Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.515 EUR

5.80 B EUR

181.06 B EUR

959.24 M

About General Motors Company

Sector

Industry

CEO

Mary Teresa Barra

Website

Headquarters

Detroit

Founded

1908

FIGI

BBG00KTFF9R5

General Motors Co. engages in the designing, manufacturing, and selling of trucks, crossovers, cars, and automobile parts, and in providing software-enabled services and subscriptions. It operates through the following segments: GMNA, GMI, Cruise, and GM Financial. The company was founded by William C. Durant on September 16, 1908 and is headquartered in Detroit, MI.

Related stocks

General Motors (NYSE: $GM) Reports 17% Y0Y in Q12025 Sales General Motors (NYSE: NYSE:GM ) opened at $44.46 on April 4th, 2025, down 3.91%. The stock declined $1.80 in early trading. This came a day after Trump’s new 25% auto import tariffs took effect. In a report released on April 2nd, GM delivered 693,363 vehicles in Q1 2025, a 17% year-over-year increa

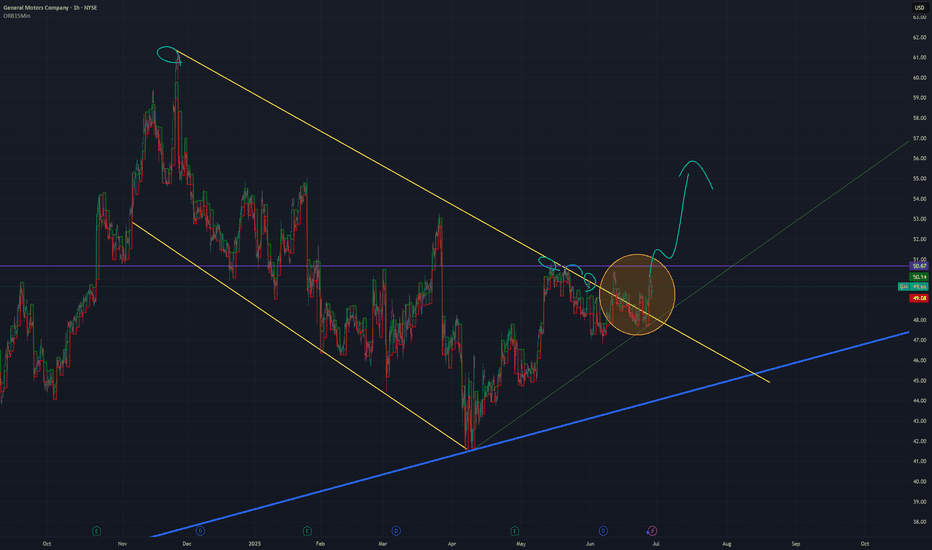

GM Stock Chart Fibonacci Analysis 032125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 48/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

GM 1H Long Swing Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ volumed SOS test / T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

Calculated affordable stop limit

1 to 2 R/R above 1D T1 before 1/2 1M

Daily CounterTrend

"- short balance

- unvolumed expanding T1

+ volumed 2Sp+

+ test"

Monthly Trend

GM 5M Long Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS level

+ support level

+ 1/2 correction

+ Sp

Calculated affordable stop limir

1 to 2 R/R take profit

1H Trend

"+ long impulse

+ volumed SOS test / T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

+ weak test

+ first buying bar closed"

1D C

GM Surging on Buyback & Dividend News! Can Bulls Push to $50+?Technical Analysis for February 27, 2025:

1. Current Price Action:

* GM surged on buyback and dividend news, reaching a high of $50.19 before pulling back to $48.60.

* Forming an ascending wedge pattern, indicating either a continuation or a breakdown.

* POC (Point of Control) at $48 is

General Motors: Is All the Bad News Priced In?Tariff fears have battered General Motors, but some traders may see an opportunity.

