📚 What To Look for When Charting Here is a chart of EURCAD. There were various opportunities available both short term and long term. Once you can identify chart patterns, you can easily anticipate where price will go next.

A great chart pattern that I always use is flags - Bull Flags and Bear Flags. In the chart you can see that many times price impulsed and then created a flag and then carried on with the move. Flags can be found both in higher timeframes as well as lower time frames.

Be sure to look out for them!

FLAG

Reversal Impulse Price Action - Trend Change Confirmation Hello everyone:

Welcome back to another price action structures/patterns video.

Today let's take a look into the reversal Impulse price action from the market.

I have back tested and seen these types of price action happen very often in any market, any time frame. Its signaling a very strong trend change and reversal momentum from the price.

Let's take a look into what it looks like usually, and how to effectively take advantage of these types of price action in the market.

Seeing them on the HTF, giving us strong bias for a reversal trend change coming.

Seeing them on the LTF, signs of reversal from the LTF first, and leading towards the beginning of the HTF reversal move.

Remember, Multi-time frame analysis is key. If we spot a potential HTF reversal impulse, then likely LTF price action is also showing reversal price action structures/patterns.

We want to pair as many positive confluences as we can together to give us an edge entering the trades.

As always, any questions, comments or feedback please let me know.

Thank you

Jojo

Bullish patterns in tradingToday there are several popular bullish patterns on the Forex market.

1. Flag - trend continuation.

Has a strong price movement (flag staff), then a correction zone (flag cloth). The correction zone can be located both horizontally and inclined to the "shaft".

2. Cup

Or else "cup with handle. U-shape + corrective movement (" handle ") within 1/3 of the" cup. "Formation of the" handle "is the process of price consolidation towards the line.

After the pattern is formed, the price continues to move in the direction of the cup.

3. Symmetric triangle

It can be either a reversal or a continuing trend.

Formed between two converging support and resistance lines. You can start trading after the breakout of the pattern (depending on the breakout, either buy or sell).

4. Diamond

Reversal pattern formed at local highs and lows of the price chart. The basis is either an uptrend or a downtrend. Completion options - correction or global trend reversal.

5. Double bottom.

It is based on a downward movement + two chart lows and a high point between them. Completes the formation after breaking through the base line. Further - the price growth from the base line in the volume of the figure size.

6. Pennant

Continuation of the main trend. Price gaps are possible prior to the formation of the pattern. In a bullish scenario, the pattern is preceded by an uptrend. Completion of the pattern formation - a breakout in the direction of the previous trend.

--------------------

Share your opinion in the comments and support the idea with likes.

Thank you for your support!

USDCAD Backtesting & Chart Work session on Price Action AnalysisHello everyone:

Welcome to a backtesting/charting session on price action analysis.

Many have inquired about how to properly identify market phrases (Impulse phrase vs corrective phrase).

In addition, how to use trendline properly to identify a structure/pattern as a continuation or reversal correction.

This session will be the start to all these.

So let's take a look into this. To start, make sure you have a new chart layout just for backtesting/charting work.

his won't get overlapped on your current chart for your normal analysis.

Utilizing tradingview’s feature on “replay”, this is how we can backtest and do chart work on previous price action that has already happened.

As we already see the price moved in that period of time, we then look for potential buy/sell bias entries to get familiar with the move within the market.

1. Start from the Higher time frames, top down approach. Utilize multi-time frame analysis to your advantage.

2. Identify what market phrase you are in, is the current price in a HTF impulse phrase ? or in a corrective phrase.

3. Now that you have a more clear bias on the HTF, then go down to the lower time frame to confirm your bias.

Do we see the same bearish/bullish price action on the LTF as well ? If so then that's a good indication that both HTF and LTF have the same buy/sell opportunity.

Look for possible entries on the LTF.

4. Repeat this process with different pairs, different markets to “program” our minds into looking for the similar buy/sell setups in the current, live market.

This is how we don't get FOMO, or fear of losing. If you have done enough backtesting and charting, then you simply remove the emotion out of the equation.

You have seen the move play out over and over again, then it comes down to probabilities.

Feel free to ask me questions, comments or feedback :)

Thank you

How I trade Head and Shoulder Price Action Pattern/StructureHello everyone:

In this quick educational video, I will go over how I utilize Head and Shoulder Pattern/structure in the market.

Specifically, how I identify reversal price action from a Head and Shoulder Pattern.

