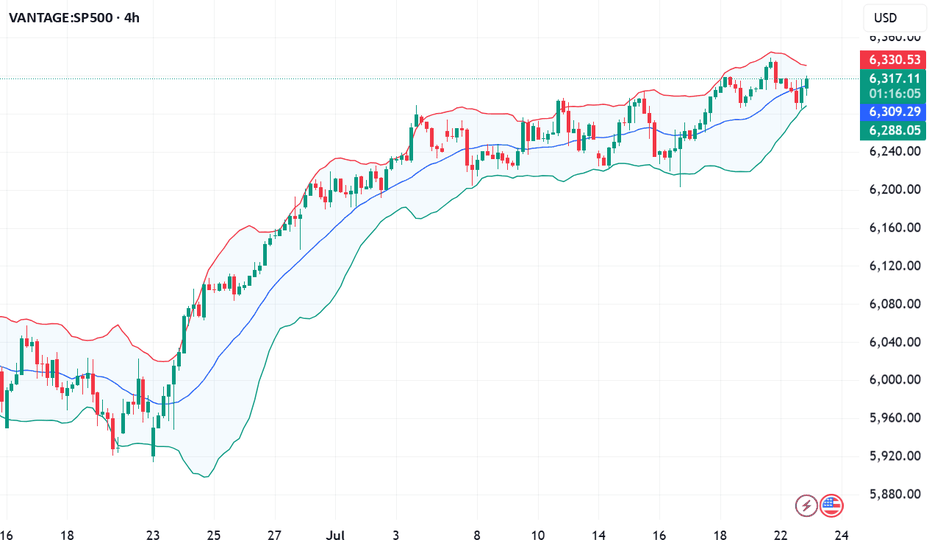

During this trading week, the S&P 500 Index has shown a predominantly downward/upward course of action and created a new Key Resistance at 6280. Currently, the index exhibits a bullish bias, with the Outer Index Rally objective set at 6420. However, it is crucial to note that the current price action may cause prices to see in a new light from their current fluctuation to push toward the Mean Support at 6200 before resuming their upward movement.

SPIUSD trade ideas

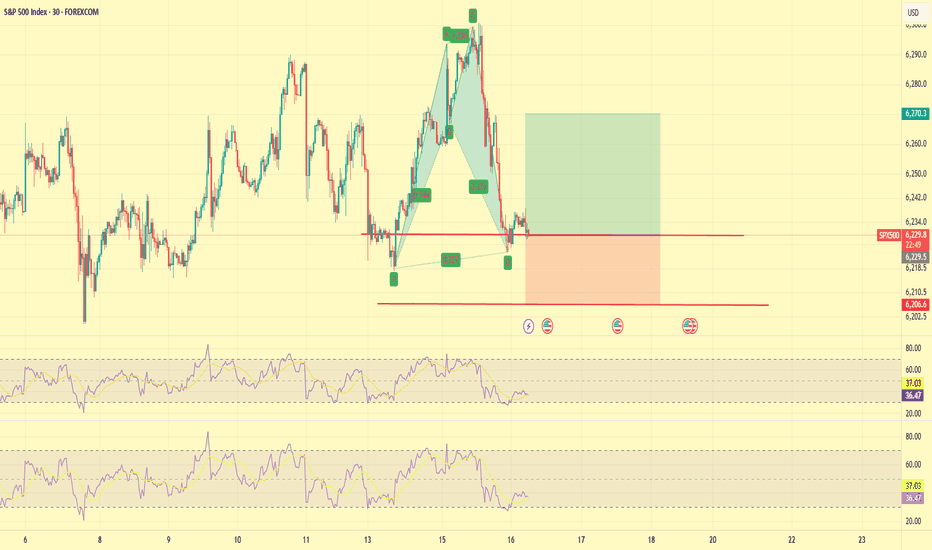

ASCENDING WEDGE ON WATCH - ELLIOTT WAVE 3 NEARLY COMPLETEThe WAVE 3 extension can go further but it seems likely that coinciding with earnings this month we will have the potential for the start of WAVE 4 retracement.

The possible resignation of Jerome Powell could further intensify the charts.

AlphaTrend is an advanced trading indicator that leverages proprietary tools, real-time data, and custom metrics to give traders a competitive edge. Designed for all experience levels, it works instantly—no advanced charting skills required.

