How to Spot Flag Patterns on TradingViewLearn to identify and trade flag patterns in TradingView with this step-by-step tutorial from Optimus Futures. Flag patterns are continuation formations that help traders join existing trends by buying high and selling higher, or selling low and buying back lower.

What You'll Learn:

• How to identify bullish and bearish flag patterns on any timeframe

• Breaking down flag patterns into two parts: the flagpole and the flag

• Finding strong flagpole formations with fast, obvious price moves

• Spotting flag consolidation areas that form tight ranges

• Why flag patterns work: buyer and seller psychology explained

• Real chart examples showing how flag patterns develop and play out

This tutorial may help futures traders and technical analysts who want to trade with market trends rather than against them. The concepts covered could assist you in identifying opportunities to join strong price movements when they pause before continuing.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

FLAG

BTCUSD: Decoding the Price Action Through "Tape Reading"🚀 BTCUSD: Decoding the Price Action Through "Tape Reading" 🚀

Hey Traders,

Let's dive into a "tape reading" analysis of BTCUSD, breaking down the recent price movements and looking ahead. We've seen some fascinating patterns emerge, and understanding them could be key to our next moves.

🔍 A Look Back: The Bullish Flag Formations 🔍

Our journey begins on April 7th, 2025, with the establishment of a strong "Flag Pole" at $74,489.00. This was supported by a robust double bottom, setting the stage for what was to come.

First "Flag" Confirmation: We saw the first "Flag" form, confirmed by a powerful "Hammer" candle on April 20th, 2025. This Hammer, with its unique "bottom-less Marubozu" body, signaled significant underlying strength.

Second "Flag" Confirmation: Another "Flag" emerged, solidified by strong multi-day bottom support around $94,791.00. This resilience suggested continued upward momentum.

The Breakout: On May 8th, 2025, BTCUSD surged, breaking out of its previous patterns and entering a new "flag pole" formation.

Third "Flag" & All-Time High: May 15th, 2025, brought the third "Flag" formation, again supported by a "Hammer" and a bullish Marubozu. This momentum culminated in a breach of the $105,770.00 multi-month price level on May 20th, 2025, breaking the previous all-time high from December 17th, 2024! We then rocketed to a new all-time high of $112,000.

📉 Recent Developments: The Downtrend and Key Levels 📉

Since the all-time high, we've started to experience a shift:

Downtrend Begins: A downtrend initiated around May 22nd, 2025.

High-Low Formations: We observed a second high-low formation on May 27th, 2025, followed by another on June 9th, 2025.

Double Top & Hanging Man: A clear double top formation emerged, further supported by a "Hanging Man" candle on June 10th, 2025.

🔮 What's Next? The Critical Close 🔮

Today's candle close is absolutely paramount! As of now, the candle is still forming, but my current read suggests a potential move to fill the wick of the June 13th, 2025, "Hammer" candle.

The direction BTCUSD takes – North or South – will largely be dictated by how today's candle closes. This will be our prime dominant signal.

Monthly Candle Perspective:

Interestingly, the Monthly candle is showing similar "Flag" patterns. Check out the chart here for a broader perspective:

Let me know your thoughts in the comments below! Are you seeing the same patterns?

Trade safe!

_________________________________________________________________________________

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

OPEC Countdown: Inverted H&S Signals Potential Oil Price Rise🧭 Market Context – OPEC in Focus

As Crude Oil Futures (CL) grind in tight consolidation, the calendar reminds traders that the next OPEC meeting takes place on May 28, 2025. This is no ordinary headline event — OPEC decisions directly influence global oil supply. From quota adjustments to production cuts, their moves can rapidly shift price dynamics across energy markets. Every tick in crude oil reflects not just current flows but also positioning ahead of such announcements.

OPEC — the Organization of the Petroleum Exporting Countries — coordinates oil policy among major producers. Its impact reverberates through futures markets like CL and MCL (Micro Crude), where both institutional and retail traders align positions weeks in advance. This time, technicals are speaking loud and clear.

A compelling bottoming structure is taking shape. The Daily timeframe reveals an Inverted Head and Shoulders pattern coinciding with a bullish flag, compressing into a potential breakout zone. If momentum confirms, CL could burst into a trend move — just as OPEC makes its call.

📊 Technical Focus – Inverted H&S + Flag Pattern

Price action on the CL daily chart outlines a classic Inverted Head and Shoulders — a reversal structure that traders often monitor for high-conviction setups. The neckline sits at 64.19, and price is currently coiled just below it, forming a bullish flag that overlaps with the pattern’s right shoulder.

What makes this setup powerful is its precision. Not only does the flag compress volatility, but the symmetry of the shoulders, the clean neckline, and the breakout potential align with high-quality chart pattern criteria.

The confirmation of the breakout typically requires trading activity above 64.19, which would trigger the measured move projection. That target? Around 70.59, which is near a relevant UFO-based resistance level — a region where sellers historically stepped in with force (UnFilled Orders to Sell).

Importantly, this bullish thesis will fail if price drops below 60.02, the base of the flag. That invalidation would potentially flip sentiment and set up a bearish scenario with a target near the next UFO support at 53.58.

To properly visualize the dual scenario forming in Crude Oil, a multi-timeframe approach is often very useful as each timeframe adds clarity to structure, breakout logic, and entry/exit positioning:

Weekly Chart: Reveals two consecutive indecision candles, reflecting hesitation as the market awaits the OPEC outcome.

