USDCHFHello Traders! 👋

What are your thoughts on USDCHF?

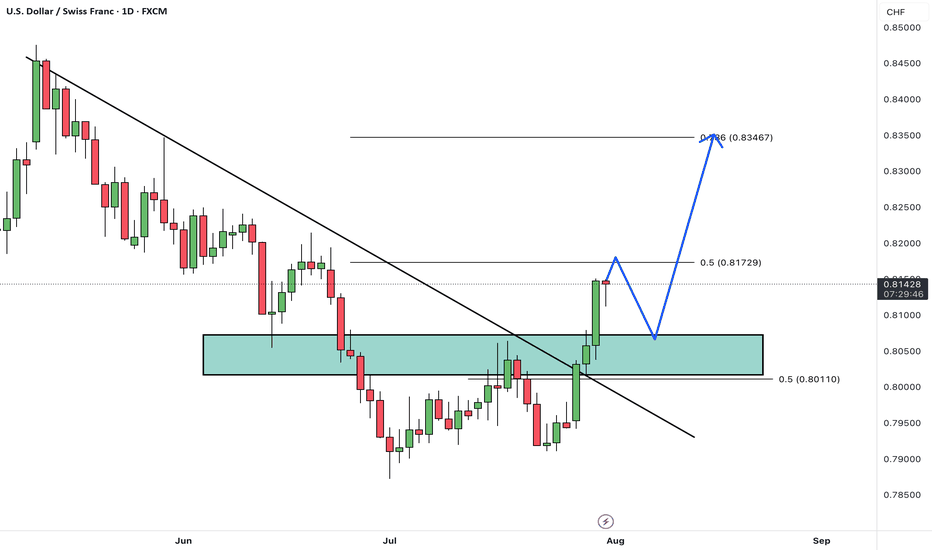

USD/CHF has broken above its descending trendline and cleared a resistance zone, signaling a potential trend reversal and growing bullish momentum.

After some minor consolidation and a pullback to the breakout zone, we expect the pair to continue i

About U.S. Dollar / Swiss Franc

The USDCHF, also known as the “swissie” is the fifth most traded currency in the Forex market. It is considered to be a safe haven pair due to its stability and neutral character of Switzerland and is a reserve currency used by markets worldwide.

Related currencies

Lingrid | USDCHF Potential Bullish Move Following Level BreakoutFX:USDCHF surged from a higher low and is now retesting the broken structure near 0.802, maintaining its position within the broader upward channel. A clean bounce from this zone would confirm the bullish structure, targeting the upper channel resistance near 0.815. Pullback and higher low structur

USDCHF Forming Falling WedgeUSDCHF has recently broken out of a falling wedge pattern on the daily timeframe, which is typically a bullish reversal signal. After an extended period of compression and lower highs, the pair has pierced above the descending trendline with strong bullish momentum. This breakout indicates a shift i

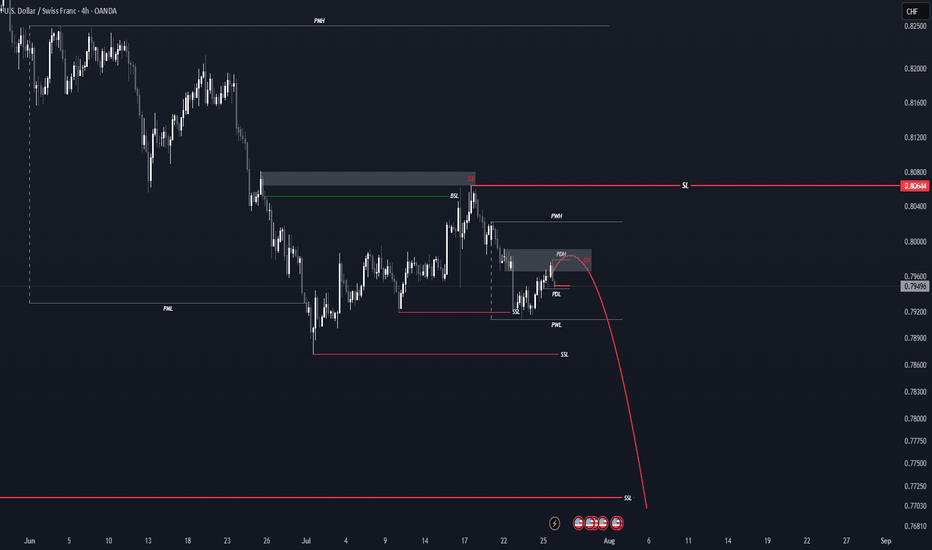

USDCHF Potential DownsidesHey Traders, in today's trading session we are monitoring USDCHF for a selling opportunity around 0.81000 zone, USDCHF is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.81000 support and resistance area.