ADVANCED and PRO versions are available. (See below)

🔍 How It Works

At the core of AlphaTrend is Dynamic Reversion Bands — a sophisticated real-time system that adapts to price action by automatically adjusting to evolving market conditions.

These bands act like a roadmap, helping traders identify:

Mean reversion trade opportunities

Trend strength

Emotion-driven market conditions (like FOMO)

The system is rooted in Mean Reversion Theory:

If an asset's price deviates significantly from its historical average, it tends to “revert” back to that average over time. Traders can use this behavior to spot potential buying or selling opportunities:

Overbought Conditions: If the price moves too far above the mean, it may signal a pullback—traders might sell or short.

Oversold Conditions: If the price drops well below the mean, it may be undervalued—traders might buy in anticipation of a bounce.

⚪🟡🔴🟡⚪ Dynamic DOTS

AlphaTrend visualizes market overextension through dynamic DOTS:

White DOTS = Average conditions

Yellow DOTS = Above average conditions

Red DOTS = Extreme conditions

The DOTS update in real time as the candle is forming—appearing, disappearing, and shifting color based on current intensity levels. Once the candle closes, however, the DOTS do not repaint. This ensures clarity and confidence in every signal.

This is crucial, as many indicators repaint and revise data after the fact, undermining traders’ trust. With AlphaTrend, once a candle closes, the data remains permanently fixed.

📊 Adaptability and Market Insight

AlphaTrend adapts to any timeframe, but performs best on longer-duration candles, where signals are fewer but more reliable. Multi-interval displays (e.g., 1hr, 4hr, Daily) are highly recommended. That being said it does tend to give strong signals on all time frames even down to 1 min candles.

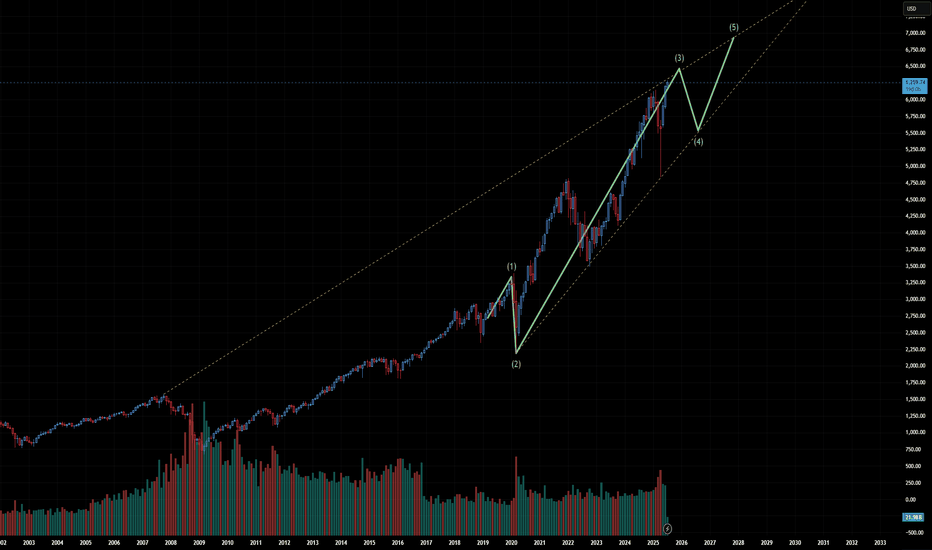

S&P 500 - Medium Timeframe AnalysisAs illustrated, we appear to be in the final wave to the upside. At this stage, I’m treating Wave 5 as a standard impulse. However, given that Wave 4 retraced deeply, nearly to the termination point of Wave 1, there remains a modest possibility that this higher-degree Wave 5 in gray, which began in 2020, could ultimately unfold as an ending diagonal. That said, this scenario remains highly unlikely, as the internal structure of the preceding waves does not exhibit the characteristics of corrective price action.

Position builders?📈 This One Daily Signal Ignited a 1,000+ Point Rally

While everyone else panicked during that April drop…

The ELFIEDT RSI + Reversion system quietly printed one word:

UP.

💹 That one green tag at the bottom?

It wasn’t just a bounce.