Daily chart: Presents a MACD bullish divergence, potentially adding strength to the reversal case.

Zoomed-in 4H chart: Further clarifies the boundaries of the bullish flag.

🎯 Trade Plan – CL and MCL Long/Short Scenarios

⏫ Bullish Trade Plan:

o Product: CL or MCL

o Entry: Break above 64.19

o Target: 70.59 (UFO resistance)

o Stop Options:

Option A: 60.02 (tight, under flag)

Option B: ATR-based trailing stop

o Ideal for momentum traders taking advantage of chart pattern combined with fundamental data coming out of an OPEC meeting

⏬ Bearish Trade Plan:

o Trigger: Break below 60.02

o Target: 53.58 (UFO support)

o Stop Options:

Option A: 64.19 (tight, above flag)

Option B: ATR-based trailing stop

o Ideal for momentum traders fading pattern failures

⚙️ Contract Specs – CL vs MCL

Crude Oil can be traded through two futures contracts on CME Group: the standard CL (WTI Crude Oil Futures) and the smaller-sized MCL (Micro WTI Crude Oil Futures). Both offer identical tick structures, making MCL a powerful instrument for traders needing more flexibility in position sizing.

CL represents 1,000 barrels of crude per contract. Each tick (0.01 move) is worth $10, and one full point of movement equals $1,000. The current estimated initial margin required to trade one CL contract is approximately $6,000 per contract, although this may vary based on market volatility and brokerage terms.

MCL, the micro version, represents 100 barrels per contract — exactly 1/10th the size of CL. Each 0.01 tick move is worth $1, with one point equaling $100. The estimated initial margin for MCL is around $600, offering traders access to the same technical setups at significantly reduced capital exposure.

These two contracts mirror each other tick-for-tick. MCL is ideal for:

Testing breakout trades with lower risk

Scaling in/out around events like OPEC

Implementing precise risk management strategies

Meanwhile, CL provides larger exposure and higher dollar returns but requires tighter control of risk and account drawdowns. Traders can choose either—or both—based on their strategy and account size.

🛡️ Risk Management – The Foundation of Survival

Technical setups don’t make traders profitable — risk management does.

Before the OPEC meeting, traders must be aware that volatility can spike, spreads may widen, and whipsaws can invalidate even the cleanest chart pattern.

That’s why stop losses aren’t optional — they’re mandatory. Whether you choose a near level, a deeper stop below the head, or an ATR-based trailing method, the key is clear: define risk before entry.

MCL helps mitigate capital exposure for those testing breakout confirmation. CL demands higher margin and greater drawdown flexibility — but offers bigger tick rewards.

Precision also applies to exits. Targets must be defined before entry to maintain reward-to-risk discipline. Avoid adding to losers or chasing breakouts post-event.

And most importantly — never hold a losing position into an event like OPEC, hoping for recovery. Risk is not a gamble. It’s a calculated variable. Treat it with respect.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

How to Identify and Trade Flag Patterns EffectivelyThe flag pattern is one of the most effective trading setups in the crypto market, known for its reliability and high probability of continuation in trending markets. Here’s a detailed overview of what a flag pattern is, how to identify it, and why it works so well in crypto trading.

What is a Flag Pattern?

A flag pattern appears as a brief consolidation following a strong price movement, resembling a rectangular shape. There are two main types of flag patterns: bull flags and bear flags.

Bull Flag: This pattern typically forms after a strong upward price movement (the flagpole), followed by a slight pullback or consolidation (the flag) before the price continues its upward trend. The flag usually slopes downward or moves sideways.

Example of Bullish Flag Pattern.

Bear Flag: Conversely, a bear flag occurs after a significant downward movement, followed by a consolidation that trends slightly upward, indicating a continuation of the downward trend once the price breaks down through the flag.

Example of Bearish Flag Pattern.

Identifying Flag Patterns

To identify a flag pattern, traders look for:

🏳️ Flagpole: This is the initial sharp price movement.

🏳️ Flag Formation: This should be a consolidation phase that lasts from 2-3 candles up to more than ten, depending on the timeframe.

🏳️ Volume Analysis: Ideally, the volume should be higher during the flagpole and lower during the flag consolidation. An increase in volume upon breakout is a strong confirmation of the continuation.

Here is the example chart for identifying the flag pattern:

Trading the Flag Pattern

To trade a flag pattern effectively, follow these steps:

📈 Entry: For a bull flag, consider entering the trade once the price breaks above the upper boundary of the flag. For a bear flag, enter on a break below the lower boundary.

📈 Stop Loss: Place your stop loss just below the flag (for bull flags) or above the flag (for bear flags).

📈 Profit Target: A common target is to measure the height of the flagpole and project that distance from the breakout point.

Example chart showing how to place a trade using the flag pattern:

Why It Works in Crypto Markets

The flag pattern is particularly effective in the crypto market for several reasons:

📊Volatility: Cryptocurrencies are highly volatile, which can create strong price movements leading to clear flag formations.

📈 Trend Continuation: Flags often appear in trending markets, where there’s a significant amount of bullish or bearish momentum.

🧠 Psychological Factors: Traders recognize these patterns, leading to increased buying or selling pressure at breakout points.

