About US Dollar vs Offshore Chinese Renminbi

The U.S. Dollar vs. the offshore Chinese Renminbi. The Renminbi (CNH) is the designation used when the currency is traded offshore. It often referred as the Yuan and uses the letters CNY when traded inside China. China is the world’s second largest economy behind the U.S. but is the world’s largest exporter.

Related currencies

Time to load up on more YUAN - USDCNHThis is not a short term trade , in fact it should be a mid to longer term investment instead !

I believe the chinese yuan, RMB will continue to strengthen against the USD in the mid to longer term. Short term, we may find some sideway movements before it eventually breaks down from the 7.11 price

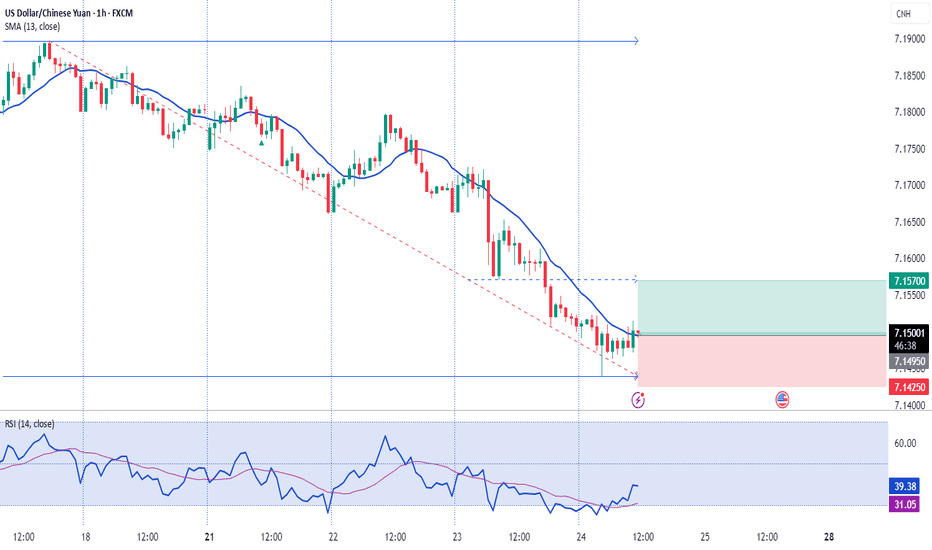

Smart Money Concept Sell to Buy via Quasimodo EntriesPrice has swept upside liquidity above a key level and tapped perfectly into our supply zone (Discount) for a sell on the higher timeframe. When price gets to the demand zone (Discount), where we have a sweep (SWE) of sell-side liquidity, A break of structure (BOS) confirming bullish momentum and P

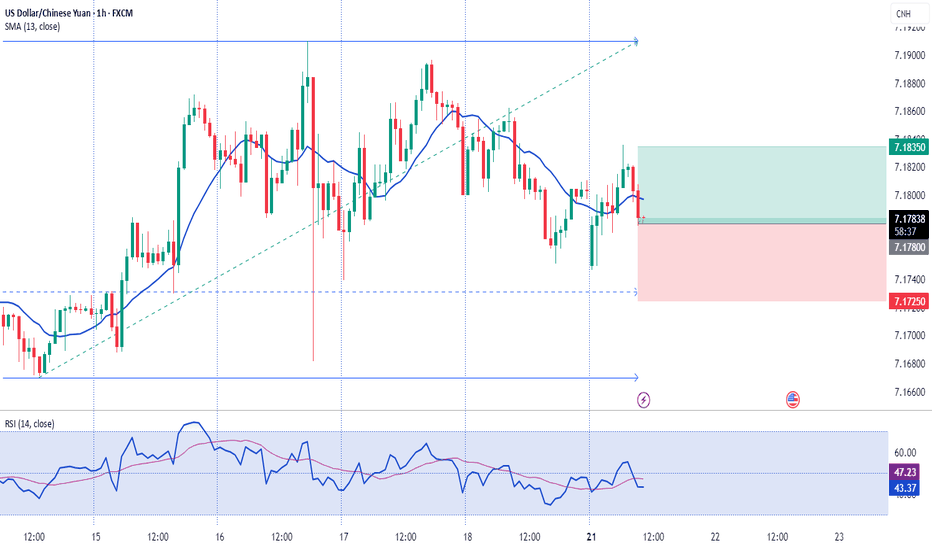

29.06.2025 #USDCNHBUY 7.16250 | STOP 7.14850 | TAKE 7.17950 | The US dollar is likely to rise against the yuan amid political factors and the publication of data on business activity in the non-manufacturing sector (PMI) in China. Technically, the pair has approached and is consolidating around medium-term support le

USD/CNH coiling for a breakdown?Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it ca

USD/CNH: The Trade War Pressure Point

USD/CNH is at the centre of the tariff war. A three-year resistance zone near 7.35/7.32 has failed once again. This repeated failure shows strategic resistance by Chinese policymakers or macro selling pressure.

Support Levels: 7.27 and 7.25 must hold. A drop through these levels could spark a move

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDCNH is 7.1777 CNH — it has decreased by −0.02% in the past 24 hours. See more of USDCNH rate dynamics on the detailed chart.

The value of the USDCNH pair is quoted as 1 USD per x CNH. For example, if the pair is trading at 1.50, it means it takes 1.5 CNH to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDCNH has the volatility rating of 0.15%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDCNH showed a 0.21% rise over the past week, the month change is a 0.17% rise, and over the last year it has decreased by −0.03%. Track live rate changes on the USDCNH chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDCNH right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDCNH technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDCNH shows the sell signal, and 1 month rating is neutral. See more of USDCNH technicals for a more comprehensive analysis.