It was the start of a full-blown trend reversal.

⸻

🟢 Why Long-Term Traders Love This System:

✅ Signals only appear at extreme structure zones

✅ RSI was buried in oversold with clean divergence

✅ Daily timeframe = position-size confidence

✅ No need to overtrade — just buy the dip and hold

✅ Over 1,000+ points and still running…

⸻

This is what we call “High Conviction Buying.”

You didn’t need to time the top.

You just needed to trust a clean, unemotional signal at the bottom.

⸻

💬 DM “SP500 LONG” to see how this could’ve been on your chart

📲 Follow for more real, repeatable swing & position trade setups

🔒 Daily edge. Weekly confirmation. Monthly rewards.

Because sometimes…

📉 The scariest candles…

🔥 Become the most profitable trades.

Third quarter and something we didn’t expectso I’ve been watching the markets for a while and honestly this new admin is doing something that many didn’t saw coming.

it's not even a full year yet, we’re still on Q3, but the impact on the economy is starting to show. what really gets my attention is the tariff collection, it’s been really high and from what I see it’s even generating some kind of surplus in certain areas.

at first I thought this was going to slow down the market or create pressure, but the opposite happened, the stock market has been hitting all time highs, especially in tech and defense sectors.

inflation didn’t spike like people was saying, that calmed down many investors and the flow of money is pretty obvious.

i’m not an expert or nothing but this first months looks like there’s a real direction and the money is moving in a positive way. still need to see how this year closes but if it stays like this, could be one of the strongest starts for a president in a long time.

just wanted to share my thoughts, what you guys think?

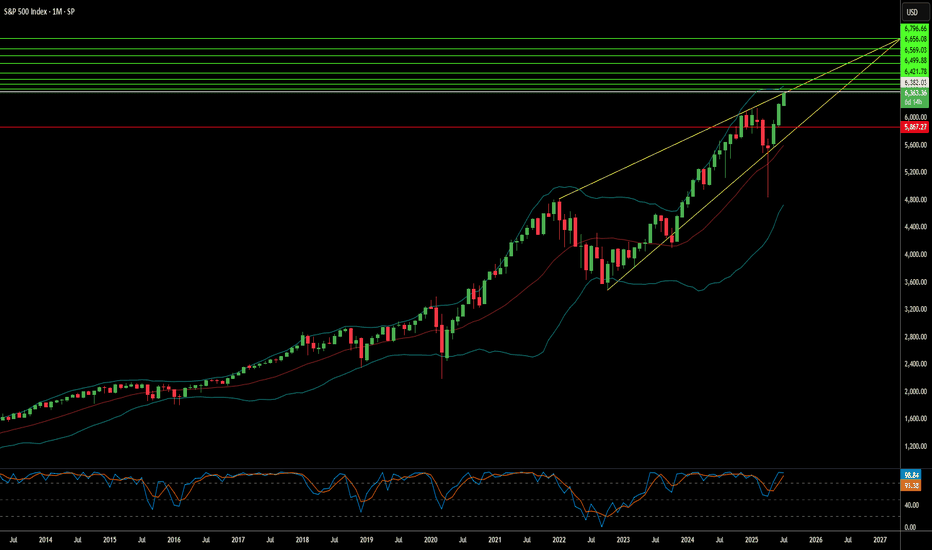

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

ECB on the agenda: The ECB is on the agenda today. I don't envision a particularly volatile event, although a continuation of the 'limited further cuts narrative' should see the EUR supported, particularly given growing thoughts of a US / EUR trade deal.

All in all, with the S&P still climbing, I continue to hold the view that 'risk on' trades are viable, especially since the announcement of the US / JAPAN trade deal. It's just a case of choosing whether to short the JPY or USD.

In other news, 'soft' SERVICE PMI data from the UK puts a little more pressure on the BOE to cut rates, arguably creating a GBP short 'catalyst' trade for anyone at the charts in that moment.

Also, a relatively hawkish speech from the RBA'S BULLOCK, keeps the AUD high on my 'to long list'.