Example of Bullish and Bearish Flag Pattern:

Bullish Flag:

Bearish Flag:

Flag patterns are highly effective in crypto trading, offering clear signals for trend continuation. They are especially useful in volatile markets, providing reliable entry and exit points. By identifying strong momentum during the breakout and combining it with volume analysis, traders can use flag patterns to make well-informed, high-probability trades.

All About the Flag Pattern (Beginner-Friendly)Hello everyone,

Today, I’ve prepared an educational guide on chart patterns, specifically focusing on the Flag Pattern.

This content is designed to be easy for beginners to follow, so I hope you find it engaging and informative. :)

Below is the outline I’ll be using for this post:

————

✔️ Outline

1. What is a Flag Pattern?

Definition

Key Components

Characteristics

2. Bullish Flag Pattern

Basic Characteristics

Examples

3. Bearish Flag Pattern

Basic Characteristics

Examples

————

1. What is a Flag Pattern?

1) Definition

A Flag Pattern forms during a brief consolidation phase after a strong price movement, often signaling the continuation of a trend. It typically appears when prices make a sharp move, either up or down, followed by a period of sideways or slightly counter-trend movement.

Flag Patterns can occur in both uptrends and downtrends, named for their resemblance to an actual flag. After a strong price move, the market consolidates briefly before continuing in the original trend direction.

2) Key Components

Flagpole: The initial strong price movement that sets the overall trend direction before the consolidation phase.

Flag: The consolidation period where prices move sideways or slightly counter to the trend, often forming a rectangle or parallelogram. This phase typically occurs with a decrease in trading volume.

Breakout: The moment when the price resumes its original trend direction. In an uptrend, this is an upward breakout, and in a downtrend, a downward breakout, confirming the continuation of the trend.

3) Characteristics

Duration: The Flag Pattern typically lasts longer than the Flagpole but varies depending on the timeframe.

Volume: Volume usually decreases during the Flag’s formation and increases once the breakout occurs.

Reliability: The Flag Pattern is considered a reliable indicator of trend continuation, making it a favorite among traders using trend-based strategies.

————

2. Bullish Flag Pattern

1) Basic Characteristics

A Bullish Flag forms after a strong upward price movement, signaling a temporary consolidation phase. During this consolidation, volume typically decreases, suggesting that the market is pausing rather than reversing. After this phase, the price often continues its upward trend, accompanied by an increase in volume. Bullish Flag Patterns also help relieve overbought conditions in technical indicators, providing the market with a chance to prepare for another move up.

2-1) Example 1

This chart from May 2023 shows a strong Flagpole followed by a long consolidation phase (Flag). The volume then increased as the price broke out, completing the Bullish Flag Pattern.

2-2) Example 2

In this chart from March 2021, we see a similar setup: a strong Flagpole, followed by a consolidation phase, leading to a breakout that continued the upward trend.

————

3. Bearish Flag Pattern

1) Basic Characteristics

The Bearish Flag Pattern is the inverse of the Bullish Flag. It follows a strong downward move (Flagpole) and is followed by a period of consolidation (Flag) with decreasing volume. Like its bullish counterpart, the Bearish Flag can relieve oversold conditions, leading to a continuation of the downtrend after a breakout.

2-1) Example 1

This chart from May 2022 displays a Bearish Flag Pattern: a strong downward Flagpole, followed by a Flag consolidation phase. After the consolidation, a breakout occurred, continuing the downtrend.

2-2) Example 2

This chart from February 2022 also illustrates a strong downward Flagpole, followed by a consolidation phase (Flag), leading to a breakout that completed the Bearish Flag Pattern.

This guide will help you better understand the Flag Pattern and how it can be used in your trading strategy effectively!

————

✔️ Conclusion

I hope the various Flag Patterns and market analysis techniques covered in this post prove helpful in your investment journey. Chart analysis is not merely a technical skill but also a deeper understanding of market psychology and movement. Flag Patterns, along with other chart patterns, visually reflect the psychological dynamics of the market. Mastering their use can greatly contribute to successful trading.

That being said, the crypto market is inherently unpredictable and fast-moving. While technical analysis is a valuable tool, it’s important to adopt a comprehensive approach that considers broader market trends and external factors. I encourage you to apply the insights gained from this post with a balanced and cautious perspective when making investment decisions.

New opportunities are constantly emerging, and those who are prepared to seize them will find success. The chart represents the market’s voice. Listening to it, interpreting it, and making informed decisions based on that interpretation is "the essence" of chart analysis.

I sincerely hope that, through continuous learning and experience, you’ll evolve into a more confident and successful investor.

The Mechanics Of Trading - Part XII - 6-4-24 FlagsPart XII

I started this video because a friend asked me for help determining trends on multi-interval (time frames) and asked how I look at trading across multiple intervals. Asking how to best setup/use price trends to capture the best trade setups.

Essentially, it comes down to three key components...

A. Initial reversal/impulse waves should be traded lightly (if at all). They are the "potential price reversal setups" that are usually the most dangerous for traders (and often fairly short in length).

B. Looking for the second wave to form provides traders with the opportunity to catch the bigger Wave-3. This wave forms after the impulse (Wave-1) and a corrective wave (Wave-2), which must stay below any previous ultimate high or above any previous ultimate low.

