Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.2 EUR

364.10 M EUR

14.53 B EUR

233.09 M

About Estee Lauder Companies, Inc. (The)

Sector

Industry

CEO

Stéphane de la Faverie

Website

Headquarters

New York

Founded

1946

FIGI

BBG00P0P7CS4

The Estée Lauder Companies, Inc. engages in the manufacture of skin care, makeup, fragrance and hair care products. It sells products under Estée Lauder, Clinique, Origins, MAC, Bobbi Brown, La Mer, Jo Malone London, Aveda and Too Faced. Its channels consist of department stores, multi-brand retailers, upscale perfumeries and pharmacies, and prestige salons and spas. The company was founded by Estee Lauder and Joseph Lauder in 1946 and is headquartered in New York, NY.

Related stocks

Best Long Trade Description (EL | Estee Lauder)📄

Ticker: NYSE:EL (Estee Lauder)

Timeframe: 30-Minute Chart

Trade Type: Long – Breakout Setup

Price is breaking out from a symmetrical triangle near a key support zone. Entry triggered at $85.55 with a clean structure and volume support. Targeting a move toward $89.38, with a tight stop below $8

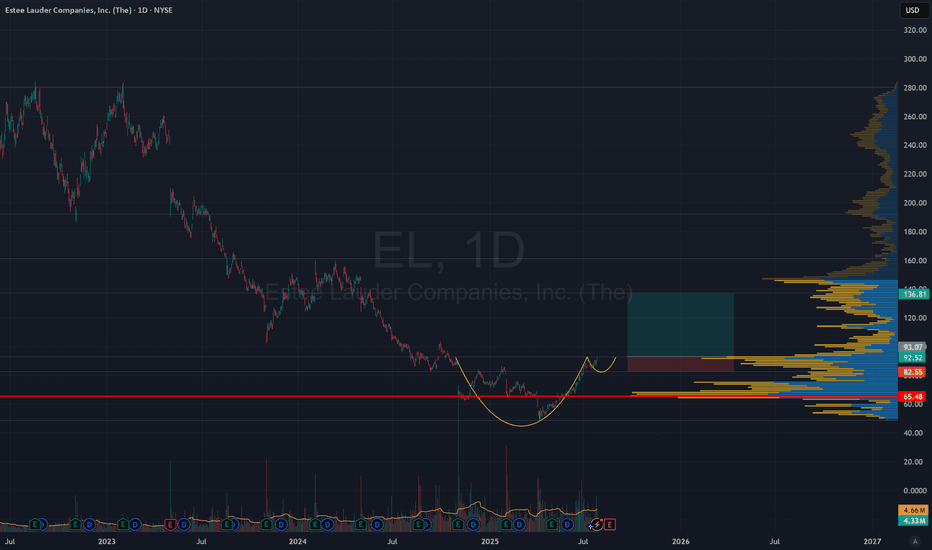

Estee Lauder | EL | Long at $67.33Reentering Estee Lauder at $67.33 due to the persistence of the Director, Paul Fribourg, buying around $33,000,000 worth of shares between $63-$66 (even after the earnings debacle). While the company had a horrendous outlook for FY2025, the bad news may be already priced in (i.e. cutting 7,000 jobs,

Long Trade Idea: EL (Estée Lauder Companies, Inc.)!🧠

📅 Timeframe: 30-Minute

💼 Type: Long Position

📈 Setup: Breakout from rising wedge + bullish continuation

📍 Trade Details:

Entry: $85.12 (breakout confirmation with bullish momentum)

Stop Loss: $83.85 (below wedge support & structure)

Target 1: $86.87 (minor resistance)

Target 2: $89.38 (major

Breakout Setup: $EL !🚨 🚨

📈 Price cracked key resistance at $78.85

🔁 Breakout + Retest confirmed

🎯 Targeting: $83.94

🛡️ Stop Loss: $76.85

📐 Risk/Reward: ~2.5R

🔥 Bullish structure, strong momentum, and volume behind the move.

Is this the start of a bigger reversal? 👀

#EL #BreakoutTrade #SwingSetup #NYSEStocks #ProfittoP

EL (Estée Lauder) Swing Trade Setup — June 15, 2025🔻 EL (Estée Lauder) Swing Trade Setup — June 15, 2025

💡 Ticker: EL

📉 Setup Type: Bearish Swing — Weekly PUT

📅 Expiry: June 20, 2025

⏱ Entry Timing: At Market Open

💬 Confidence: 70%

🧠 Model Insights & Technical Context

Across the board, our four AI models (Grok, Llama, DeepSeek, Gemini) provide the

EL: "I May Be Early...But I'm Not Wrong"Having a little fun with this one since Burry's EL position is getting so much attention

With that said I see why its in his portfolio

Expect to hold this for 5-10 years to see it to fruition but yeah...I think Burry has another winner on his hands

As always time will tell and price is king

EL | This is Ready for a Move Higher | LONGThe Estee Lauder Companies, Inc. engages in the manufacture of skin care, makeup, fragrance and hair care products. It sells products under Estee Lauder, Clinique, Origins, MAC, Bobbi Brown, La Mer, Jo Malone London, Aveda and Too Faced. Its channels consist of department stores, multi-brand retaile

EL buyEstee Lauder Companies Inc. Stock Analysis (EL) as of May 16, 2025:

Current Price: At 16:00:00 EDT, EL is trading at $65.18, up 2.40% from its opening price of $64.77.