Wall Street takes off: 5 secret growth engines for #S&P500 Record closes for the indices on July 21 came from a powerful combo: a surge in #Google , a strong start to the earnings season, gains in #Apple (+0.6%), #Amazon (+1.4%), plus #Microsoft, #Meta Platforms, and #Nvidia . This momentum, coupled with market bets on imminent Fed rate cuts and hopes for a softening US-EU tariff conflict, pushed #S&P500 and #NQ100 to new all-time highs.

5 mega drivers that could keep #S&P500 and #NQ100 on the runway through 2025:

• AI capex and monetization: Top cloud providers are ramping up spending in computing clusters and generative AI solutions. The growing lineup of paid AI products (Google Gemini, Microsoft Copilot+ Apps, Amazon Bedrock) is starting to generate significant revenue, boosting profit estimates for the “Magnificent 7.”

• Fed policy easing: If inflation keeps drifting towards 2%, we may see the first rate cut of the cycle between July and September. Historically, every 25 bps drop in 10-year UST yields adds ~2% to the #NQ100 ’s valuation multiple.

• Record buybacks and dividends: #S&P500 companies hold $3.5 trillion in cash. After tax relief on repatriated foreign earnings earlier this year, several megacap boards approved accelerated buybacks — mechanically supporting stock prices.

• Easing tariff risks: Potential trade deals between the US and EU, and the US and Mexico, would remove the threat of 20–50% tariffs priced into valuations, unlocking CAPEX in manufacturing and semiconductors — sectors with a heavy #NQ100 weight.

• Resilient consumers and services: Unemployment remains near 4%, and household spending is growing 2–3% YoY. This supports e-commerce, streaming, and platform advertising — together making up ~40% of #NQ100 and ~28% of #S&P500 .

The current highs of #S&P500 and #NQ100 aren’t a random spike — they result from strong corporate earnings, expectations of Fed cuts, and hopes of trade détente. If even some of these five drivers materialize, the indices have a strong chance to stay elevated and set new records by year-end. FreshForex analysts believe current prices could spark a new rally, with today’s market conditions offering plenty of entry points in both indices and stock CFDs.

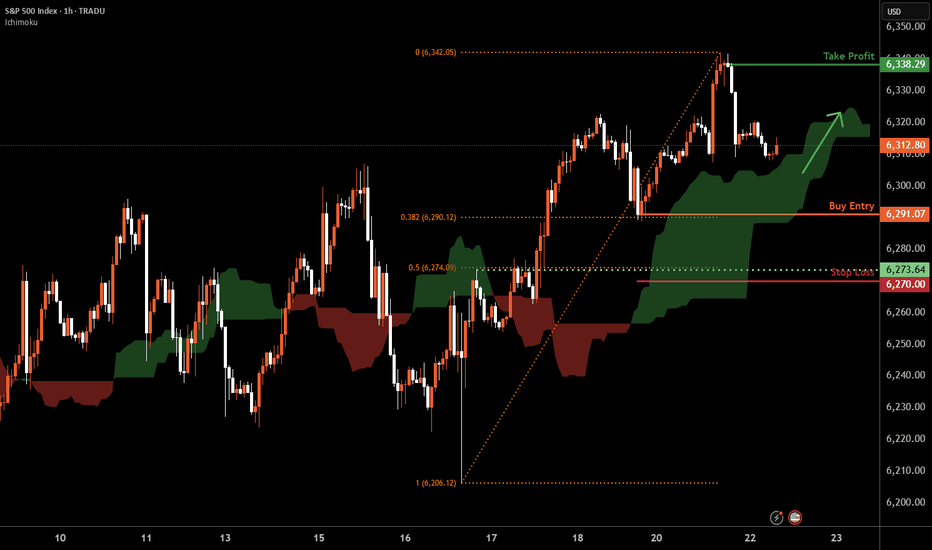

S&P 500 H1 | Swing-low support at 38.2% Fibonacci retracementThe S&P 500 (SPX500) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 6,291.07 which is a swing-low support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 6,270.00 which is a level that lies underneath a pullback support and the 50% Fibonacci retracement.

Take profit is at 6,338.29 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Weekly Review: The S&P and NASDAQ once again hit all time highs during the week starting Monday 14 July. Which is a sign of confidence despite the ongoing external threats (tariffs / Middle East). I've noticed the current earnings season wasn't approached with as much trepidation as recent earnings seasons have been. Of course, that could come crashing down as companies continue to report over the next couple of weeks.