C. Wave-3, and Wave-5 if applicable, are where traders can flex their muscles related to trade size using the techniques I present to try to capture the MEAT (Sweet Spot) of any trend.

Remember, after Wave-3, you must prepare for the potential end of a trend setup where volatility is likely to increase and risks become a bit more elevated.

I go over multiple techniques in this video.

Fibonacci techniques and Fibonacci Price Theory

Anchor Bars (breakaway bars)

Using Fibonacci Retracements to identify key support/resistance levels for trending

Stochastics

RSI

Wave formations (ZigZag)

and Others

This video is designed as an instructional video to help you incorporate usable techniques into your own trading style.

Hope you enjoy.

Market structure, Right side of the marketMarket structure is one of the most important thing one can learn in trading. If you are day trading or investing staying on right side of the market is very important. Market structure help to identify the right side of the market. Lets say market is making HH (Higher high) and HL (higher low) that's bullish market structure. Meaning buyers are in control and its a bull trend. If market making LL (Lower low) and LH (Lower high) then seller are in control making it a bear trend.

Market are always in trend or trading range. In trend you are either in a bull trend or a bear trend. Market usually don't go from bull trend to bear trend. Often it will stay a trading range after a trend. If market breaks that trading range in trend direction then we call that flag pattern. If it was a bull tend a bull flag and on a bear trend a bear flag, but if price fails to continue going in earlier trend direction then its become a failed flag and then trader thinks we might get a trend reversal.

lets say market is in a bull trend so its making HH and HL . But if market fail to make a HH or HL and it ends up making LH then people start to think if this bull trend is still a strong bull trend which can cause market to shift from bull trend to trading range. And after a LL many bull will get out of their position which could create a LH and end up reversing a trend. In which case if price in a bull structure and market making HH and HL you should only be a buyer and after market structure change its direction then you can think if you should sell.

What is the ( Flag pattern) ?A flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause.

The flag pattern is formed by two main components:

Flagpole : The first part of the pattern is a strong and sharp price movement, either upward (bullish flag) or downward (bearish flag). This initial move is known as the flagpole and represents a strong surge in buying or selling activity.

Flag : Following the flagpole, there is a period of consolidation where prices move in a rectangular or parallelogram-shaped pattern. This consolidation phase is referred to as the flag. The flag is characterized by decreasing volatility and typically forms a channel or a rectangle.

There are two types of flag patterns:

Bullish Flag: The flagpole is an upward price movement, and the flag is a downward-sloping consolidation. This pattern suggests a temporary pause in the upward trend before a potential continuation.

Bearish Flag: The flagpole is a downward price movement, and the flag is an upward-sloping consolidation. This pattern indicates a temporary pause in the downward trend before a potential continuation.

Traders often look for flag patterns as they may provide insights into the market sentiment and offer potential trading opportunities. The breakout direction (up or down) from the flag pattern is considered a signal for the potential future price movement. However, it's important to note that not all flags result in a continuation of the previous trend, and traders often use other technical indicators and analysis to confirm signals and manage risk.

Advanced Bull Flag ConceptsHave you ever wondered why price action sometimes forms a bull flag pattern?

Have you ever wondered if there is a way to predict whether a bull flag will break out before it actually does so?

In this post, I will try to address these questions by presenting a couple of theories about the nature of bull flags.

Bull Flag Theories

(1) The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole; and

(2) Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

I will try my best to clearly explain both theories in detail below.

Note: Although this analysis is also generally true for bull pennants, bear flags, and bear pennants, to keep things simple I will focus solely on bull flags. Additionally, this analysis is generally true across timeframes.

Part I - The Basics of a Bull Flag

First, let's begin with the basics. As shown in the image below, bull flags form when an asset is in a strong uptrend. The uptrend forms the flagpole of the bull flag structure.

The flag structure forms when price consolidates, usually in a falling trend. This consolidation phase is often characterized by price oscillators rotating back down while the price retraces only a small part of its prior upward move.

From a market psychology perspective, bull flags often form when most market participants who bought the asset continue to hold it expecting the uptrend to resume, while only a minority of market participants sell (or short the asset) as its price corrects downward. The bull flag pattern is a continuation pattern because it reflects the market's general expectation that price will eventually resume its upward move.

Once the price definitively breaks above the upper channel of the flag (often with strong momentum and high volume), the bull flag pattern is validated. Upon breakout, the expected move up is equal to the vertical height of the flagpole.

Part II - The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole

Here's where things begin to get interesting. Below is the golden ratio.

Two quantities, a and b (where a > b ), form the golden ratio if their ratio is the same as the ratio of their sum to the larger of the two quantities. (See the equation below)

The equation above shows the Greek letter phi which denotes the golden ratio. Phi is equivalent to a/b when such ratio is also equivalent to (a + b)/a.

Although bull flags can take various forms, it is my hypothesis, based on chart analysis and research, that the most perfectly structured bull flags (ones that also have the highest probability of successful breakouts) occur when the flag forms a golden ratio to the flagpole.

Mathematically, this means that the vertical height of the flagpole is equivalent to (a + b) and the vertical height (i.e. the width) of the flag is equivalent to b. This is also to say that price retraces down to the 0.382 Fibonacci level as measured by applying Fibonacci retracement levels along the flagpole (or to the 0.618 point on the vertical height of the flagpole if one measures from the bottom to top).