Trade safe, Joe.

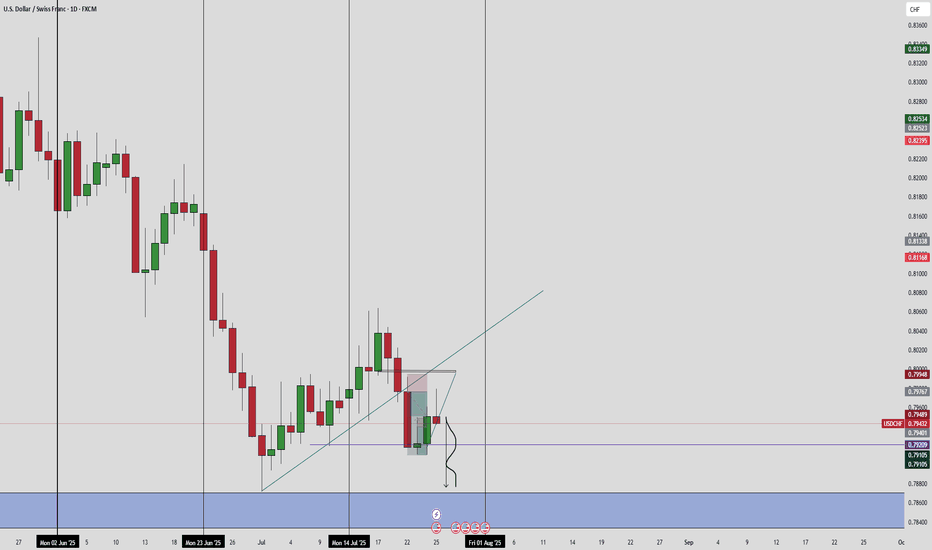

Sell Setup – USD/CHF (1H Timeframe)Chart Summary (1H – USD/CHF)

The pair was bullish, then got sharply rejected near 0.8100.

Price is now inside the Ichimoku Cloud, which means indecision.

Bearish signs:

Price failing to push back above cloud

Chikou Span (lagging line) is heading below candles

Flat Kijun-sen + bearish twist for

USDCHF CLEAR BEARISH WEEKLY OBJECTIVEUSD/CHF is showing clear bearish sentiment heading into the early part of the week. The pair exhibits signs of a potential sharp decline, with momentum favoring the downside. Traders should keep a close watch on this pair for possible breakdown opportunities throughout the week.

USD/CHF Rally Threatens ReversalThe July opening range broke to the topside on the heels of yesterday’s FOMC rate decision and takes USD/CHF back above the 25% parallel- a weekly close back above the April lows at 8040 tomorrow would suggest a more significant low is in place / a larger reversal is underway. Look for initial suppo

Market Analysis: USD/CHF Consolidates GainsMarket Analysis: USD/CHF Consolidates Gains

USD/CHF is rising and might aim for a move toward the 0.8120 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF is showing positive signs above the 0.8040 resistance zone.

- There is a connecting bullish trend line forming with sup

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDCHF is 0.80509 CHF — it has increased by 0.16% in the past 24 hours. See more of USDCHF rate dynamics on the detailed chart.

The value of the USDCHF pair is quoted as 1 USD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDCHF has the volatility rating of 0.54%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDCHF showed a 1.24% rise over the past week, the month change is a 1.33% rise, and over the last year it has decreased by −7.77%. Track live rate changes on the USDCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

USDCHF is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDCHF technical analysis. The technical rating for the pair is neutral today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDCHF shows the sell signal, and 1 month rating is sell. See more of USDCHF technicals for a more comprehensive analysis.