Once again, the currencies didn't quite react in accordance with the overall 'positive risk environment'. As each of the 'risk off currencies' offers their own separate challenges:

Ever since the recent NFP data, the USD had been strong, the FED continues to maintain a view for a 'slow pace of rate cuts' and US data backs up that view. Particularly this week's retail sales data, even CPI, although relatively benign, wasn't soft enough to warrant a 'FED pivot' towards a more dovish stance. The USD spent most of the week on the front foot, although the 'higher for longer' narrative was put to the test when the president once again offered his views on Mr Powell. Also FED board member WALLER chipped in with some dovish comments. Currently, it's up in the air as to how many more rate cut the FED will implement before year end (if any). The narrative at the July FOMC meeting could go a long way to determine the dollar's direction for the rest of the summer. But ultimately, it'll be the data that decides.

Recently, I've been encouraged by the re-emergence of JPY weakness. This past week, I put any periods of JPY strength down to profit taking before this weekends election. I need to do some reading regarding the implications of the result. But I'm 'hopeful' that over the coming weeks and months the 'old fashioned, JPY short 'risk on trade', will be prevalent.

The CHF continues to have a mind of it's own. It could be tracking EUR strength, it could be the article I read about gold, it could be SNB intervention, It could be random, or something I'm not aware of. Ultimately, until I'm comfortable the CHF is back in correlation with the risk environment, my preference is to short the JPY instead.

In other news, disappointing AUD data took the shine off the hawkish RBA. But I still view the AUD as a good 'risk on' long.

I'll begin the new week with an open mind. My preference remains for 'risk on' trades. But it's a case of keeping up to date with all of the narratives, if momentum aligns with logic and a narrative. And you feel comfortable with a stop loss and profit target, place the trade. But, be aware that the narrative the market is focused on can change from day to day.

On a personal note, it was a week of two trades. A post US CPI 'risk on' AUD JPY long. The trade stopped out. And as discussed during the week, it was one of those situations where if I would have been at the charts and hour later, I would have traded a different pair. That's life.

The second trade was AUD USD long. Post WALLER'S dovish comments, I felt the USD short momentum could continue. On my account the trade hit profit by the skin of its teeth before reversing. Again, that's life. Sometimes you get good luck, sometimes you get bad luck. I feel it's important to acknowledge good luck, as we often only focus on the bad luck we have.

The USD is finely poised and I'm intrigued to see where the data and rate cut narrative takes it over the coming weeks.

Results:

Trade 1: AUD JPY -1

Trade 2: AUD USD +1.2

Total = +0.2%

Miss This Watchlist, Miss Next Week’s OpportunitiesHey friends,it’s Skeptic 🩵 hope you’re having a great weekend!I know it’s the weekend, so a lot of you are probably chilling away from the charts, but for some, trading’s such an addiction that even weekends can’t keep you away. In this video, I’m gonna break down my weekly watchlist for you. Knowing it will help you miss fewer good opportunities, avoid FOMO, and have a plan ready for different scenarios and events.

Don’t forget money management , and stay clear of FOMO. & if it helped smash that boost bottom and follow for more !

S&P500 Bullish breakout supported at 6207Trump’s $3.4 Trillion Tax Plan

Favors wealthy investors: Tax burden shifts based on how you earn, not how much.

Winners: Business owners, investors, high-income earners.

Losers: Immigrants, elite universities.

Trade Tensions

EU Tariffs: Brussels targets $72B in US goods (e.g., Boeing, cars, bourbon) in response to Trump’s tariff threats.

Impact: Risk to transatlantic trade; US open to talks.

US-China Tech Relations

Nvidia: Resumes H20 AI chip sales to China after US approval—boosted chip stocks.

Trump: To announce $70B in AI & energy investments today in Pennsylvania.

Trend: Signs of easing tensions between US and China.