I realize that this can be quite confusing, so let’s walk through some visualizations.

Let's first visualize this hypothesis using the golden rectangle. Below is an image of the golden rectangle. A golden rectangle is composed of a square (with sides equal to a) and a smaller golden rectangle (with width equal to b and length equal to a).

Now let's rotate the golden rectangle to better visualize the hypothesized flag pattern.

The bull flag is hypothetically an approximation of the golden rectangle, whereby the width of the flag is in a golden ratio approximation to the length of the flagpole.

In the illustration below, there are multiple bull flags contained within a Fibonacci spiral. The spiral is made up of golden rectangles, with each larger golden rectangle containing a smaller golden rectangle inside it. The smaller golden rectangle is the flag structure, and the length of the larger golden rectangle is the flagpole.

One can think of the Fibonacci spiral and the golden rectangles as a series of bull flags that build on top of each other in a repeating pattern. In this diagram, price is represented by the increasing length of the sides of each golden rectangle. In other words, the price on a chart can be seen as spiraling higher after each bull flag breakout.

Of course, not all bull flags form a structure that approximates the golden ratio, but it is my belief that in forming a bull flag, price action is aspiring to achieve as close of a golden ratio approximation as it can. I believe that the bull flags that best approximate the golden ratio structure also present the highest probability for a successful break out.

To learn more about Fibonacci spirals, including the golden spiral that Fibonacci spirals approximate, you can check out this Wikipedia article: en.wikipedia.org

Part III - Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

To see how Fibonacci levels and regression analysis can give insight into whether a bull flag will break out or break down before it does so, let's consider an example.

Let’s consider the massive bull flag that the iShares Russell 2000 ETF (IWM) formed in 2021.

In 2021, the monthly chart of IWM formed what appeared to be a bull flag, as shown below.

Now let's see why Fibonacci analysis and regression analysis were warning that this bull flag was not likely to break out successfully.

First, IWM's price did not retrace to a Fibonacci level before attempting a breakout (when using the pole as the Fibonacci retracement reference point). In the chart below, we see that price tried to break out, without even so much as retracing down to the highest Fibonacci retracement level: $196.71. By not undergoing Fibonacci retracement, price did not give its oscillators the opportunity to rotate back down fully. Instead, price remained overextended at the time it attempted to break out.

Now let's look at regression analysis. Below is a log-linear regression channel that contains IWM's entire price history. As noted in my prior posts, a regression channel simply indicates how far above or below the mean (or average) price an asset's current price is trading. In the regression channel above, the red line is the mean price, the upper channel line is 2 standard deviations above the mean, and the lower channel line is 2 standard deviations below the mean.

A successful breakout of the bull flag would have taken IWM's price way above its regression channel, to a level that is too many standard deviations above its mean price for us not to question the probability of the breakout’s success. Achieving the full measured move up would have been extremely unlikely, assuming that the regression channel is valid and that price tends to revert back to its mean over time. What was more likely than a breakout was a breakdown, and a reversion back to the mean, which is what ended up happening with IWM.

Another interesting note about IWM’s bull flag is that it presented a false breakout in November 2021. This false breakout was presenting multiple warnings signs including being a UTAD test of a Wyckoff Distribution. As shown below, however, another important clue that the November 2021 breakout would likely fail was that the breakout was not confirmed when comparing IWM to the money supply (M2SL). See the chart below.

One can interpret this chart to mean that in late 2021, IWM’s price was rising because the central bank was increasing the money supply, but not due to improving strength of the underlying companies that comprise the ETF. Using the money supply as a ratio to an asset elucidates the true inherent strength of the asset's value. To understand more about why the money supply can be used in this manner, you can check out my post below.

Part IV - Additional Comments

I have a few additional comments. I usually use Fibonacci levels on a log-scale chart to identify Fibonacci spirals because Fibonacci spirals are logarithmic spirals. However, when using Fibonacci levels based on log scale, the ratios, percentages and numbers, can seem quite confusing because they are logarithmically adjusted. If you choose to replicate my process, please be mindful of this. While using log-scale charts is critical for higher timeframes (e.g. the monthly chart or higher), I have not identified much benefit to using it on shorter timeframes.

In a prior post, I noted that Plug Power (PLUG) is currently forming one of the best-looking log-scale, golden ratio bull flags I have ever seen. If my above hypotheses are true, I would expect to see PLUG move dramatically higher in the years to come. For more information about PLUG, you can read my post linked below. (This is not a solicitation to buy PLUG. Please do your own research and carefully consider all risks.)

At the risk of making this post too long and too dense, I just want to briefly note that it is also my hypothesis, based on observation and research, that the golden ratio is where many S-curve dilemmas are solved. If you don't know what an S-curve dilemma is and you'd like to read about this you can see my post below about Jumping S-Curves .

In short, an S-curve dilemma is another way of conceptualizing the question of whether a bull flag will break out or break down.

I hope that someone finds value in this post. I spent a lot of time studying, researching, analyzing, and cogitating the mathematical nature of price action to reach many of the conclusions here. Thank you for your valuable time in reading my post.

Learn To Trade Breakout/Flags More Efficiently - Part IIn my first tutorial, I tried to show how price channels can be used to identify and validate strong trade setups. Additionally, I attempted to show you how to identify better trade setups from what I consider invalid trade setups.