It's important to understand that Head and Shoulder Is a reversal structure in the market.

When we identify these patterns, they are usually at the top or the bottom of the over price action,

and its signaling a bullish or a bearish trend may be exhausted, and a reversal trend may begin.

Typical H and S will have a bullish move up, followed by a continuation correction (Left Shoulder), and move up again.

At the peak (Head) , instead of a continuation to push up further, we then see a reversal bearish push down.

Then, we see price form that bearish continuation correction (Right Shoulder) now, looking to push the price back lower.

Just like any other price action structures/patterns that I have been talking about, these structures/patterns will appear in any time frames, any market.

So it's important to understand multi-time frame analysis and top down approach.

A 5 min H and S pattern may not be that strong reversal to give you 100 plus pips because the HTF is showing us different bias.

From my experiences, a H and S pattern works best when we spot on the LTF price action. When we have a clear bias on the HTF for a potential bearish reversal, we go down to the LTF to look for confirmation and entry.

Remember a H and S pattern will not always be “textbook” perfect like you will learn from various courses/lessons. The market itself is not perfect, so remember that when you analyze the market.

Last but not least, and inverse H and S is just a mirror of a typical H and S. It's just now you are spotting them at the bottom of the overall price action, and rather to reverse into a bullish trend.

As always, any questions, comments or feedback please let me know.

Thank you

Jojo

In depth look at continuation bull/bear flag structures/patterns

Hello everyone:

Welcome back to another quick educational video on price action structures/patterns.

Today let's go deeper into the continuation correctional structure. Specifically, the continuation bull/bear flag structure.

First it's important to understand that a bullish/bearish flag is a continuation correction.

They are representing a correctional phrase of the price action, before resuming the previous impulse phrase.

As price action traders, we must be able to identify what correction we are seeing.

This will allow you to get ahead and make your forecasting so you are prepare to any potential entries

Second, bullish/bearish flag correction will appear in any time frames, any markets, and in different sizes.

Typically a flag correction will have at least 2 swing highs and 2 swing lows and relatively even and proportion in angle or length.

They can be slightly slanted or very parallel to each other. Remember the market is not perfect, it wont always present us picture perfect, textbook structures.

Thirds, So its important to understand multi-time frame analysis, top down approach.

A LTF bullish/bearish flag may or may not have the potential to start taking off massively due to the higher time frame showing us a conflicting bias.

So its important to add as much confluence to your trade as possible.

As always, any questions, feedback or comments please let me know :)

See you all in my next weekly outlook stream.

Thank you

FLAG = Impulse + Correction - "Learn More Earn More" with usWhat makes the chart interesting today is that:

. GBPAUD challenging the 1.8415 ~ 1.8450 resistance zone.

. Min 450 pips room to run. A break above 1.8450 could push the pair to its 1.8900 previous areas of interest.

. A rejection at the Flag range resistance, however, could lead to another retest of the Flag’s support.

Will the GBP see an upside breakout against the AUD ?

No one knows it! We have to wait and see!

BASICS TECHNICAL ANALYSIS - TRENDFOLLOW FORMATIONFORMATION ANALYSIS: PRICE PATTERNS AND CHART FORMATIONS

A trend setting of technical analysis is formation analysis. In doing so, certain combinations of movement and correction are considered.

If such a combination is detected, the trader can try to trade the resolution of the formation.

Basically, a different is made between the trend continuation formations and the trend reversal formations.

They are often caused by resistance and support lines.

Trend continuation pattern:

Confirm the strength of a trend. These are, for example, rising / falling triangles. Even flags and pennants (see picture) are seen as a trend continuation.

