8/5/25 - $tsm - Good to be back8/5/25 :: VROCKSTAR :: NYSE:TSM

Good to be back

- you all know i stick to the winners so it's always been $TSM/ NASDAQ:NVDA and then everyone else (go read the posts if inclined w/ more thoughts on either)

- NYSE:TSM is a key infrastructure layer for the next 5-10 yr of hyper-AI growth and not

Key facts today

Taiwan Semiconductor Manufacturing Co. (2330) has received board approval for a $10 billion capital injection into TSMC Global to lower foreign exchange hedging costs.

Intel faces challenges in advanced chip production, especially competing with Taiwan Semiconductor Manufacturing Co. (2330) for clients, and may halt its next-gen 14A process without major customers.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.17 T TWD

2.89 T TWD

23.86 B

About TAIWAN SEMICONDUCTOR MANUFACTURING

Sector

Industry

CEO

Che Chia Wei

Website

Headquarters

Hsinchu

Founded

1987

ISIN

TW0002330008

FIGI

BBG000BN2JD8

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products, information applications, wired and wireless communications systems products, and automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras. The company was founded by Chung Mou Chang on February 21, 1987 and is headquartered in Hsinchu, Taiwan.

Related stocks

TSM - LONG Swing Entry PlanNYSE:TSM - LONG Swing Entry Plan

E1: $231.00 – $229.00

→ Open initial position targeting +8% from entry level.

E2: $221.00 – $218.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $212.00 – $207.

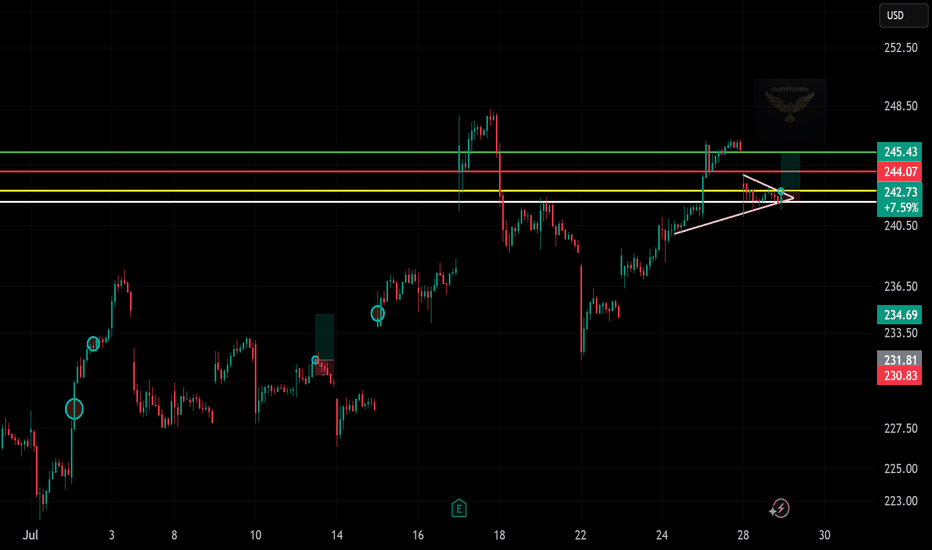

Trade Setup: LONG on TSM !📈 (Taiwan Semiconductor)

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Ascending triangle breakout

📉 Previous Trend: Recovery after drop

🔁 Setup: Bullish continuation with breakout confirmation

🧩 Technical Breakdown:

Support Zone:

~$242.50 (yellow horizontal support)

Uptrend line holding as dynamic su

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

============================

TSMCThe Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world’s largest and most advanced semiconductor foundry, headquartered in Hsinchu Science Park, Taiwan. Founded in 1987 by Morris Chang, TSMC pioneered the pure-play foundry model, focusing exclusively on manufacturing chips design

TSM (Taiwan Semiconductor)-Breakout Play with Strong FundamentaTicker: TSM (NYSE)

Recommendation: BUY

Current Price: $216.62

Entry Zone: $216 - $218 (Breakout confirmation)

Stop Loss: $190 (Key support level, -12.3% from entry)

Take Profit: $270.04 (+24.7% upside)