Understanding and maintaining at least a 2:1 Reward-to-risk factor for any trade you consider taking is essential. Secondly, it is essential to understand and use proper allocation levels for trades.

The simple way to understand allocation levels is to focus on the RISK amount. If your trade risks $5 per share and you can't afford to risk $500 on this trade, then you should NOT attempt to trade 100 shares of this stock.

Set your risk level based on how much you intend to risk for the trade - nothing more.

If you can only risk $250, then you would only trade 50 shares.

If you can only risk $125, then you would only trade 25 shares.

Learning to find and identify proper trade setups on Daily and Weekly charts is critical for success in the long run. I firmly believe price tells us everything we need to know about a chart, and indicators reflect price.

As you continue to learn some of the techniques I use in various price chart setups, I hope you can refine your techniques to become better traders.

I will likely create a PART II and PART III version of these types of advanced trade setups.

Hope you enjoy.

Bearish and Bullish Flag Chart PatternsFlag Pattern:

A flag is a chart pattern formed during a counter-trend move after a sharp price movement.

Why is it called Flag?

It is named because of the way it reminds the viewer of a flag on a flagpole.

What does the Flag Pattern represent?

It signifies trend reversals or breakouts after a period of consolidation.

The five main characteristics of a Flag Pattern are:

1. The preceding trend

2. The consolidation channel

3. The volume pattern

4. A breakout

5. A confirmation occurs when the price moves in the same direction as the breakout.

How to identify the Flag Pattern:

The most important part of the flag pattern is to identify a strong trend (in either direction, as the flag may be inverted, triggering a bearish move!). Take a look at the higher time frames when you find a flag pole to ensure the price is not simply ranging. It could be meeting a large area of resistance!

Bullish Flag Pattern:

When the prices are in an uptrend, a bullish flag pattern shows a slow consolidation lower after an aggressive uptrend. This indicates that there is more buying pressure moving the prices up than down and indicates that the momentum will continue in an uptrend.

Traders wait for the price to break above the resistance of the consolidation after this pattern is formed to enter a long position.

The breakout indicates that the prior uptrend will continue.

Example of a Bullish Flag Pattern:

Bearish Flag Pattern:

When the prices are in a downtrend, a bearish flag pattern shows a slow consolidation higher after an aggressive downtrend. This indicates that there is more selling pressure moving the prices down than up and indicates that the momentum will continue in a downtrend.

Traders wait for the price to break below the support of the consolidation after this pattern is formed to enter a short position.

Example of a Bearish Flag Pattern:

Conclusion:

A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. When the prices are in an uptrend, a bullish pattern shows a slow consolidation lower after an aggressive uptrend. When the prices are in a downtrend, a bearish pattern shows a slow consolidation higher after an aggressive downtrend. It is formed when there is an increase in demand or supply that causes the prices to move up or down.

May you all be PROFITABLE,

🚩 Bull Flags VS Bear Flags🚩What is a Flag Pattern?

A flag pattern is a commonly observed technical analysis pattern used to identify potential continuation of current market trends.

It is characterized by a period of consolidation, where the market experiences a relatively small range of movement, following a significant price movement.

This pattern is formed as the market returns to a state of equilibrium, following a large move. The flag pattern is considered a continuation pattern,

as it often indicates that the market will continue to move in the same direction as the preceding trend, once the flag breaks out.

This breakout typically occurs when the price of the security breaches the upper or lower boundary of the flag, and it is usually accompanied by an increase in trading volume.

📈📉The difference between a Bull flag VS Bear flag

The difference between a bullish and a bearish flag is in the direction of the price movement. With the bullish flag, the idea is to participate in a strong uptrend. Meanwhile, with the bearish flag pattern, the idea is to trade short in the direction of the prevailing downtrend.

- Downtrend vs uptrend: Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel channel.

- Bull flag: A bull flag is a sharp, strong volume rally of an asset or stock that portrays a positive development.

- Bear flag: A bear flag is a sharp volume decline on a negative development.

- Bull flag and bear flag share the same traits: Traits of Flag Patterns include support and resistant levels, flag, flag pole, breakout points and price projections.

📍Entry opportunities

The most important component of any flag pattern trade is the entry. It’s generally advisable to wait for a candle to close beyond the breakout point before creating any orders to avoid being burned by a false signal. In the example above, the entries are made on a High risk - High reward mindset with stop loss bellow the flag pattern. Most traders will enter a flag pattern trade on the day after the price has broken beyond the trend line. The length of the flag pole is typically used to calculate the profit target. Even when the formation of a flag pattern is obvious, there is no guarantee that the price will move in the expected direction. As with most technical analysis, you will get the best results from flag patterns by applying them to longer-term charts as you will have more time to consider your strategy and analyze the price action.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

What is Flag pattern and how to trade with that?Flag Pattern (Bullish)

* One of the most common patterns of price trend continuation is the FLAG pattern. How to identify this pattern? How to use it in trading most effectively?I will cover it all through this post.

* The Flag pattern is a type of price pattern in bullish trends. This pattern consists of a strong increase (called a flagpole), followed by a countertrend with two levels of Resistance and Support (called flags). The price forms this pattern after a strong increase. It then breaks out of the Resistance and continues rising, marking the end of the pattern. This is a very common behavior of prices during an uptrend.