Earnings Focus: Big US Banks

Q2 results (JPM, Citi, WFC, BNY Mellon, BlackRock) will highlight:

Net interest income: How rate levels affect profits

Loan growth & credit quality: Signs of lending strength or weakness

Capital markets activity: Trading & investment banking trends

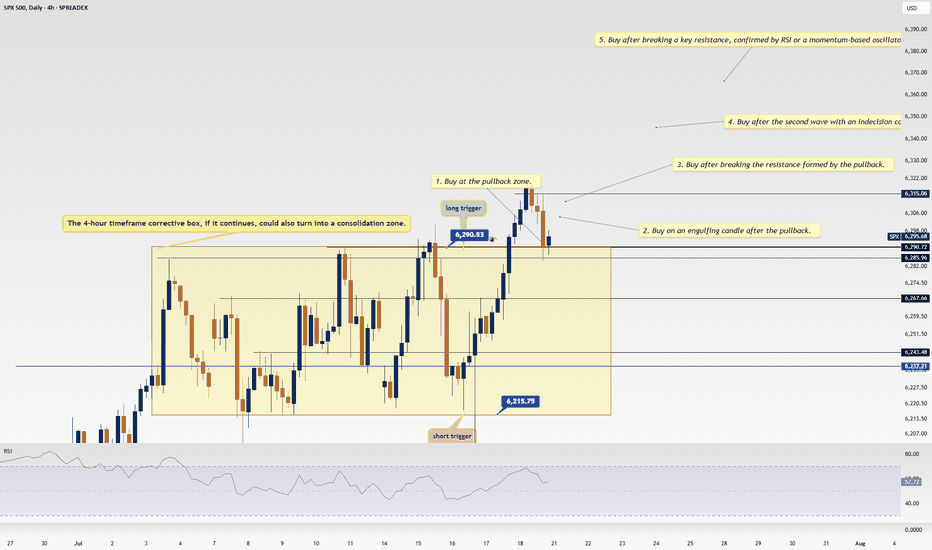

Key Support and Resistance Levels

Resistance Level 1: 6335

Resistance Level 2: 6380

Resistance Level 3: 6420

Support Level 1: 6207

Support Level 2: 6160

Support Level 3: 6115

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P 500: Defying Tariff Headwinds, Breaking RecordsThe S&P 500 has staged a remarkable rally in 2025, shattering all-time highs and capturing global attention. This surge has unfolded despite the negative economic overhang of renewed tariff threats and ongoing trade tensions, raising critical questions for investors: How did the market overcome such headwinds, and what lies ahead for both the short and long term?

The Rally Against the Odds

Tariff Turbulence: Earlier this year, President Trump announced sweeping new tariffs, sparking fears of supply chain disruptions and higher costs for American companies. Historically, such moves have triggered volatility and corrections.

Market Resilience: Despite these concerns, the S&P 500 not only recovered losses from the spring but surged to new record highs, with the index climbing over 23% since April’s lows. Major tech companies, especially those leading in AI and innovation, have been at the forefront of this advance.

Investor Sentiment: The rally has been fueled by optimism around potential Federal Reserve rate cuts, robust corporate earnings, and expectations of long-term economic growth—even as the immediate impact of tariffs remains uncertain.

Short-Term Correction: A Healthy Pause?

While the long-term outlook remains bullish, several indicators suggest the market may be due for a short-term correction:

Narrow Market Breadth: The current rally has been driven by a handful of mega-cap stocks, leaving the median S&P 500 stock well below its own 52-week high. Historically, such narrow leadership often precedes periods of consolidation or pullbacks.

Valuation Concerns: Stock valuations are at elevated levels, and some analysts warn that earnings growth could slow as companies adapt to higher input costs and shifting trade policies.

Correction Forecasts: Some strategists predict the S&P 500 could correct to around 5,250 by the third quarter of 2025, citing factors like slowing consumer spending and persistent policy uncertainty.

Long-Term Outlook: Higher Highs Ahead

Despite the potential for near-term volatility, the long-term trajectory for the S&P 500 remains positive:

Fed Policy Tailwinds: Anticipated rate cuts and lower bond yields are expected to provide further support for equities, encouraging risk-taking and higher valuations.

Corporate Adaptation: Companies are actively offsetting tariff impacts through cost savings, supply chain adjustments, and strategic pricing.

Growth Sectors: Innovation in technology, productivity gains, and deregulation are setting the stage for sustained profit growth, especially in sectors like AI, robotics, and defense.

Key Takeaways for Investors

Stay Disciplined: While a short-term correction is possible, history shows that markets often rebound strongly after periods of volatility.