Risk/Reward Ratio: 1:2

📈 Technical Analysis

Trend: Strong bullish momentum across all timeframes

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSM5285159

TSMC Arizona Corp. 3.25% 25-OCT-2051Yield to maturity

5.74%

Maturity date

Oct 25, 2051

TSM5285158

TSMC Arizona Corp. 3.125% 25-OCT-2041Yield to maturity

5.56%

Maturity date

Oct 25, 2041

TSM5399900

TSMC Arizona Corp. 4.5% 22-APR-2052Yield to maturity

5.14%

Maturity date

Apr 22, 2052

TSM5170546

TSMC Global Ltd. 2.25% 23-APR-2031Yield to maturity

4.62%

Maturity date

Apr 23, 2031

TSM5050794

TSMC Global Ltd. 1.375% 28-SEP-2030Yield to maturity

4.57%

Maturity date

Sep 28, 2030

TSM5170544

TSMC Global Ltd. 1.75% 23-APR-2028Yield to maturity

4.55%

Maturity date

Apr 23, 2028

TSM5285157

TSMC Arizona Corp. 2.5% 25-OCT-2031Yield to maturity

4.50%

Maturity date

Oct 25, 2031

TSM5448853

TSMC Global Ltd. 4.625% 22-JUL-2032Yield to maturity

4.41%

Maturity date

Jul 22, 2032

TSM5399899

TSMC Arizona Corp. 4.25% 22-APR-2032Yield to maturity

4.38%

Maturity date

Apr 22, 2032

TSM5050792

TSMC Global Ltd. 1.0% 28-SEP-2027Yield to maturity

4.34%

Maturity date

Sep 28, 2027

TSM5050790

TSMC Global Ltd. 0.75% 28-SEP-2025Yield to maturity

4.33%

Maturity date

Sep 28, 2025

See all 2330 bonds

Curated watchlists where 2330 is featured.

Frequently Asked Questions

The current price of 2330 is 1,180 TWD — it has increased by 0.43% in the past 24 hours. Watch TAIWAN SEMICONDUCTOR MANUFACTURING stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TWSE exchange TAIWAN SEMICONDUCTOR MANUFACTURING stocks are traded under the ticker 2330.

2330 stock has risen by 4.42% compared to the previous week, the month change is a 7.76% rise, over the last year TAIWAN SEMICONDUCTOR MANUFACTURING has showed a 25.27% increase.

We've gathered analysts' opinions on TAIWAN SEMICONDUCTOR MANUFACTURING future price: according to them, 2330 price has a max estimate of 1,620.00 TWD and a min estimate of 1,200.00 TWD. Watch 2330 chart and read a more detailed TAIWAN SEMICONDUCTOR MANUFACTURING stock forecast: see what analysts think of TAIWAN SEMICONDUCTOR MANUFACTURING and suggest that you do with its stocks.

2330 reached its all-time high on Aug 8, 2025 with the price of 1,185 TWD, and its all-time low was 5 TWD and was reached on Sep 5, 1994. View more price dynamics on 2330 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

2330 stock is 1.71% volatile and has beta coefficient of 1.26. Track TAIWAN SEMICONDUCTOR MANUFACTURING stock price on the chart and check out the list of the most volatile stocks — is TAIWAN SEMICONDUCTOR MANUFACTURING there?

Today TAIWAN SEMICONDUCTOR MANUFACTURING has the market capitalization of 30.60 T, it has increased by 3.51% over the last week.

Yes, you can track TAIWAN SEMICONDUCTOR MANUFACTURING financials in yearly and quarterly reports right on TradingView.

TAIWAN SEMICONDUCTOR MANUFACTURING is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

2330 earnings for the last quarter are 15.36 TWD per share, whereas the estimation was 14.47 TWD resulting in a 6.13% surprise. The estimated earnings for the next quarter are 15.32 TWD per share. See more details about TAIWAN SEMICONDUCTOR MANUFACTURING earnings.

TAIWAN SEMICONDUCTOR MANUFACTURING revenue for the last quarter amounts to 933.79 B TWD, despite the estimated figure of 920.91 B TWD. In the next quarter, revenue is expected to reach 945.74 B TWD.

2330 net income for the last quarter is 398.27 B TWD, while the quarter before that showed 361.56 B TWD of net income which accounts for 10.15% change. Track more TAIWAN SEMICONDUCTOR MANUFACTURING financial stats to get the full picture.

TAIWAN SEMICONDUCTOR MANUFACTURING dividend yield was 1.58% in 2024, and payout ratio reached 37.57%. The year before the numbers were 2.19% and 40.20% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TAIWAN SEMICONDUCTOR MANUFACTURING EBITDA is 2.34 T TWD, and current EBITDA margin is 68.62%. See more stats in TAIWAN SEMICONDUCTOR MANUFACTURING financial statements.

Like other stocks, 2330 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TAIWAN SEMICONDUCTOR MANUFACTURING stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TAIWAN SEMICONDUCTOR MANUFACTURING technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TAIWAN SEMICONDUCTOR MANUFACTURING stock shows the buy signal. See more of TAIWAN SEMICONDUCTOR MANUFACTURING technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.