* After breaking out of the Resistance, the price can retest this new Support.

How to open an order :

Entry Point : Right after the candlestick breaks out of the Resistance.

Stop-Loss : At the bottom of the price channel (the lowest point of the support).

Target : At the price whose, from the entry point, the length is equal to the length of the flagpole.

* In the future, we will publish other patterns such as Triangle, head and shoulders, wedge and other educational materials 📚 . Please follow our page to be informed as soon as the materials are published.

Thank you all for supporting our activity with Likes 👍 and Comments ❤️

Triangles, Flags, Pennants.Chart patterns, are becoming one of my favorites points of view in the market.

Using this tools i become more aware of where i am in the market, the trend and where i can place correct entry's

Lets consider the difficulty of this structures. First i am not using individual lines in this chart, i am using tool bar channels. That means that the line above has to be the same as the line below, that been said. the patterns showed in this chart are just made for expert traders. Simple and clean.

We can force some structures, but when we use tool bar patterns its very hard to find structures that make sense in the market.

Thanks fo the support traders.

And keep rocking in the free world.

How to use trendline to identify price action structure/patternHi everyone:

Many have asked me about how to properly use trendlines to identify price action structures and patterns. So in today’s educational video, I will go over this topic in more detail.

First, I use the trendline as a “frame” to identify structures and patterns, and NOT use it as a Support/Resistance.

What I do is to put in the trendline for the highs and lows of the price action that can help me to pinpoint what the price is doing, what kind of a correctional structure that it is currently in.

Typically after an impulse phase of the market, then we start to identify a structure/pattern by connecting the swing highs and lows.

Second, as I always point out in my videos/streams, a structure/pattern needs at least 2 swing highs and lows to classify as a structure.

Certainly more swing highs and lows are good, but it's not necessary. Often I get asked about the “third touch” or more. To me it's not necessary, but if price does form the third touch, I would proceed the same as the price has a second touch.

Third, we are identifying the price action correctional structure, and sometimes the market is not perfect, it will not give you a textbook looking bullish flag as an example.

Hence the backtesting and chartwork from each trader is important to get your mind familiarized with the market and its “imperfect” development of the price action.

After identifying the impulse phase, then look to see what the market is doing. Is it falling into a consolidation ?

Not much movement except sideway price action, or ascending/descending like consolidation will give you a clue on whether the price is correcting to continue, or correcting to reverse.

Take a look at the educational videos I have made in the past regarding the type of correctional structures we typically see in the market. All the videos are down below.

Continue to backtest and do chart work to get familiar with drawing in the structures/patterns. The more you do these, the better and easier it is for you to identify them in your trading journey.

Remember, the market is not perfect, so not all the structures/patterns will be “Textbook” like on the real, live market. Learn to deal with the “imperfect” market, so you can better utilize price action analysis to your advantage.

Any questions, comments or feedback welcome to let me know :)

Thank you

Below are all my price action structures/patterns videos on different type of corrections.

Continuation and Reversal Correction

Identify a correction for the next impulse move in price action analysis

Impulse VS Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Parallel Channel (Horizontal, Ascending, Descending)

Reversal Ascending/Descending Channel

Reversal Rising/Falling Wedge

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Continuation/Reversal Expanding Structure/Pattern

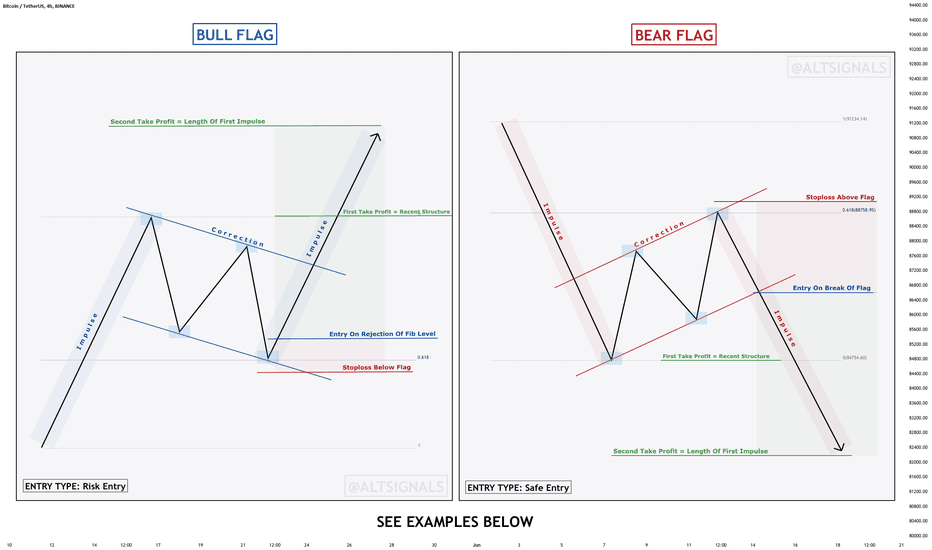

EDUCATION - Identifying & Trading Flag PatternsIn this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

FLAG PATTERNS - Hi

(1) as you see when a bullish pattern wants to be a bearish pattern , after breaking support line , we can see a bullish flag or bullish triangle .

(2) as you see when a bearish pattern wants to be a bullish pattern after breaking resistance line we can see

bearish triangle or a bearish flag pattern .

so these patterns will help you to understand market better .