The first pattern on today’s chart is the price gap from January 28 after the automaker reported quarterly results. At the time, tariff fears overshadowed better-than-expected earnings and revenue. But now Trump has

GM Faces Pressure After Mixed Earnings and Key Technical BreakdoMarket Sentiment Overview

General Motors is under scrutiny after reporting better-than-expected revenue but revealing a net loss due to one-time charges. This mixed outcome has heightened volatility in GM's stock, with significant downward momentum visible in recent trading. The market appears to be

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

G

GM5502199

General Motors Financial Company, Inc. 6.75% 20-NOV-2028Yield to maturity

6.61%

Maturity date

Nov 20, 2028

G

GM5973482

General Motors Financial Company, Inc. FRN 07-JAN-2030Yield to maturity

6.22%

Maturity date

Jan 7, 2030

G

GM6006873

General Motors Financial Company, Inc. 5.7% 20-FEB-2033Yield to maturity

6.02%

Maturity date

Feb 20, 2033

G

GM6018639

General Motors Financial Company, Inc. FRN 04-APR-2028Yield to maturity

5.90%

Maturity date

Apr 4, 2028

See all GMOT bonds

Curated watchlists where GMOT is featured.

Frequently Asked Questions

The current price of GMOT is 44.760 EUR — it has increased by 0.01% in the past 24 hours. Watch GENERAL MOTORS CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange GENERAL MOTORS CO stocks are traded under the ticker GMOT.

GMOT stock has risen by 5.17% compared to the previous week, the month change is a 8.25% rise, over the last year GENERAL MOTORS CO has showed a 3.58% increase.

We've gathered analysts' opinions on GENERAL MOTORS CO future price: according to them, GMOT price has a max estimate of 70.60 EUR and a min estimate of 28.92 EUR. Watch GMOT chart and read a more detailed GENERAL MOTORS CO stock forecast: see what analysts think of GENERAL MOTORS CO and suggest that you do with its stocks.

GMOT reached its all-time high on Jan 5, 2022 with the price of 58.300 EUR, and its all-time low was 14.730 EUR and was reached on Mar 18, 2020. View more price dynamics on GMOT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GMOT stock is 0.66% volatile and has beta coefficient of 0.82. Track GENERAL MOTORS CO stock price on the chart and check out the list of the most volatile stocks — is GENERAL MOTORS CO there?

Today GENERAL MOTORS CO has the market capitalization of 43.19 B, it has decreased by −1.59% over the last week.

Yes, you can track GENERAL MOTORS CO financials in yearly and quarterly reports right on TradingView.

GENERAL MOTORS CO is going to release the next earnings report on Jul 22, 2025. Keep track of upcoming events with our Earnings Calendar.

GMOT earnings for the last quarter are 2.57 EUR per share, whereas the estimation was 2.48 EUR resulting in a 3.70% surprise. The estimated earnings for the next quarter are 2.00 EUR per share. See more details about GENERAL MOTORS CO earnings.

GENERAL MOTORS CO revenue for the last quarter amounts to 40.69 B EUR, despite the estimated figure of 39.96 B EUR. In the next quarter, revenue is expected to reach 38.93 B EUR.

GMOT net income for the last quarter is 2.57 B EUR, while the quarter before that showed −2.86 B EUR of net income which accounts for 189.97% change. Track more GENERAL MOTORS CO financial stats to get the full picture.

Yes, GMOT dividends are paid quarterly. The last dividend per share was 0.13 EUR. As of today, Dividend Yield (TTM)% is 0.96%. Tracking GENERAL MOTORS CO dividends might help you take more informed decisions.

GENERAL MOTORS CO dividend yield was 0.90% in 2024, and payout ratio reached 7.54%. The year before the numbers were 1.00% and 4.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 7, 2025, the company has 162 K employees. See our rating of the largest employees — is GENERAL MOTORS CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GENERAL MOTORS CO EBITDA is 28.89 B EUR, and current EBITDA margin is 12.93%. See more stats in GENERAL MOTORS CO financial statements.

Like other stocks, GMOT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GENERAL MOTORS CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GENERAL MOTORS CO technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GENERAL MOTORS CO stock shows the buy signal. See more of GENERAL MOTORS CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.