Diversify Exposure: With market gains concentrated in a few names, diversification and active stock selection are more important than ever.

Focus on Fundamentals: Long-term investors should look beyond headlines and focus on companies with resilient earnings and adaptive business models.

The S&P 500’s ability to break records in the face of tariff headwinds is a testament to the underlying strength and adaptability of the U.S. economy. While short-term bumps are likely, the path ahead still points toward new highs for those with patience and perspective.

This article is for informational purposes only and does not constitute investment advice. Always consult with a financial advisor before making investment decisions.

#spx500 #stockmarket #analysis #economy #us #nasdaq #fed #bonds #rates #trading

S&P500 Slips Ahead of CPI & Earnings SeasonEquities began the week under pressure, with the S&P 500 dropping 0.5%, slipping below the 6,230-resistance area. Although the Fed minutes released last week indicate that most members are open to cutting rates this year, inflation data and second-quarter earnings could change that trajectory.

Upcoming Events to Watch:

• CPI Release (Tuesday 14:30 SAST): A cooler-than-expected print would support a breakout in risk assets. A hot reading could shift expectations toward policy tightening, weighing on equities.

• Q2 Earnings Season: Major banks including JPMorgan Chase, Wells Fargo, and Citigroup will report this week. Strong earnings may cushion the market, while any weakness could exacerbate volatility.

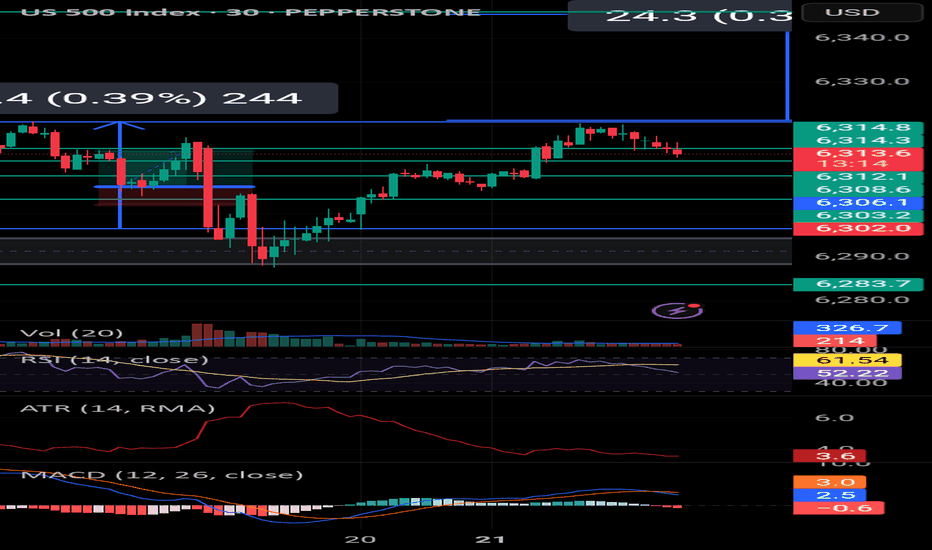

S&P500 Technical View:

• Immediate Resistance: 6,230

• Potential Upside: A cooler CPI could see the index rally toward 6,290.

• Support Levels: Should inflation surprise to the upside, the index may slide to 6,190, or even 6,150 in extended selling.

$SPXSP:SPX Update:

Rumors of Powell possibly resigning as Fed Chair have created uncertainty among buyers.

But if inflation stays low even with tariffs we might see longer holds.

If Powell does step down, markets could actually rally on hopes of upcoming rate cuts.

📉📈

Now we wait for the inflation report…

SPX500USD | Retesting All-Time HighsThe index has extended its bullish rally, printing a new local high at 6,286.5 before showing signs of slight hesitation with consecutive small-bodied candles.

Support at: 6,134.5 / 6,026.0 / 5,926.2 🔽

Resistance at: 6,286.5 🔼

🔎 Bias:

🔼 Bullish: Sustains above 6,134.5 and breaks 6,286.5 for new highs.

🔽 Bearish: Break below 6,134.5 could trigger a retracement toward 6,026.0.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

US500 Is Bullish! Long!

Here is our detailed technical review for US500.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 6,252.40.

The above observations make me that the market will inevitably achieve 6,297.19 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!