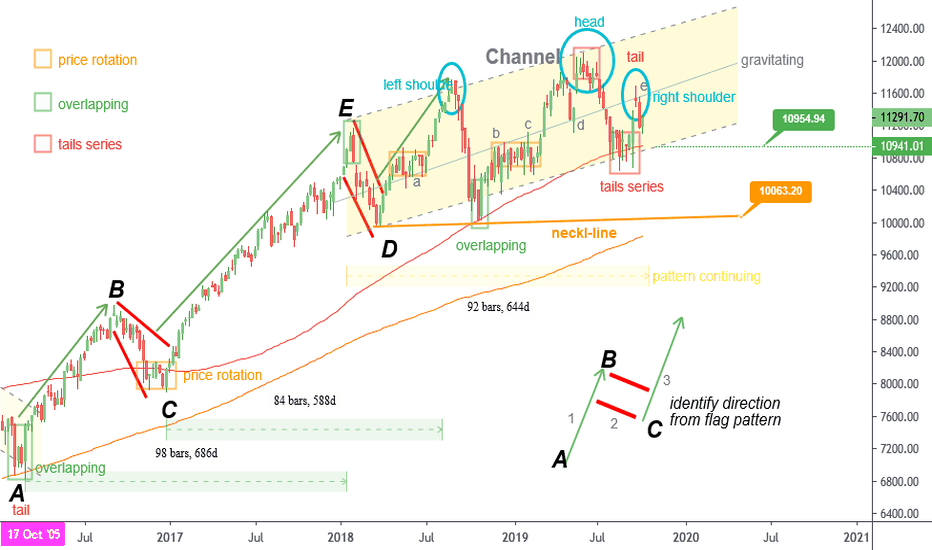

Nifty long-term chart analysis give a story from 2000 to 2020.Following patterns are found for data of 2015 to 2019 (5 years data) on weekly candle chart.

Channel pattern

Flag Patterns

Currently running Head and Shoulders pattern

Remarkable zone 1, 2 and 3

Head & Shoulders pattern is still uncompleted with right shoulder. The neckline target is 10063

At the remarkable zone, its has highly price rotatio n detected with tails

As per channel pattern , the range is 12600 to 10900. The gravitating target 12000 for nifty.

Conclusion, break 10900 below nifty can draw more downward.

History may not repeat itself, but Chart pattern gives you data points and insights to understand how the market can behave in the future.

Weekly candle chart for the spot NIFTY from 2000 to 2020 until the present. Patterns, uptrend, downtrend, or sideways trend, etc are drawn. We have divided this data in 5 years data chart. Comparing the four charts that We have generated, conclusions was written. There're many similarities and difference was found. We can get clear picture of NIFTY for next price move.

Case 1 (2000-2005)

Lot of time and brainpower attempting for technical analysis.

Case 2 (2005-2010)

Technical Chart patterns on nifty.

Case 3 (2010-2015)

Chart the weekly data for the NIFTY.

Bearish flag analysis on XAUUSD (gold)From the chart, there has been an increase in gold in a close-knit candlestick pattern, with it increasing value.

This has caused a bearish flag to arise.

This is recognised due to:

1. quick increase to reach the basis of the flag.

2. once it was reached began forming an upwards flag shape with close-knit candlestick high/ low closes.

3. once the flag lines (orange) got closer together, there is an expected bear break out due to it being a rising flag.

4. This is also backed due to the reduced volume once the flag is reaching a close.

5. as it can be seen, the break out downwards should see the price of gold to begin to slowly fall.

However, this is not the case lately due to today's actions by the Dow in response to Trump's tweets about China.

Nonetheless, if such didn't occur this should see the XAUUSD to fall lower to reach 2nd support, leading to either consolidation or a bounce off support to bring the price of gold back up. If this did not occur gold prices will be in a downtrend.

Due to Trumps recent tweets and fears of a recession due to the inverted bond yields, this may see gold prices to continue to rise upwards breaching resistance and being able to surge past $1580.

This is an example of a bearish flag and can be used to analysis all other shares, crypto's and commodities, if probable analysis is completed.

Rising flag - pennantFlags and Pennants Pattern

We will now analyse the flags and Pennants Pattern, two other Patterns of the technical analysis. Flags and Pennants are short-term continuation patterns ; are among the most reliable Patterns and they represent “short breaks” (not longer than 20 sessions) during a Trend, before the Trend continues to go in the initial direction. Let’s analyze them point by point. Remember, that in order to understand better the Patterns of the technical analysis, you should know how the Trend Lines and Resistances/Supports work (For this reason we suggest you to read: What is a Trend and what are Trend Lines; Resistance and Supports).

Features of Flags and Pennants Pattern

– When they occur: both Patterns occur during a strong Uptrend or strong Downtrend, that have high volumes of exchanges.

– What are: The Pennants are similar to the Pattern of the symmetrical Triangle, but they have a shorter duration and they are smaller (They are also similar to another Pattern, The wedge). The Flags are similar to the Pattern of the rectangle, but they have a shorter duration and they are smaller.

– In Flags, prices are contained between two parallel lines.

– In Pennants, prices are contained between two convergent lines.