📚 Impulsive & Corrective Breaks - How To Identify & Trade Them 📚What is an Impulse?

An impulse is defined as a strong move whereby the market moves quite strongly or heavily in one direction, covering a great distance in a short period of time.

Typically, when there's a trend reversal occurring, we require an impulse in the opposite direction of the trend, indicating to us that there's a possible trend reversal. The question we face now is "What does an impulse need to look like for there to be a trend reversal?". Throughout my years in trading, I've found that if a significant level is broken during the impulse, we can expect a follow through of that impulse after a brief correction or a retest.

In the Impulse diagrams, you can see that I've marked out a recent significant level where price reacted. When there was an impulse, I kept an eye on the level to see if it breaks. If it did not break, I can assume that the impulse wasn't strong enough to create a trend reversal and it is merely a bigger more aggressive correction.

However, if the level did break along with the trendline, we can assume that there is a trend reversal taking place and we should keep our focus on the key level and price action for corrections such as flags, pennants , channels etc.

Please see chart updates for examples of Impulsive Breaks and how to trade them.

What is a Correction?

A correction is defined as a relatively short-term movement of the market in the direction opposite to the main trend.

To identify whether a break of a trendline is an impulsive break of corrective break, we must also identify the key level by looking at a significant level where price reacts. If the impulse that breaks the trendline does NOT break the level, we can assume that the trend isn't ready to reverse yet and it is a corrective break. Often a corrective break ends up with an impulse breaking the significant level, at which time we can look for a correction to take our trade.

See chart updates below for examples of corrective breaks and how to trade them.

Please leave a like and comment what you think!

As always, Goodluck and trade safe!

Mr Wick.

📚 Impulsive & Corrective Breaks - How To Identify & Trade Them 📚What is an Impulse?

An impulse is defined as a strong move whereby the market moves quite strongly or heavily in one direction, covering a great distance in a short period of time.

Typically, when there's a trend reversal occurring, we require an impulse in the opposite direction of the trend, indicating to us that there's a possible trend reversal. The question we face now is "What does an impulse need to look like for there to be a trend reversal?". Throughout my years in trading, I've found that if a significant level is broken during the impulse, we can expect a follow through of that impulse after a brief correction or a retest.

In the Impulse diagrams, you can see that I've marked out a recent significant level where price reacted. When there was an impulse, I kept an eye on the level to see if it breaks. If it did not break , I can assume that the impulse wasn't strong enough to create a trend reversal and it is merely a bigger more aggressive correction.

However, if the level did break along with the trendline, we can assume that there is a trend reversal taking place and we should keep our focus on the key level and price action for corrections such as flags, pennants, channels etc.

Please see chart updates for examples of Impulsive Breaks and how to trade them.

What is a Correction?

A correction is defined as a relatively short-term movement of the market in the direction opposite to the main trend.

To identify whether a break of a trendline is an impulsive break of corrective break, we must also identify the key level by looking at a significant level where price reacts. If the impulse that breaks the trendline does NOT break the level, we can assume that the trend isn't ready to reverse yet and it is a corrective break. Often a corrective break ends up with an impulse breaking the significant level, at which time we can look for a correction to take our trade.

See chart updates below for examples of corrective breaks and how to trade them.

Please leave a like and comment what you think!

As always, Goodluck and trade safe!

Mr Wick.

How to identify a correction for the next impulse move ? How to identify if a correction is finished/completed and ready for the next impulse move ?

Hello everyone:

In this educational video I will go over how to properly identify a correction in price action analysis.

I recently made a price action workshop live stream video that went over everything on impulse - correction, structures/patterns, continuation and reversal corrections,

but I still get a lot of questions on identifying corrections itself.

How to draw, use the trendlines to identify a correction, and how to understand they are going to complete/finish.

In my opinion this is the most important part in technical analysis.

We need to understand that the market moves in phrases, it can only be in the impulsive phrase or corrective phrase.

The key to trading is to understand when a correction finishes, we are going to get the impulsive phrase which will give us traders a better edge in the market to enter, where the momentum is strong.

I have made many educational posts on price action analysis, specifically on continuation or reversal correction, which I will put the links below.

Any questions, comments, or feedback welcome to let me know.

Thank you

Jojo

Price Action Workshop

www.tradingview.com

Impulse VS Correction

Continuation and Reversal Correction

Multi-time frame analysis

Continuation Bull/Bear Flag

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Expanding Structure/Pattern

Top Chart Patterns -- 20 Patterns Will Make You Pro Trader Hi All Trader's -- We Have Today New Education Lesson For ( Top Chart Patterns )

1- Symmetrical Triangle Pattern

2- Ascending Triangle Pattern

3- Inverse Head And Shoulders Pattern

4- Cup And Handle Pattern

5- Falling Wedge

6- Symmetrical Triangle Pattern ( Bearish )

7- Ascending Triangle Pattern ( Bearish )

8- Head And Shoulders

9- Inverse Cup And Handle

10- Rising Wedge

11- Rectangle

12- Flag

13- Pennant

14- Double Bottom

15- Triple Bottom

16- Rectangle ( Bearish )

17- Flag ( Bearish )

18- Pennant ( Bearish )

19 - Double Top

20- Triple Top

Thanks For Browsing My Lesson And Hope You Still Profit Always ♥