Market Cap: $23.45 Billion USD

Analyst Ratings:

The consensus rating among analysts is "Hold."

Based on ratings from around 27 b

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

EL4914628

Estee Lauder Companies Inc. 3.125% 01-DEC-2049Yield to maturity

7.09%

Maturity date

Dec 1, 2049

US29736RAF7

ESTEE LAUDER COS 12/42Yield to maturity

7.08%

Maturity date

Aug 15, 2042

US29736RAK6

ESTEE LAUDER COS 17/47Yield to maturity

6.55%

Maturity date

Mar 15, 2047

ELAB

ESTEE LAUDER COS 2045Yield to maturity

6.39%

Maturity date

Jun 15, 2045

EL5585513

Estee Lauder Companies Inc. 5.15% 15-MAY-2053Yield to maturity

5.44%

Maturity date

May 15, 2053

EL.GB

Estee Lauder Companies Inc. 5.75% 15-OCT-2033Yield to maturity

5.23%

Maturity date

Oct 15, 2033

EL.GD

Estee Lauder Companies Inc. 6.0% 15-MAY-2037Yield to maturity

5.09%

Maturity date

May 15, 2037

US29736RAR1

ESTEE LAUDER 21/31Yield to maturity

4.98%

Maturity date

Mar 15, 2031

EL5752862

Estee Lauder Companies Inc. 5.0% 14-FEB-2034Yield to maturity

4.88%

Maturity date

Feb 14, 2034

EL5585645

Estee Lauder Companies Inc. 4.65% 15-MAY-2033Yield to maturity

4.74%

Maturity date

May 15, 2033

EL4974623

Estee Lauder Companies Inc. 2.6% 15-APR-2030Yield to maturity

4.57%

Maturity date

Apr 15, 2030

See all ESLA bonds

Curated watchlists where ESLA is featured.

Frequently Asked Questions

The current price of ESLA is 78.0 EUR — it has decreased by −4.88% in the past 24 hours. Watch ESTEE LAUDER COMPANIES-CL A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange ESTEE LAUDER COMPANIES-CL A stocks are traded under the ticker ESLA.

ESLA stock has risen by 3.72% compared to the previous week, the month change is a 7.14% rise, over the last year ESTEE LAUDER COMPANIES-CL A has showed a −15.58% decrease.

We've gathered analysts' opinions on ESTEE LAUDER COMPANIES-CL A future price: according to them, ESLA price has a max estimate of 96.44 EUR and a min estimate of 49.27 EUR. Watch ESLA chart and read a more detailed ESTEE LAUDER COMPANIES-CL A stock forecast: see what analysts think of ESTEE LAUDER COMPANIES-CL A and suggest that you do with its stocks.

ESLA reached its all-time high on Jan 4, 2022 with the price of 330.0 EUR, and its all-time low was 44.2 EUR and was reached on Apr 9, 2025. View more price dynamics on ESLA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ESLA stock is 5.13% volatile and has beta coefficient of 1.42. Track ESTEE LAUDER COMPANIES-CL A stock price on the chart and check out the list of the most volatile stocks — is ESTEE LAUDER COMPANIES-CL A there?

Today ESTEE LAUDER COMPANIES-CL A has the market capitalization of 28.69 B, it has decreased by −5.64% over the last week.

Yes, you can track ESTEE LAUDER COMPANIES-CL A financials in yearly and quarterly reports right on TradingView.

ESTEE LAUDER COMPANIES-CL A is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

ESLA earnings for the last quarter are 0.60 EUR per share, whereas the estimation was 0.29 EUR resulting in a 107.89% surprise. The estimated earnings for the next quarter are 0.08 EUR per share. See more details about ESTEE LAUDER COMPANIES-CL A earnings.

ESTEE LAUDER COMPANIES-CL A revenue for the last quarter amounts to 3.28 B EUR, despite the estimated figure of 3.25 B EUR. In the next quarter, revenue is expected to reach 2.88 B EUR.

ESLA net income for the last quarter is 146.97 M EUR, while the quarter before that showed −569.93 M EUR of net income which accounts for 125.79% change. Track more ESTEE LAUDER COMPANIES-CL A financial stats to get the full picture.

Yes, ESLA dividends are paid quarterly. The last dividend per share was 0.31 EUR. As of today, Dividend Yield (TTM)% is 1.88%. Tracking ESTEE LAUDER COMPANIES-CL A dividends might help you take more informed decisions.

ESTEE LAUDER COMPANIES-CL A dividend yield was 2.48% in 2024, and payout ratio reached 244.24%. The year before the numbers were 1.31% and 92.56% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 62 K employees. See our rating of the largest employees — is ESTEE LAUDER COMPANIES-CL A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ESTEE LAUDER COMPANIES-CL A EBITDA is 1.86 B EUR, and current EBITDA margin is 13.74%. See more stats in ESTEE LAUDER COMPANIES-CL A financial statements.

Like other stocks, ESLA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ESTEE LAUDER COMPANIES-CL A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ESTEE LAUDER COMPANIES-CL A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ESTEE LAUDER COMPANIES-CL A stock shows the neutral signal. See more of ESTEE LAUDER COMPANIES-CL A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.