– Duration: both figures, can last from 1 to 12 weeks and should normally last from 1 to 4 weeks (if they are over 12 weeks, a Pennant would be classified as a symmetrical triangle while a Flag as a rectangle). If they last between 8-12 weeks, their reliability as Patterns is less.

– Volumes: High during the Trend that precedes these Patterns; Decreasing and Low, during the formation of these Patterns. Then, rising in the Breakout point (When the Prices go out the Pattern).

– Breakout: although they are usually continuation patterns, it’s always better to wait for the Breakout from one side of the Patterns to be sure whether there will be a rise or a decline. Finding other confirmations (From oscillators or of Candlestick Patterns), and even a Pullback it would be better (There is a Pullback when the Prices return to the line that they have just cutted, then bounce on the line and come back to continue in their initial direction).

– Minimum Target Price: you have to measure the width of the Pattern, and project it from the point of Breakout upward or downward (depending on whether prices have gone out from the Pattern with a rise or a decline).

BTCUSD H4/D1 charts (2/18/2019)Good morning, traders. Bitcoin made a strong move this weekend. Make no mistake, it's been tough as there has been significant resistance, but price has moved up in spite of that and is now sitting just above the two month long descending channel resistance. In making this move, price has pushed beyond the green price target from last week and is above the daily pivot. H4 and D1 RSI bounced off their respective support levels as I noted was important to watch, leading to this move up. Currently, price is finding resistance at the 38.2% fib level but it is above the daily 50 EMA. The H4 flagpole target still sits at $3949 while the channel target sits at $4400.

I want to see price close above the January 19th swing high of $3774, at a minimum. We don't want to see today's daily candle close below that level now that price has breached it. Lower TFs are well over-bought at this time. Daily RSI is nearing overbought as well. Daily volume is building up nicely, but we need to see it expand beyond the February 8th volume. That doesn't need to happen today, but it should come on the heels of continually expanding volume to provide a case for longer TF bullishness. The worst thing traders can do at this time is to emotionally enter a trade in either direction. There are still a lot of short-term resistance levels that price must close above and it must be done consistently without any fatigue in buying. Why? Because daily RSI continues to print higher highs for the past 2.5 months while price is printing lower highs. This is happening while price is still within the symmetrical triangle. Weekly RSI suggests that we need to see a price close above $4090 to keep that hidden bearish divergence from playing out.

Every day, we have a choice to act positively or negatively, so if you get a chance, do something decent for someone today which could be as simple as sharing a nice word with them. You just might change their day, or even their life.

Remember, you can always click on the "share" button in the lower right hand of the screen, under the chart, and then click on "Make it mine" from the popup menu in order to get a live version of the chart that you can explore on your own.

BTCUSD H4/D1 charts (2/14/2019)Good morning, traders. Price continues to consolidate within a flag/descending wedge. The target based on the height of the wedge remains, as it was yesterday, the ascending red "neckline" of the possible IHS. But, as I mentioned previously, we need to see increasing candle spread and expanding volume as the right shoulder is completed and price pushes through the neckline. If we see diminishing volume and/or small candle spread then the possibility of further movement up through the descending channel's resistance is significantly reduced. But we do have a few targets if demand shows itself. The shallowest target of $3730 will get price to the red line and is based on the height of the local wedge, $3970 is based on the height of the flagpole, $4100 is based on the IHS, and $4400 is based on the height of the large descending channel. A breakdown of this wedge has price looking for initial support around $3475-$3510 with secondary support around $3430. Currently, price has retraced almost 50% of the February 8th advance.

H4 RSI continues to move within the descending broadening wedge it printed, but appears to be finding a possible floor as it flattens out around 45-50. MACD is also showing growing bullish momentum over the past two days. D1 shows price just below the daily pivot with decreasing volume the past three days and doji candles printing. This suggests that supply may be exhausting itself and, if so, we should see price move upward as demand takes over. Until it happens, however, this is just speculation. Traders should always look for confirmation of direction via pattern completions or breakdowns at the very least. The short green horizontal lines on the D1 chart mark the aforementioned targets.

Every day, we have a choice to act positively or negatively, so if you get a chance, do something decent for someone today which could be as simple as sharing a nice word with them. You just might change their day, or even their life.

Remember, you can always click on the "share" button in the lower right hand of the screen, under the chart, and then click on "Make it mine" from the popup menu in order to get a live version of the chart that you can explore on your own.